Georgia State Tax Return 2019

The ga tax return filing and payment due date has moved from april 15 to july 15 2020 due to the codvid 19 crisis.

Georgia state tax return 2019. Thats just a few cents above the national average. We will begin accepting returns january 27 2020. Please complete your federal return before starting your georgia return.

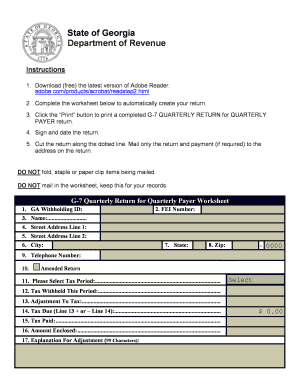

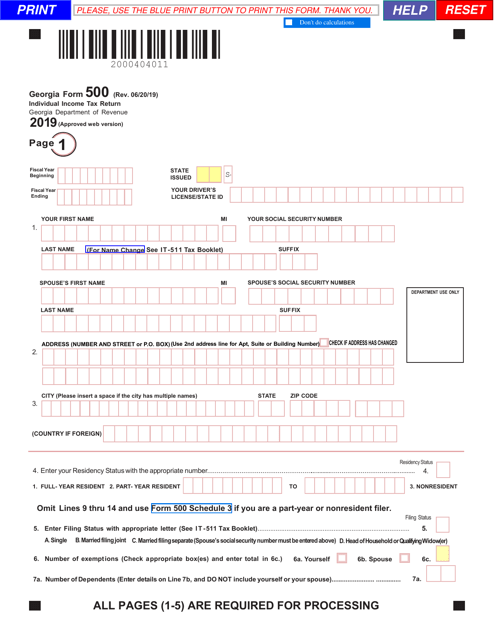

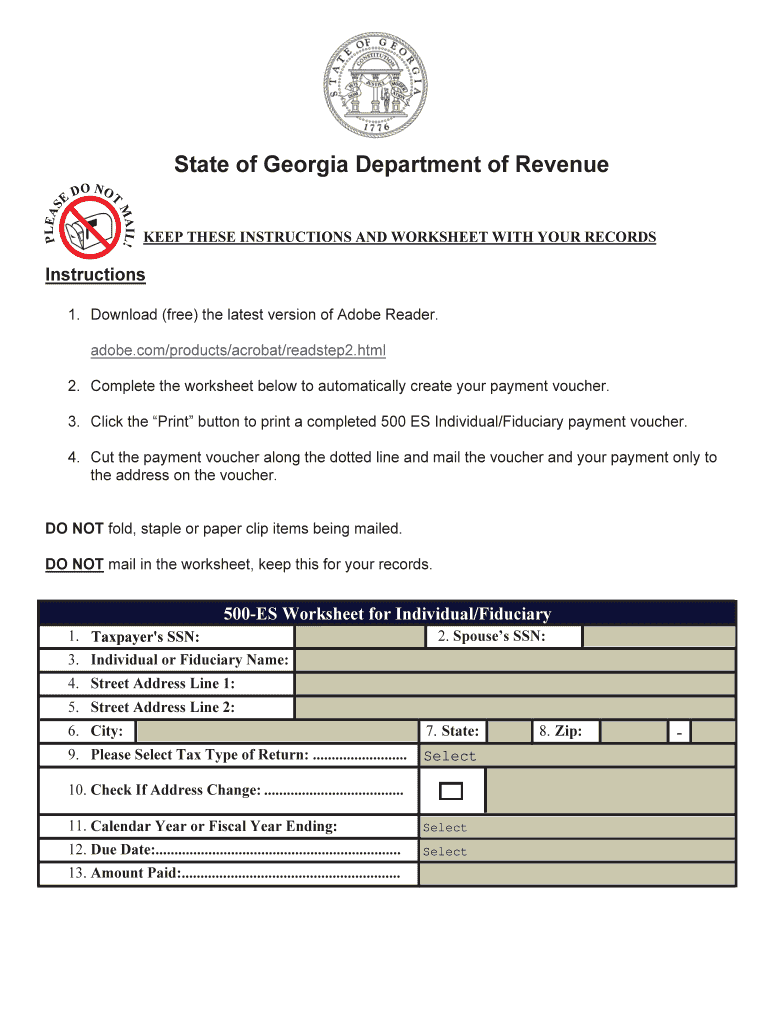

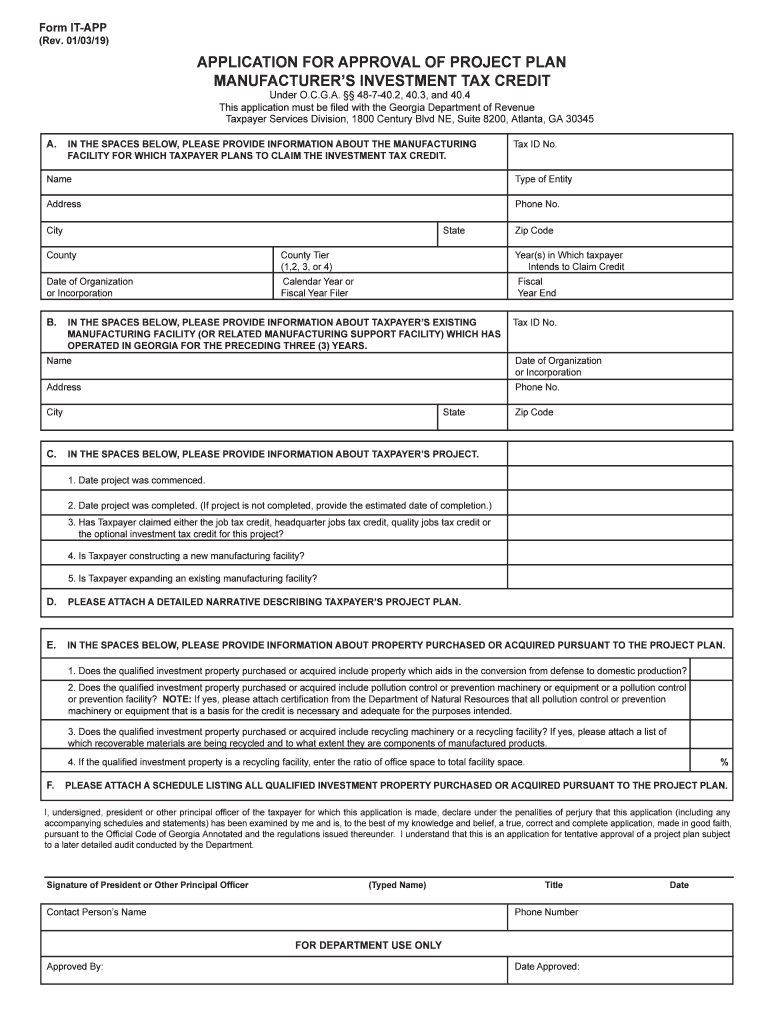

What are my payment options. Georgia state income tax form 500 must be postmarked by july 15 2020 in order to avoid penalties and late fees. File my return instructions forms and more.

