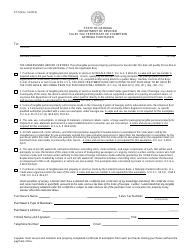

Georgia Withholding Tax Affidavit

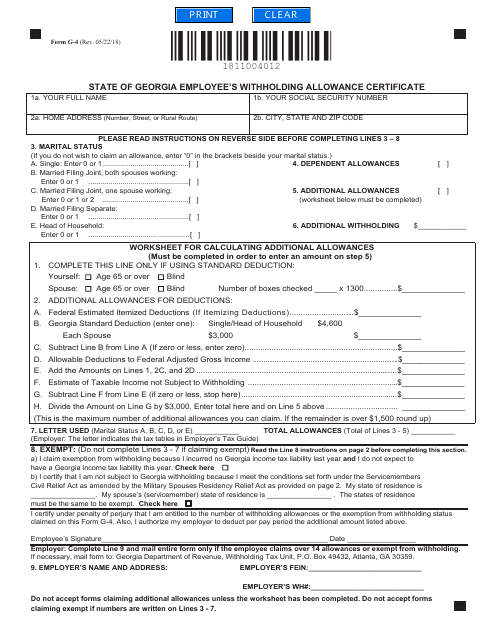

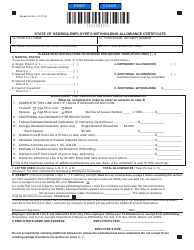

It is income tax withholding.

