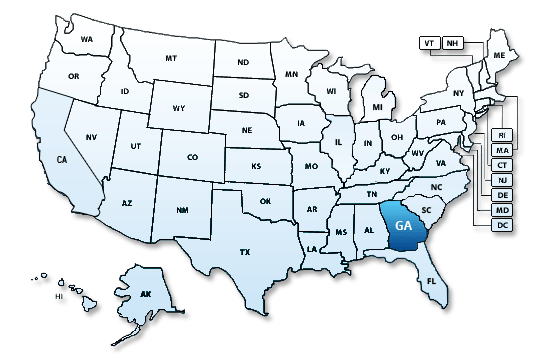

Georgia Tax Center Refund Status

Local state and federal government websites often end in gov.

Georgia tax center refund status. What can cause a delay in my georgia refund. Learn more about gtc. State of georgia government websites and email systems use georgiagov or gagov at the end of the address.

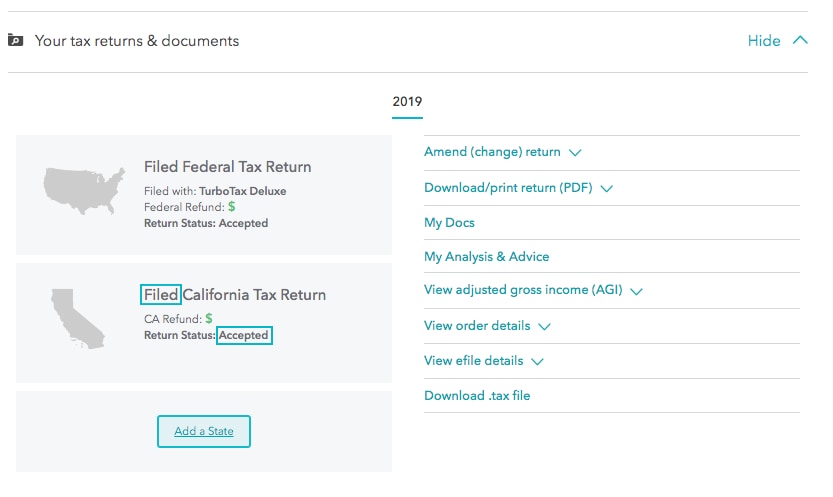

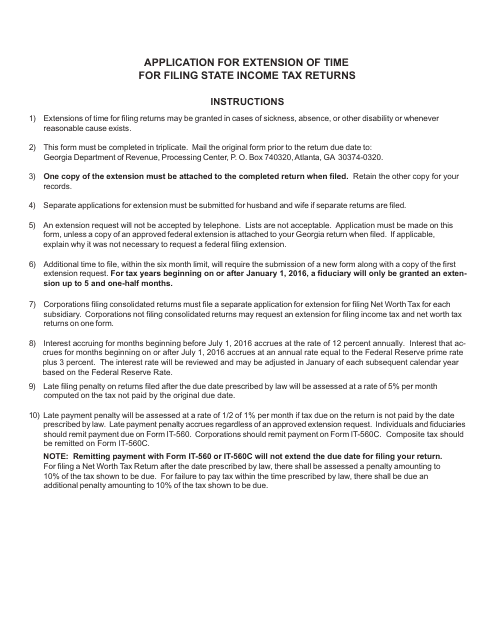

Create a profile for an individual go to the georgia tax center click on sign up for online access review the requirements to confirm you are eligible and what you need to apply. Click next for account type select individual income tax click next for id type select ssn click next. Before sharing sensitive or personal information make sure youre on an official state website.

Select ssn to provide your social security number and click next. Local state and federal government websites often end in gov. Before sharing sensitive or personal information make sure youre on an official state website.