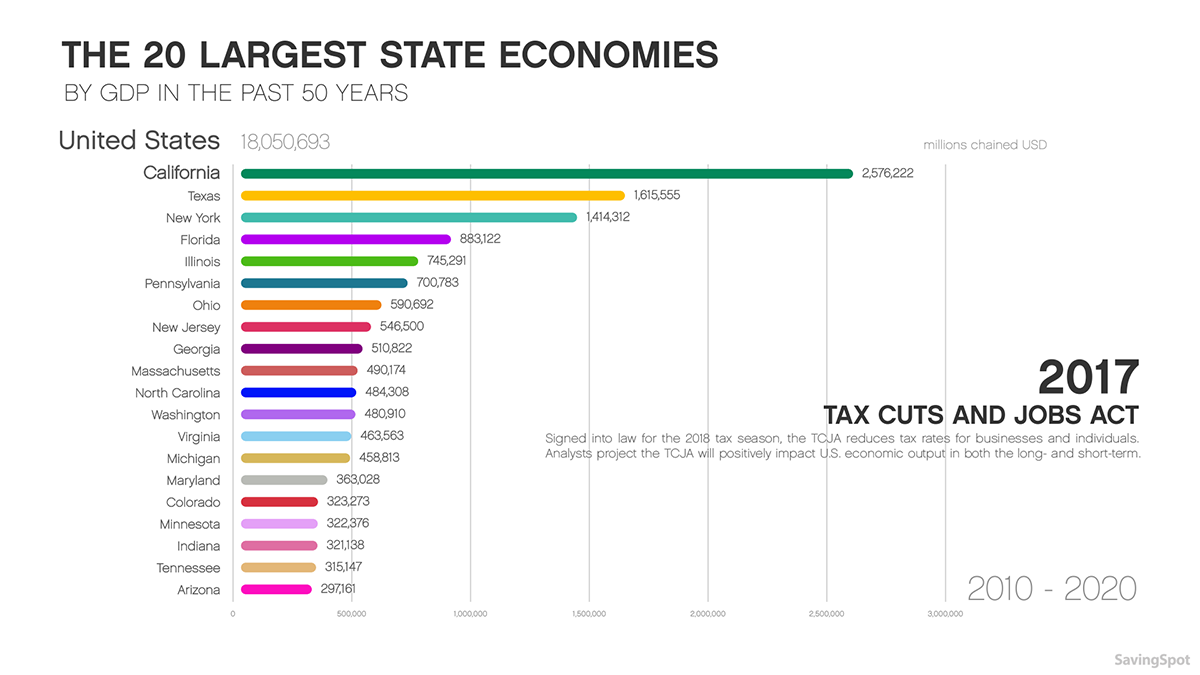

As of july 1st 2014 the state of georgia has no estate tax. Tax refund processing times vary and depend on the accuracy of the original return but youll get your refund more quickly if you file your return electronically. The georgia income tax rate for tax year 2019 is progressive from a low of 1 to a high of 575.

