Georgia State Tax Rate Paycheck

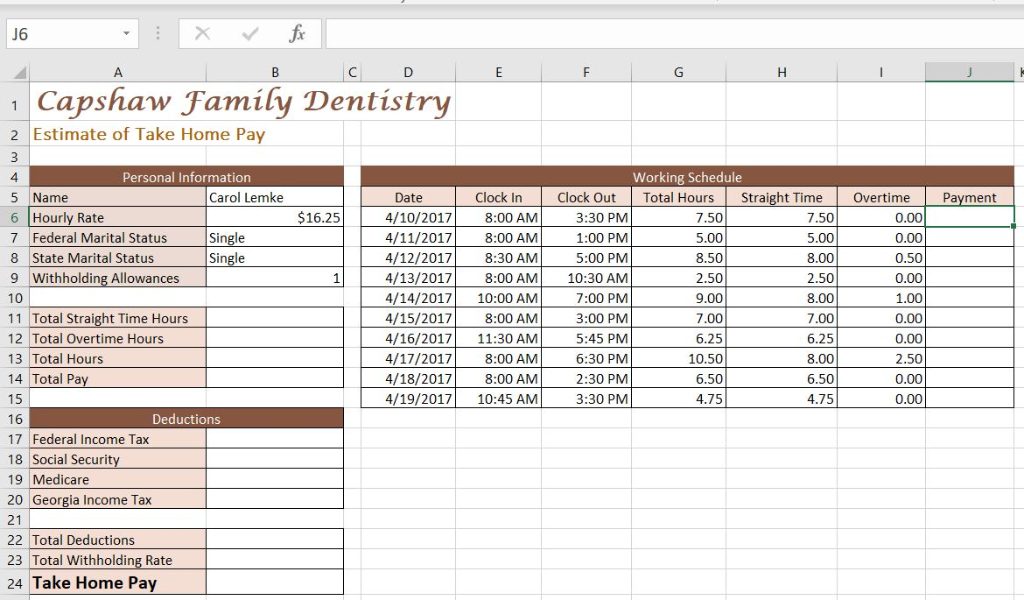

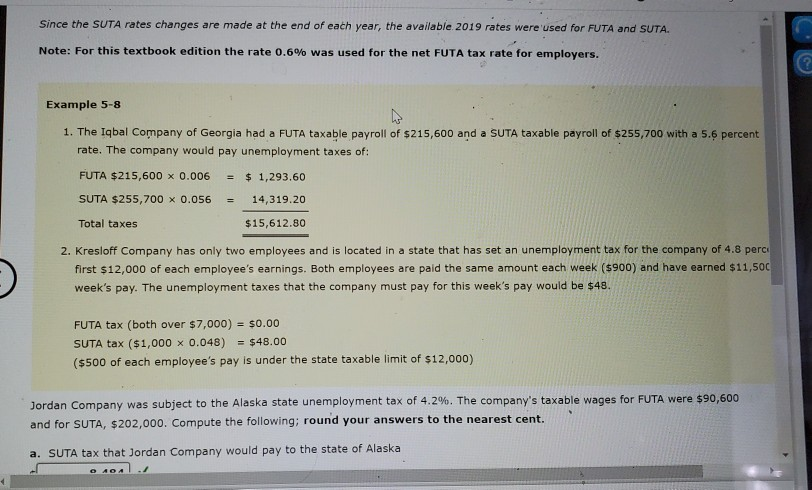

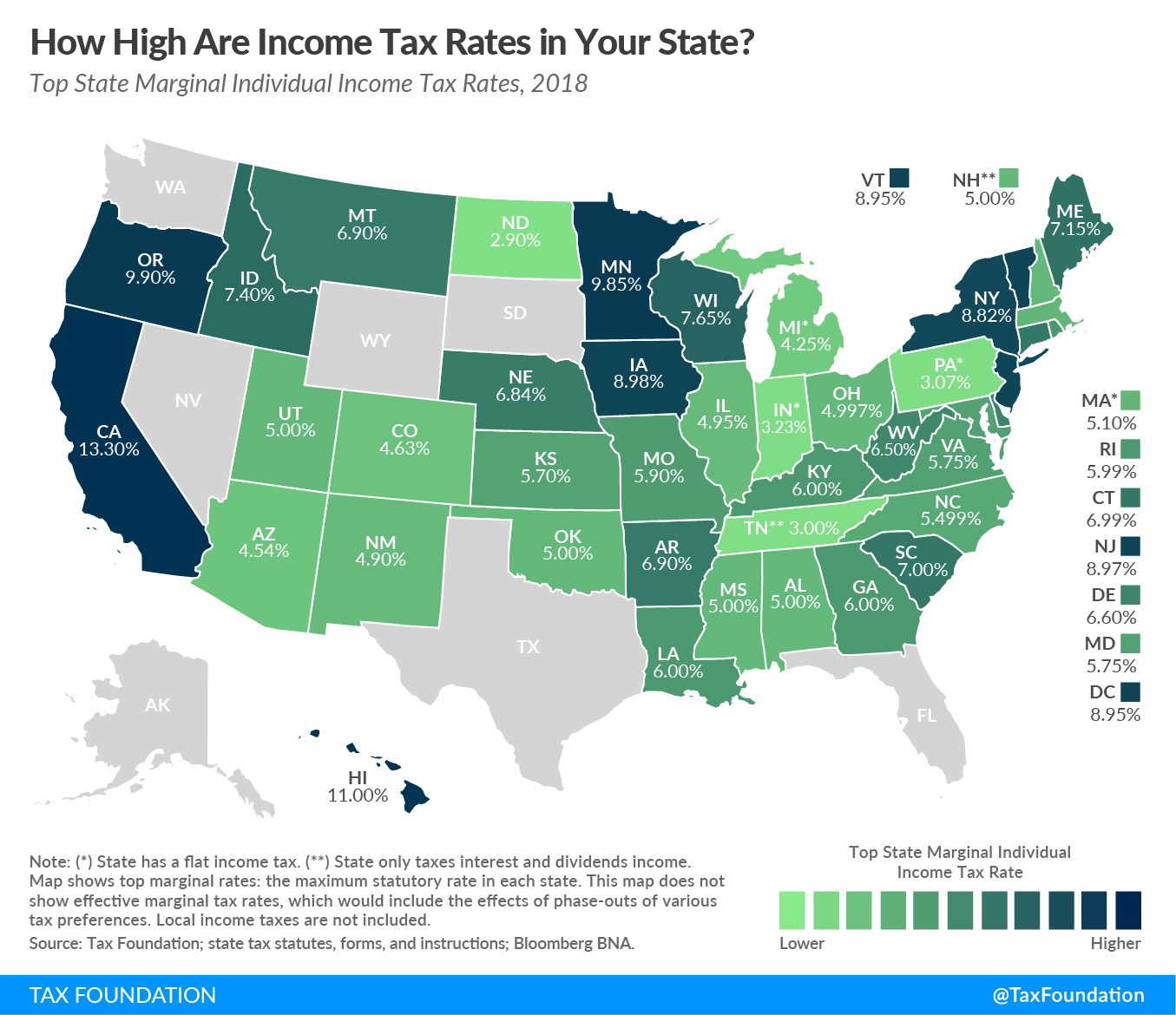

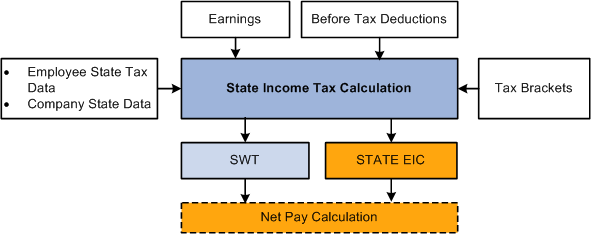

Wages nonresident distributions lottery winnings pension and annuity payments other sources of income the withholding tax rate is a graduated scale.

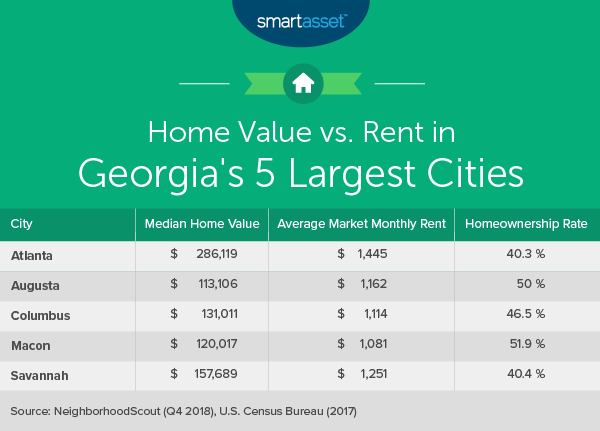

Georgia state tax rate paycheck. Detailed georgia state income tax rates and brackets are available on this page. Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate. Use smartassets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

