Georgia Tax Center Estimated Tax Payments

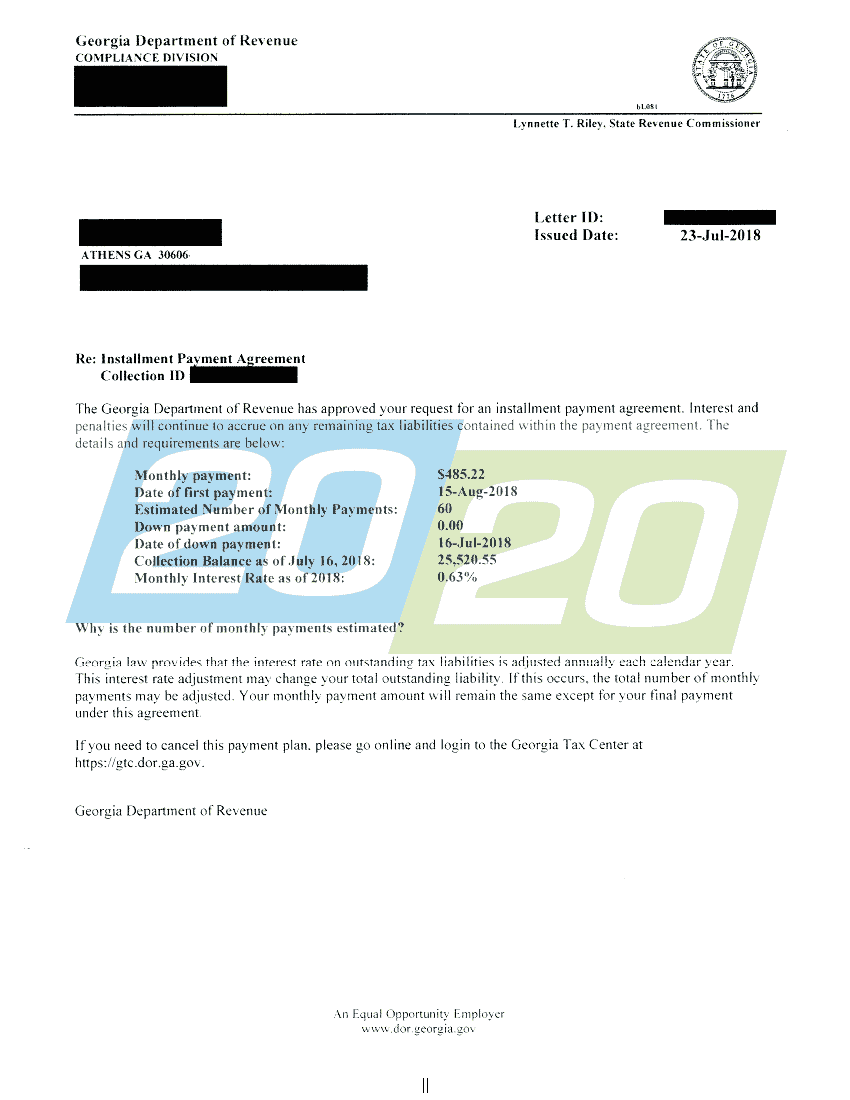

You can check your balance or view payment options through your account online.