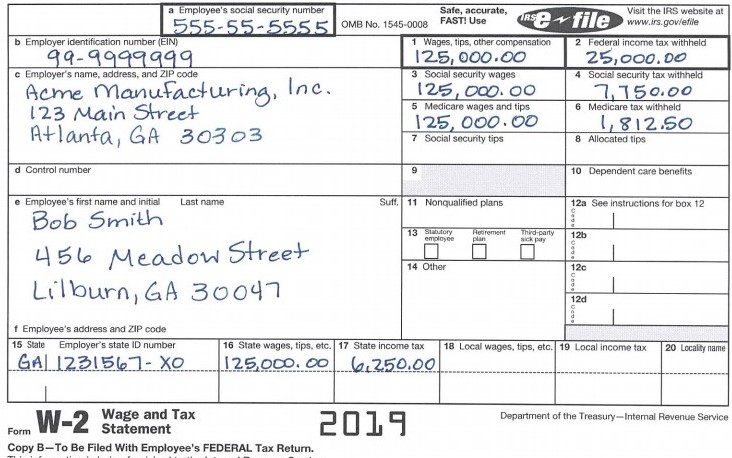

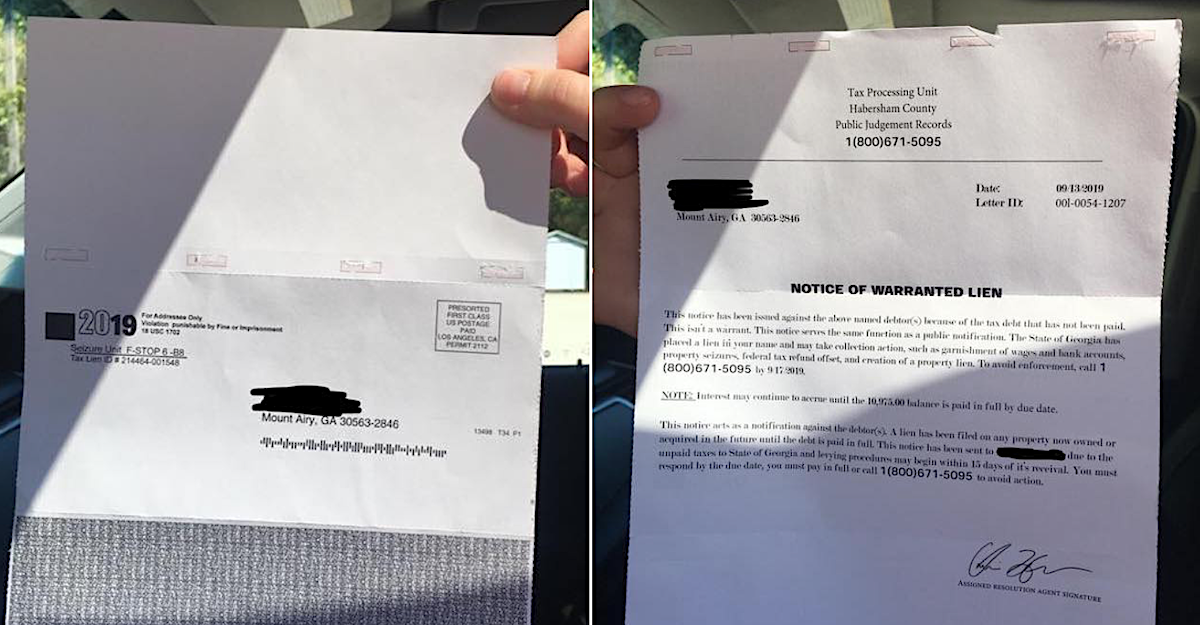

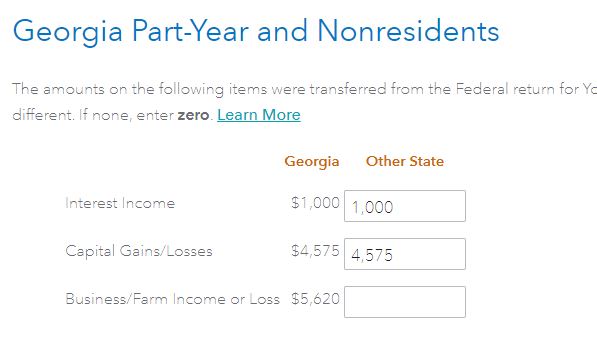

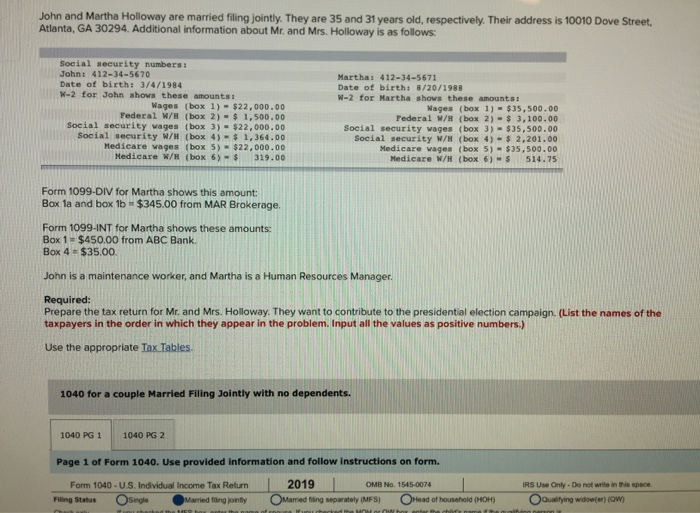

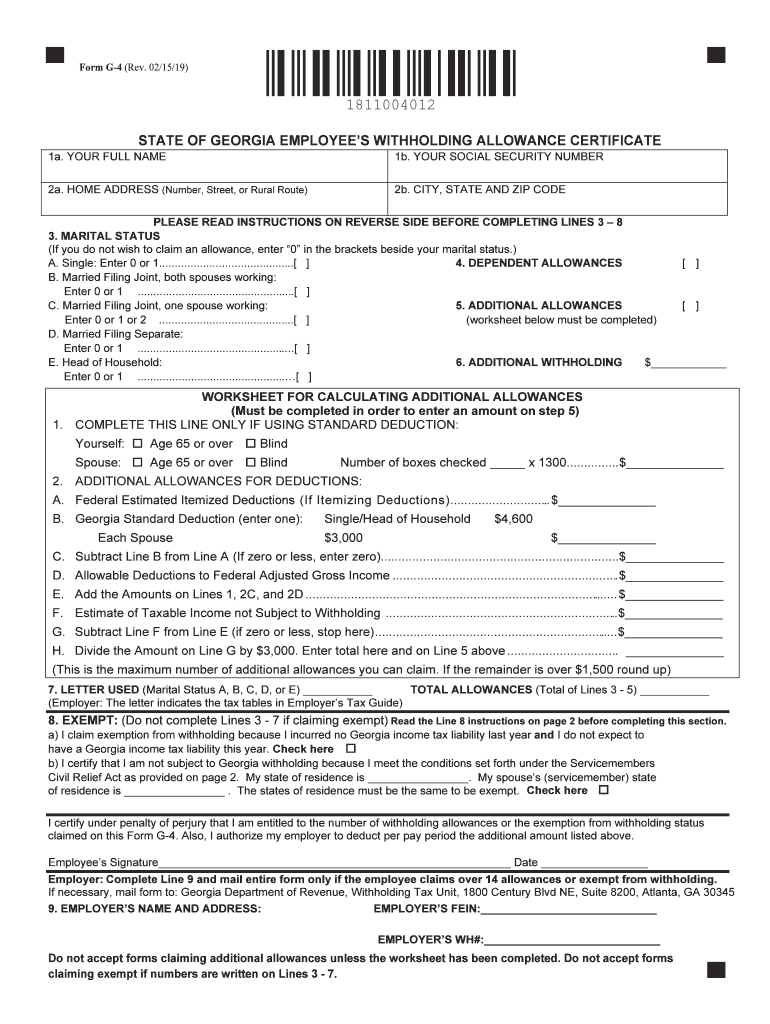

Filing state taxes the basics. Before sharing sensitive or personal information make sure youre on an official state website. The georgia individual income tax is based on the taxpayers federal adjusted gross income adjustments that are required by georgia law and the taxpayers filing requirements.

Popular online tax services. Before sharing sensitive or personal information make sure youre on an official state website. Your federal return contains information necessary for completing your georgia return.

State of georgia government websites and email systems use georgiagov or gagov at the end of the address. Printable georgia state tax forms for the 2019 tax year will be based on income earned between january 1 2019 through december 31 2019. Local state and federal government websites often end in gov.