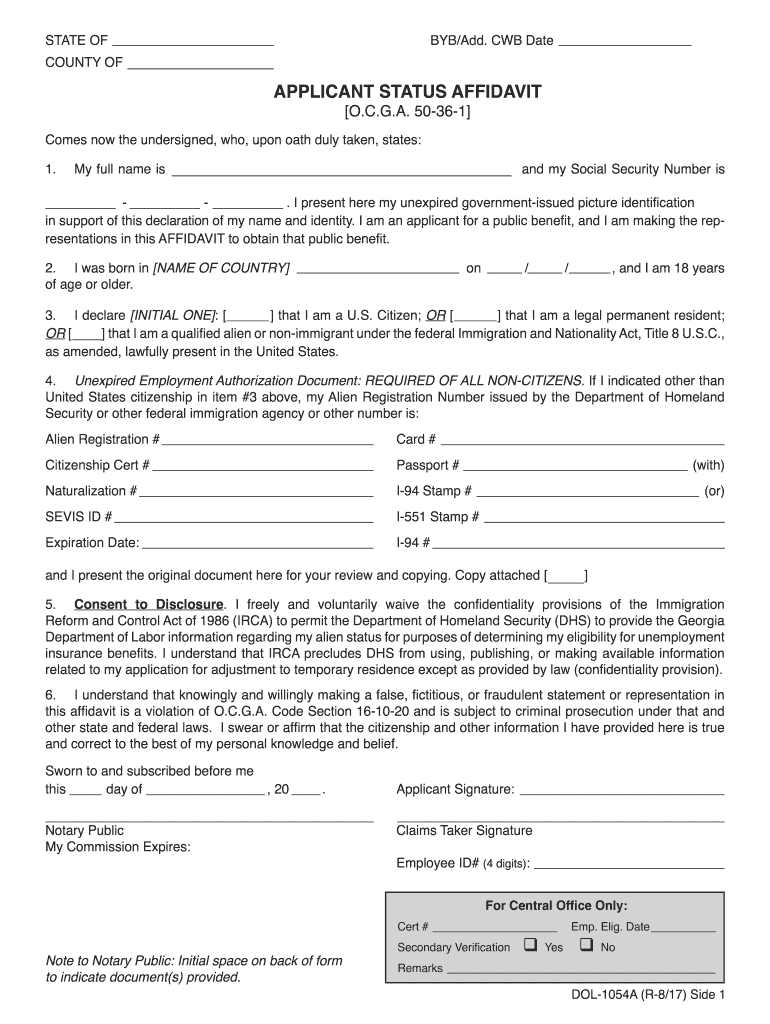

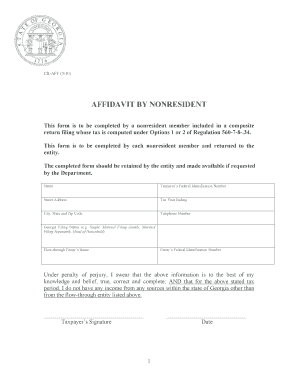

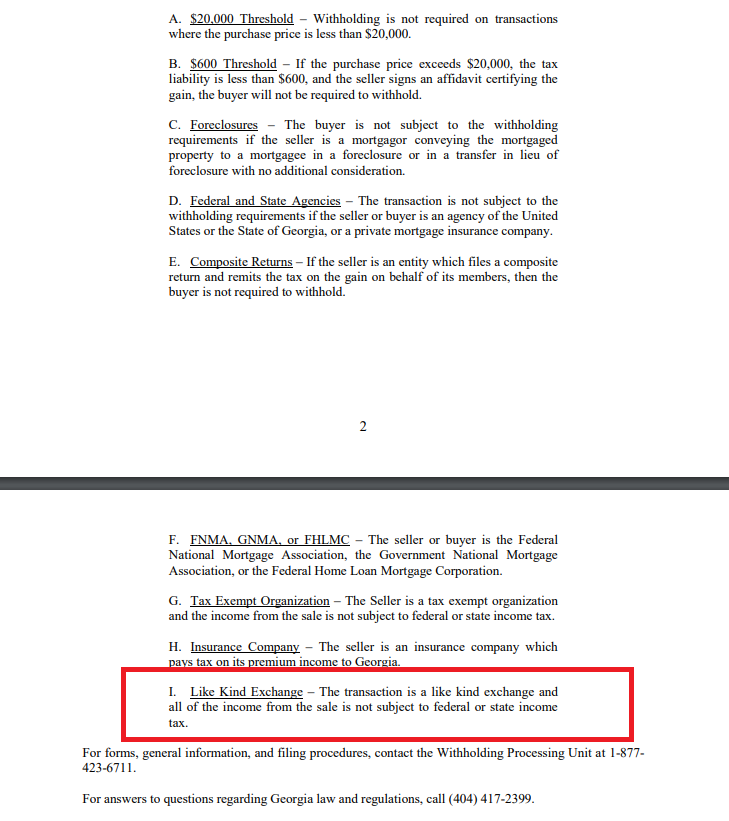

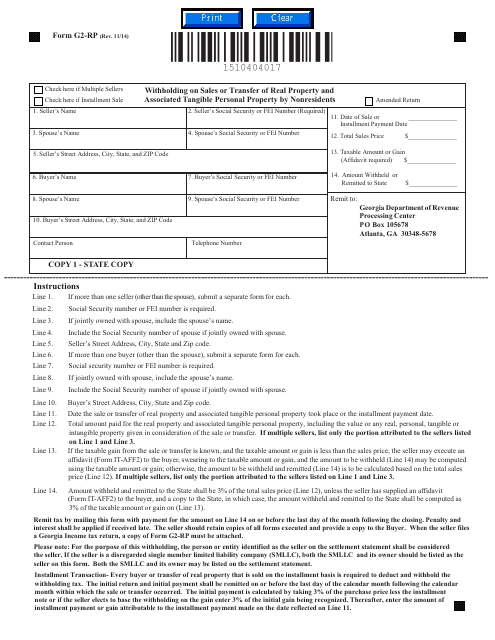

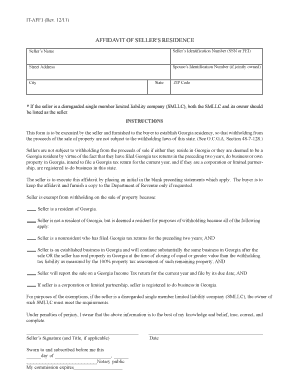

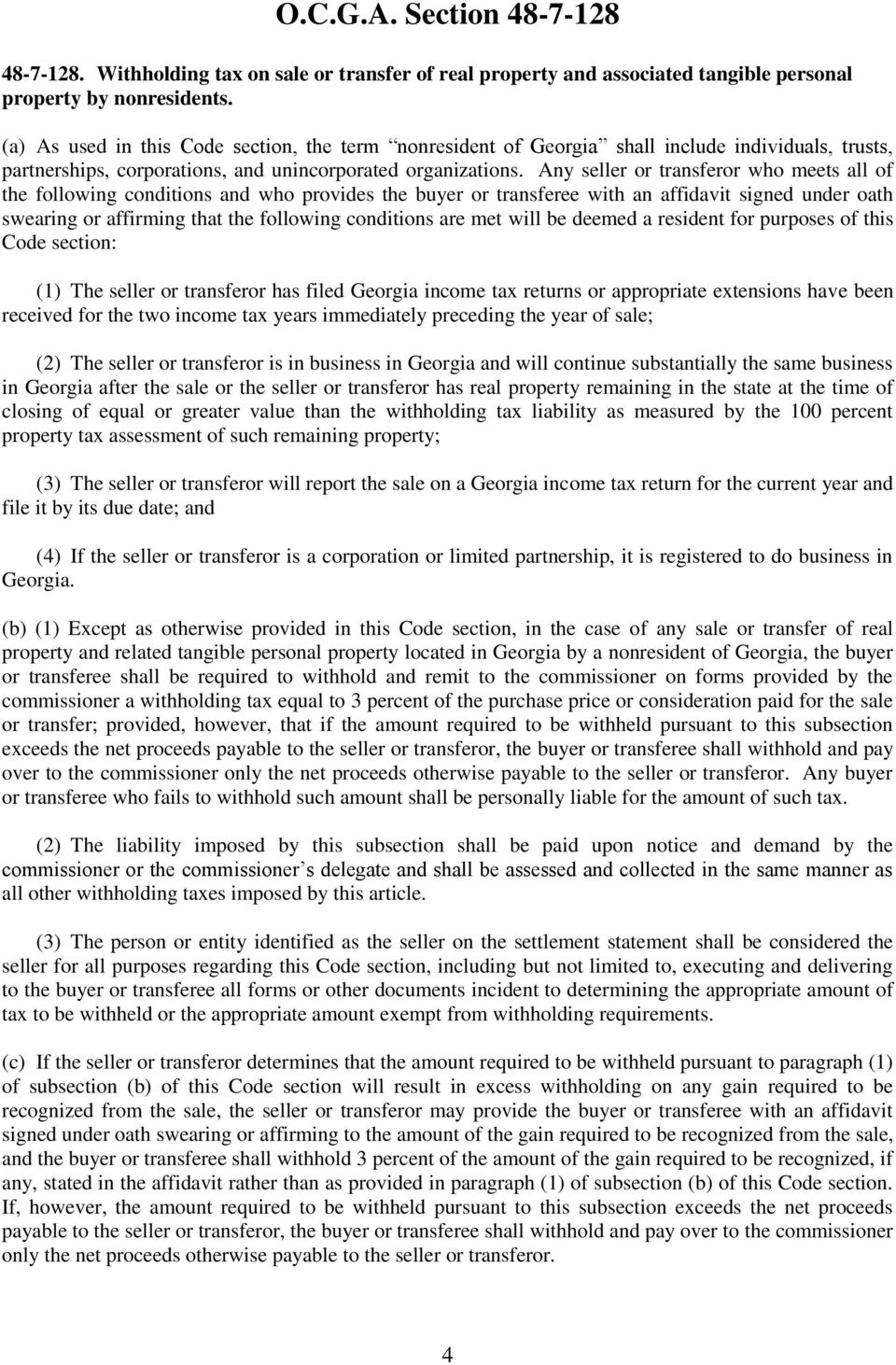

Georgia withholding tax affidavit. Withholding tax on sale or transfer of real property and associated tangible personal property by nonresidents. Affidavit of sellers gain instructions the seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to establish the gain to be recognized from a sale of real property against which gain the withholding imposed by ocga. 48 7 128 seller shall provide purchaser with an affidavit or other documentation in form and substance acceptable to purchasers counsel sufficient to demonstrate that seller is exempt from the.

Georgia tax center help individual income taxes register new business business taxes refunds information for tax professionals audits collections important updates power of attorney tax credits. How to claim withholding reported on the g2 fp and the g2 fl. How third party bulk filers add access to a withholding film tax account.

Georgia withholding tax affidavit. Section 48 7 128 is to be applied. The principle is similar to income tax withholding by employers.

The amount of georgia tax withholding should be. Film tax credit loan out withholding. The buyer withholds alabama income tax from the payment to the nonresident seller.

The buyer is responsible for providing the seller with a copy of form wnr and form wnr v. Tax withholding table single. Form used to claim exemption from income tax withholding on sale of property located in maryland and owned by nonresidents by certifying that the transferred property is the transferors.

How to file a return and make a payment for a withholding film tax account. Instructions to submit fset. Withholding on sales of realty to nonresidents in georgia 48 7 128.

Apply taxable income computed in step 7to the following table to determine the annual georgia tax withholding. 0 750 000. It aff2 affidavit of sellers gain.

If the amount of taxable income is. Certification of exemption from withholding upon disposition of maryland real estate affidavit of residence or principal residence. A as used in this code section the term nonresident of georgia shall include individuals trusts partnerships corporations and unincorporated organizations.

No this is neither a sales tax nor a real estate transfer tax. If seller does not desire purchaser to withhold a portion of the purchase price for payment to the georgia department of revenue pursuant to ocga.