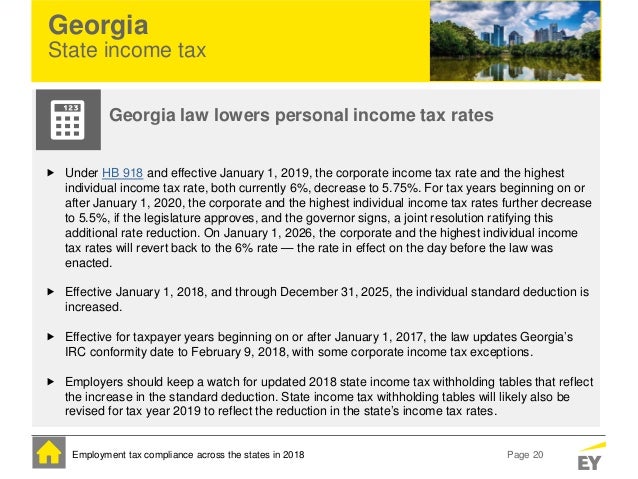

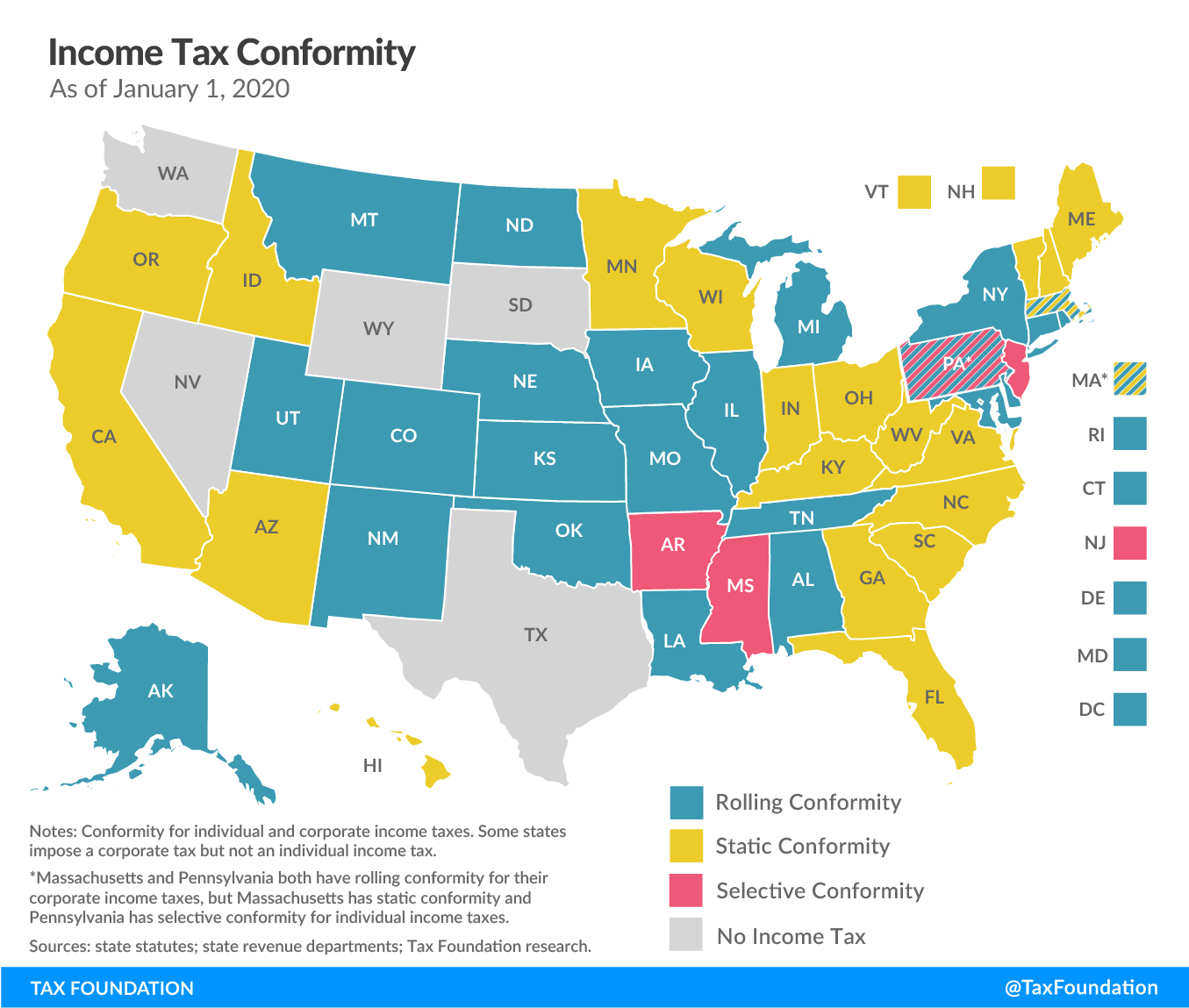

Local state and federal government websites often end in gov. This includes tax withheld from. Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575.

Local state and federal government websites often end in gov. The tax rate for the first 500000 of a motor vehicle sale is 7 because the 1 2nd lost does not apply. This years individual income tax forms.

