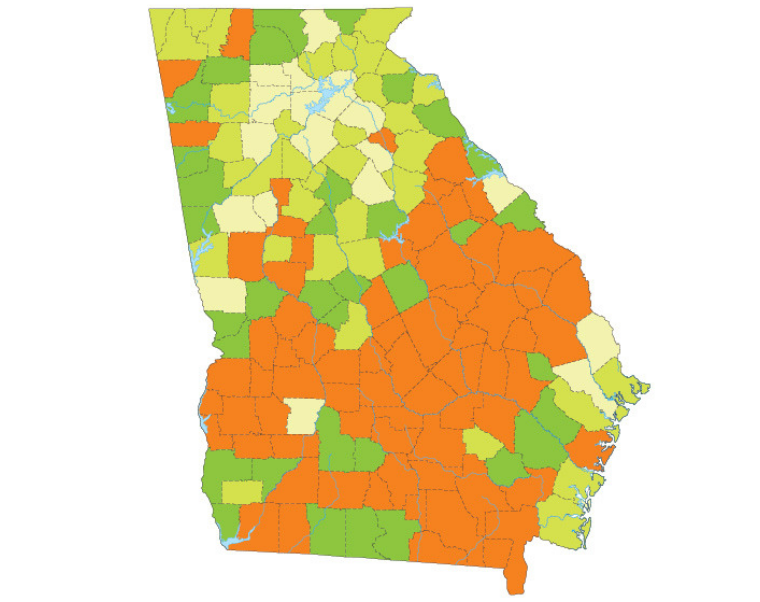

Georgia Tax Revenue By County

Due to covid 19 customers will be required to schedule an appointment.

Georgia tax revenue by county. The ad valorem calculator can also estimates the tax due if you transfer your vehicle to georgia from another state. Filing requirements for full and part year residents and military personnel. Excel file for current tax digest and 5 year history of levy 2 27 19 flpa grant instructions 30762 kb forest land protection act grant countycity pt 77 instructions.

