Georgia Withholding Tax Id Number

On the home page under searches click on sales tax ids.

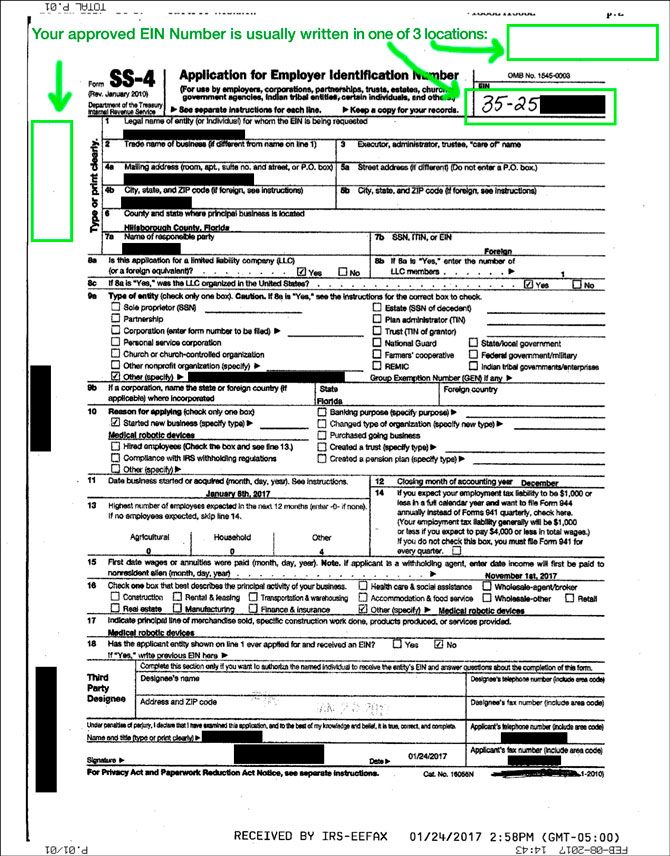

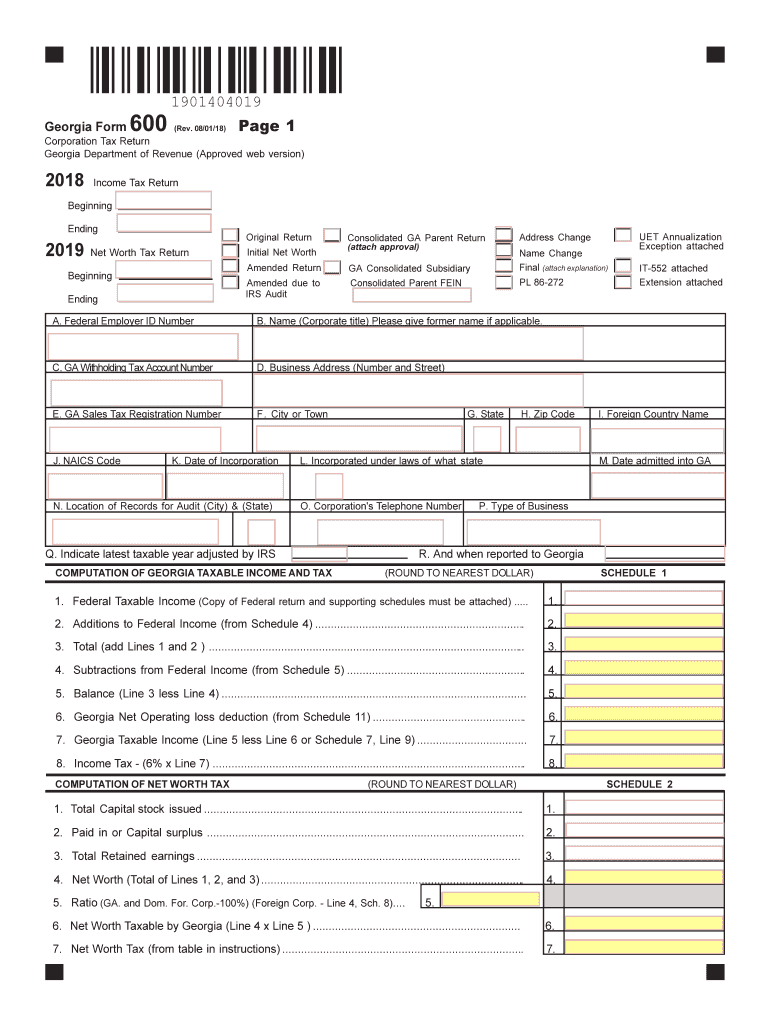

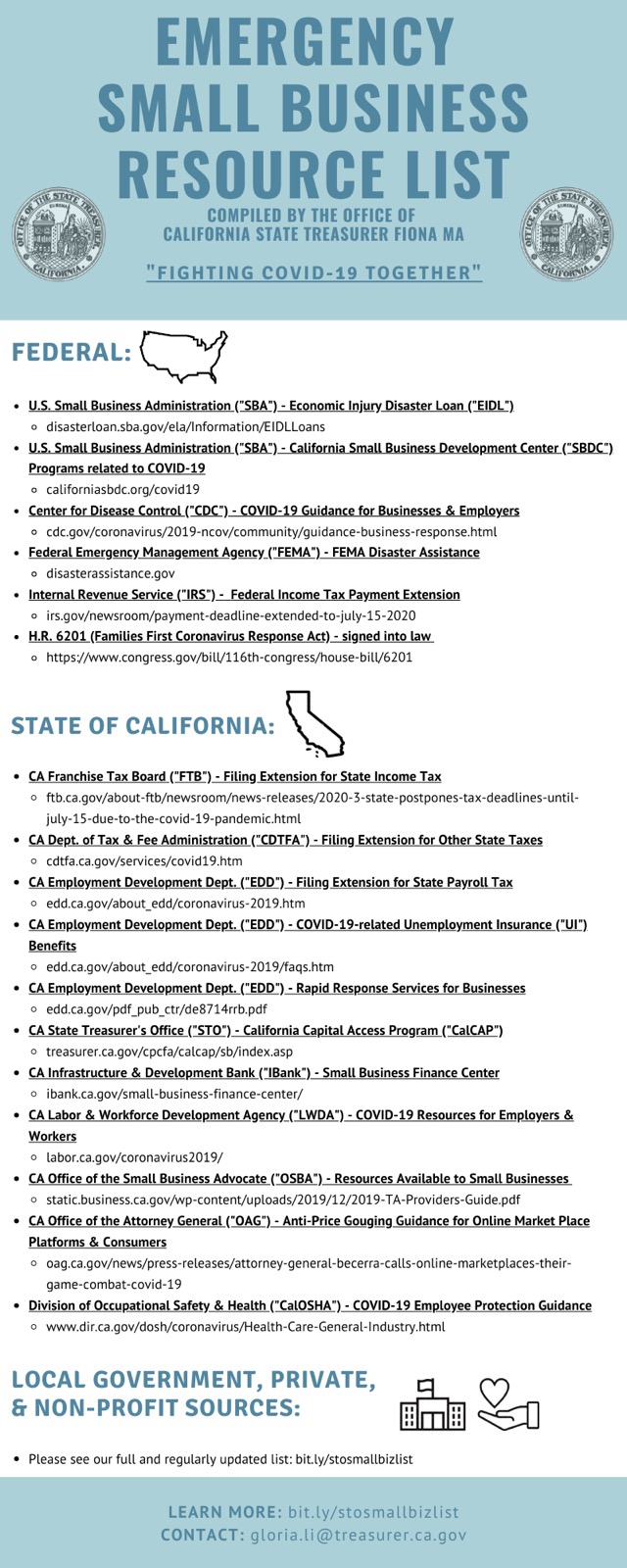

Georgia withholding tax id number. How to claim withholding reported on the g2 fp and the g2 fl. For withholding rates on bonuses and other compensation see the employers tax guide. The georgia tax id number is an identification number assigned to your business.

Email address if available. Register for a sales and use tax number. Instructions to submit fset.