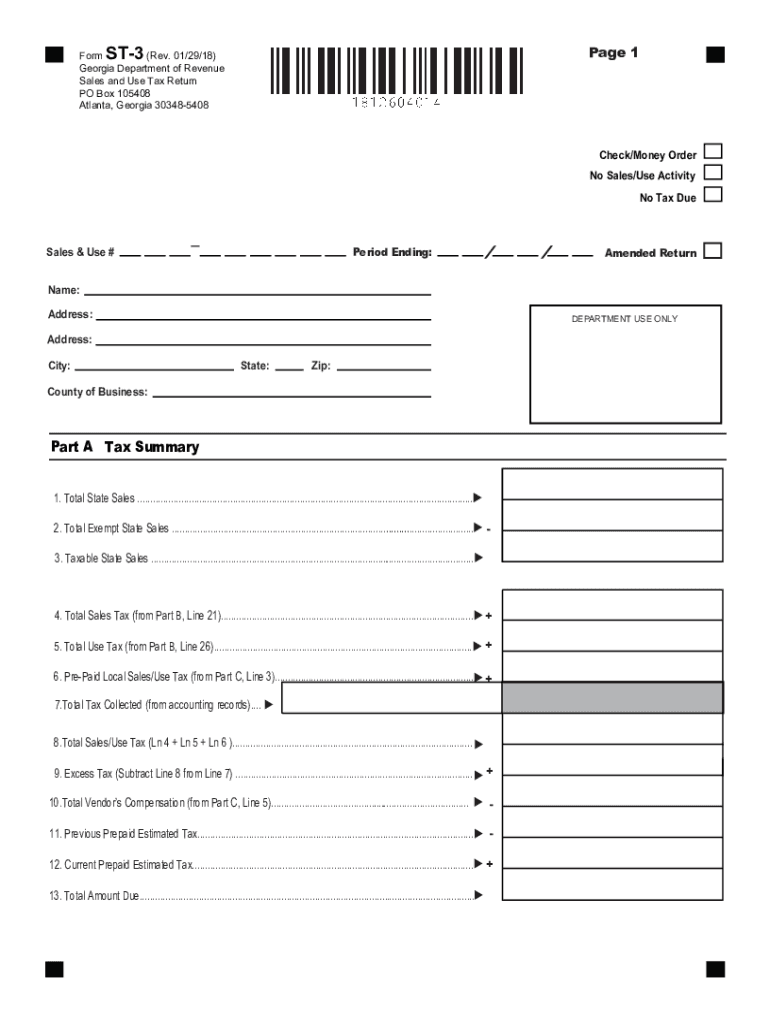

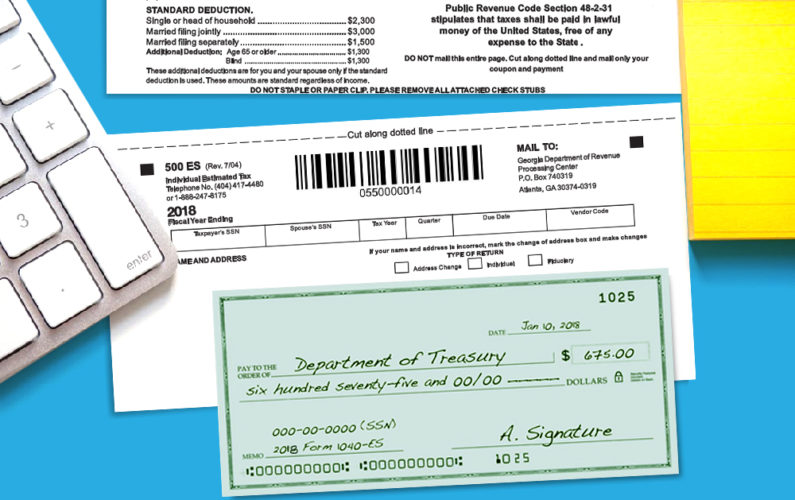

Georgia tax center estimated tax payments. To successfully complete the form you must download and use the current version of adobe acrobat reader. You can also request a payment plan online. Payment with return check or money order form 525 tv extension payments form it 560 estimated tax payment form 500 es application to request a payment plan paper.

Click next complete id information and click next complete the payor information and click next. Credit card payments are not allowed with quick payment. The georgia department of revenue works with software vendors to offer free electronic filing services to georgia taxpayers.

You have been successfully logged out. Individual go to the georgia tax center under common tasks click on make a quick payment review the request details and click next for customer type select on individual and click next for your id type select the box for social security. Credit cards are not accepted at this time for payments associated with extensions or amended returns.

See if you qualify. Taxes georgia tax center help individual income taxes register new business business taxes refunds information for tax professionals. You can check the status of your tax refund using the georgia tax center.

To make a payment for a specific filing period locate the filing period on the account summary page and select the pay link. Enter the payment effective date this is the date you want the funds to come out. Request a penalty waiver.

File your taxes for free. Tax refund processing times vary and depend on the accuracy of the original return but youll get your refund more quickly if you file your return electronically. 500 es individual and fiduciary estimated tax payment voucher.

