Georgia State Tax Rate On Capital Gains

Filing state taxes the basics.

Georgia state tax rate on capital gains. This years individual income tax forms. Filing requirements for full and part year residents and military personnel. The georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2020.

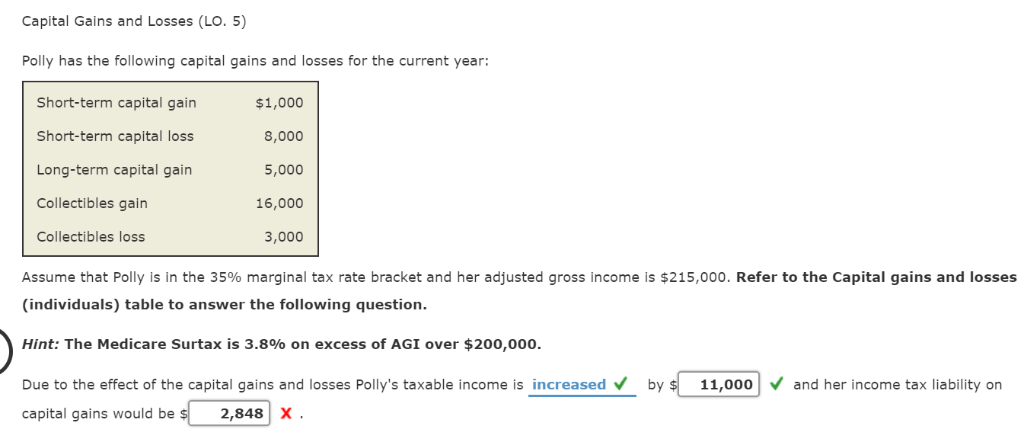

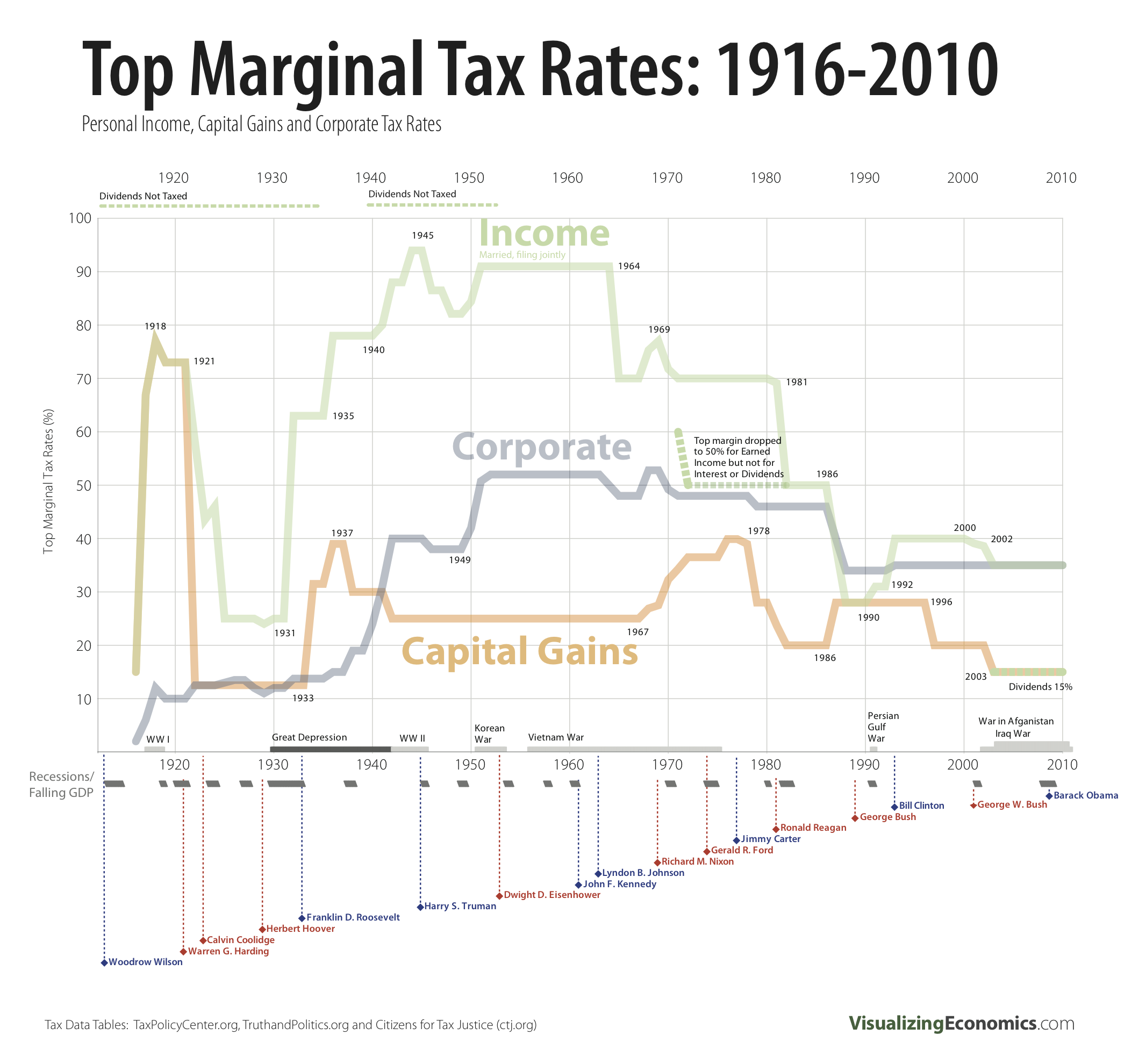

