Georgia State Tax Return Online

Georgia state income tax returns for tax year 2019 january 1 dec.

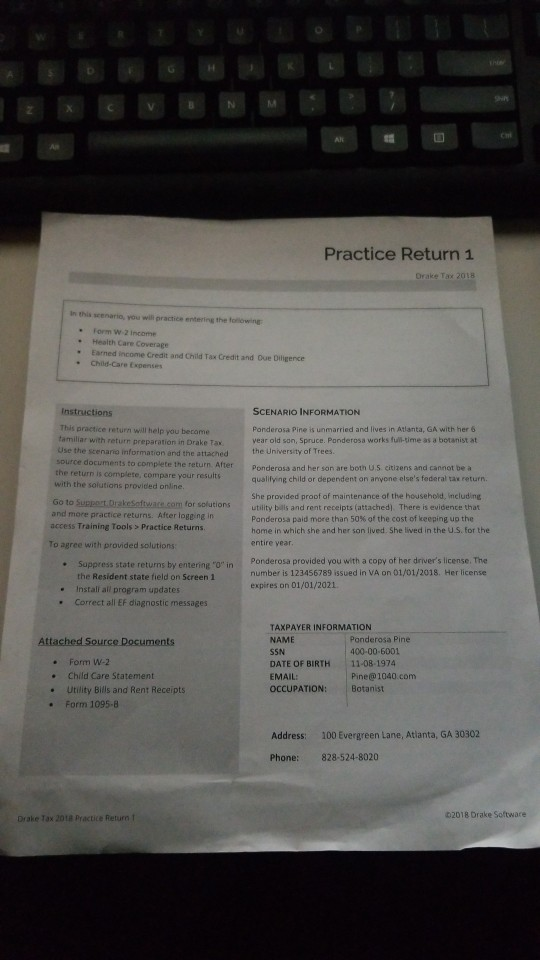

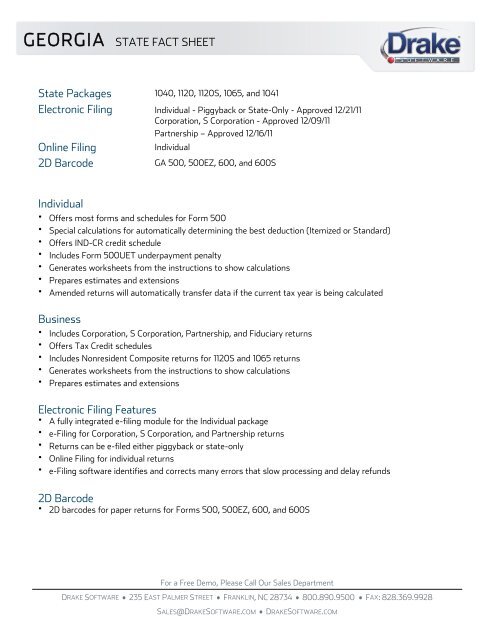

Georgia state tax return online. Notify me when a return is filed with my ssn protect yourself from fraud. All 41 plus dc income state tax returns for only 2895 yes you read it right not each but all. It may take up to 90 days from the date of receipt by dor to process a return and issue a refund.

