Georgia Unemployment Insurance Rate

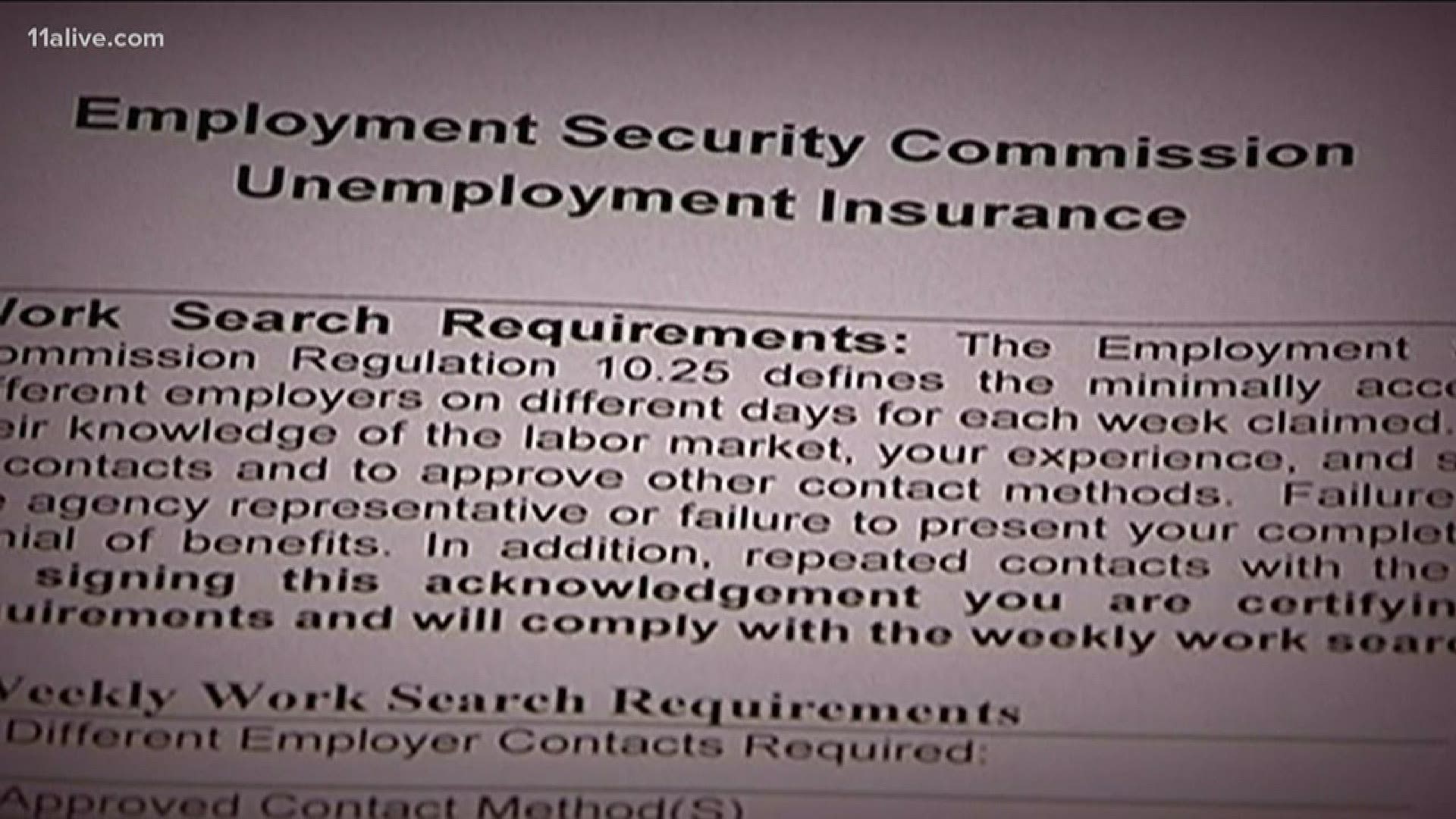

Individuals may file a claim for unemployment benefits online with the georgia department of labor and must meet certain criteria.