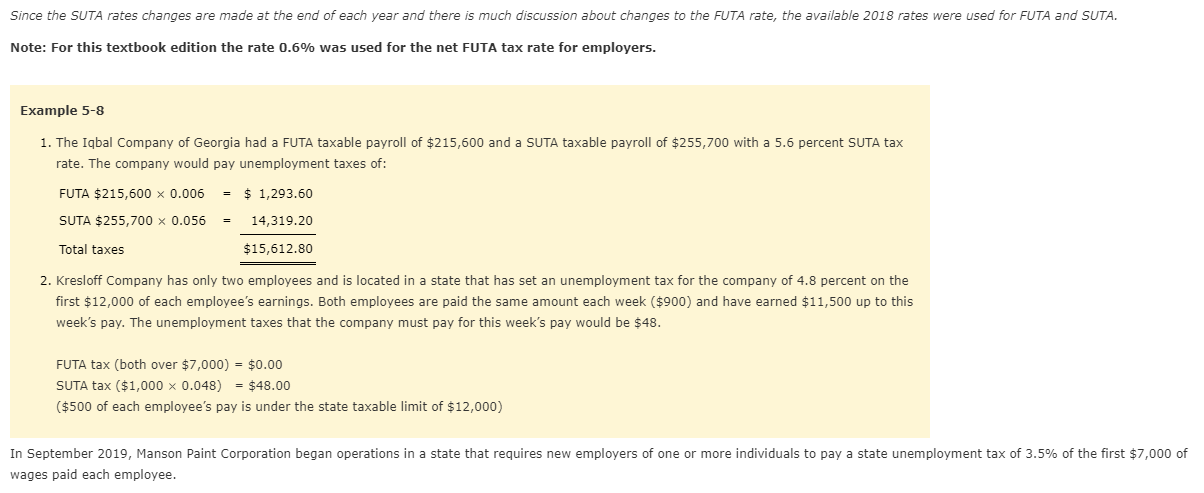

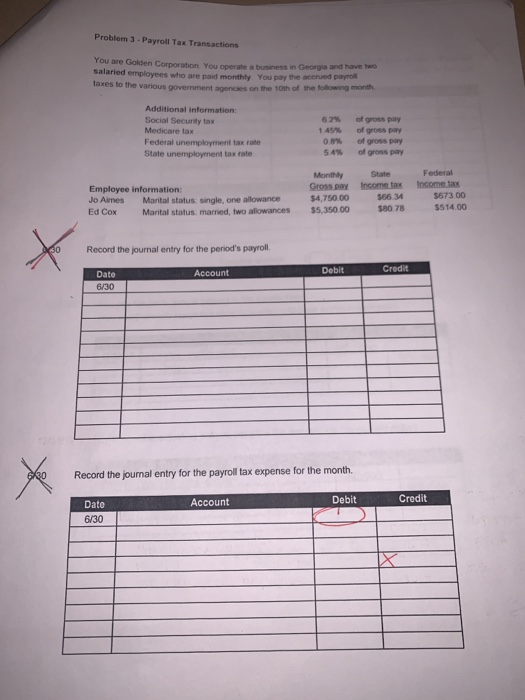

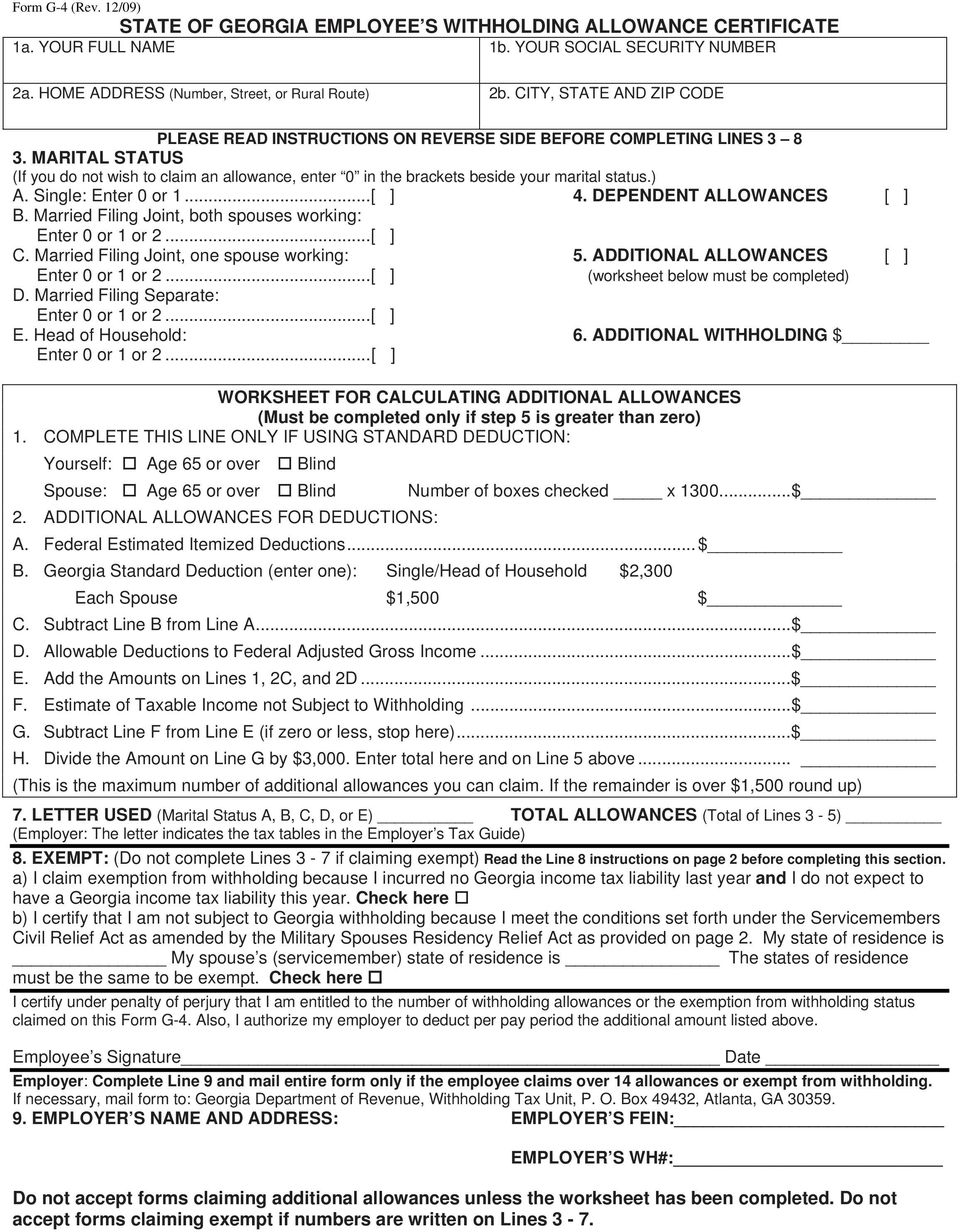

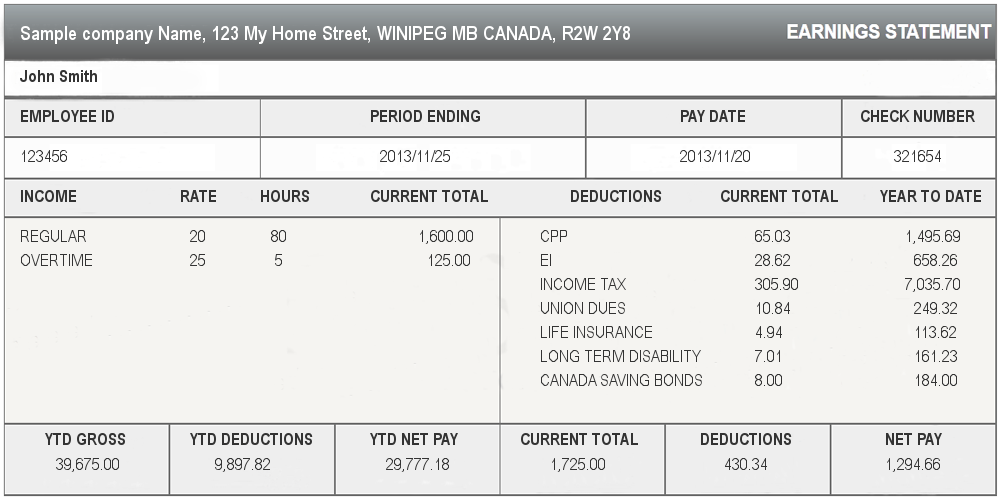

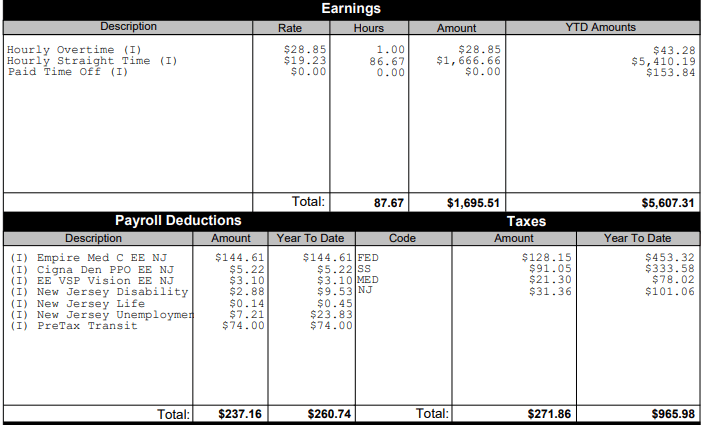

Filing requirements for full and part year residents and military personnel. Popular online tax services. For withholding rates on bonuses and other compensation see the employers tax guide.