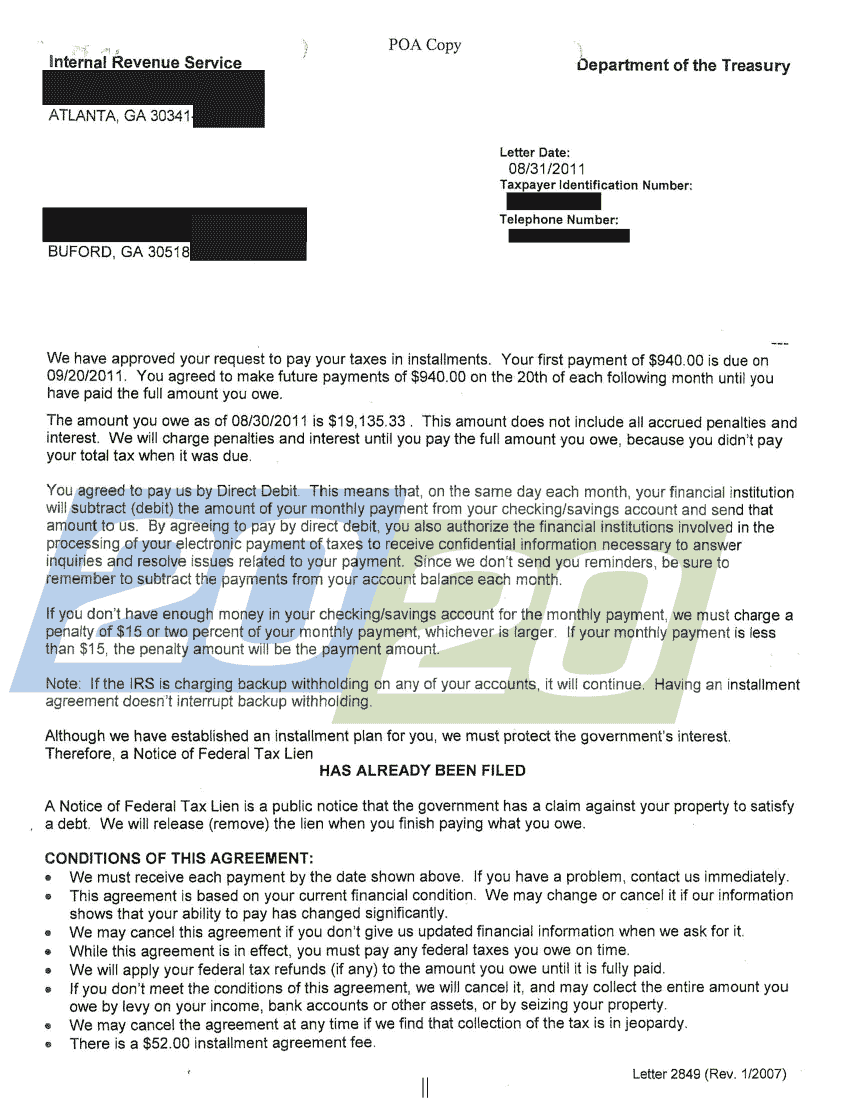

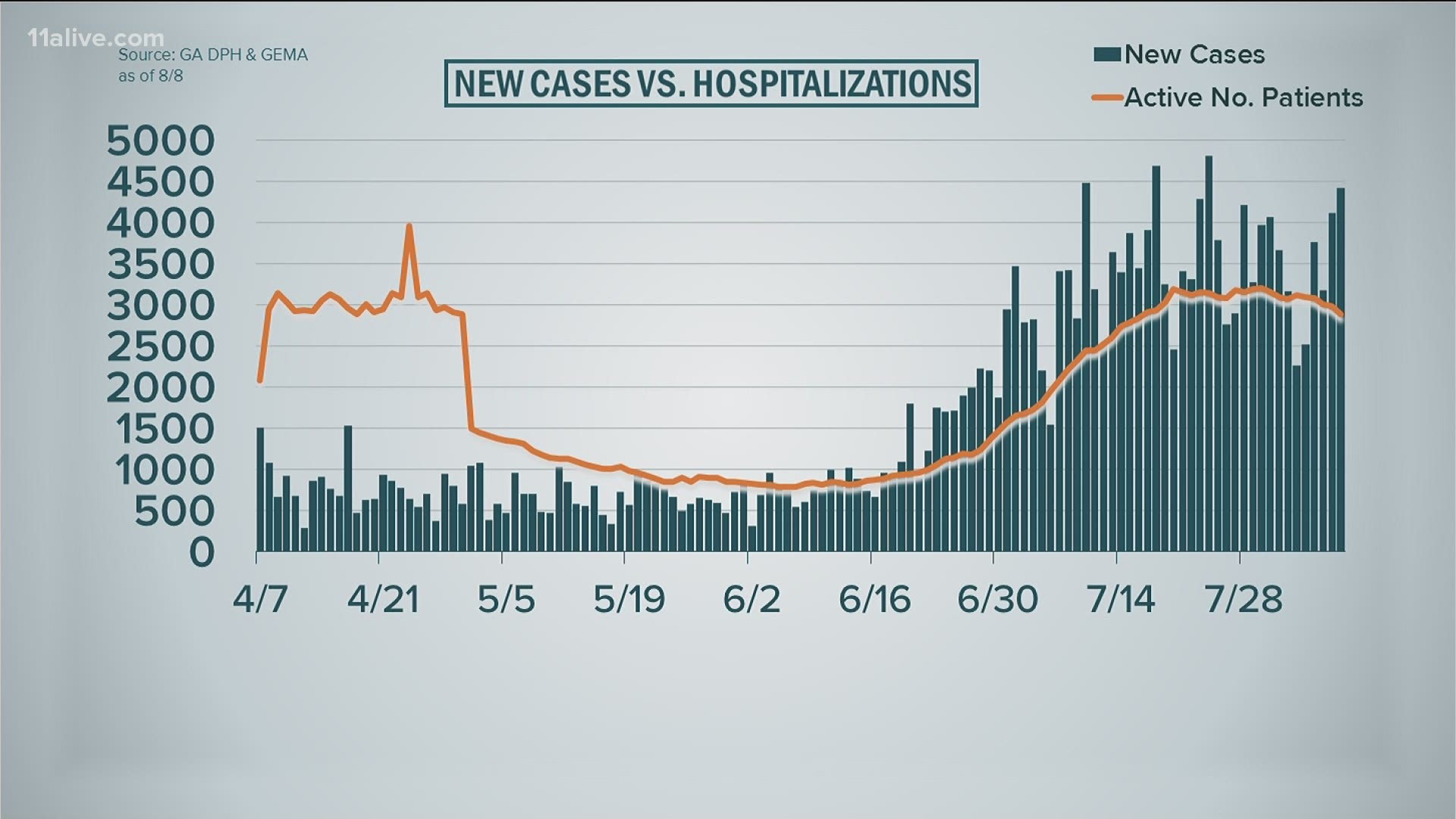

Due to covid 19 customers will be required to schedule an appointment. Film tax credit loan out withholding. Additionally taxpayers can still conduct all business with the department via online services telephone or designated secure lockbox locations.