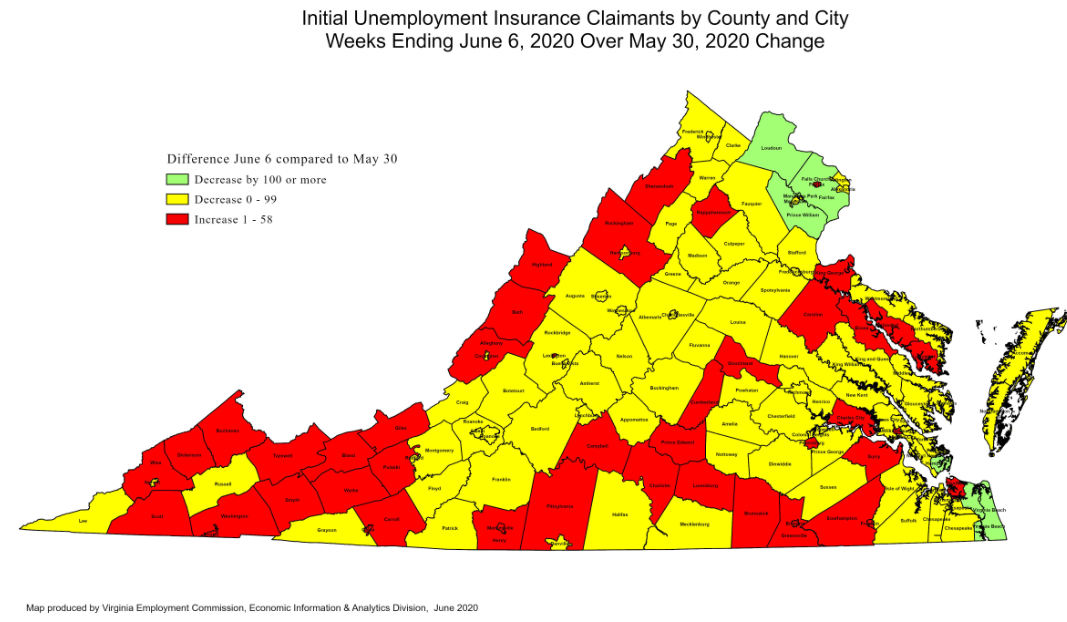

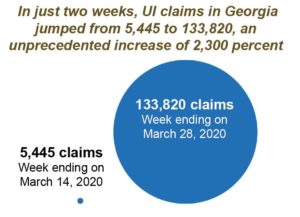

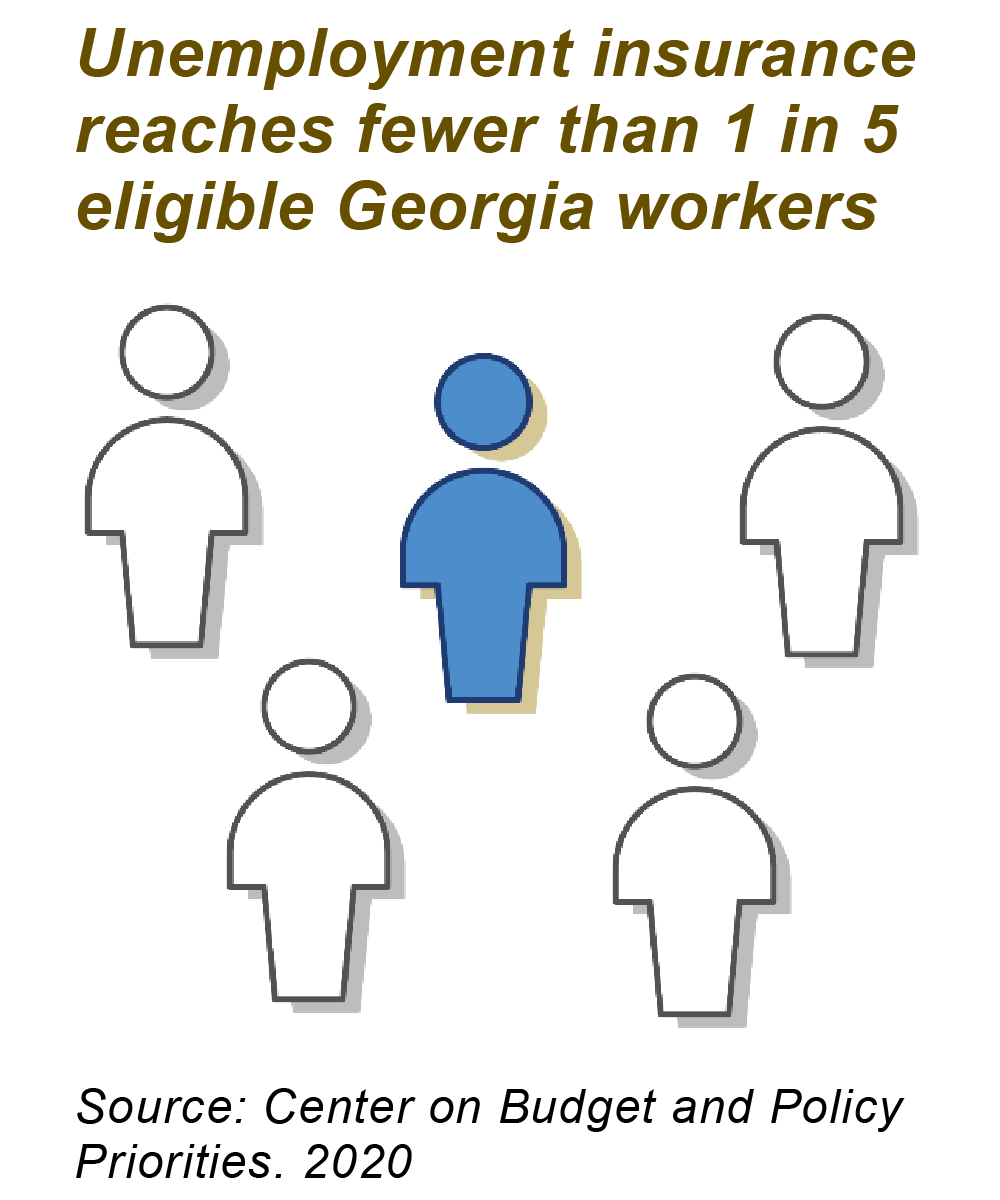

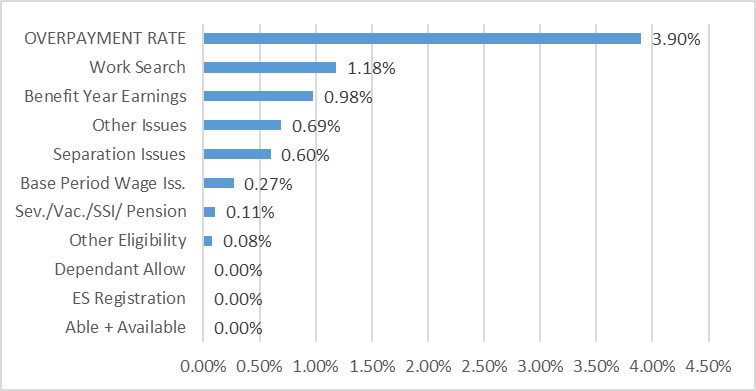

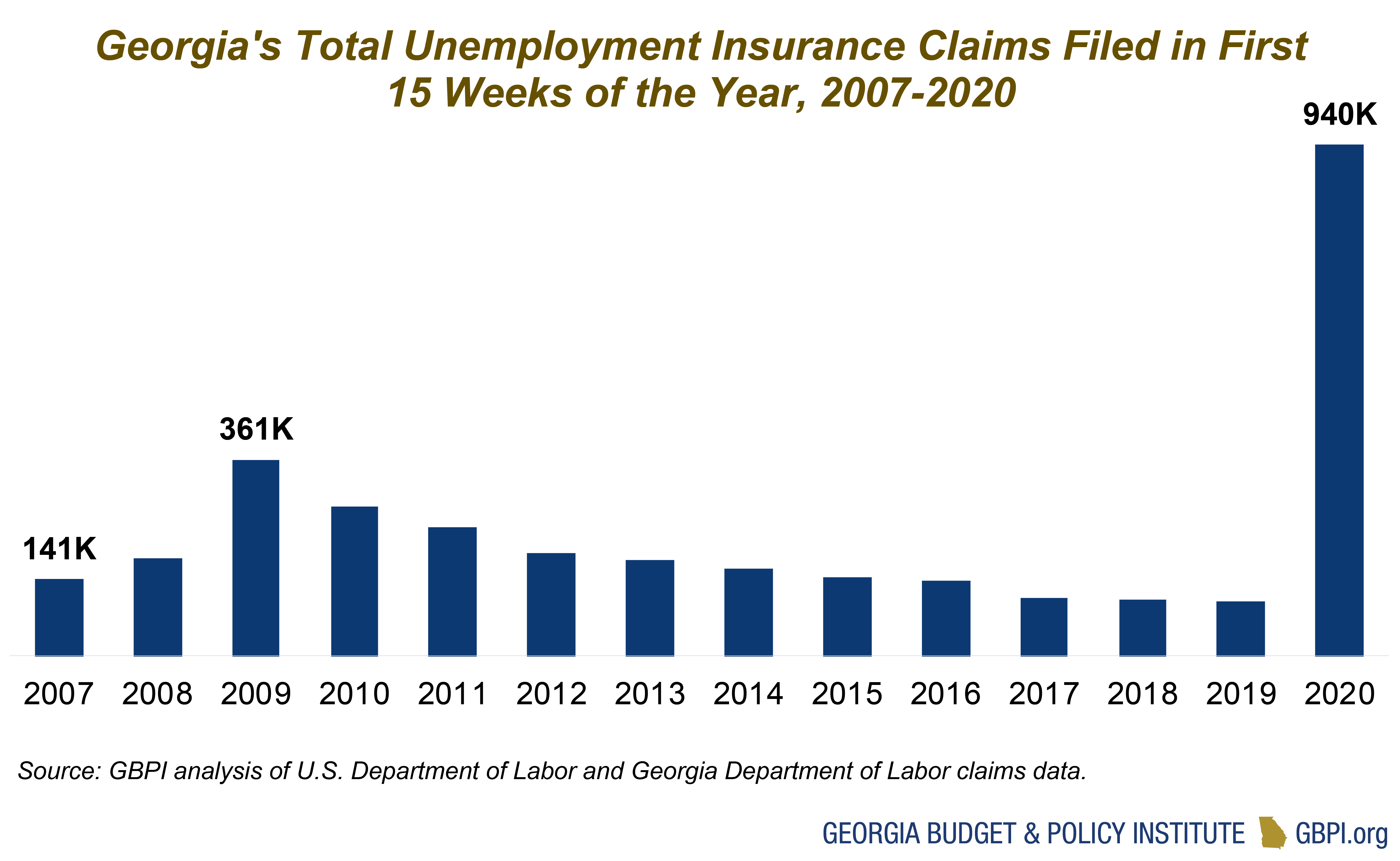

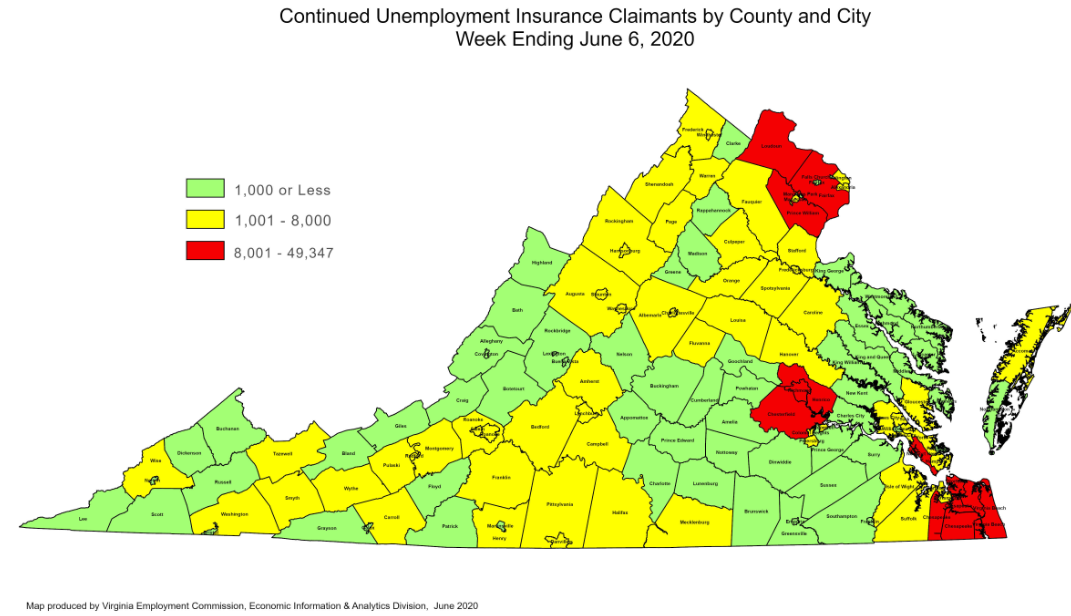

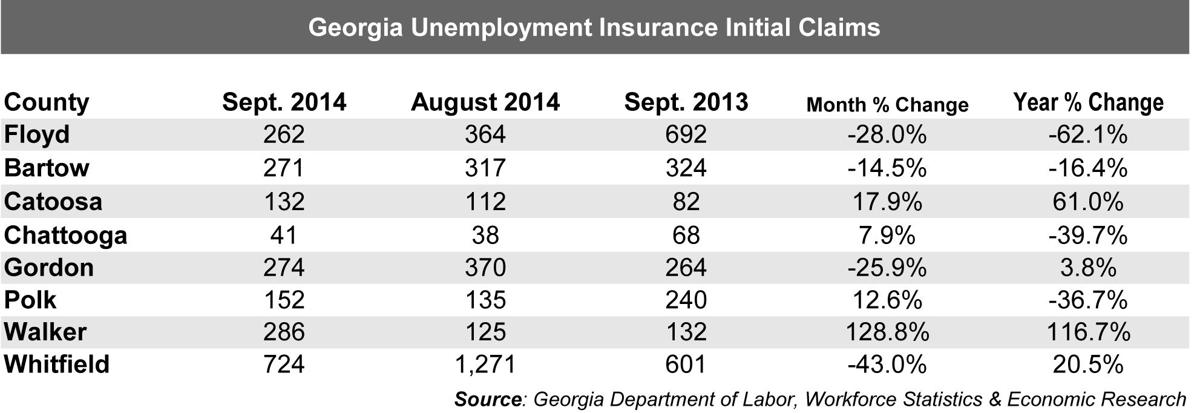

Georgia unemployment insurance rate. The georgia department of labor provides a wide range of services to job seekers and employers. Over 135000 claims have been filed by. 92 of all valid claims have received benefits in the past 19 weeks where a payment has been requested but many of the others are not eligible for payment per state and federal law.