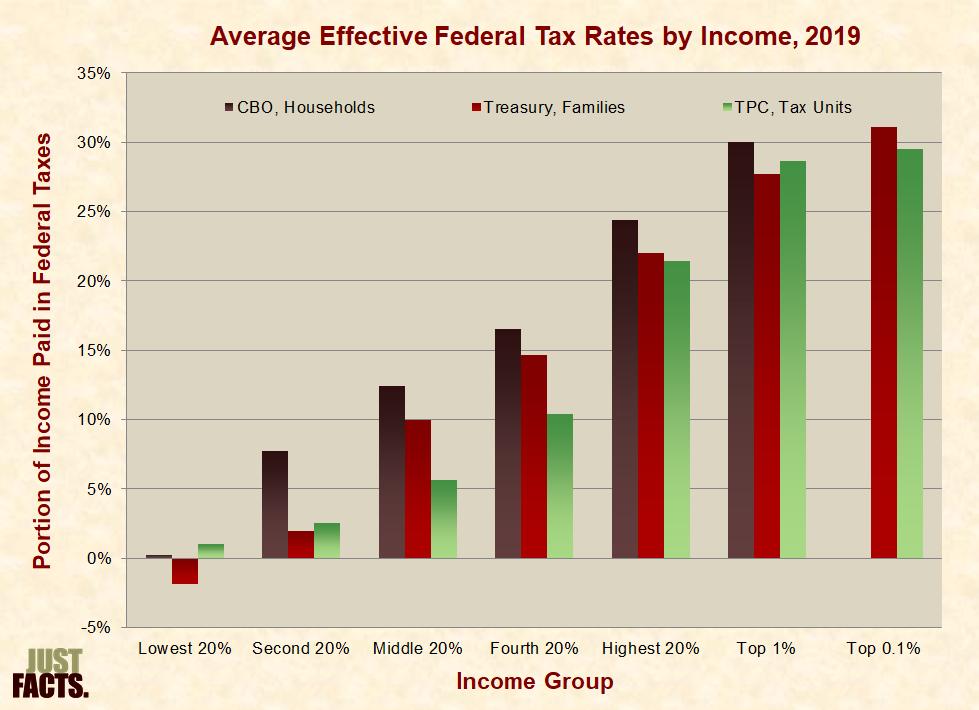

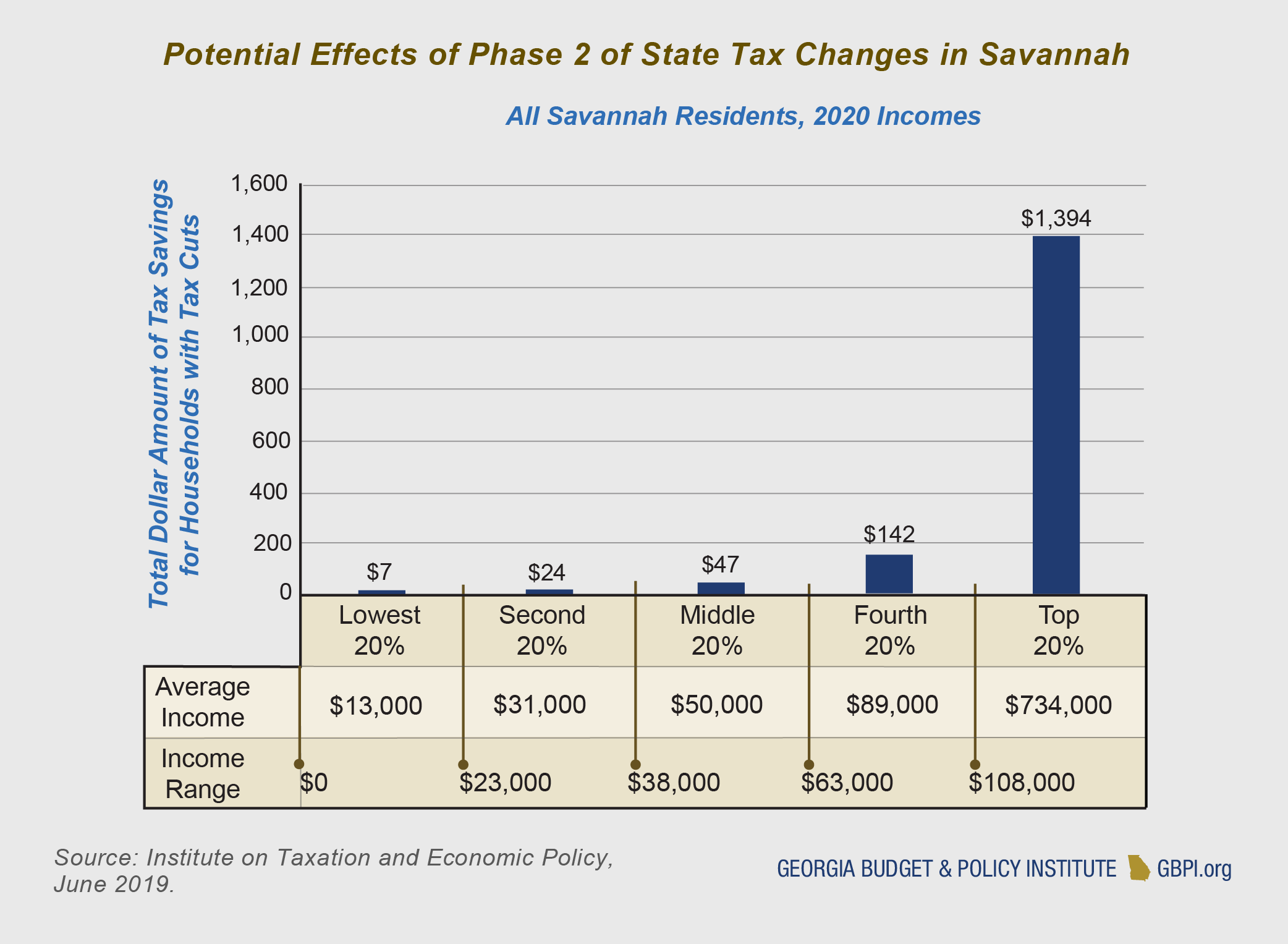

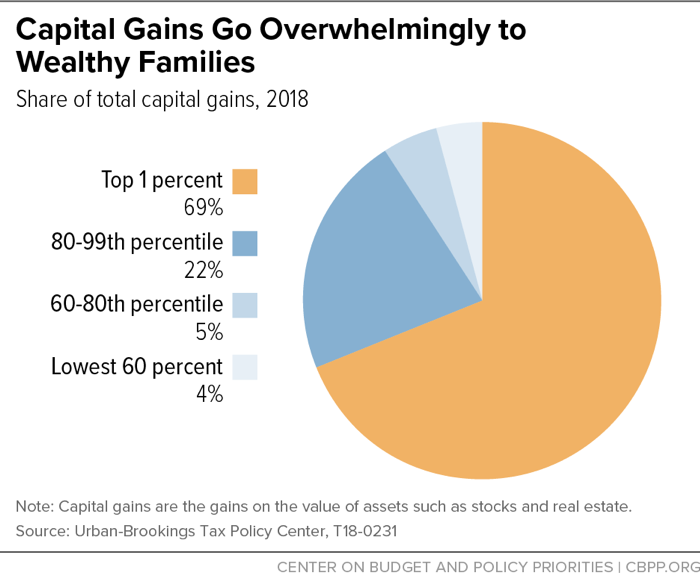

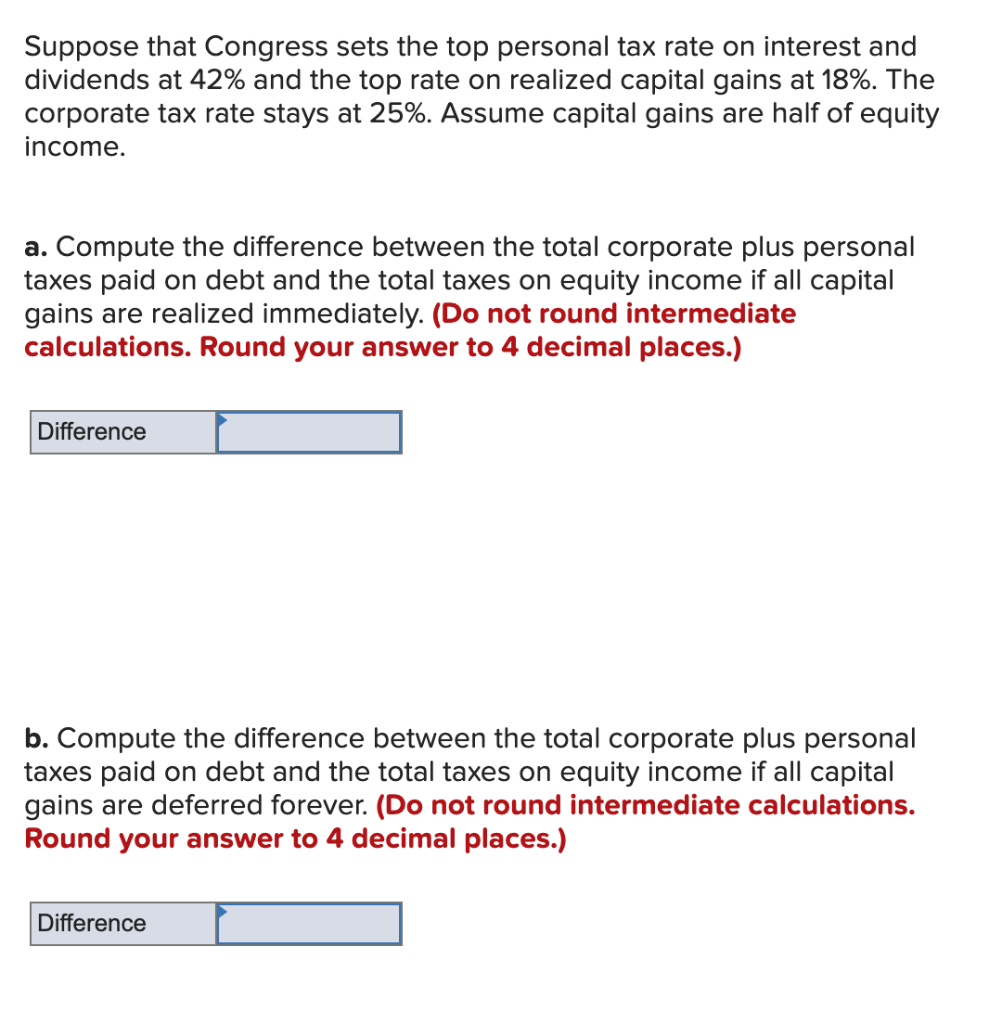

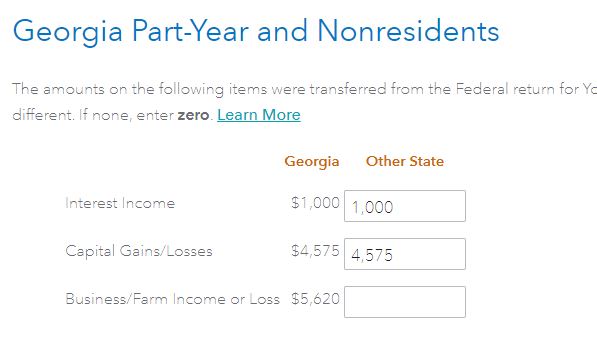

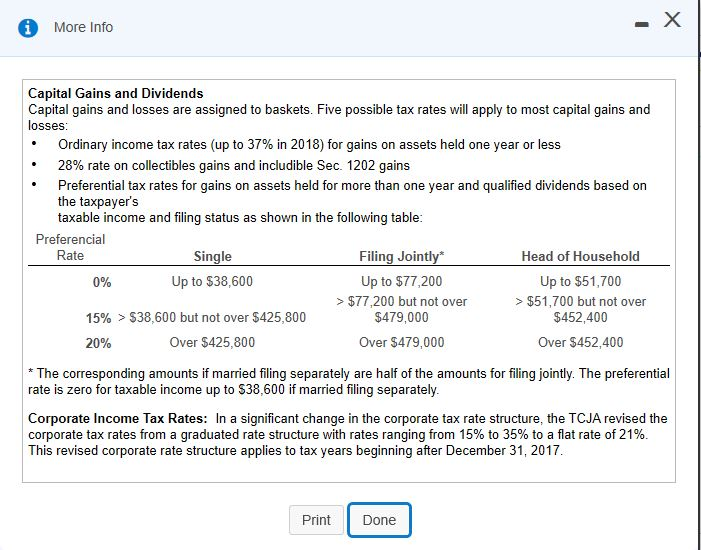

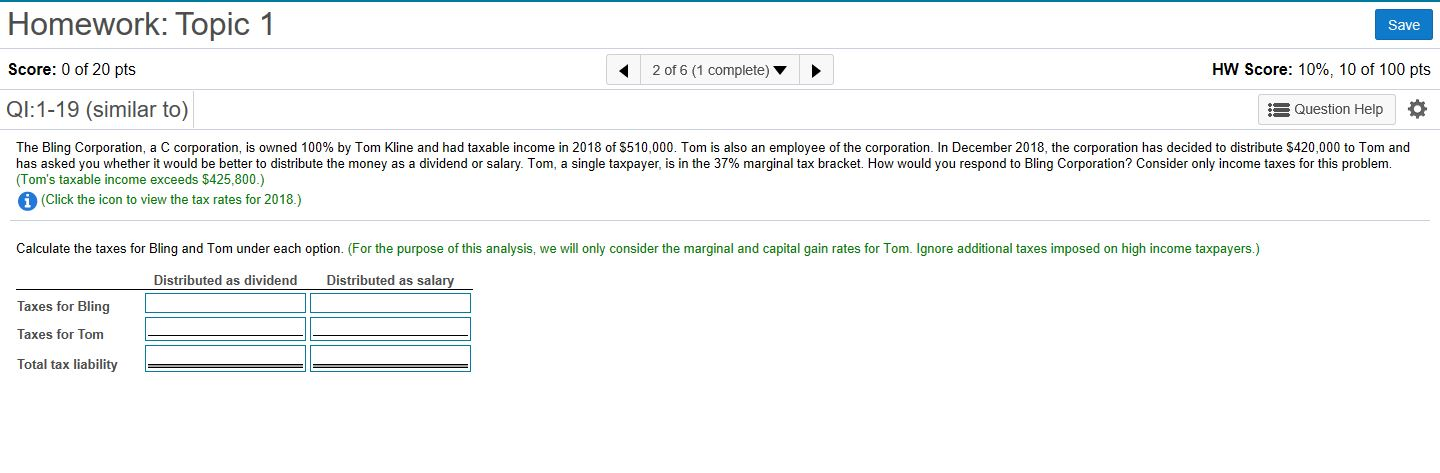

The combined rate accounts for federal state and local tax rate on capital gains income the 38 percent surtax on capital gains and the marginal effect of pease limitations which results in a tax rate increase of 118 percent. The irs taxes capital gains at the federal level and some states also tax capital gains at the state level. Examples of capital assets include stocks businesses land parcels homes personal items and more.

Short term capital gains are. Capital gains are taxable at both the federal and state levels. They are generally lower than short term capital gains tax rates.

The capital gains tax calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Capital gains tax a capital gains tax is a tax levied on the profit gleaned from the sale of a capital asset. The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling.

Detailed georgia state income tax rates and brackets are available on this page. The long term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds.

Popular online tax services. Long term capital gains tax in georgia. There are short term capital gains and long term capital gains and each is taxed at different rates.