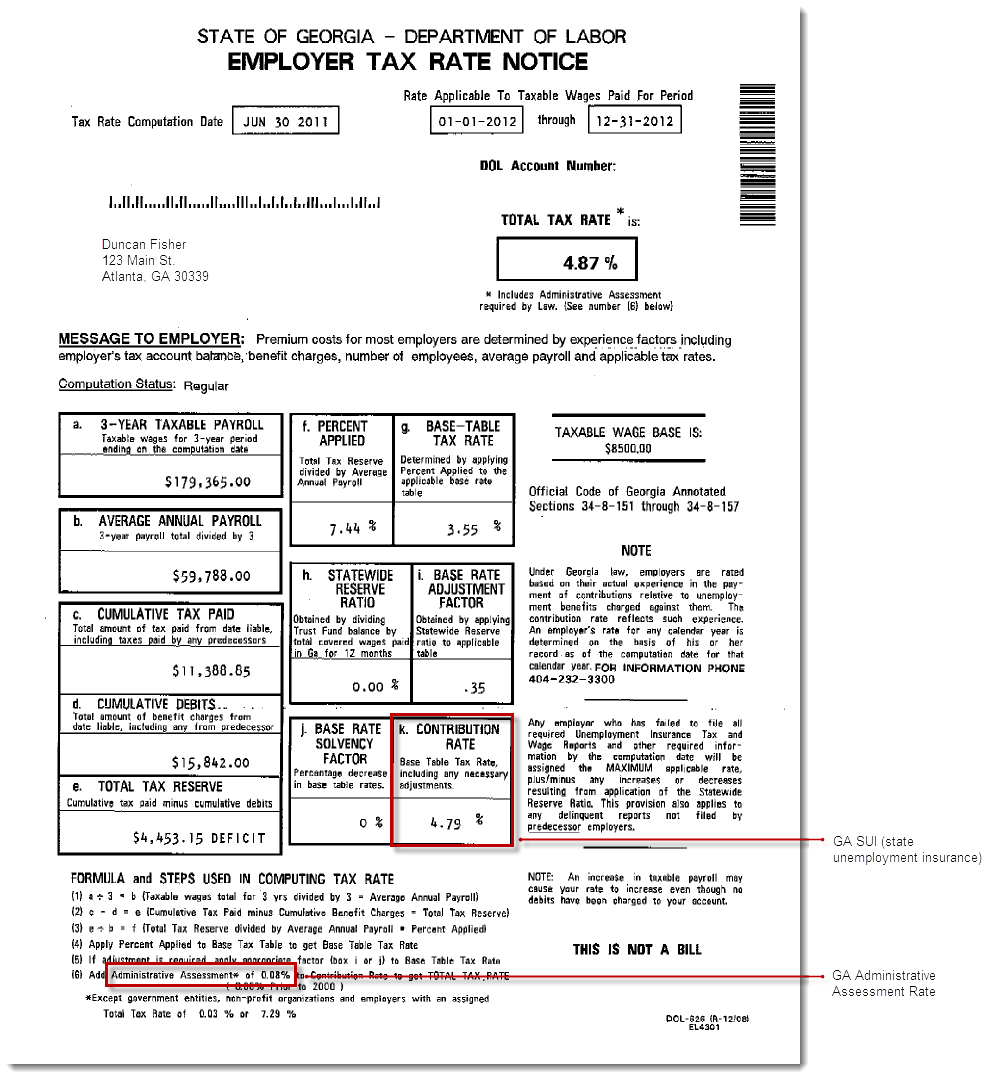

The georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2020. We can also see the progressive nature of georgia state income tax rates from the lowest ga tax rate bracket of 1 to the highest ga tax rate bracket of 575. Though this could definitely be checked off as complicated the rest of georgia payroll taxes are a breeze.

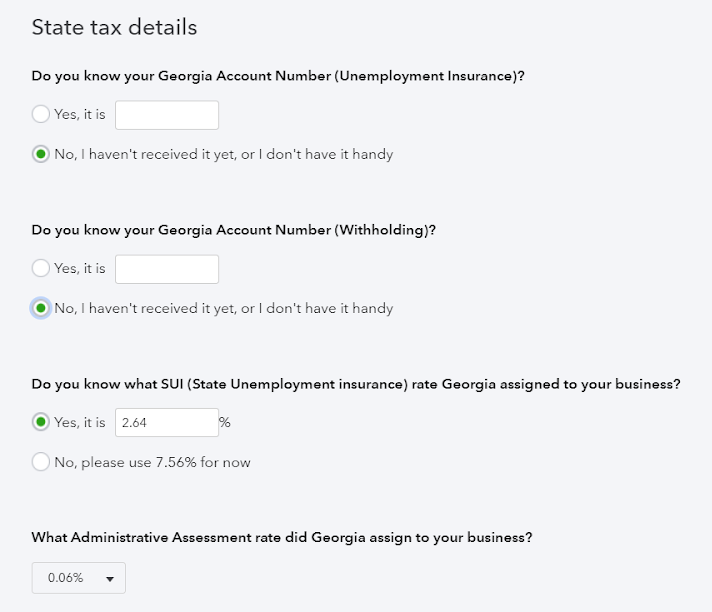

State of georgia government websites and email systems use georgiagov or gagov at the end of the address. With six different tax brackets payroll in georgia is especially progressive meaning the more your employees make the more they have to pay. Before sharing sensitive or personal information make sure youre on an official state website.