That rate generally remains in effect for at least 36 months. You must complete an application for gdol tax account or status change dol 1a form and return it to the georgia department of labor suite 850 148 andrew young international blvd atlanta ga. After applying individuals must request payments weekly to be paid unemployment benefits for weeks they are determined to meet eligibility.

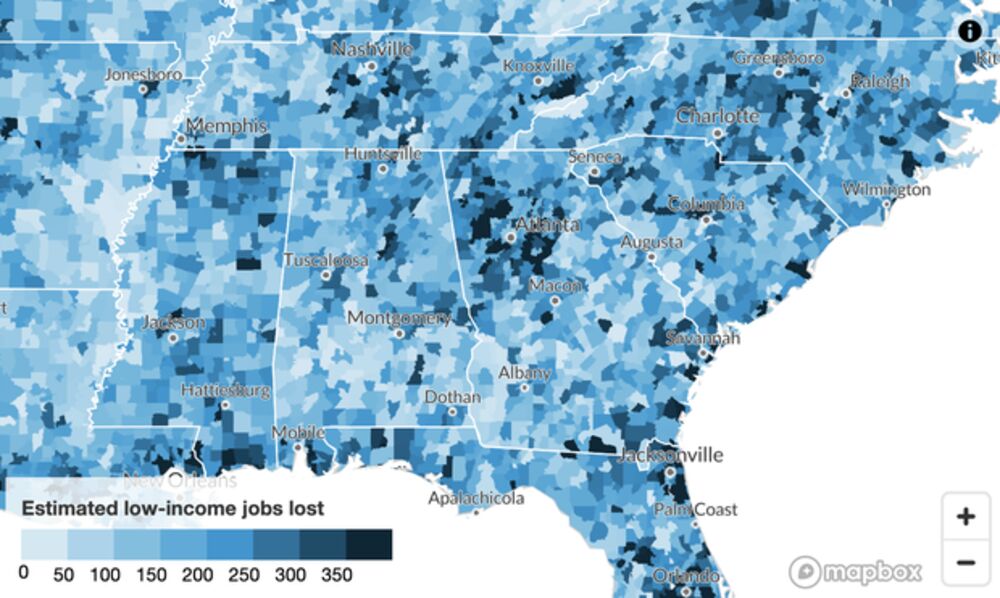

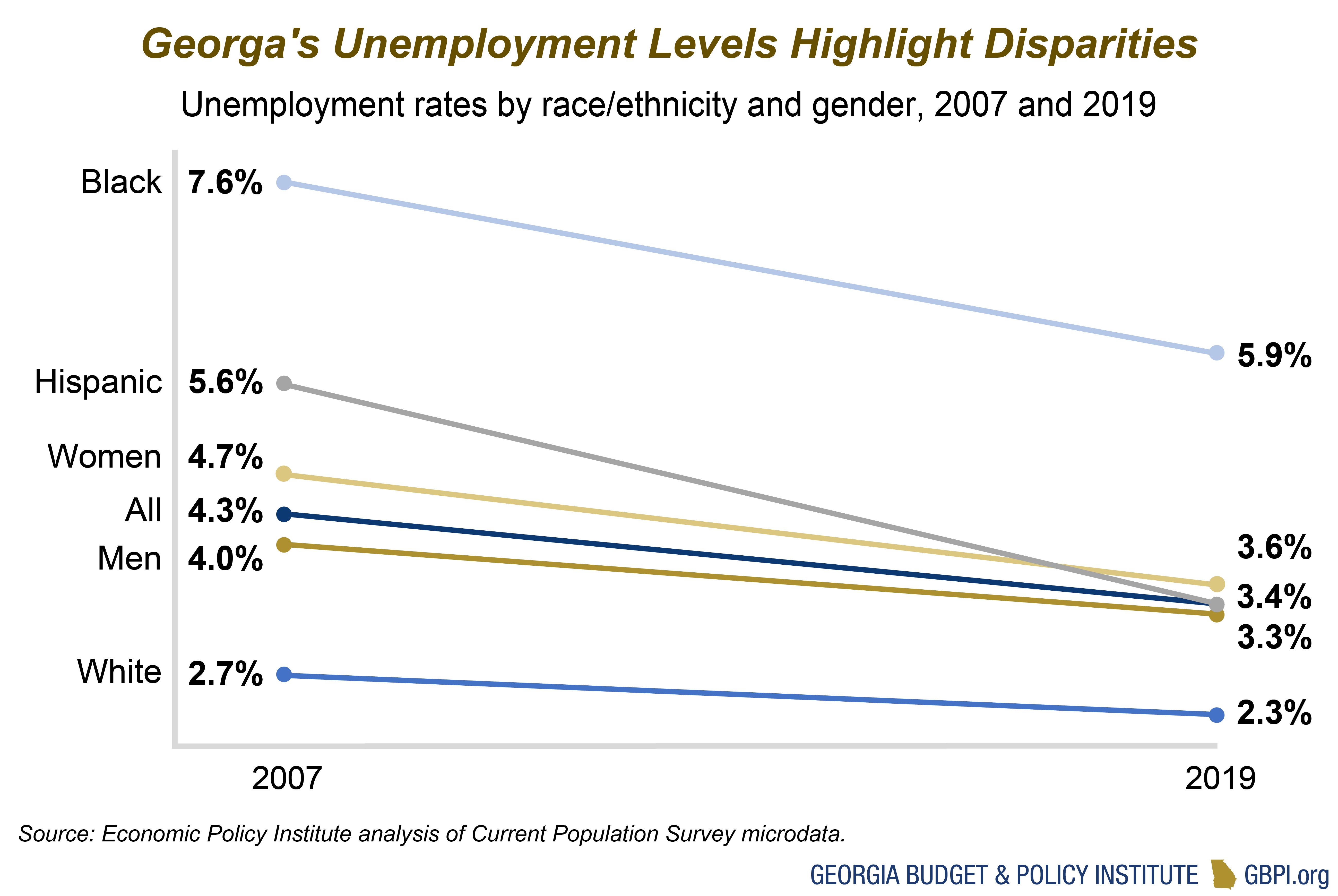

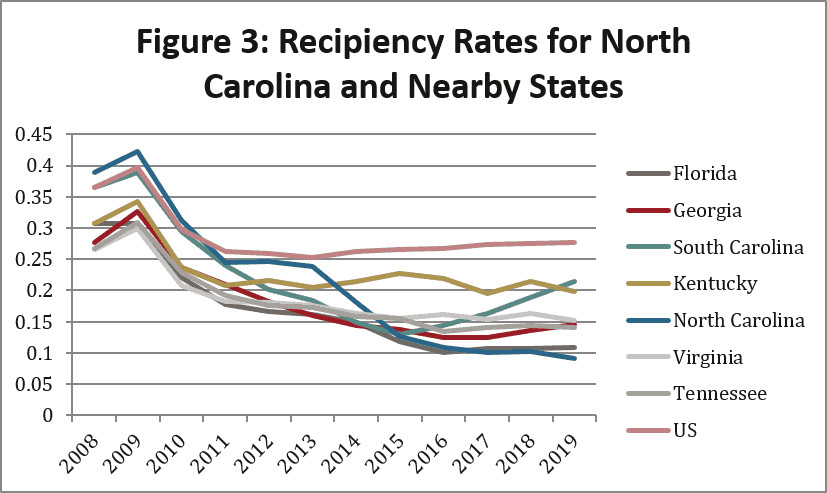

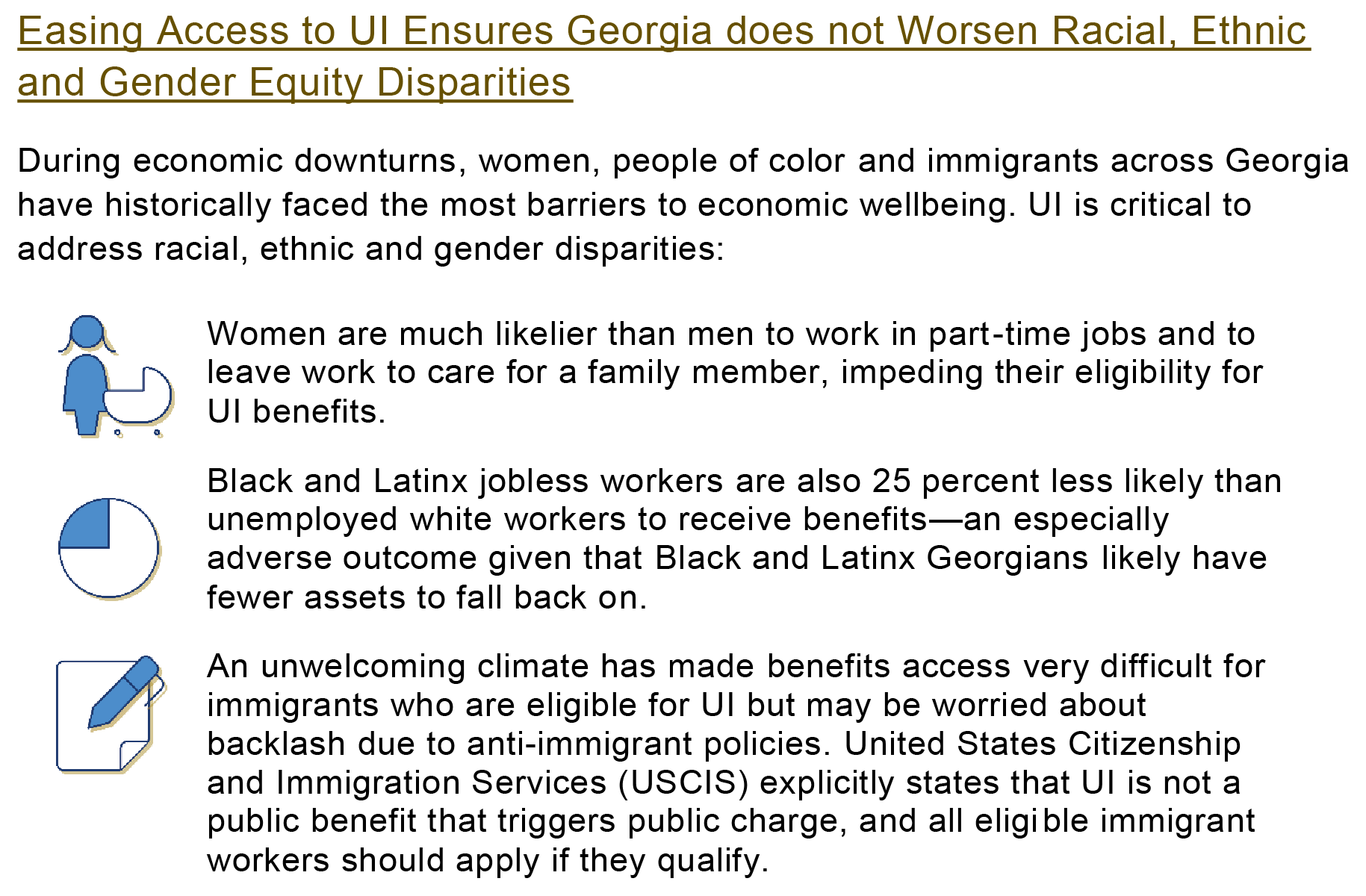

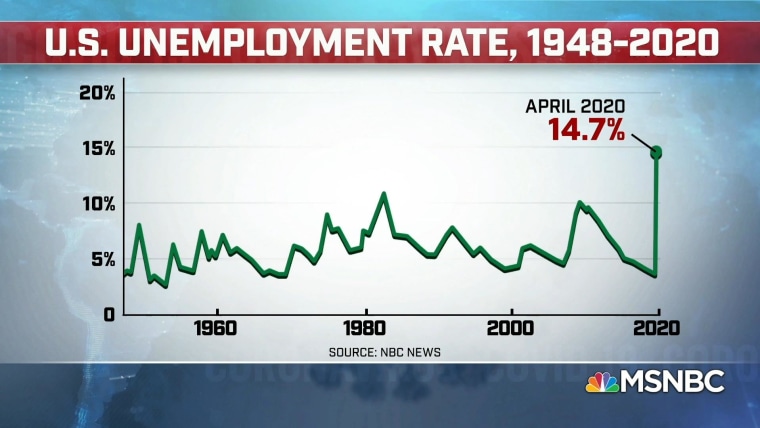

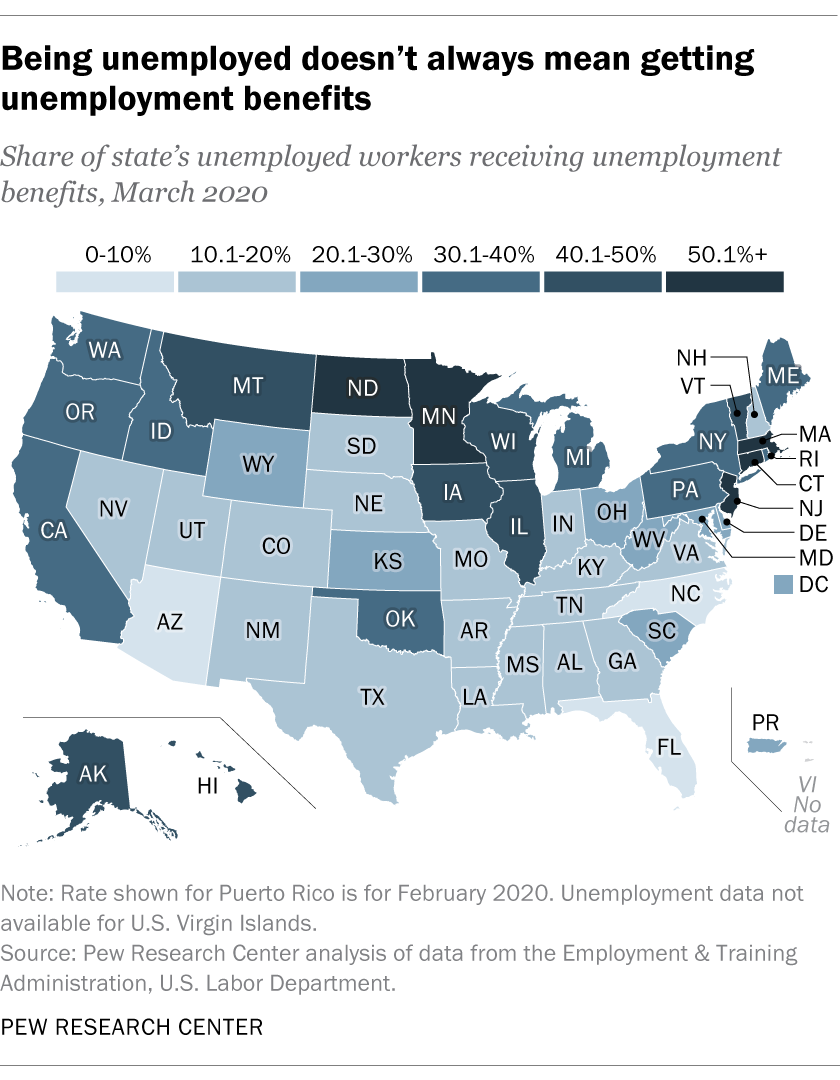

Unemployment insurance programs are governed by state governments and are funded by state federal and private companies that pay employment tax. Georgians filing unemployment insurance ui claims with the georgia department of labor must meet certain criteria. Georgias unemployment rate dropped in june to 76 a decrease of 18 percentage points from may but still more than double the rate from a year ago.

