Quitman County Georgia Tax Assessor

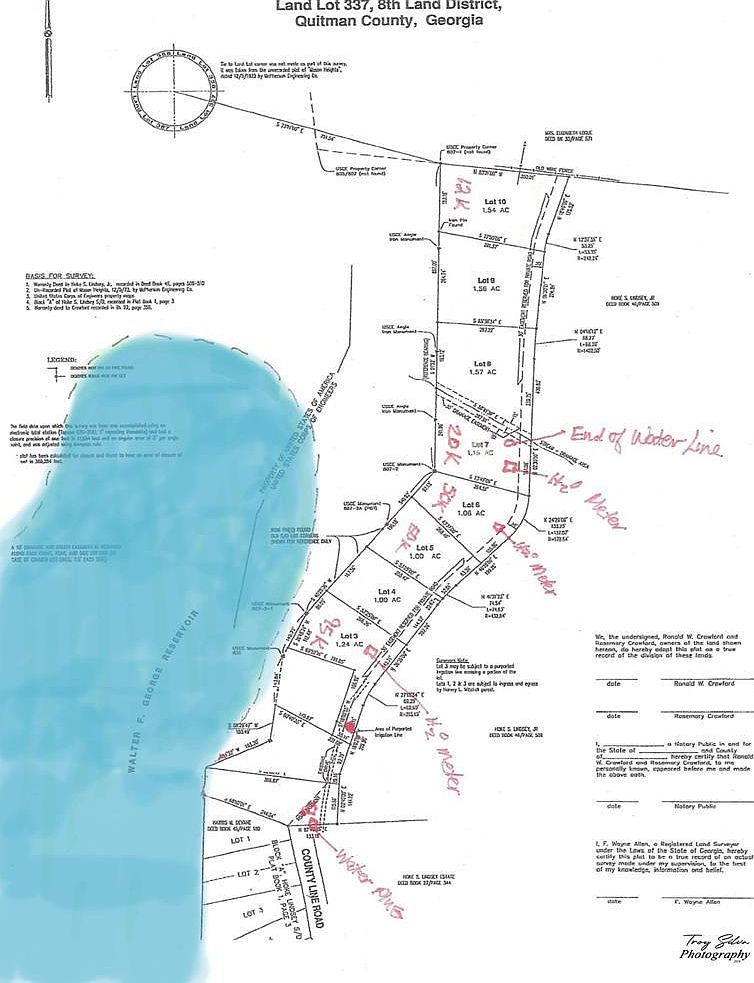

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property.

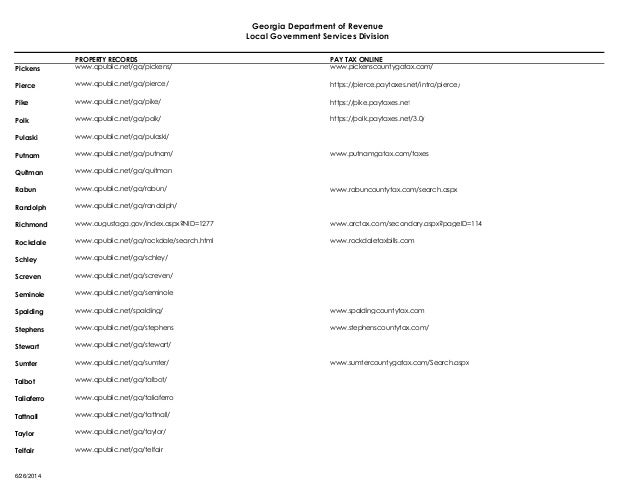

Quitman county georgia tax assessor. The quitman county property appraiser is responsible for determining the taxable value of each piece of real estate which the tax assessor will use to determine the owed property tax. The goal of the quitman county assessors office is to provide the people of quitman county with a web site that is easy to use. This interactive website will allow you to access information to the various agencies and departments of the government of georgetown quitman county.

About the quitman county assessors office. Our office is open to the public from 800 am until 500 pm monday through friday. Welcome to the official website of the consolidated government of georgetown quitman county georgia.

Our office is open to the public from 800 am until 500 pm monday through friday. Welcome to the quitman county assessors office web site. Please contact the board of assessors office at 229 334 2159 for more information concerning this notice.

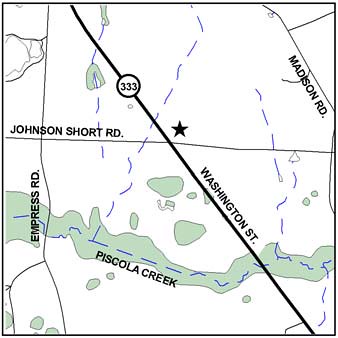

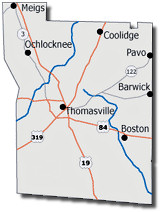

County appraisers will be in a marked appraiser vehicle. The quitman county assessors office located in georgetown georgia determines the value of all taxable property in chatham county ga. The goal of the brooks county board of tax assessors office is to provide the people of brooks county with a web site that is easy to use.

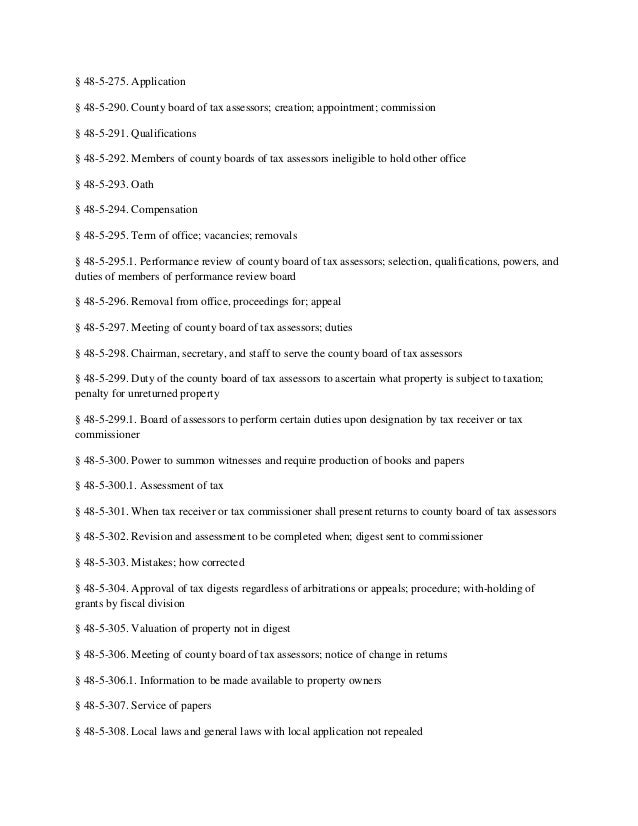

The quitman county tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in quitman county. Quitman county was created from parts of randolph and stewart counties in 1858. Visit the georgia tax assessor website your one stop portal to assessment tax parcel gis data for georgia counties.

The duties and responsibilities of the office of tax commissioner are many and varied but our main function is to serve you the citizens of quitman county.