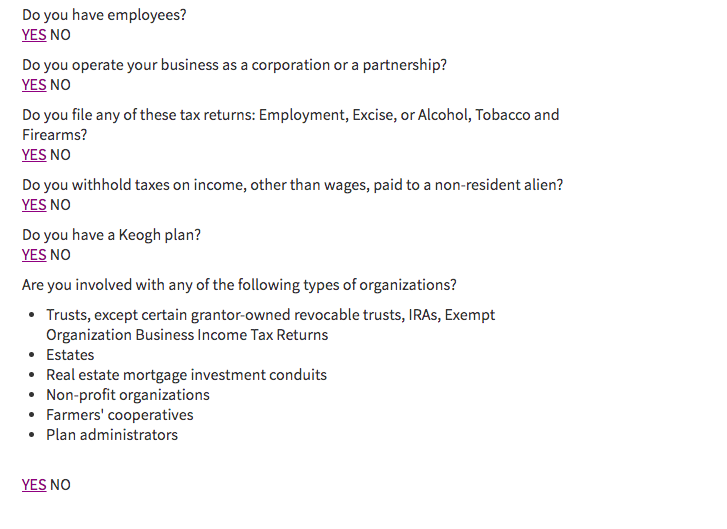

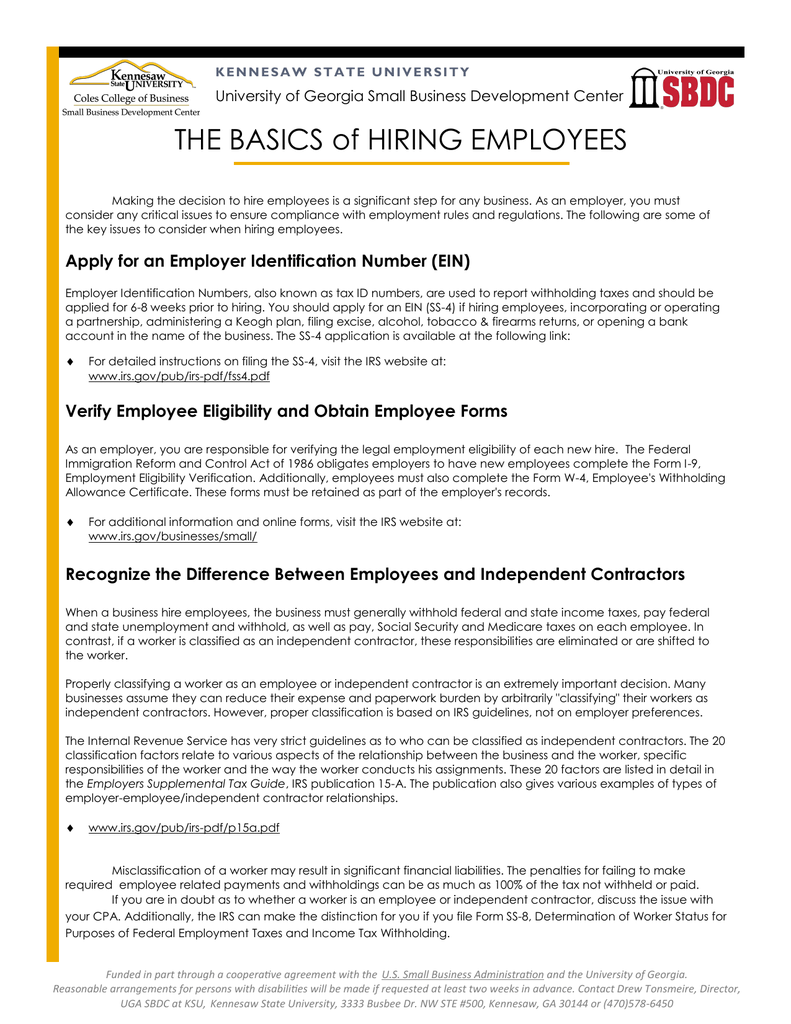

This registration does not require renewal and remains in effect as long as the business has employees whose wages are subject to georgia income tax withholding. Start the online registration process. Any business that has employees as defined in ocga.