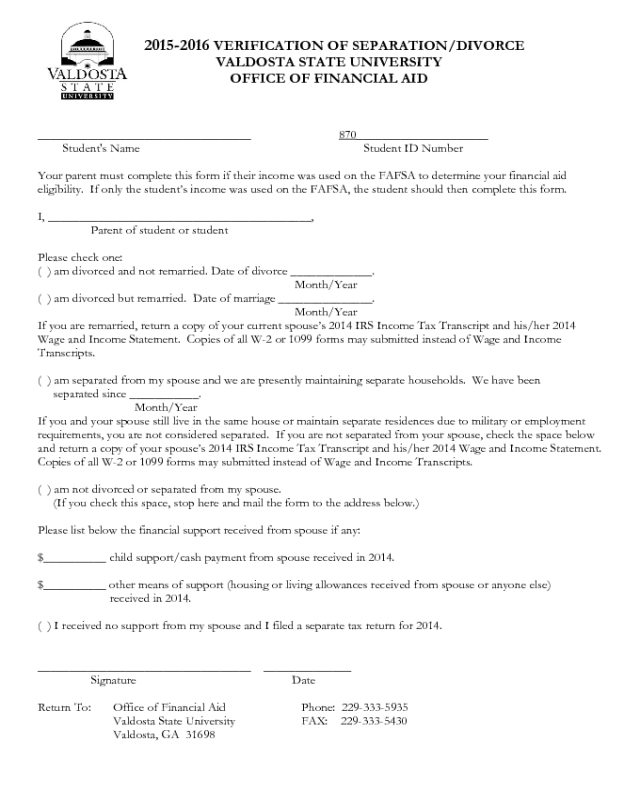

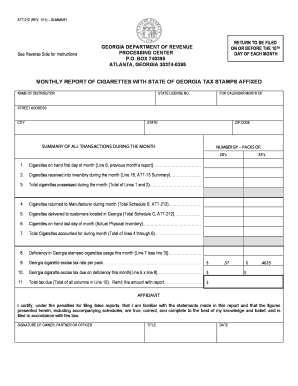

Popular online tax services. This 1099 g form is for taxpayers who itemized deductions and received a refund credit or offset. Search for income tax statutes by keyword in the official code of georgia.

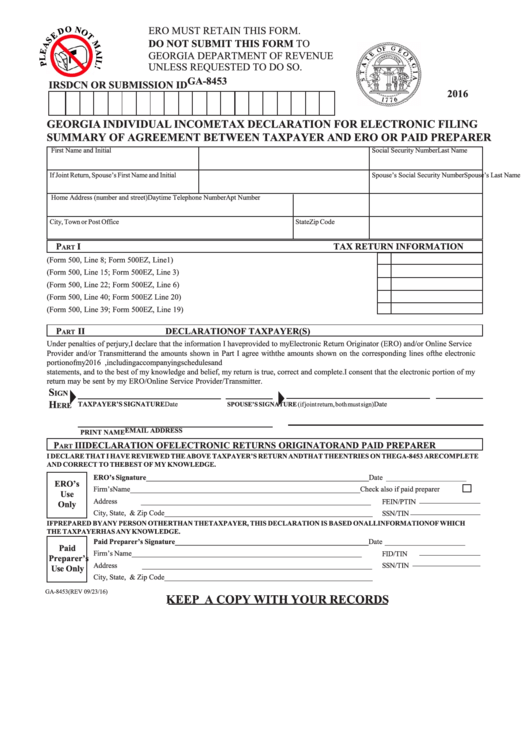

Protest a proposed assessment file a protest online. For individuals the 1099 g will no longer be mailed. 31 2019 can be prepared and e filed now with an irs or federal income tax return.

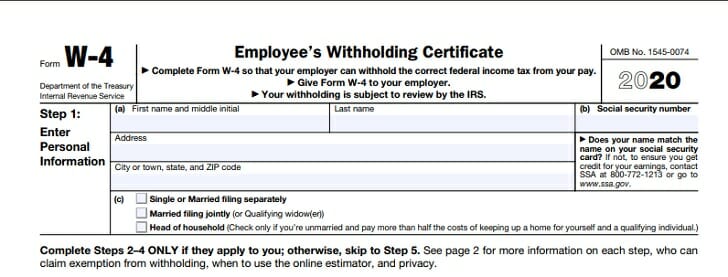

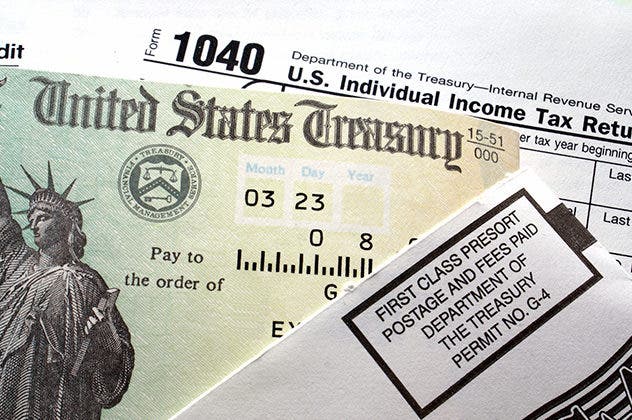

Tax refund processing times vary and depend on the accuracy of the original return but youll get your refund more quickly if you file your return electronically. State of georgia government websites and email systems use georgiagov or gagov at the end of the address. Federal tax return deadline detailslearn how to complete and file only a ga state return.