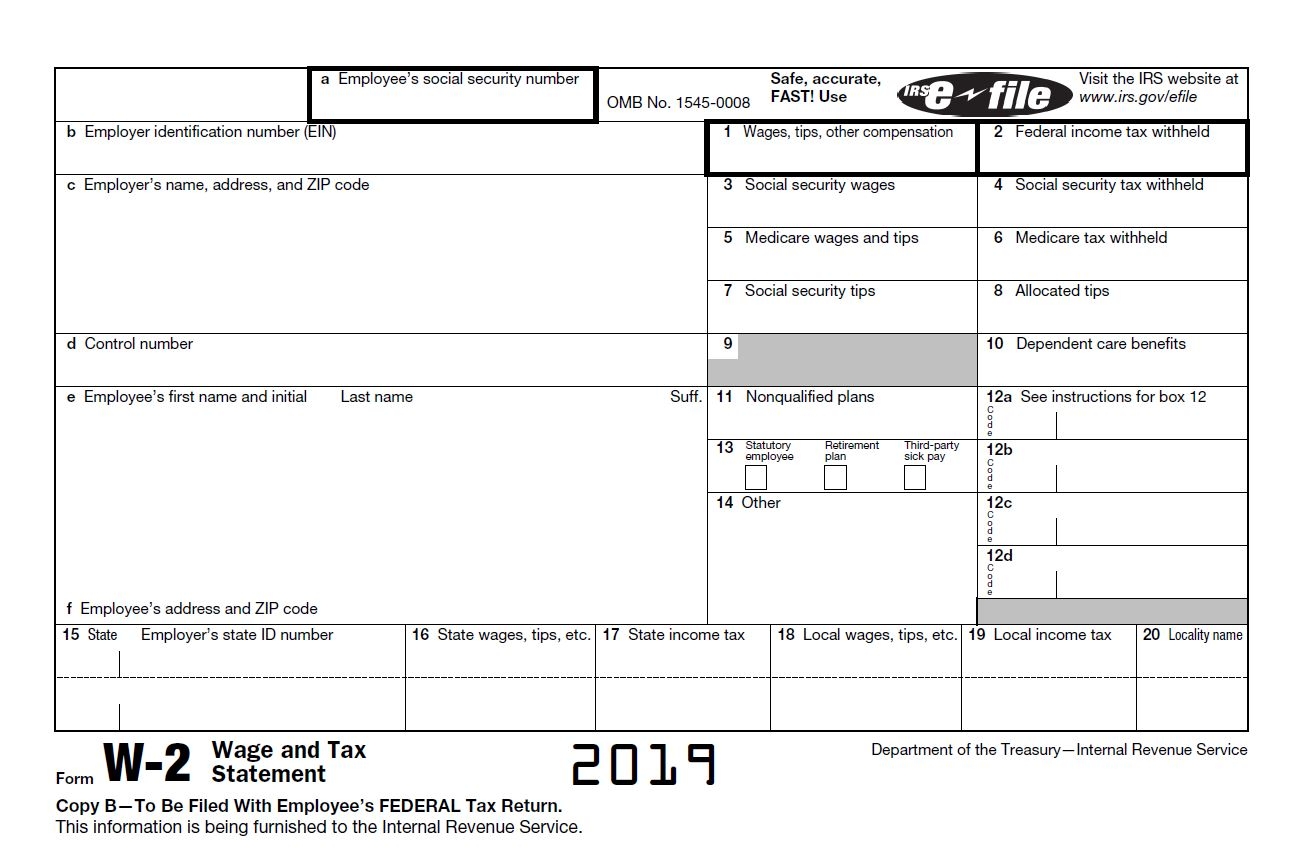

Before sharing sensitive or personal information make sure youre on an official state website. Search for income tax statutes by keyword in the official code of georgia. Georgia tax brackets 2019 2020.

Rates range from 1 to 55. The generally applicable tax rate in muscogee county is 8 state sales tax at the statewide rate of 4 plus 4 local sales taxes at a rate of 1 each. Filing state taxes the basics.

