Georgia State Tax Rate On Payroll

Taxes georgia tax center help individual income taxes.

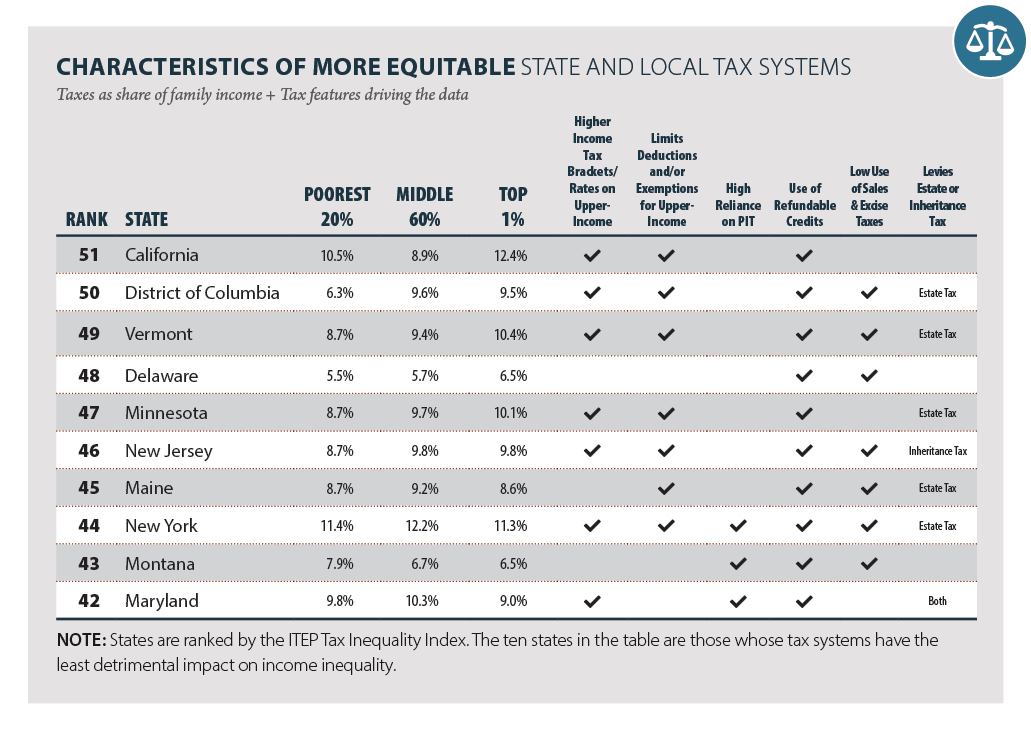

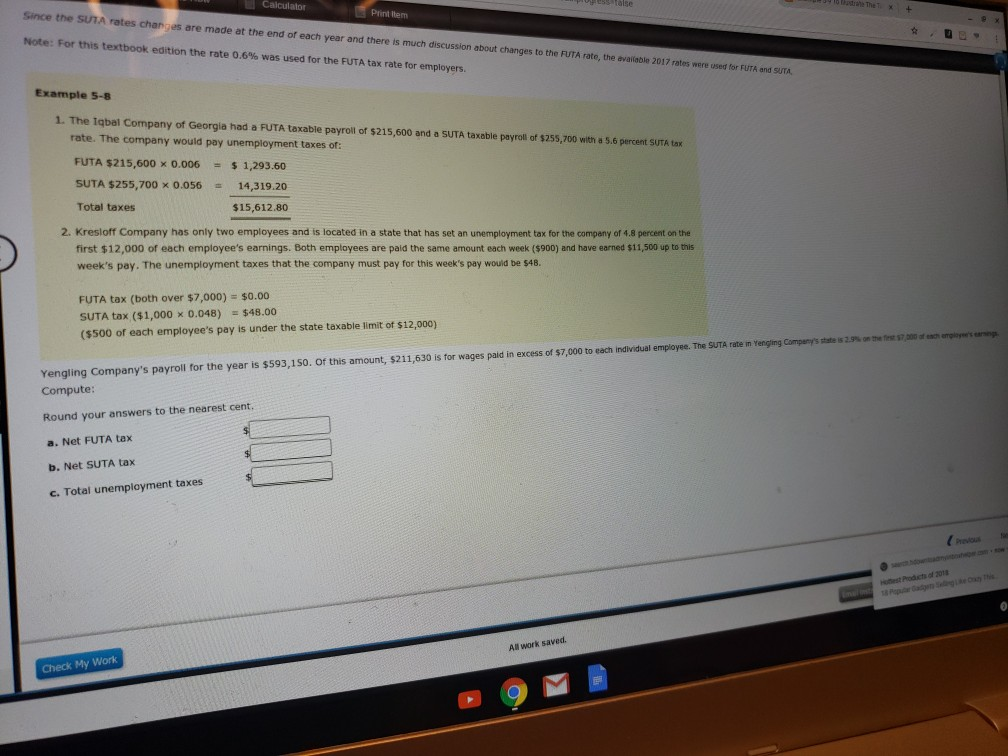

Georgia state tax rate on payroll. You can learn more about how the georgia income tax compares to other states income taxes by visiting our map of income taxes by state. Georgias income tax rates were last changed two years ago for tax year 2018 and the tax brackets were previously changed in 2009. Georgia does not have any reciprocal agreements with any other.