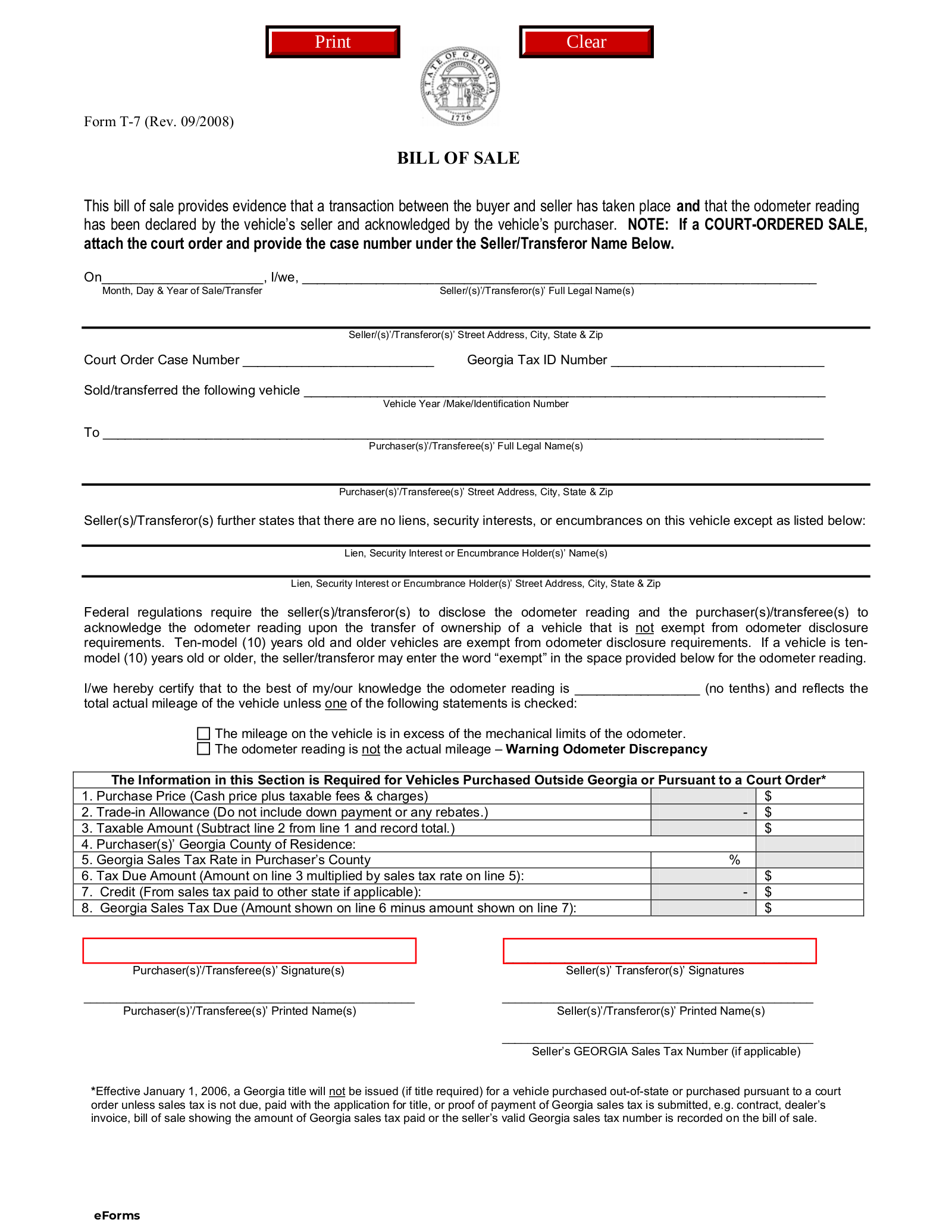

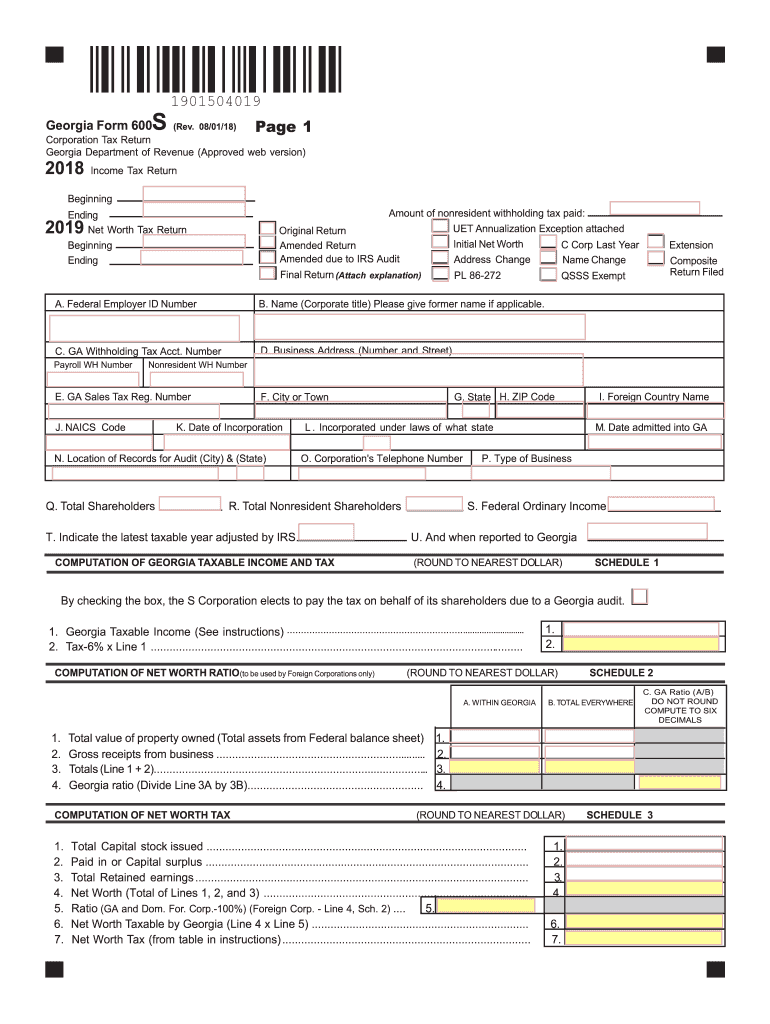

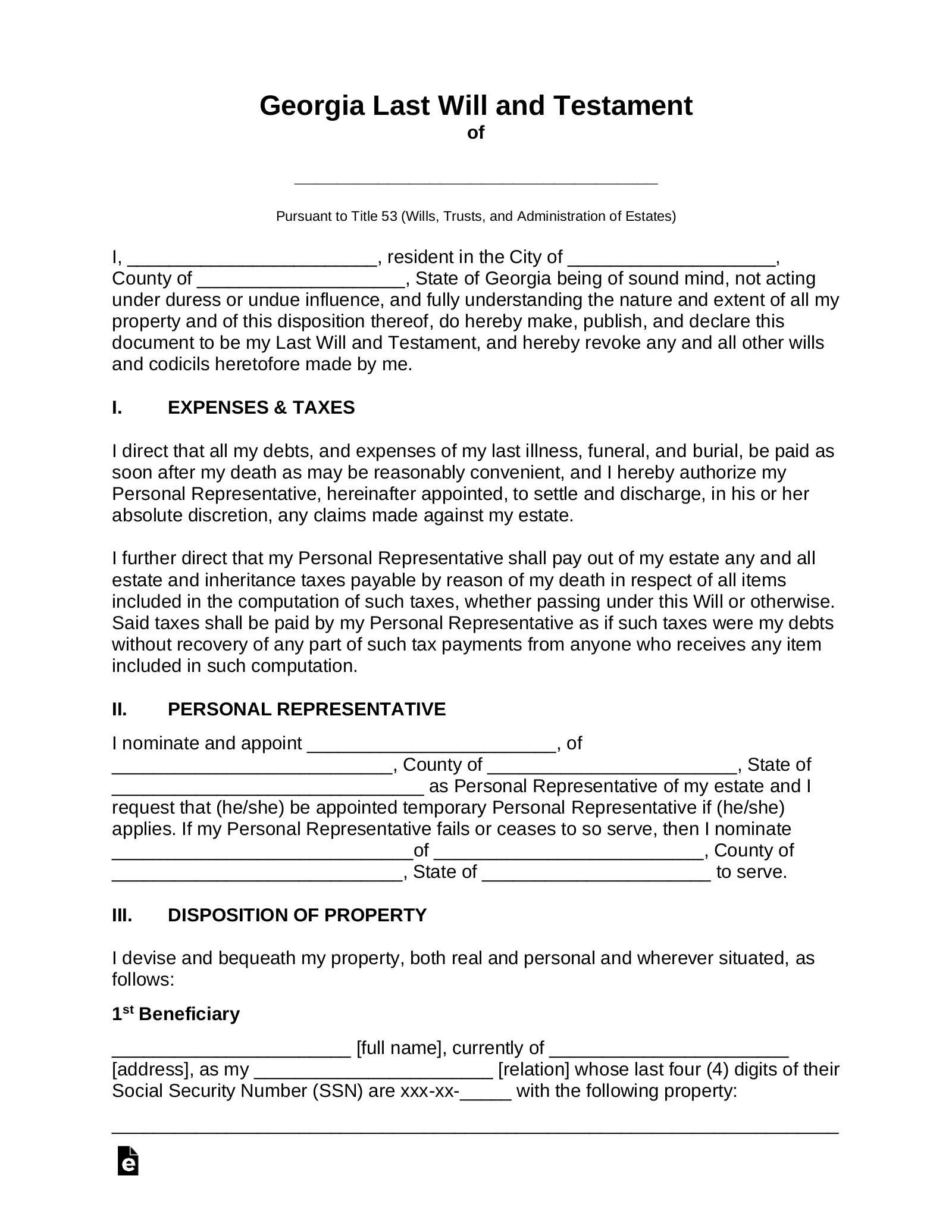

Please complete your federal return before starting your georgia return. The ga tax return filing and payment due date has moved from april 15 