Georgia Withholding Tax Sale Of Real Estate

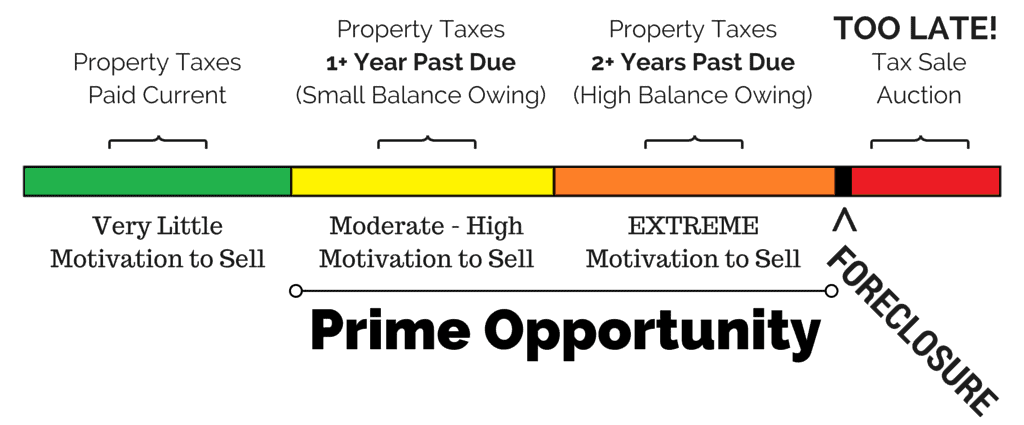

The sale of real estate by a non resident of georgia may trigger a withholding tax based on either the sales price or the amount of the sellers gain.

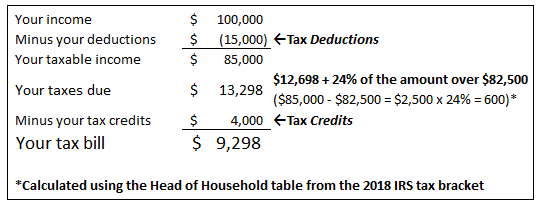

Georgia withholding tax sale of real estate. If you have a gain from the sale of your main home you may be able to exclude up to 250000 of the gain from your income 500000 on a joint return in most cases. Withholding on sales of realty to nonresidents in georgia 48 7 128. Withholding on sales or transfer of real property and associated tangible personal property by nonresidents.

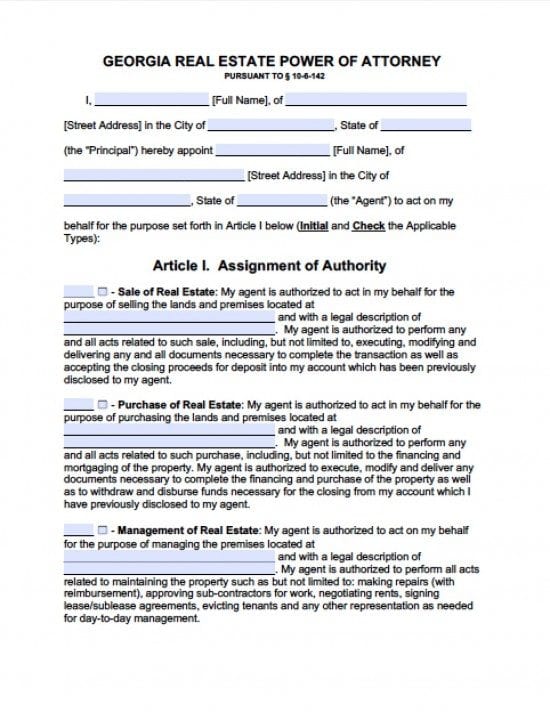

Before a deed security instrument or other writing can be recorded in the office of the clerk of the superior court the real estate transfer tax must be paid. If you can exclude all of the gain you do not need to report the sale on your tax return. G2rp withholding on sales or transfers of real property non residents 49526 kb department of.

Nonresidents include individuals trusts partnerships corporations limited liability companies limited liability partnerships and unincorporated organizations. Real estate transfer tax is an excise tax on transactions involving the sale of real property where title to the property is transferred from the seller to the buyer. Section 48 7 128 provides for income tax withholding at a rate of 3 percent on sales or transfers of real property and associated tangible personal property by nonresidents of georgia.

If you have gain that cannot be excluded it is taxable. Once the tax has been paid the clerk of the superior court or their.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcswm9xt8dsdnxspfxs6dghe2xid8zvcbwltey K2sd4qkh Q0b0 Usqp Cau

encrypted-tbn0.gstatic.com