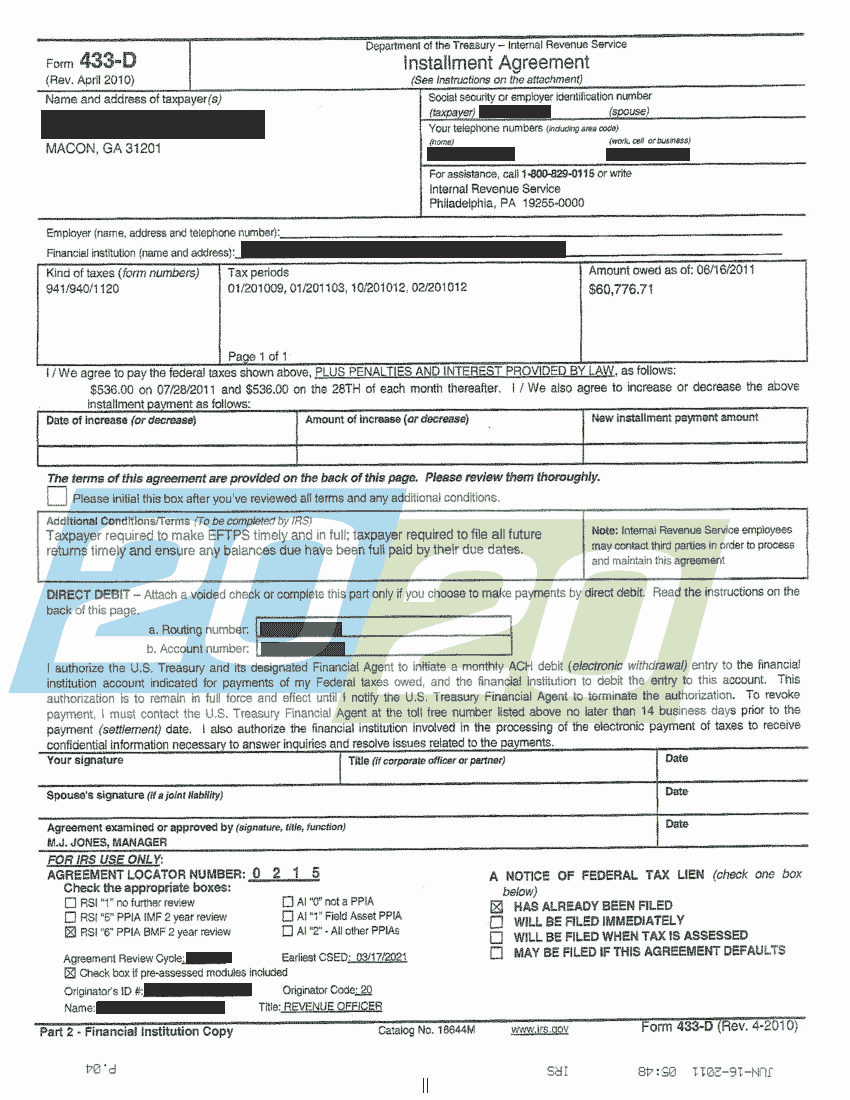

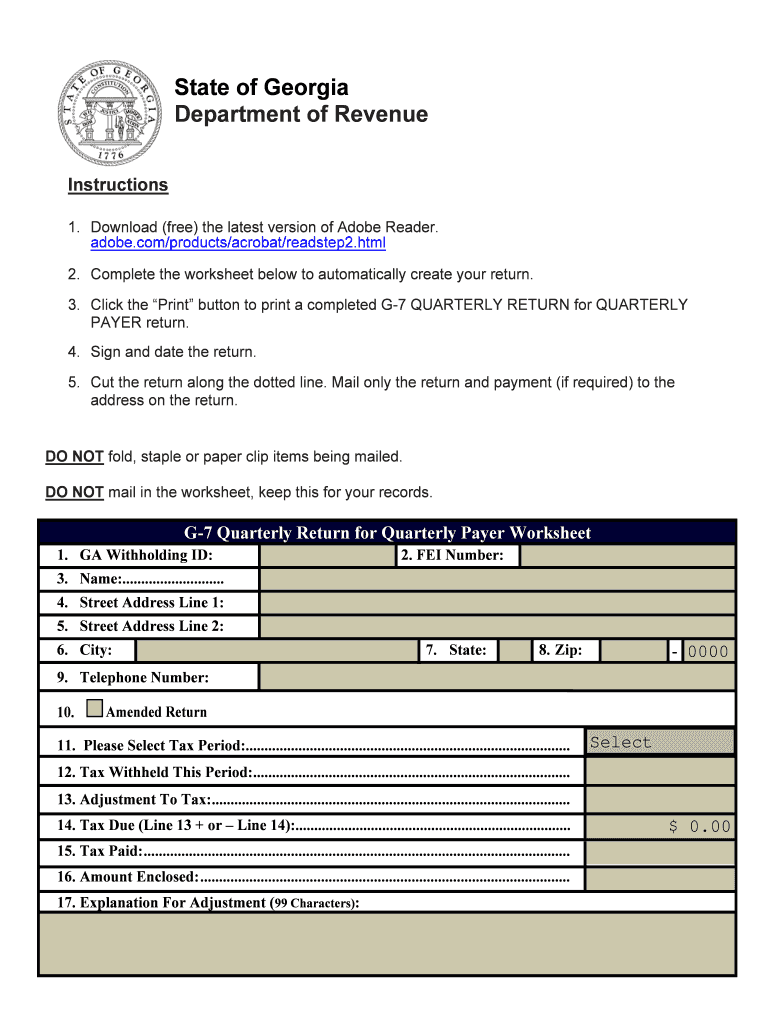

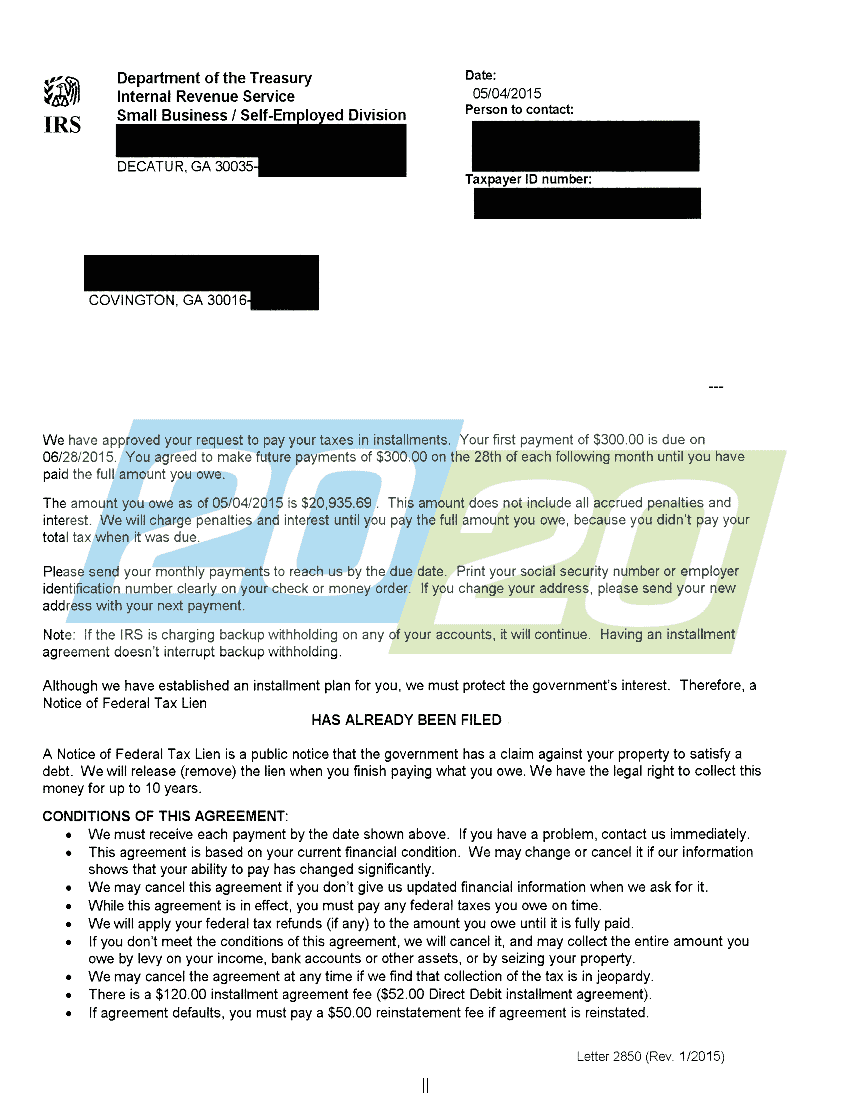

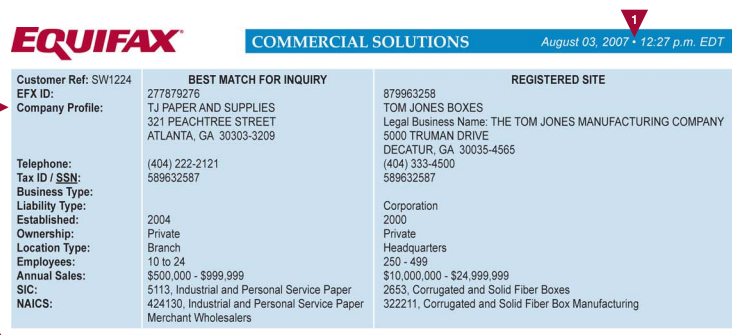

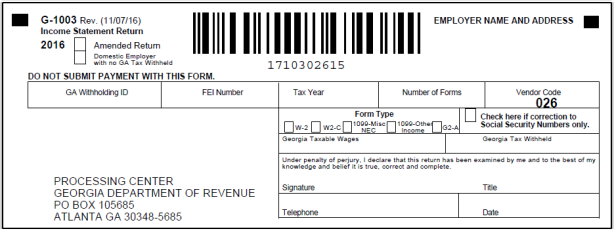

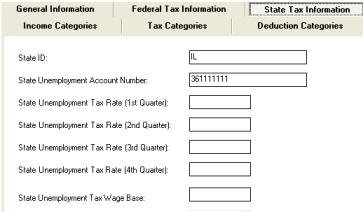

Companies who pay employees in georgia must register with the ga department of revenue dor for a withholding account number and the ga department of labor dol for a dol account number. The new service allows certain new employers to receive a gdol account number via the agency website. Sales tax numbers may be verified using the sales tax id verification tool available through the georgia tax center.