to july 15 2020 due to the codvid 19 crisis. Before sharing sensitive or personal information make sure youre on an official state website.

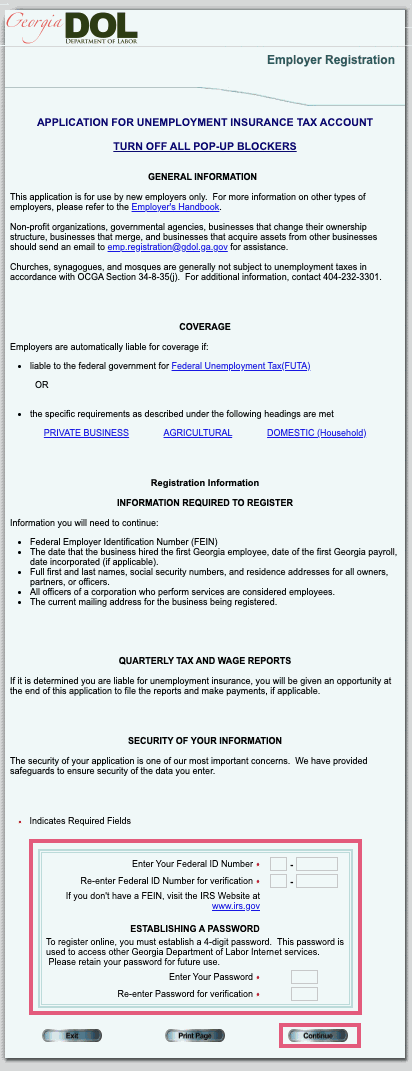

Filing state taxes the basics. Sign up for notifications. You can check the status of your tax refund using the georgia tax center.

Compare that to turbotax and hr block they charge close to 4000 for per state not all state returns. Request a payment plan using gtc instructions. The department of revenue is protecting georgia taxpayers from tax fraud.