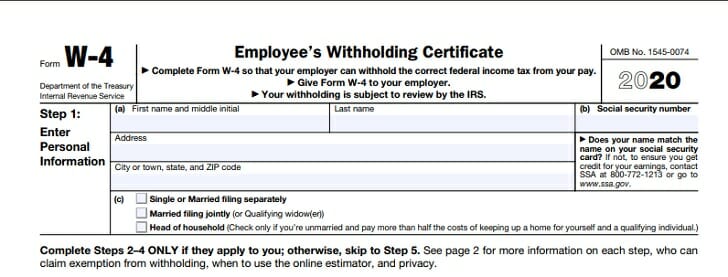

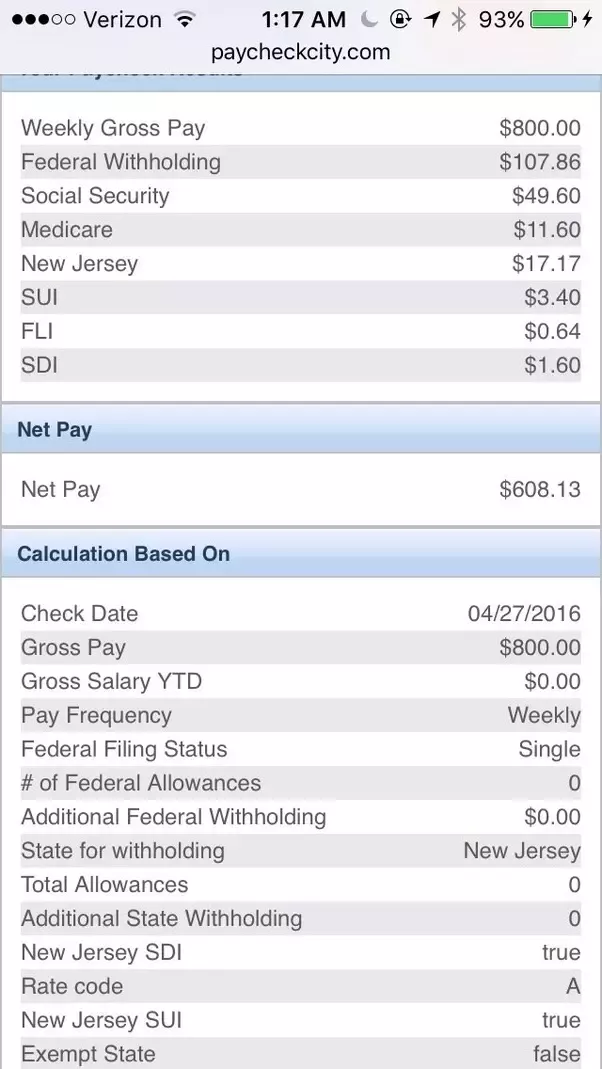

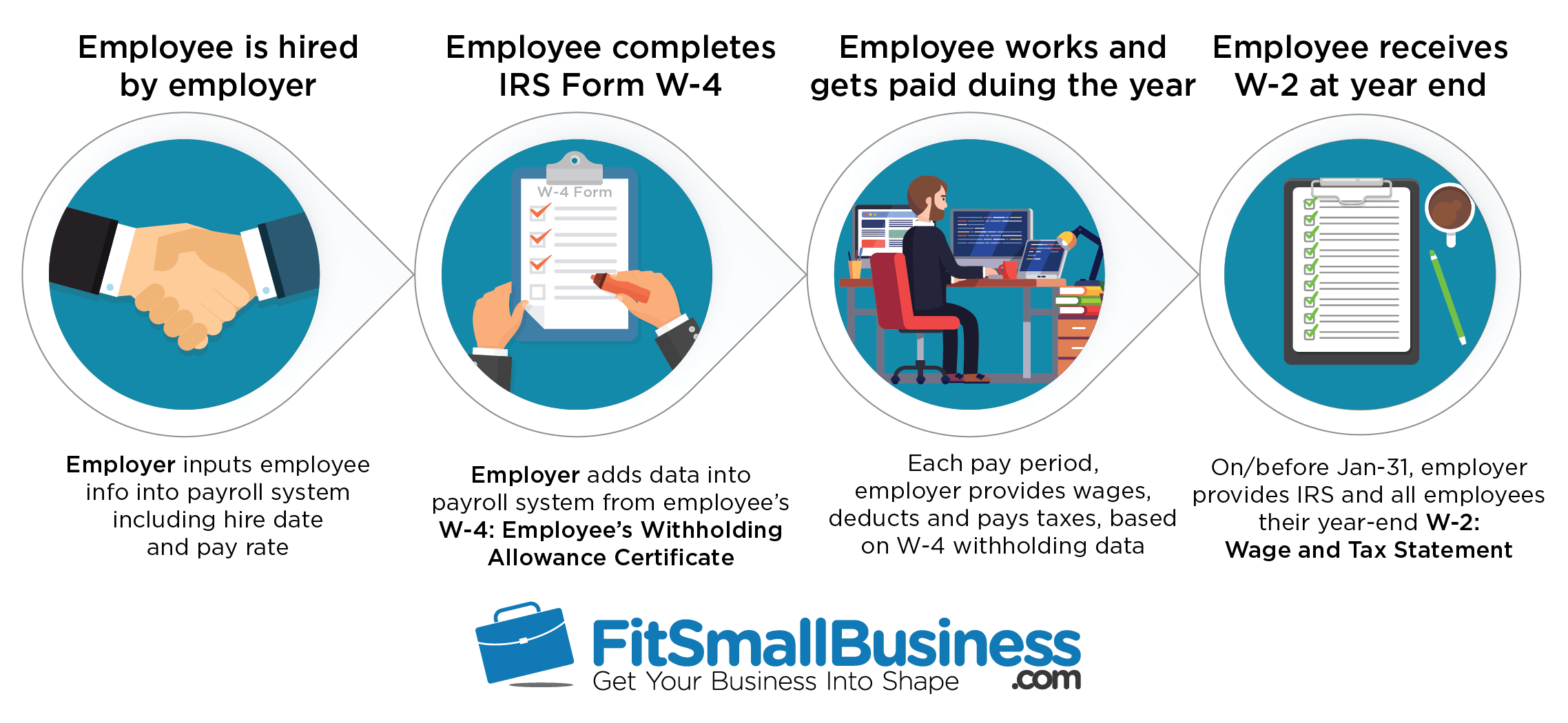

Withholding tax is the amount held from an employees wages and paid directly to the state by the employer.

/cdn.vox-cdn.com/uploads/chorus_asset/file/14724117/Undocumented_immigrant_tax_contributions2.jpg)