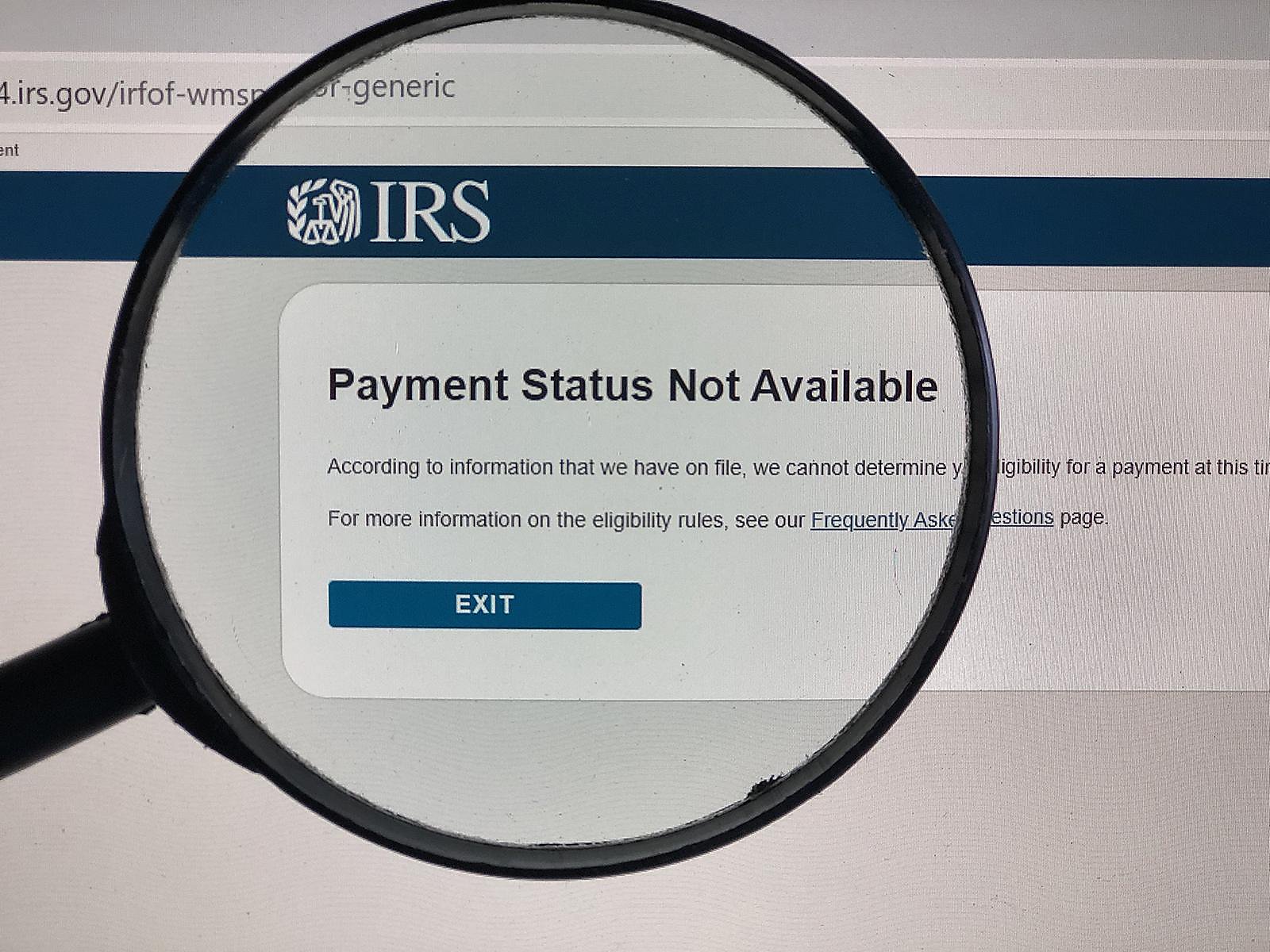

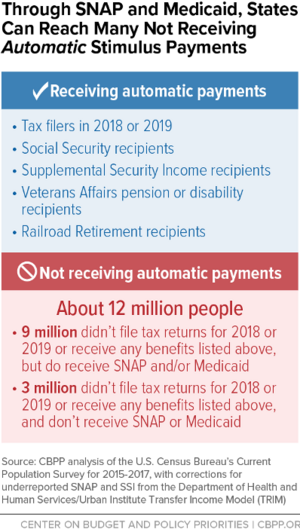

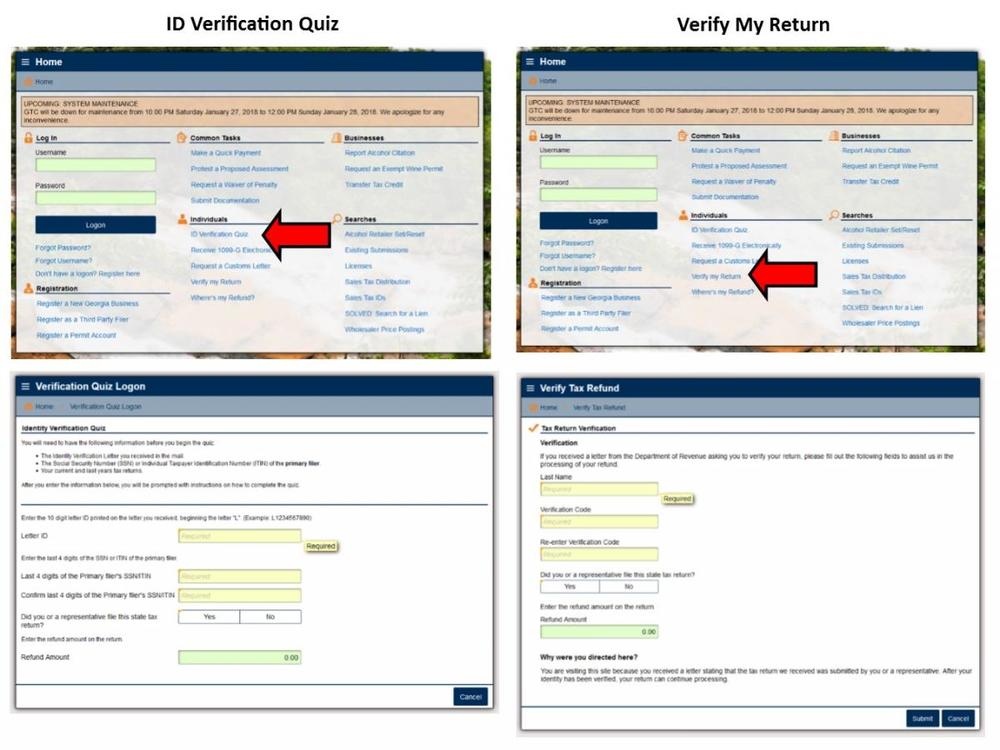

The department of revenue is protecting georgia taxpayers from tax fraud. An income tax return refund is the result of too much tax withholding estimated tax payments by a taxpayer throughout a tax year. It may take up to 90 days from the date of receipt by dor to process a return and issue a refund.

You may also call for refund status. You can check the status of your tax refund using the georgia tax center. Visit the georgia tax center gtc gtc is an accurate and safe way for individuals and businesses to take care of their state tax needs.

Tax refund processing times vary and depend on the accuracy of the original return but youll get your refund more quickly if you file your return electronically. Online support is available for many features to help you get started or if you need assistance with some of the many features. A number of things could cause a delay in your georgia refund.

Click next to view your refund status. Georgia department of revenue issues most refunds within 21 business days. We will begin accepting returns january 27 2020.

.png)

/arc-anglerfish-arc2-prod-mco.s3.amazonaws.com/public/NRGBXRS2UVDTNJWWEDSBXTTV6U.jpg)

.png)

/where-s-your-tax-refund-3193203-v4-5b688dc546e0fb004fc28d4e.png)