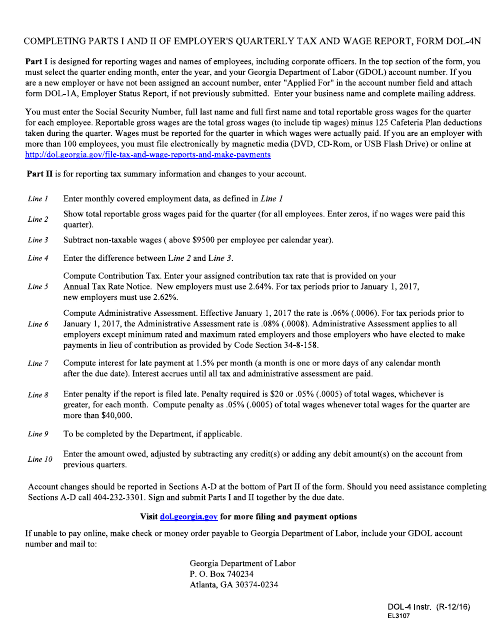

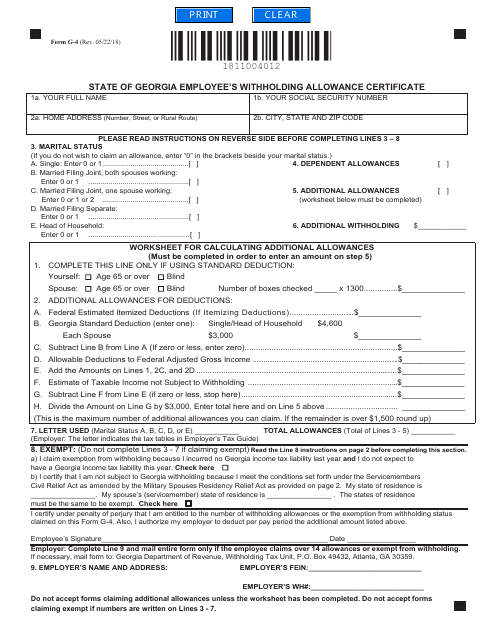

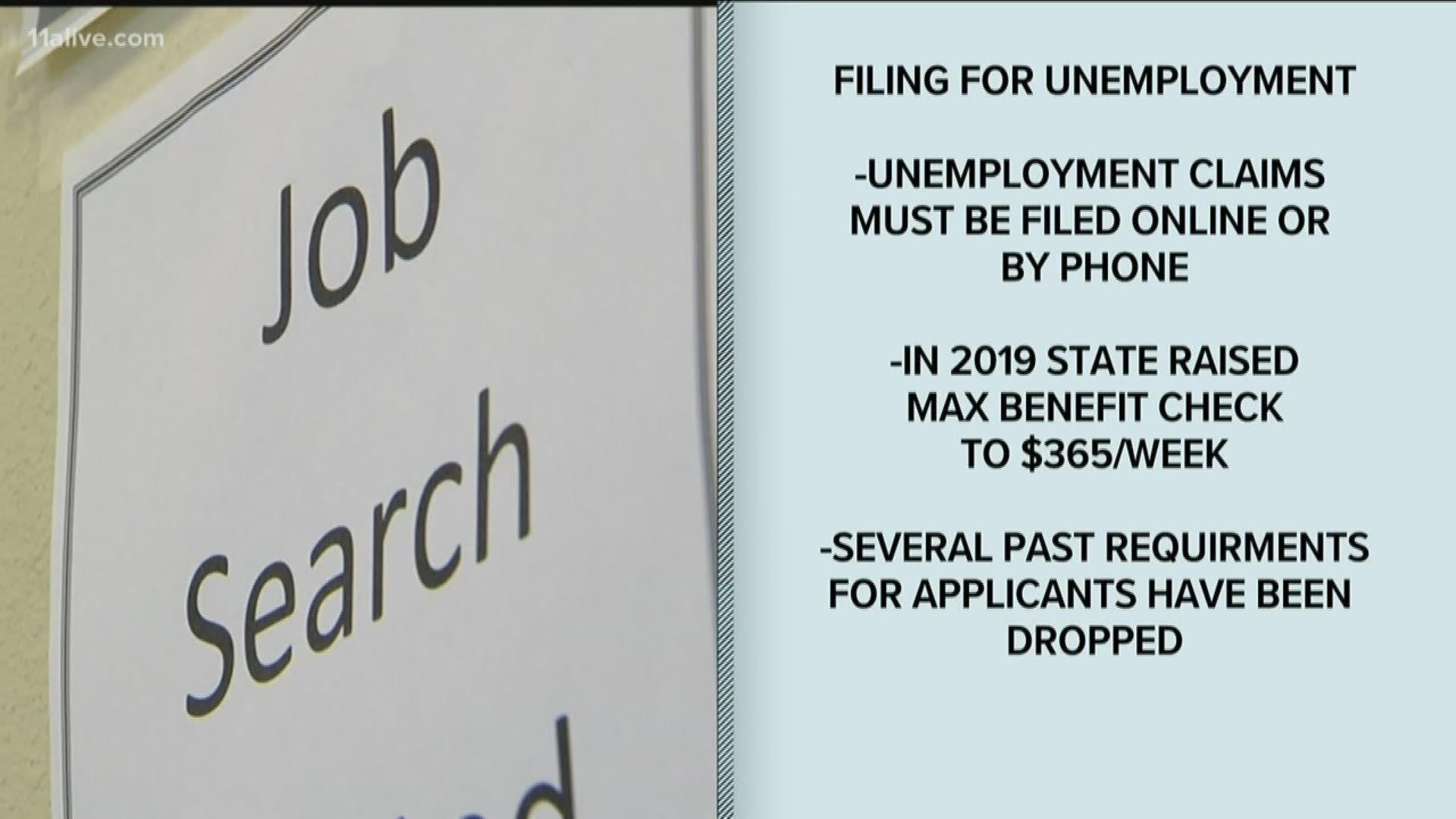

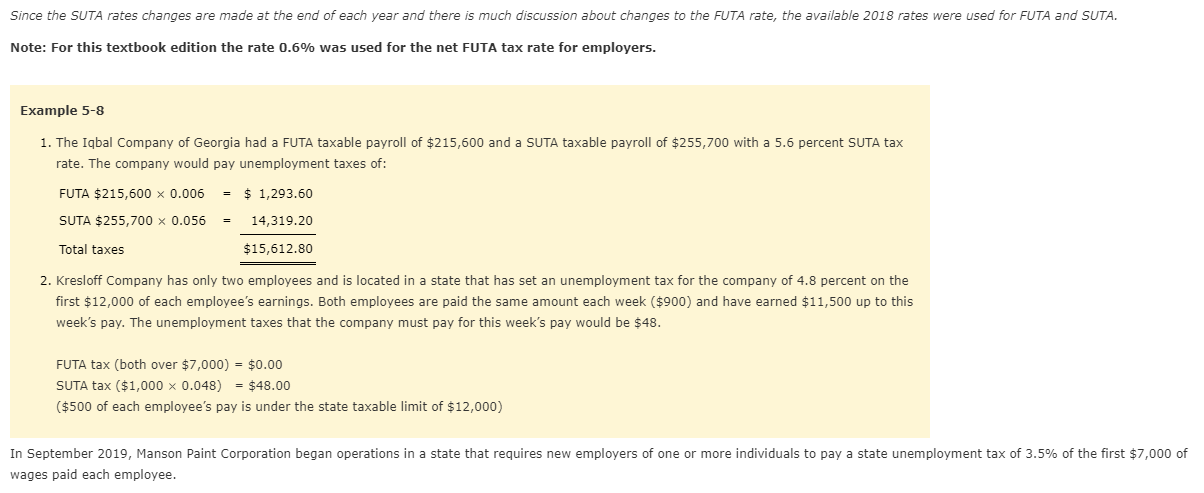

State of georgia government websites and email systems use georgiagov or gagov at the end of the address. Georgia requires employers to withhold state income taxes from employee paychecks in addition to employer paid unemployment taxesyou can find georgias tax rates hereemployees fill out g 4 georgia employees withholding allowance certificate to be used when calculating withholdings. Peach state residents who make more money can expect to pay more in state and federal taxes.