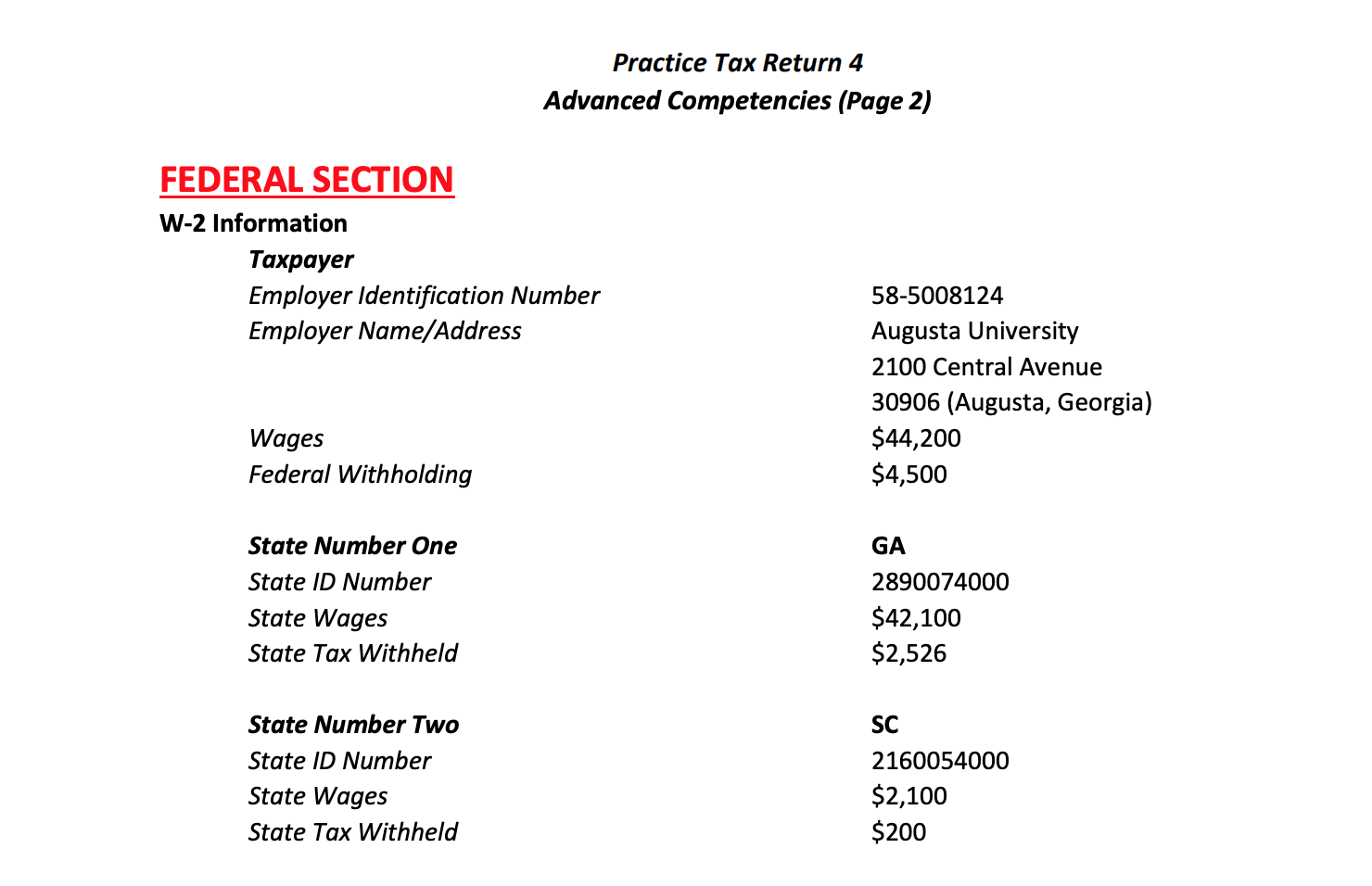

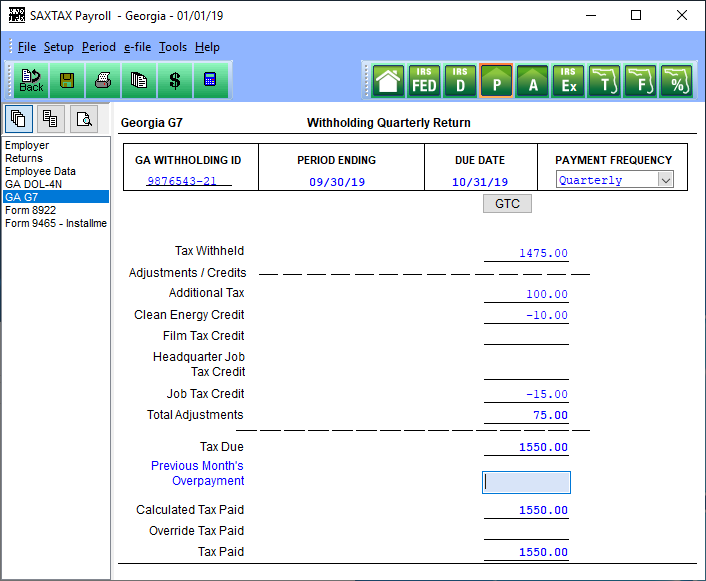

How to file a return and make a payment for a withholding film tax account. 9999999aa 7 digits and two capital letters apply online at the ga dor using an ein to receive. Federal identification number if applicable.

The department of revenue has resumed in person customer service as of monday june 1 2020. Enter the sales tax numbers for verification. 48 7 1004 must register for a withholding payroll number.

Visit the georgia tax center. Social security numbers of owners partners or officers. How third party bulk filers add access to a withholding film tax account.

Name and address of owners partners or officers. Georgia tax account number if it is an existing business. This system can only be utilized by employers that have private agriculture and domestic employment and have not previously registered with gdol.

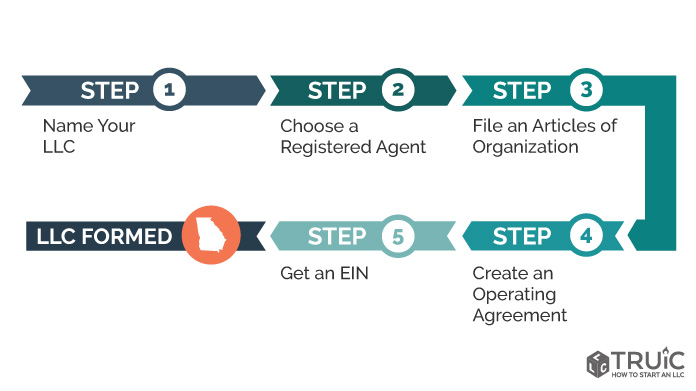

Ga department of revenue withholding account number. The georgia department of labor gdol has unveiled a new online employer tax registration system. Entities doing business in georgia may need to register for one or more tax types in order to obtain the specific identification numbers permits andor licenses required.