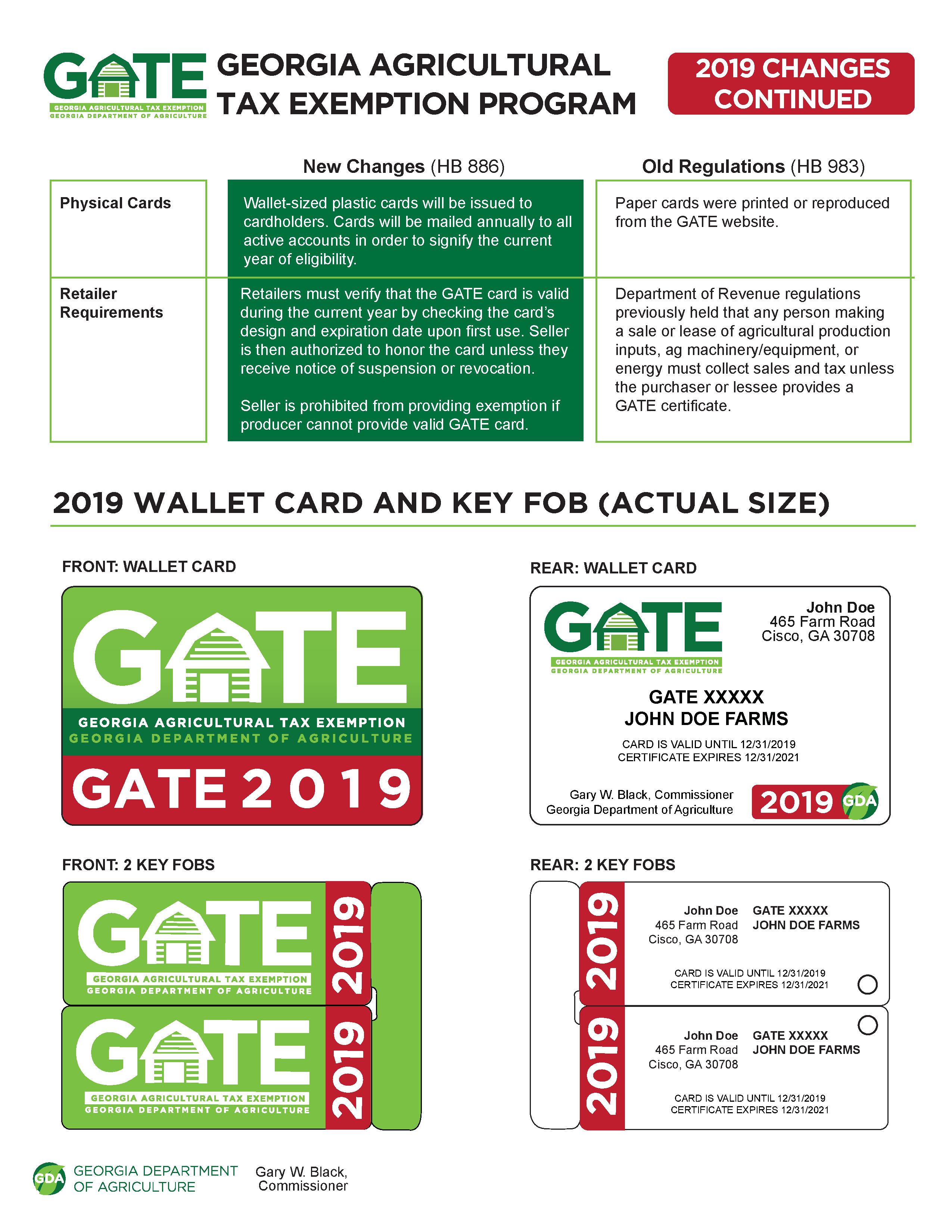

Any questions pertaining to tax exemptions at the local level should be asked to and answered by your county tax commissioners office. This 1099 g form is for taxpayers who itemized deductions and received a refund credit or offset. This tax is based on the value of the vehicle.