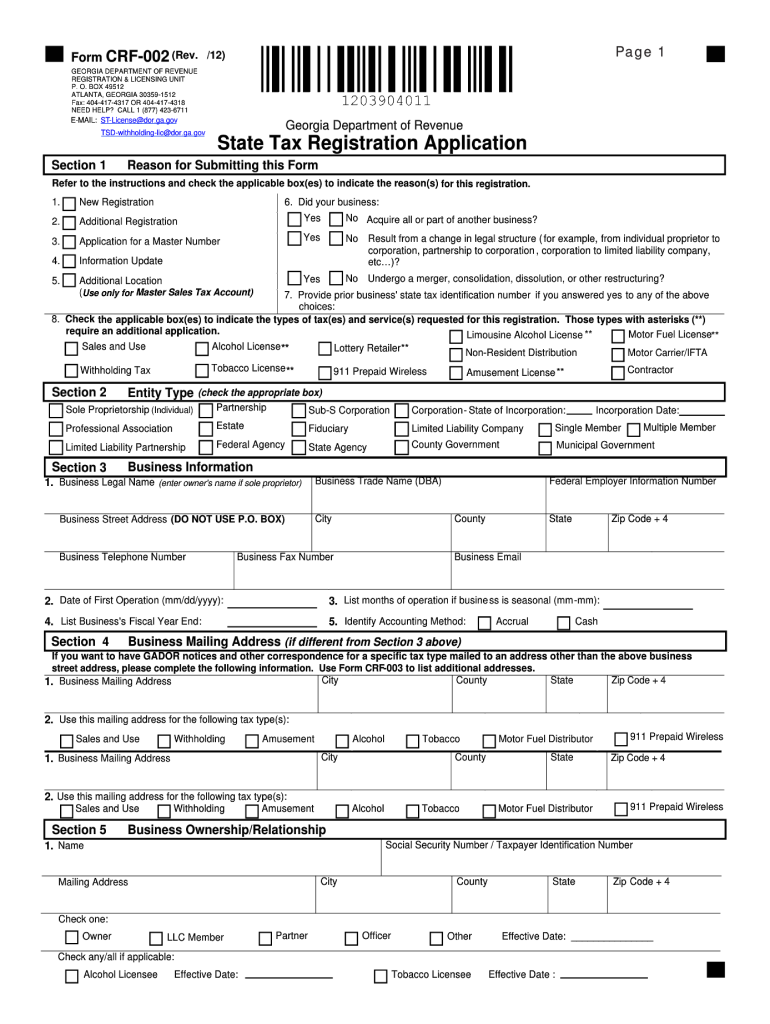

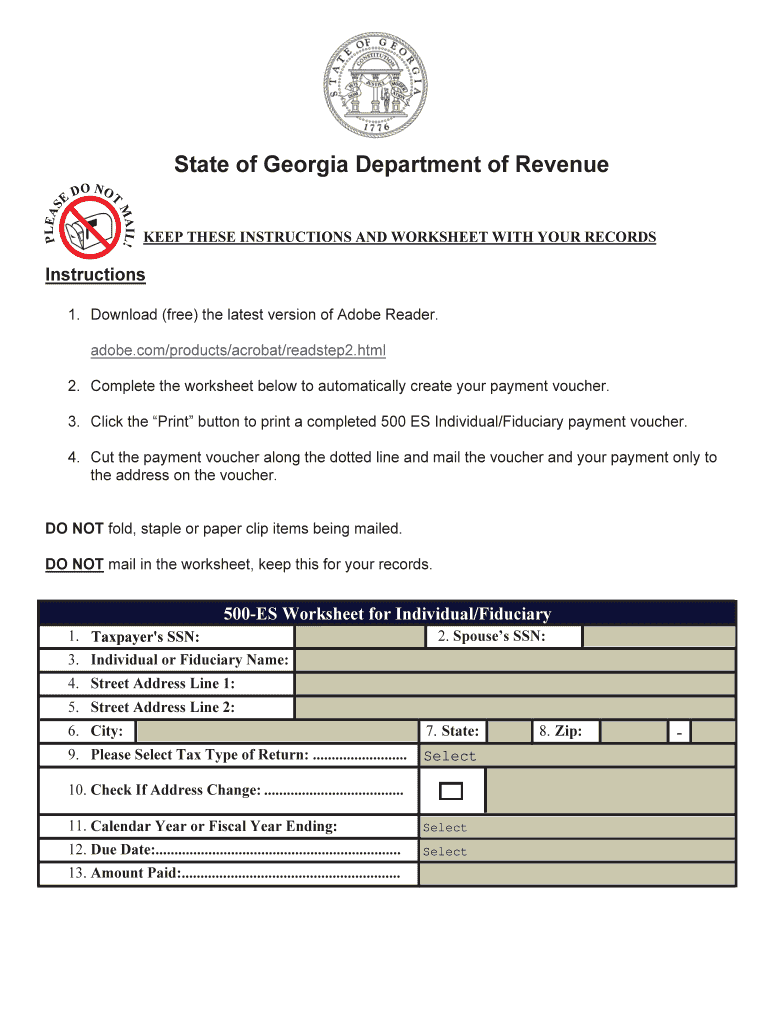

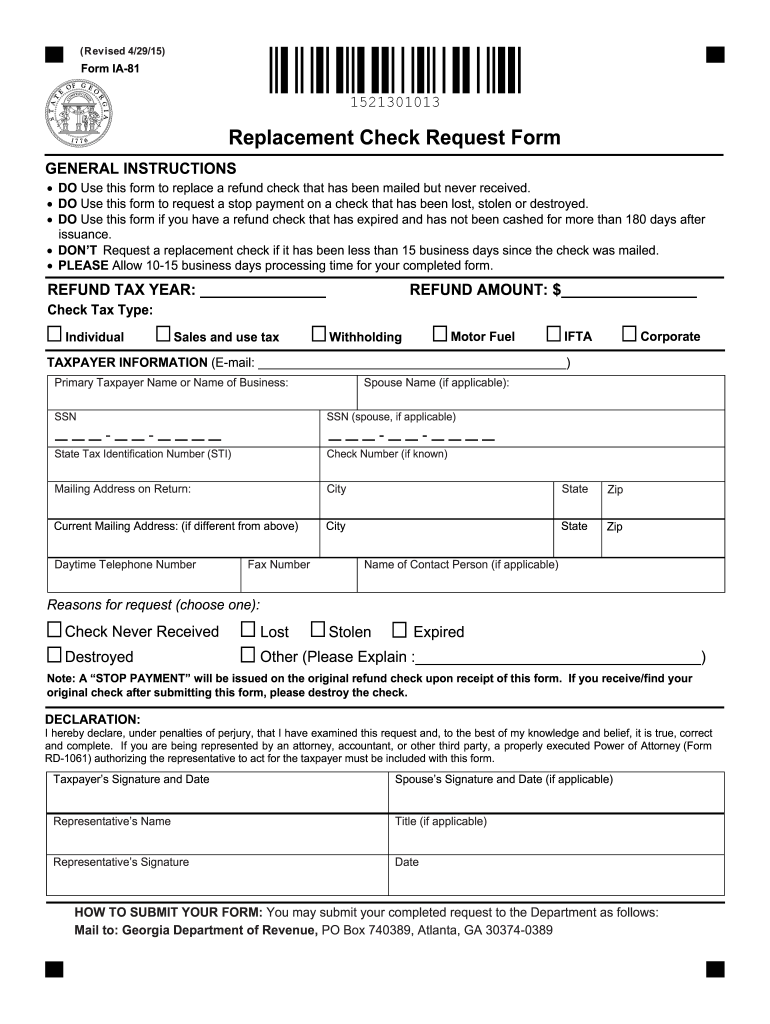

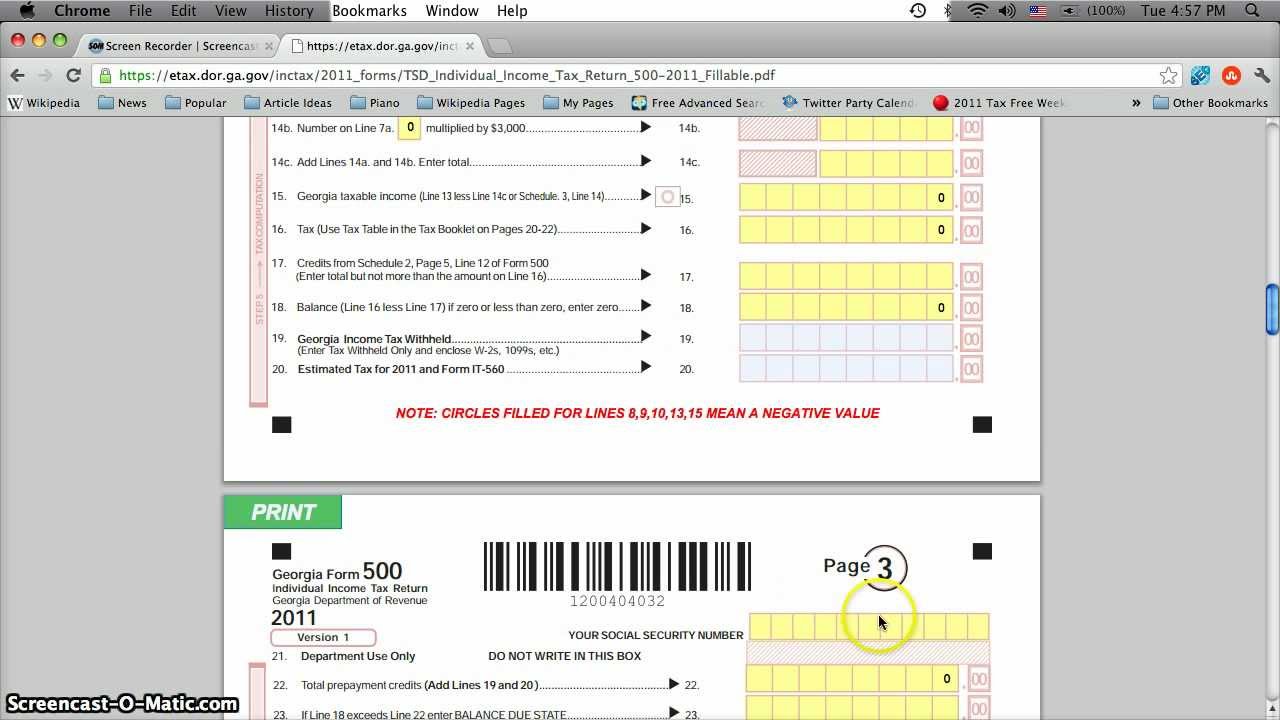

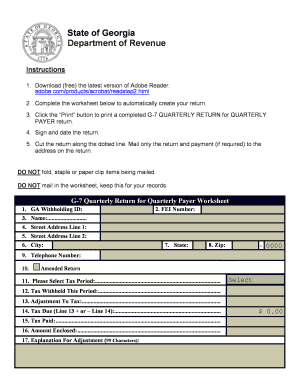

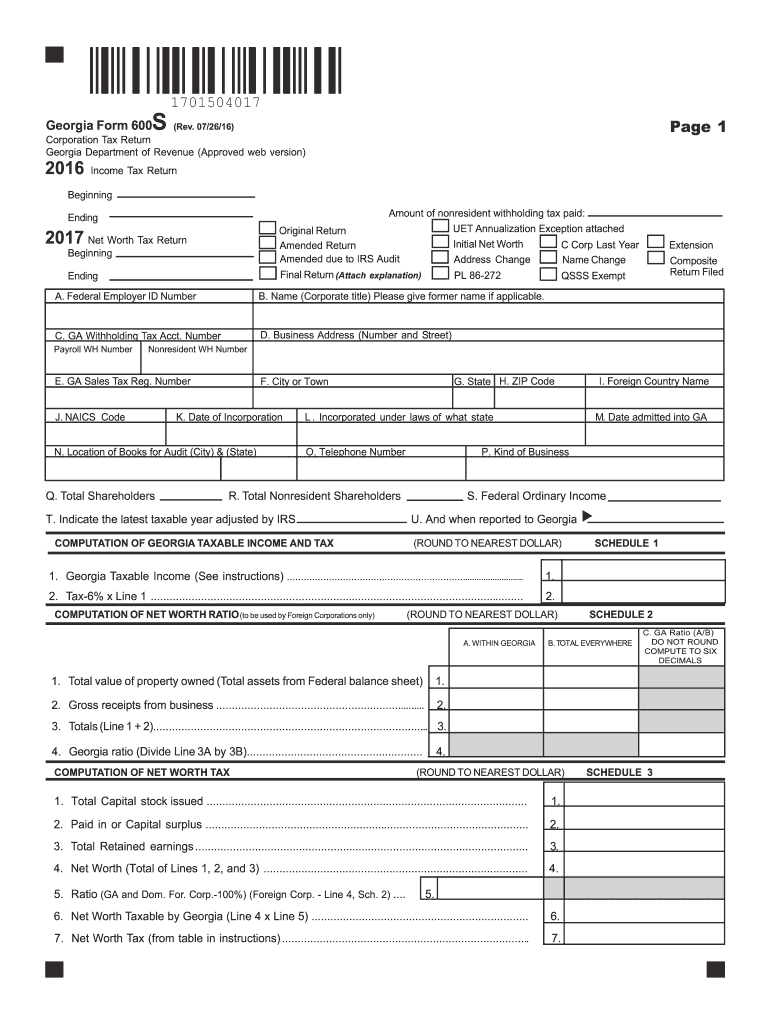

No outstanding tax liability or missing returns. Payment with return check or money order form 525 tv extension payments form it 560 estimated tax payment form 500 es. Quick payments using gtc instructions state tax liens estimated tax and assessments only at this time paper forms.

Taxpayers now can search for their 1099 g and 1099 int on the georgia tax center by selecting the view your form 1099 g or 1099 int link under individuals. We will begin accepting returns january 27 2020. Receive your 1099 g electronically setup gtc to make your 1099 g available online.

The georgia individual income tax is based on the taxpayers federal adjusted gross income adjustments that are required by georgia law and the taxpayers filing requirements. This years individual income tax forms. Local state and federal government websites often end in gov.

An income tax return refund is the result of too much tax withholding estimated tax payments by a taxpayer throughout a tax year.

:max_bytes(150000):strip_icc()/where-s-your-tax-refund-3193203-v4-5b688dc546e0fb004fc28d4e.png)

%201.jpg)