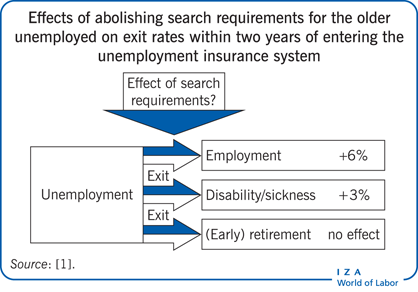

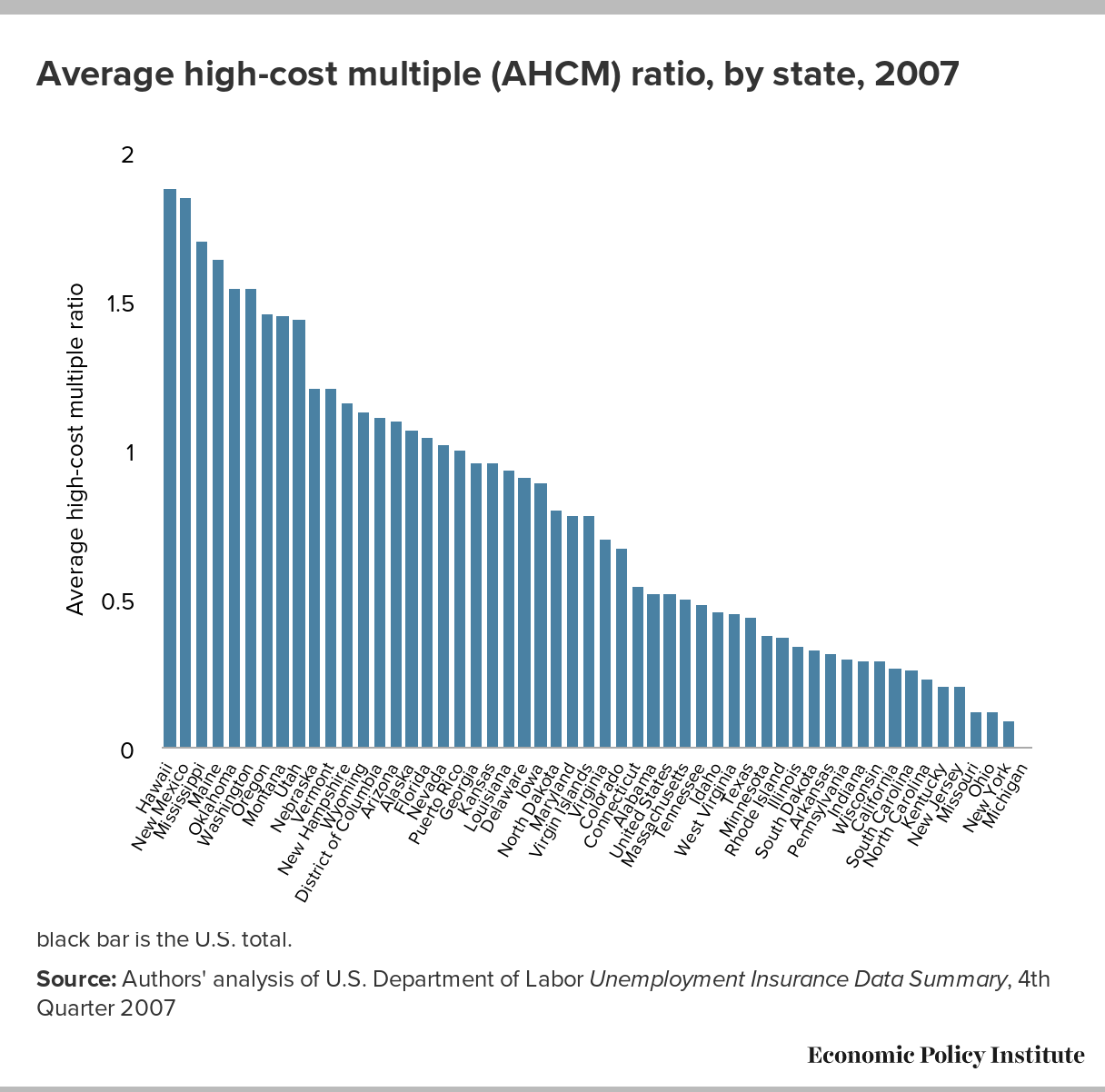

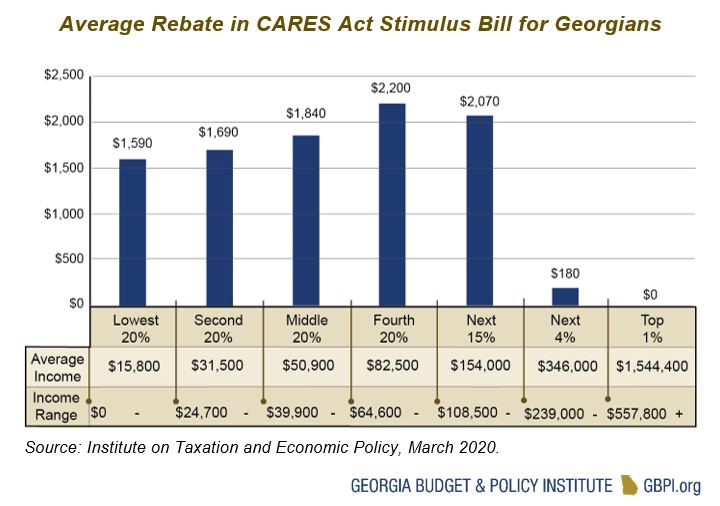

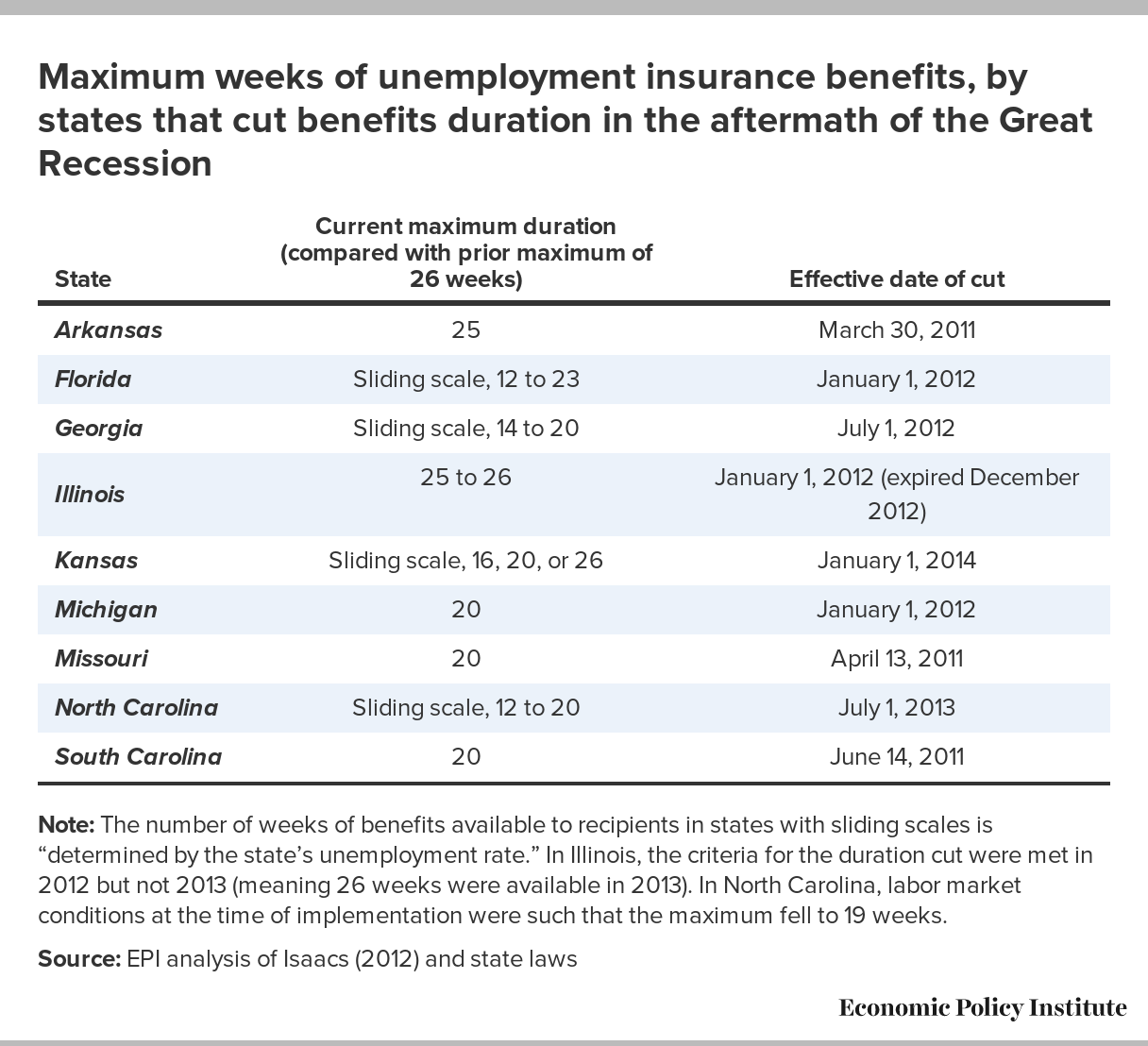

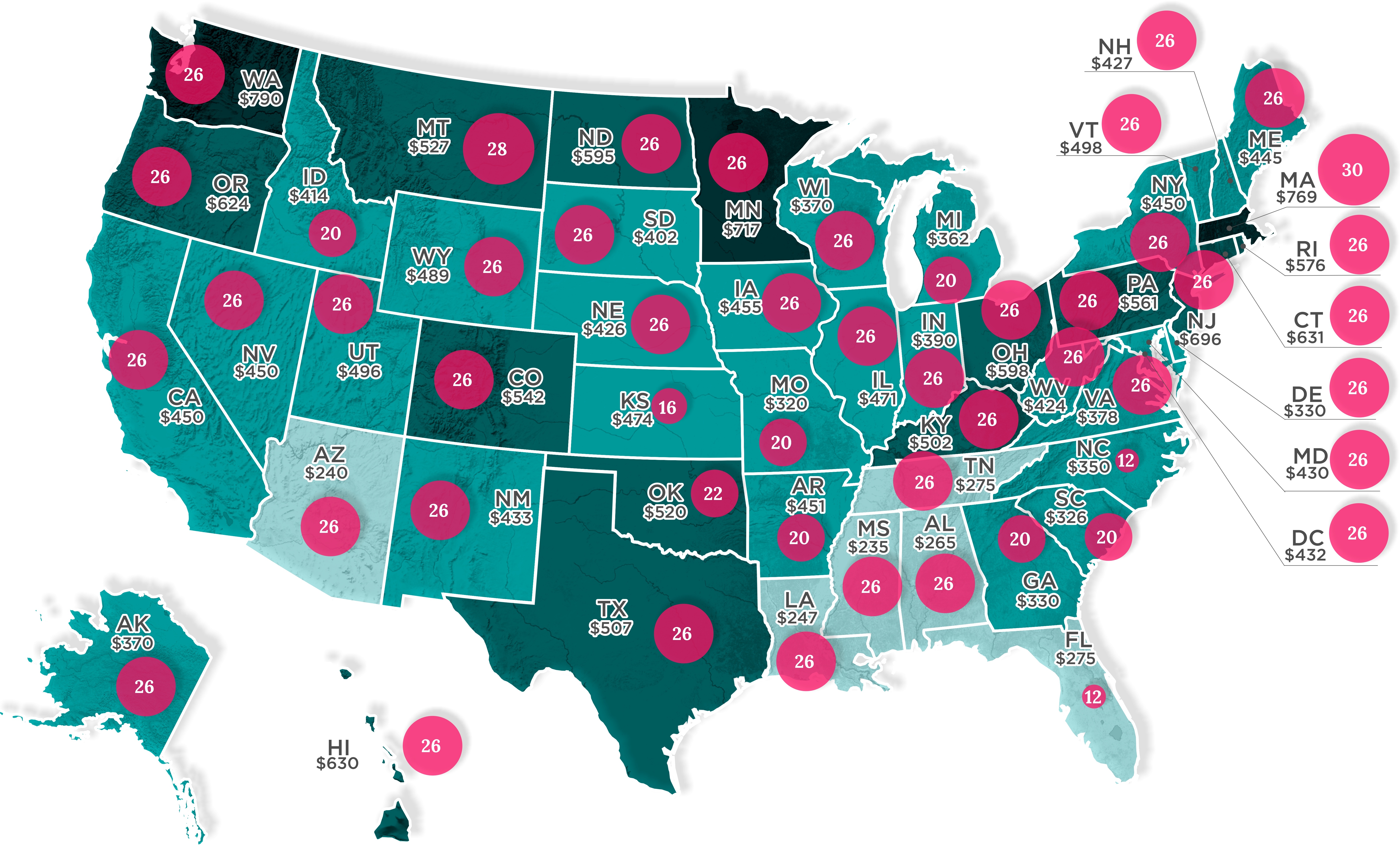

The table below provides a list of state unemployment benefits including the minimum and maximum weekly unemployment rates for all 50 states in america plus washington dc puerto rico and the us. The 2020 annual ui tax rate notices are now available on the georgia department of labor gdol employer portalif you are not registered on the employer portal please register immediately to avoid delays in receiving this important information. Contributory employers pay taxes at a specified rate.

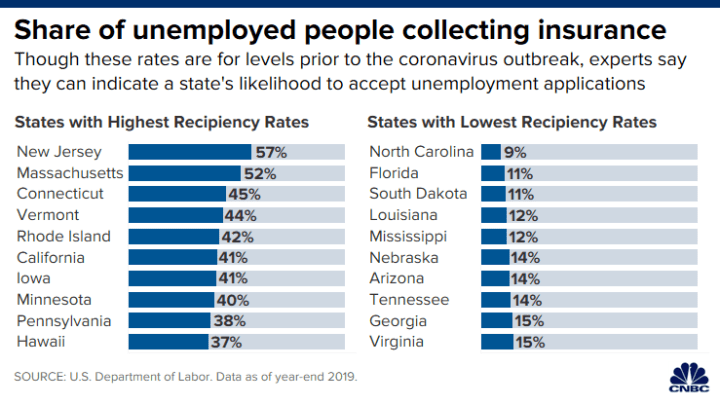

In georgia employers pay the entire cost of unemployment insurance benefits. In recent years in georgia that amount known as the taxable wage base has been stable at 9500. Ultimately the onus is on the state government to balance the checkbook so the state has to decide the benefits maximum amount duration and eligibility to receive the benefits.

In recent years the rate has been 27. Just be aware that states and territories can and do regularly change their maximum benefit amounts. However its always possible that amount could change.

The state ui tax rate for new employers also can change from one year to the next. Atlanta ga the georgia department of labor has recently been asked why not all initial unemployment insurance ui claims from the middle of march have not been paid.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19920630/GettyImages_1215036999.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/19867737/unemployment.jpg)