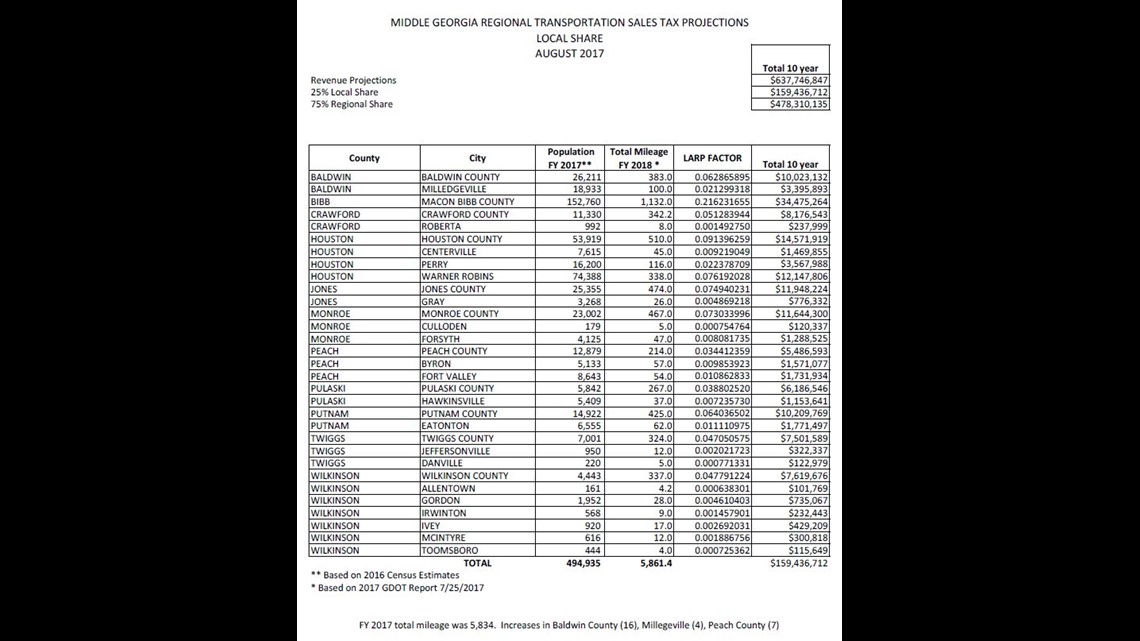

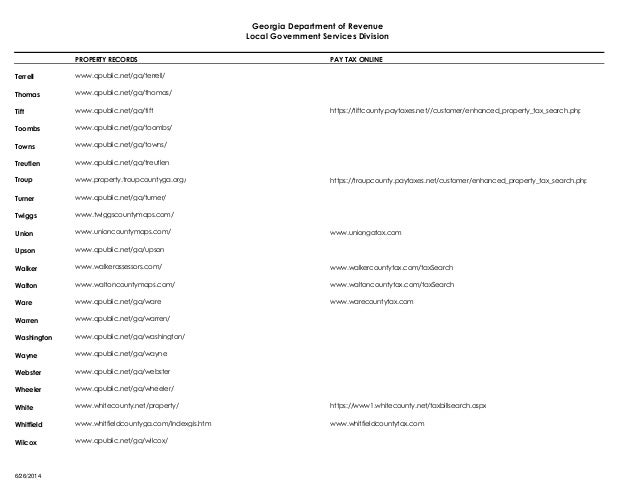

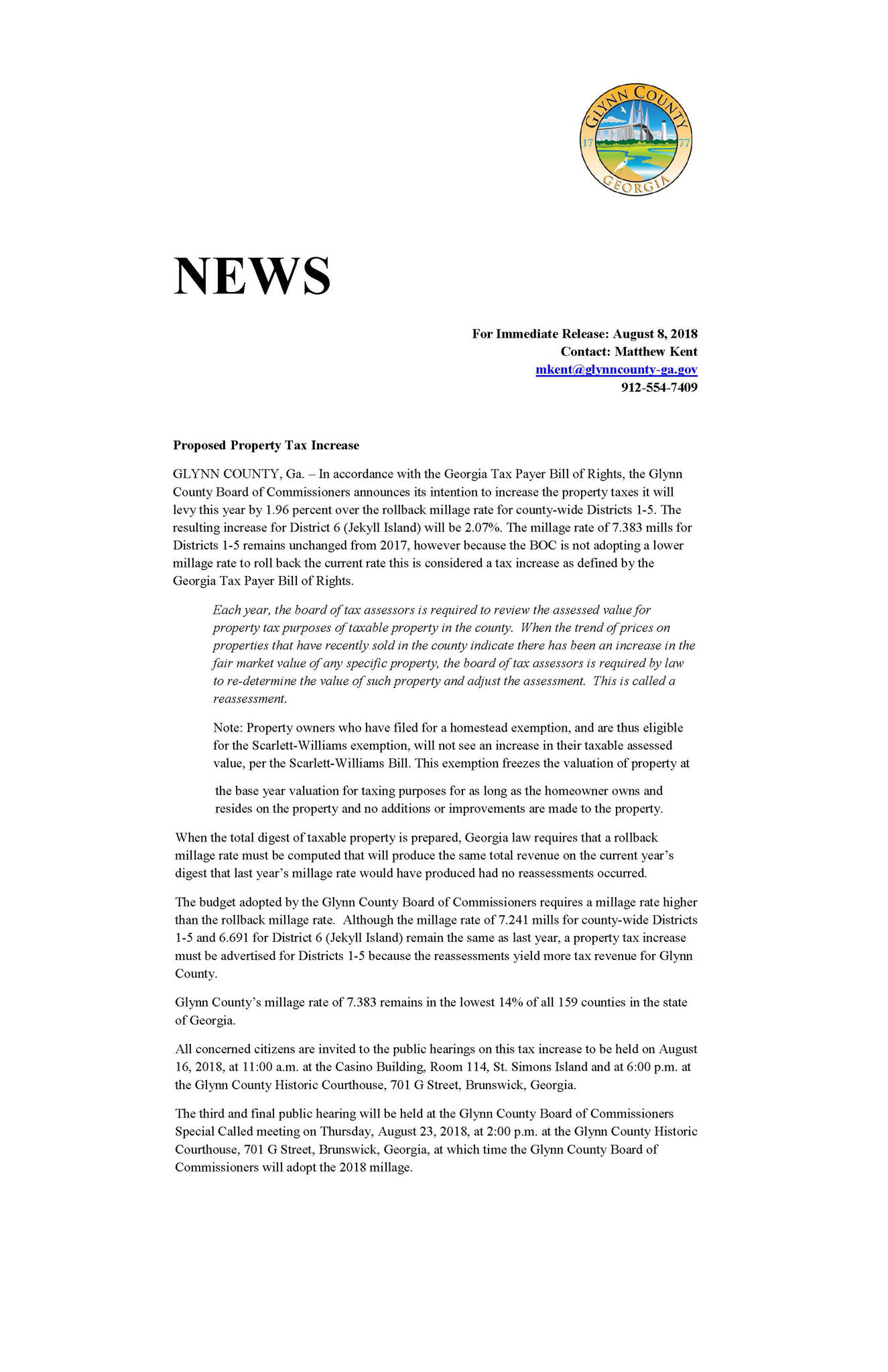

The distributions section provides technical assistance to governing authorities on local tax referendums. This unit distributes monthly sales tax proceeds publishes state and local sales and use tax rates maintains local sales tax revenue data receives flpa requests and distributes monthly 911 proceeds to local governments operating a qualified emergency system. Before sharing sensitive or personal information make sure youre on an official state website.

The tax must be paid at the time of sale by georgia residents or within six months of establishing residency by those moving to georgia. Ad valorem vehicle taxes if you purchased your vehicle in georgia before march 1 2013 you are subject to an annual tax. This webpage is a service provided by the georgia department of revenue local government services division.

Comments or questions about this page should be directed to local government services. Want to find more county property tax facts. The administration of tax exemptions is as interpreted by the tax commissioners of georgias 159 counties.

Search for income tax statutes by keyword in the official code of georgia. The department of revenue has resumed in person customer service as of monday june 1 2020. Local state and federal government websites often end in gov.

Gdvs personnel will assist veterans in obtaining the necessary documentation for filing. Filing state taxes the basics. State of georgia government websites and email systems use georgiagov or gagov at the end of the address.

Popular online tax services. Taxpayers now can search for their 1099 g and 1099 int on the georgia tax center by selecting the view your form 1099 g or 1099 int link under individuals. Additionally taxpayers can still conduct all business with the department via online services telephone or designated secure lockbox locations.

For individuals the 1099 g will no longer be mailed.

.png)