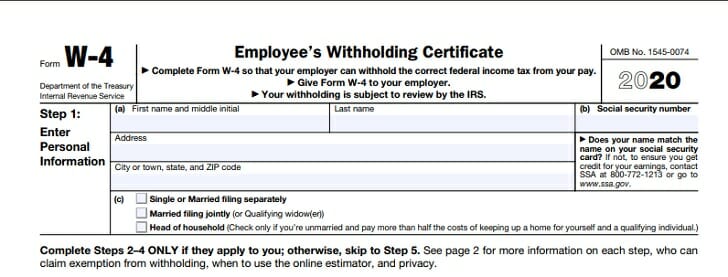

Georgia W 4 Form 2019

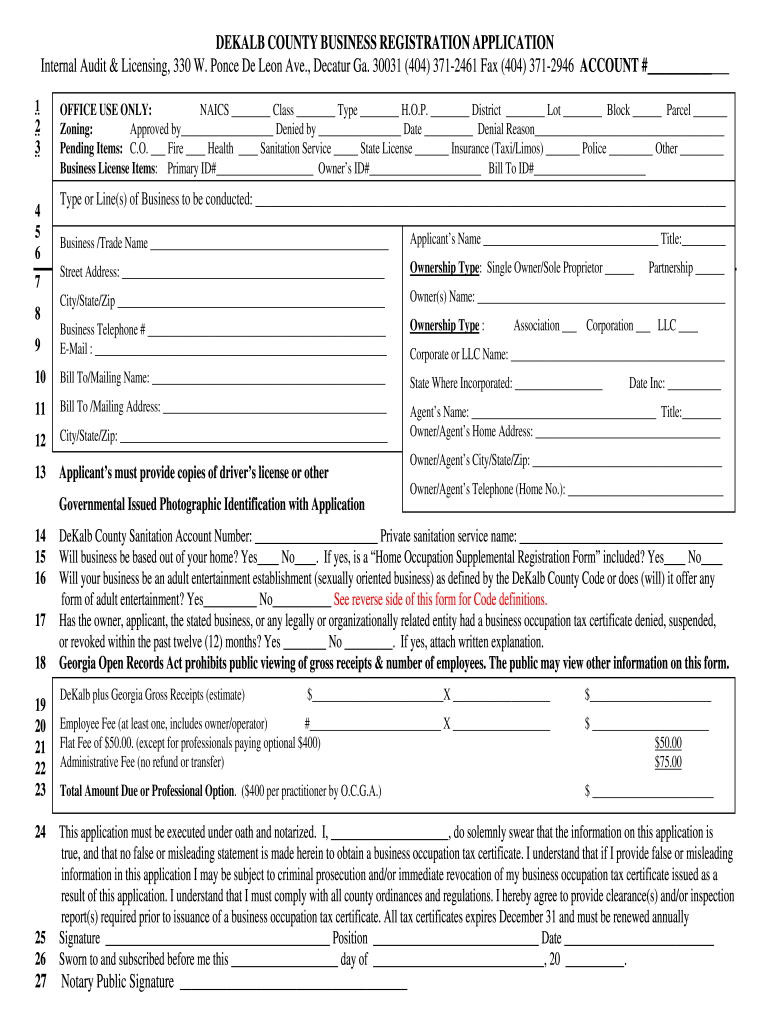

City state and zip code please read instructions on reverse side before completing lines 3 8 3.

Georgia w 4 form 2019. You may be able to reduce the tax withheld from your paycheck if you expect to claim other tax. Your social security number 2a. Tsdemployeeswithholdingallowancecertificateg 4pdf 19647 kb department of.

Local state and federal government websites often end in gov. 2 income includes all of your wages and other income including income earned by a spouse if you are filing a joint return. 2019 12062019 form w 4 sp employees withholding certificate spanish version 2019 12132019 form w 4 sp employees withholding certificate spanish version 2020 01022020 form w 4p.

Withholding certificate for pension or annuity payments 2019. W 4 2019 form w 4 2019 page. Withholdingcertificateforpensionorannuitypaymentsg 4ppdf 20131 kb department of.

Before sharing sensitive or personal information make sure youre on an official state website. Form w 4 2020 employees withholding certificate. S m n h number of exemptions.

For example if you earn 60000 per year and your spouse earns 20000 you should complete the worksheets to determine what to enter on lines 5 and 6 of your form w 4 and your spouse should enter zero 0 on lines 5 and 6 of his or her form w 4. Your full name 1b. Calculate your state income tax step by step.

Home address number street or rural route 2b. State of georgia government websites and email systems use georgiagov or gagov at the end of the address. State of georgia government websites and email systems use georgiagov or gagov at the end of the address.

Forms w 4 filed for all other jobs. Form g4 is to be completed and submitted to your employer in order to have tax withheld from your wages. Line 16 on your 2019 form 1040 or 1040 sr is zero or less than the sum of lines 18a 18b and 18c or 2 you were not required to file a return because your income was below the filing threshold for your correct filing status.

021519 state of georgia employees withholding allowance certificate 1a. Local state and federal government websites often end in gov.

.jpg)

/GettyImages-469951742-5a81e2fac0647100379f6983.jpg)