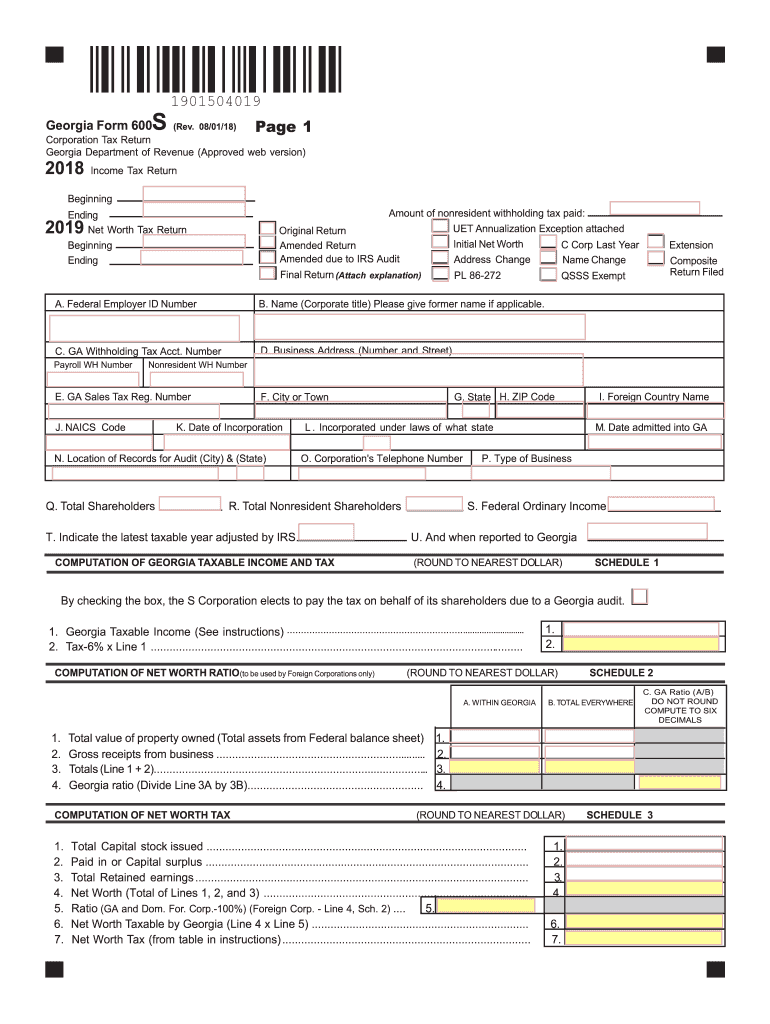

Filing requirements for full and part year residents and military personnel. It may take up to 90 days from the date of receipt by dor to process a return and issue a refund. Georgia state income tax returns for tax year 2019 january 1 dec.