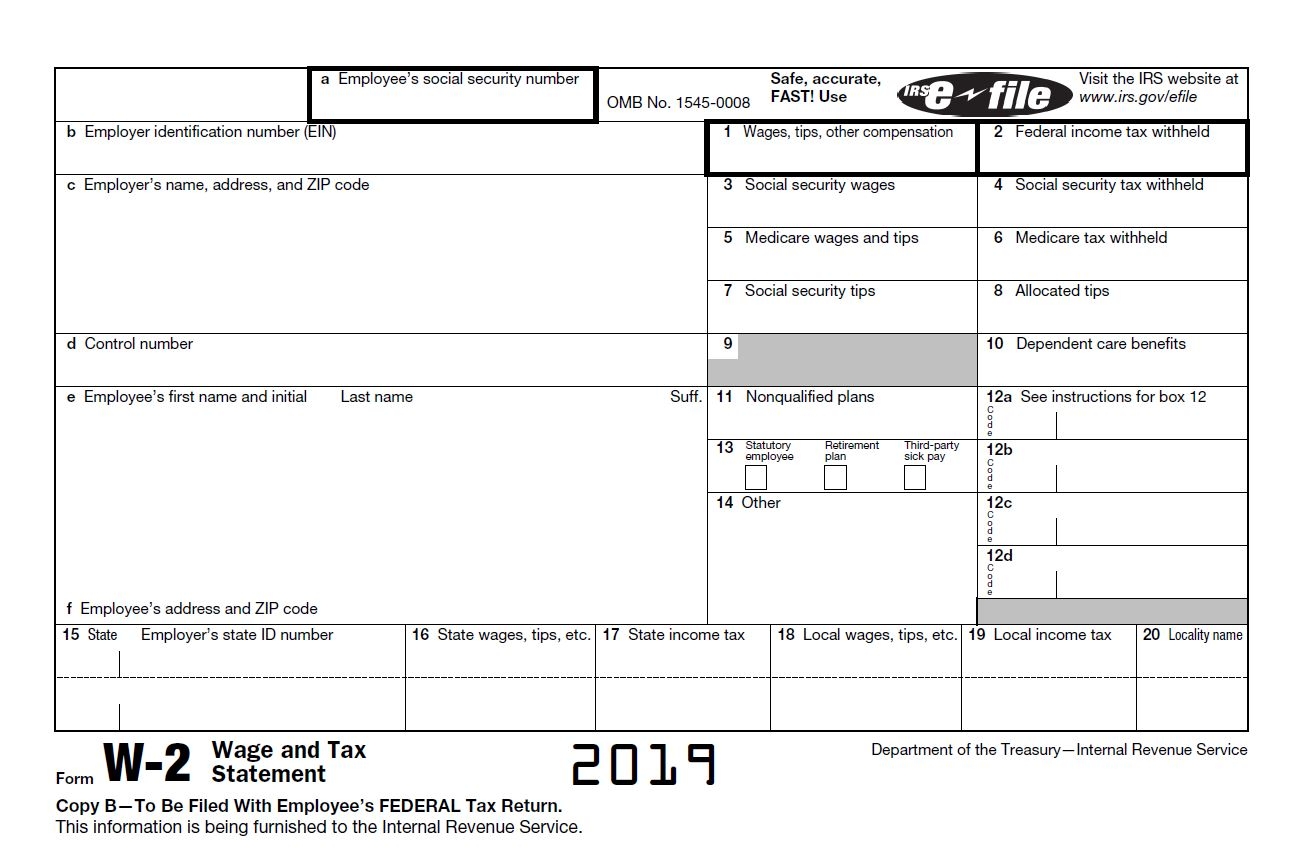

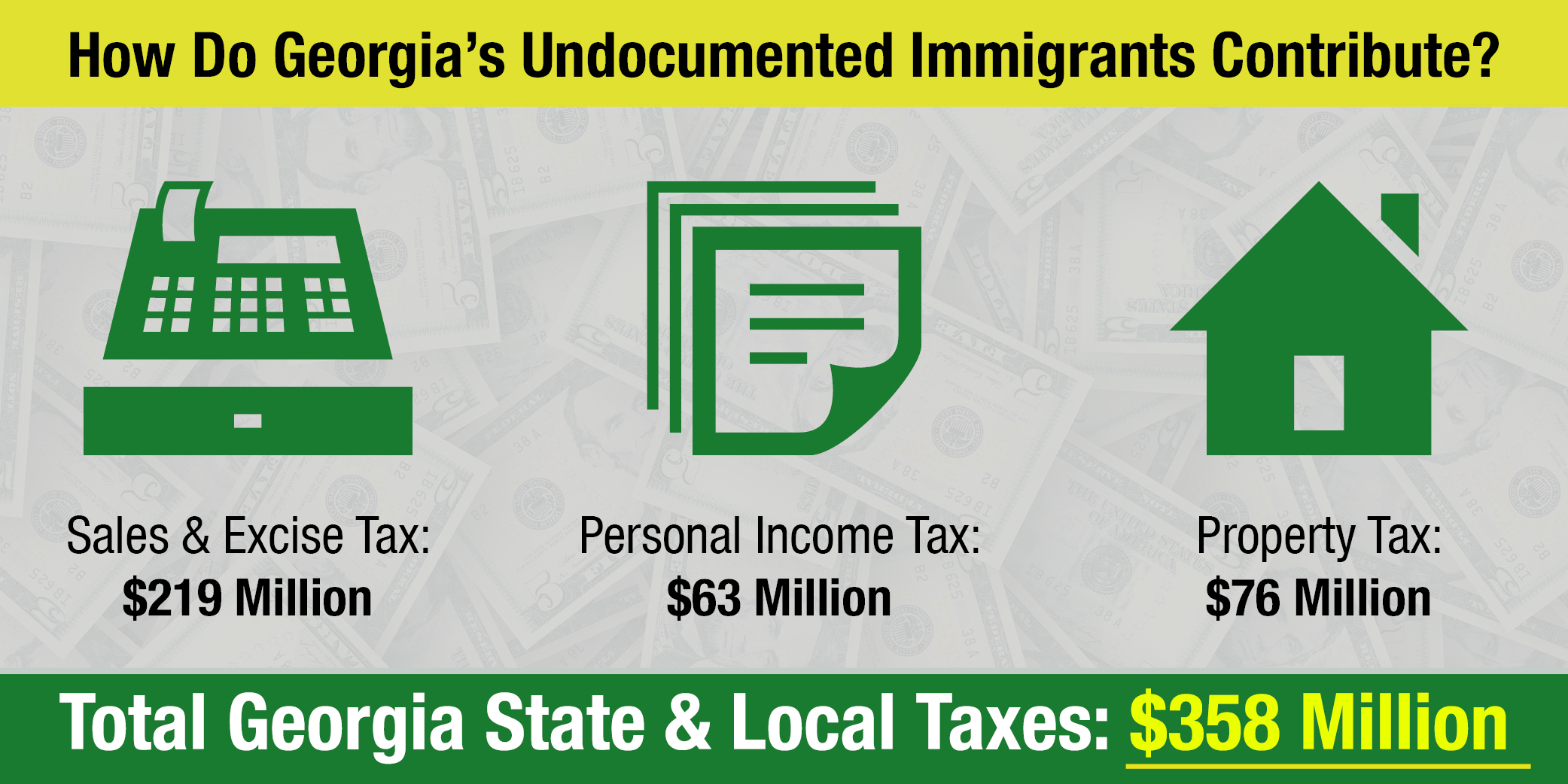

Wages nonresident distributions lottery winnings pension and annuity payments other sources of income the withholding tax rate is a graduated scale. Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. This includes tax withheld from.

It is also mandatory to have a tax id number if you have hired employees. Before registering for any tax type learn more about the differences and requirements for each of the tax types by visiting tax registration.

Video Psers Retirement Application Instructions Employees Retirement System Of Georgia

www.ers.ga.gov

Ein Lookup How To Find Business Tax Id Numbers For You And Others Seek Business Capital

www.seekcapital.com

State Tax Filing Guidance For Coronavirus Pandemic Updated 8 13 20 9 Am Et U S States Are Providing Tax Filing And Payme

www.aicpa.org

Https Dor Georgia Gov Sites Dor Georgia Gov Files Related Files Document Third 20party 20filers 20 20gtc 20functionality Pdf

.jpg)