Savannah Georgia Real Estate Taxes

Savannah georgia 31401 912 652 7100 912 652 7101.

Savannah georgia real estate taxes. Tax commissioner 222 w oglethorpe avenue 107 savannah georgia 31401 912 652 7100 912 652 7101 e mail. The average effective property tax rate is 091. Its important to keep in mind though that property taxes in georgia vary greatly between locations.

County property tax facts property tax returns and payment property tax homestead exemptions freeport exemption property tax appeals property tax valuation property tax millage rates property tax online property tax forms laws. Property tax balance information dates back to tax year 2011. The tax commissioner also collects and disburses real and personal property taxes for the city of tybee island city of port wentworth and city of pooler and garden city.

Some county properties in which the tax mappin begins with 1 are subject to city property taxes. The median real estate tax payment in georgia is 1448 per year which is around 650 less than the 2090 national mark. View print or pay.

Westside 912 644 4010. More about property tax. The chatham county board of assessors provides information of property sales record cards and taxes through its website.

According to georgia law municipal property taxes must be based on the approved county tax digest. Property tax proposed and adopted rules. Each person firm or corporation owning or holding in trust or consignment any machinery and equipment merchandise inventories boats and boat motors aircraft and any other kind of personal property with exception of personal tools exempt by.

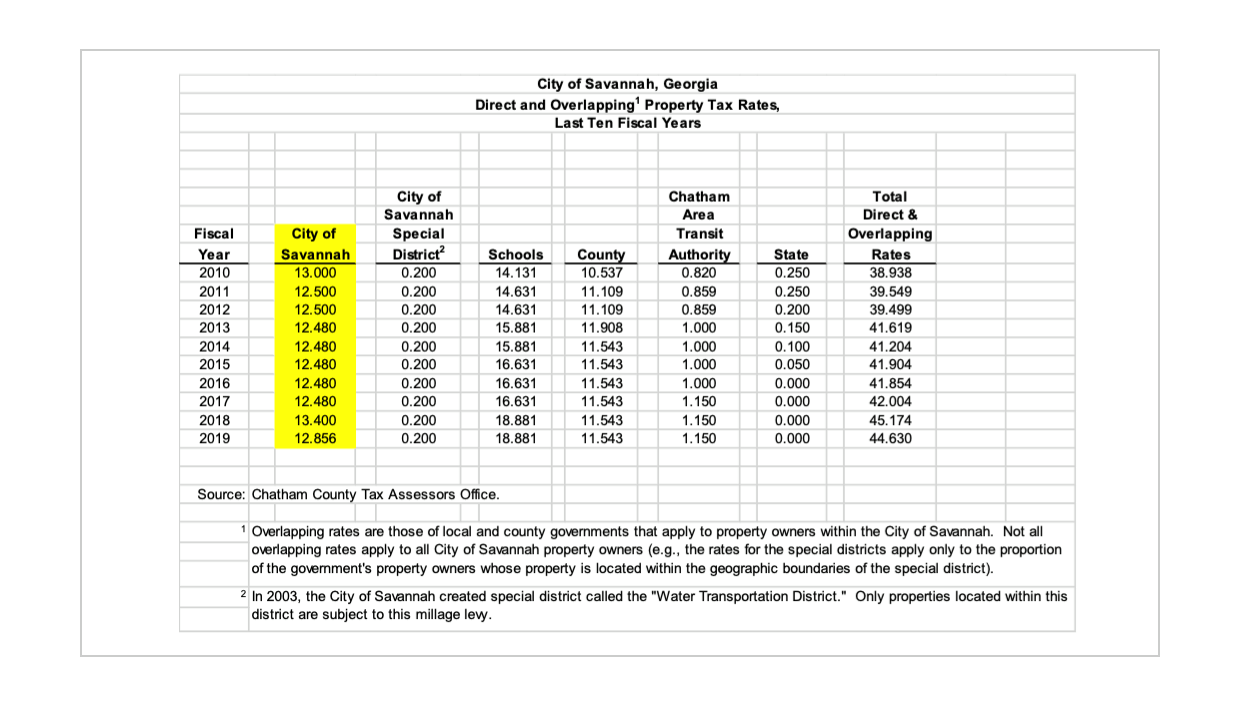

Zillow has 1136 homes for sale in savannah ga matching. Chatham county residents who reside within savannahs city limits are required to pay both county and city property taxes per georgia law. Only city of savannah property tax information and online payment services are available from this site.

View listing photos review sales history and use our detailed real estate filters to find the perfect place. Sagis savannah area geographic information system is focused on providing access to geospatial data in a standardized format to all interested parties. The tax mappin for all city properties begins with 2.

Monday friday board of assessors. Tax on real property shall be based on the assessed value thereof as determined by the chatham county board of tax. Property tax code enforcement and street paving clearance form.

Savannah area geographic information system sagis.