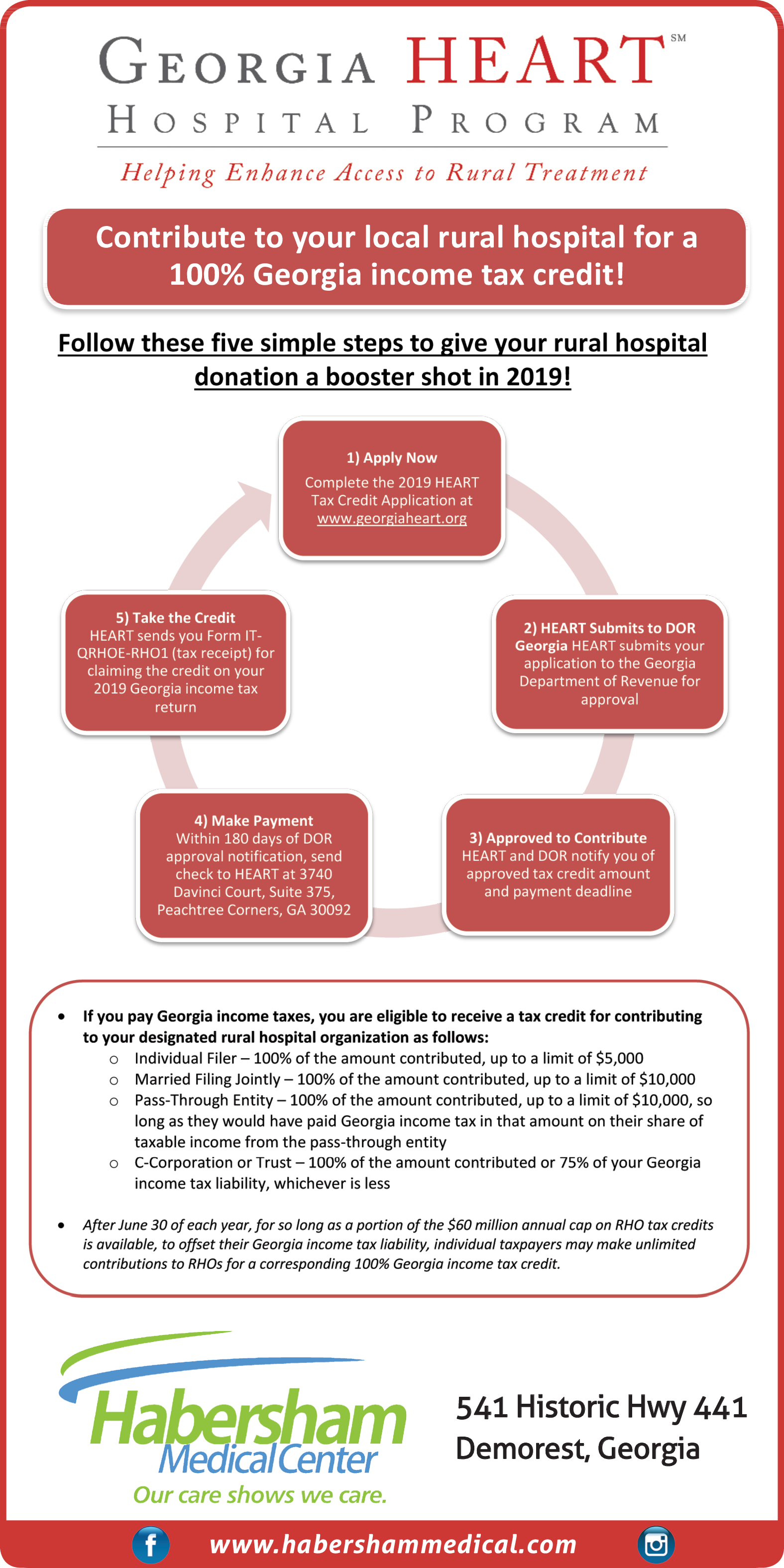

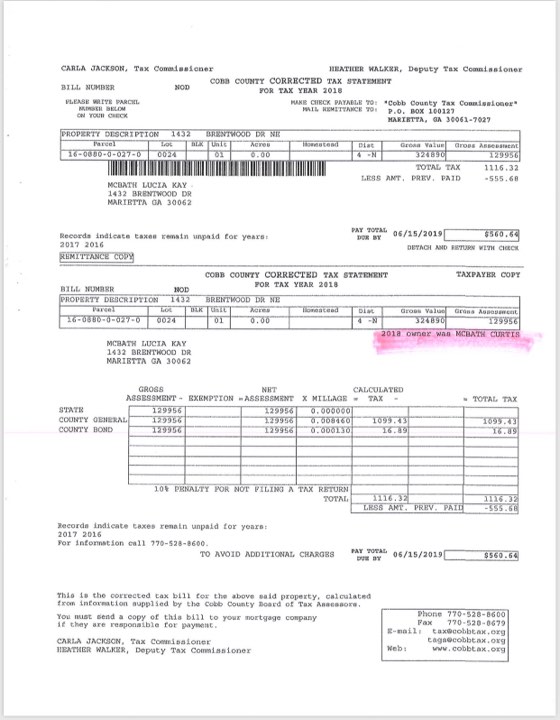

Georgia collects gasoline taxes of 3515 cents per gallon of regular gasoline. The department of revenue is protecting georgia taxpayers from tax fraud. This years individual income tax forms.

If you expect a refund your state may take only a few days to process it or the state may take a few months. 31 2019 can be prepared and e filed now with an irs or federal income tax return. State of georgia government websites and email systems use georgiagov or gagov at the end of the address.

You can check the status of your tax refund using the georgia tax center. An income tax return refund is the result of too much tax withholding estimated tax payments by a taxpayer throughout a tax year. 2019 500 individual income tax return 18 mb 2018 500.

When you file your federal income tax return you can check the status of your refund by visiting the irs website or its mobile apphowever each state has its own process for handling state income taxes.