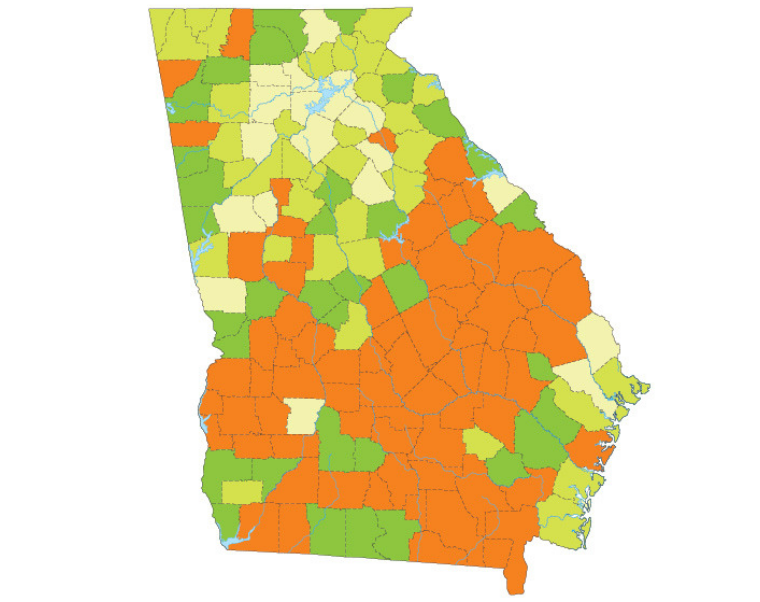

Georgias maximum marginal income tax rate is the 1st highest in the united states ranking directly below georgias. In georgia different tax brackets are. In fulton county the states most populous the effective property tax rate is 103.

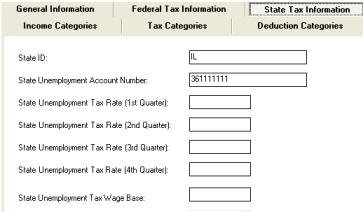

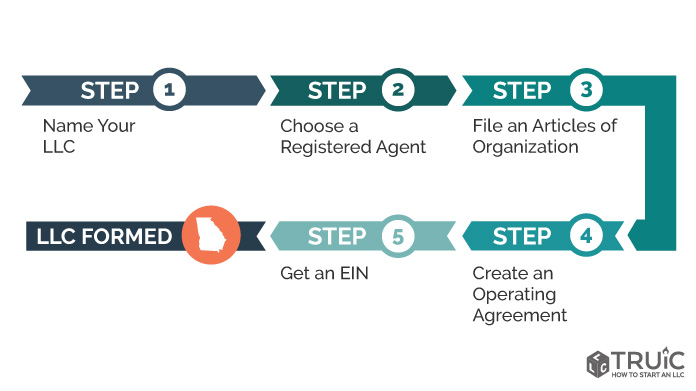

Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. What are my state payroll tax obligations. Georgia new hire reporting program po box 90728 atlanta ga 30364 0728.

Before sharing sensitive or personal information make sure youre on an official state website. You can try it free for 30 days with no obligation and no credt card needed. With six different tax brackets payroll in georgia is especially progressive meaning the more your employees make the more they have to pay.

That varies by county however. For the entire state of georgia the average effective property tax rate is 091 which is less than the national average of 108. Overview of georgia taxes.

Local state and federal government websites often end in gov. State of georgia government websites and email systems use georgiagov or gagov at the end of the address. Each marginal rate only applies to earnings within the applicable marginal tax bracket.

Rates range from 1 to 55. Local state and federal government websites often end in gov. Before sharing sensitive or personal information make sure youre on an official state website.

County rates in georgia range from less than 050 to over 180. If you want to simplify payroll tax calculations you can download ezpaycheck payroll software which can calculate federal tax state tax medicare tax social security tax and other taxes for you automatically.

/cdn.vox-cdn.com/uploads/chorus_asset/file/14724117/Undocumented_immigrant_tax_contributions2.jpg)