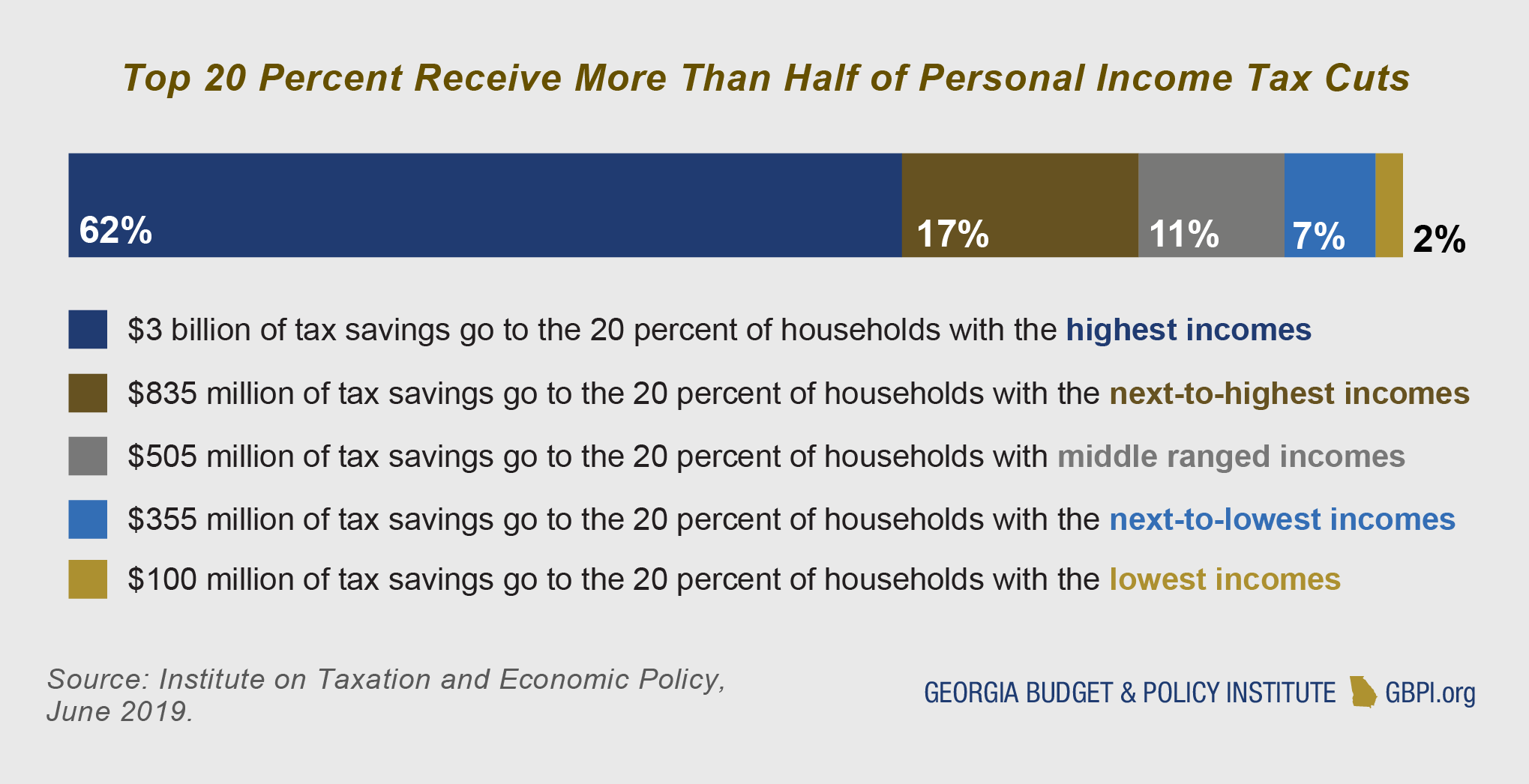

Underpayment of estimated tax or failure to pay estimated tax 9 per year of the underpayment use form 600 uet to compute the penalty and 5 of georgia income tax imposed for the taxable year 48 7 120 and 48 7 126. Make a quick payment no login required. Credit cards are only accepted as payment for current year individual income tax due on original forms 500 500ez 500es corporate income tax due on original forms 600 and 602es and liabilities presented to taxpayers via georgia department of revenue assessment notices.

Taxes georgia tax center help individual income taxes register new business business taxes refunds information for tax professionals. You may need fein ssn georgia tax number etc. You may now close this window.

%201.jpg)