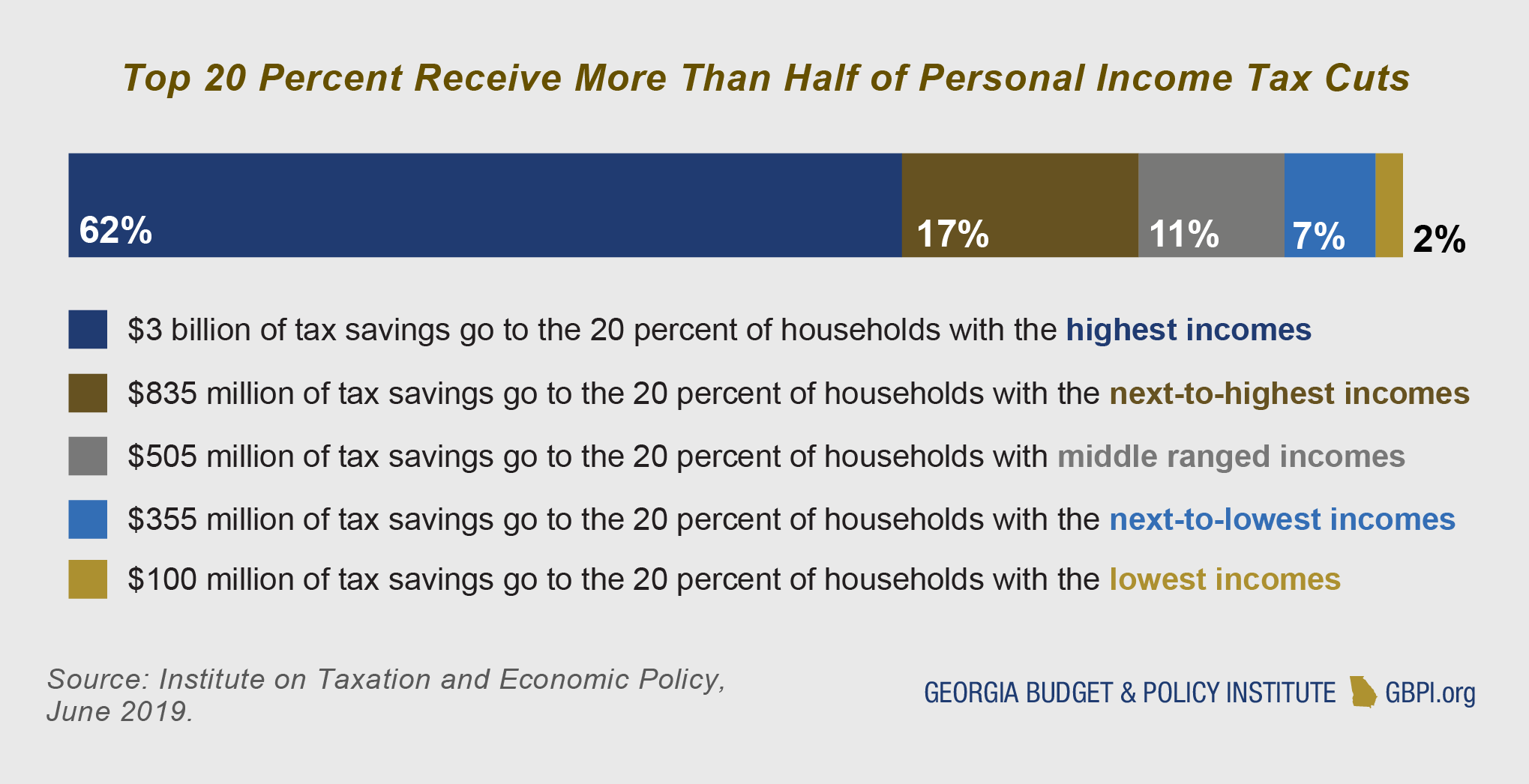

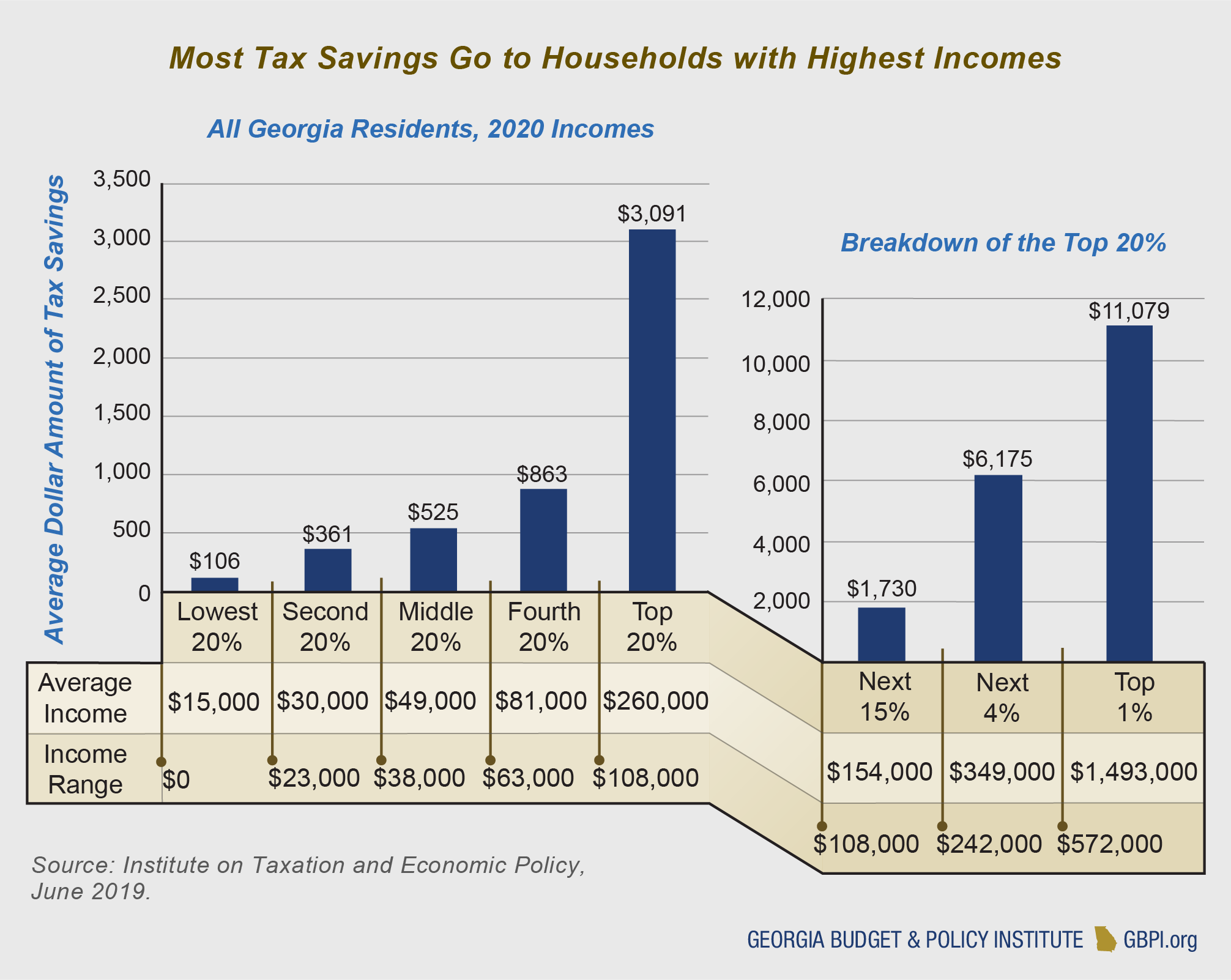

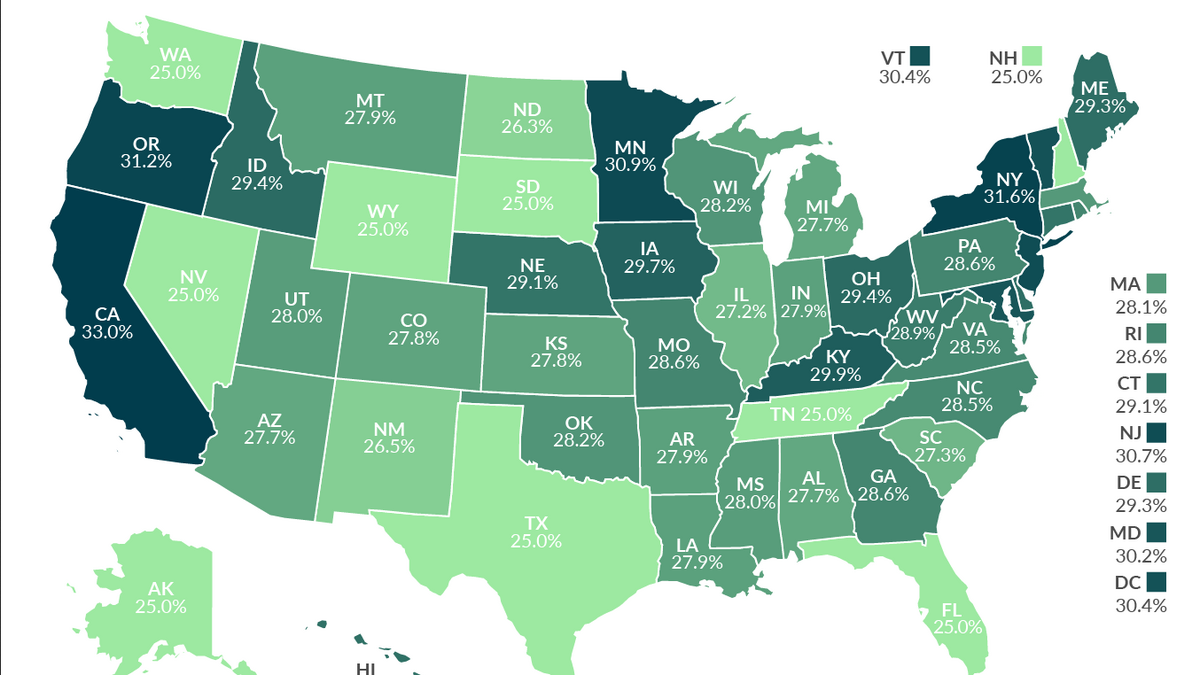

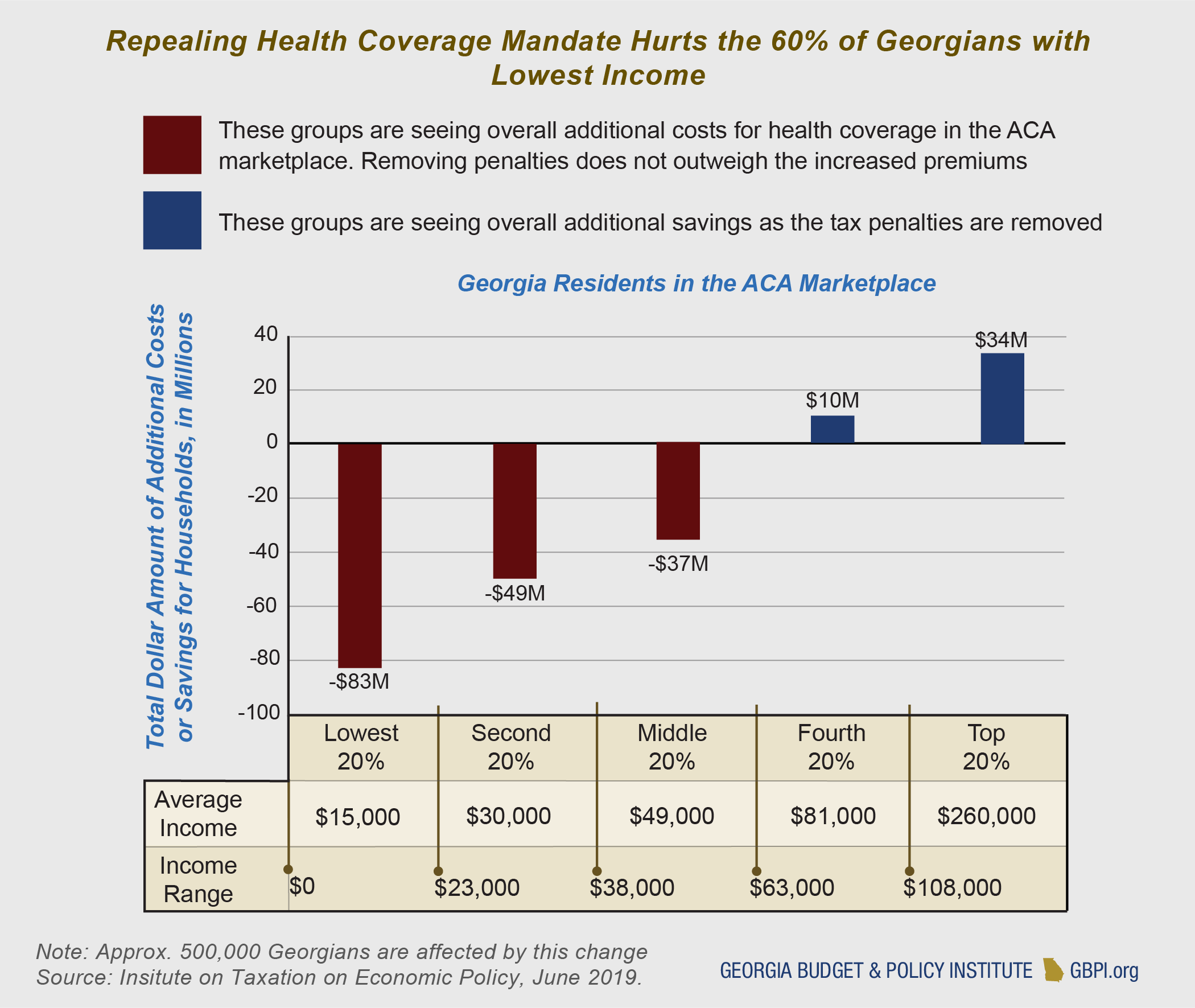

California 33 percent new york 316 percent oregon 312 percent and minnesota 309 percent. Capital gains tax see also. If youre married and file your tax return jointly the irs is even more generous letting you exclude typically up to 500000 in capital gains.

Capital gains tax rate filing single. Thats thanks to a taxpayer relief act of 1997. Additional state capital gains tax information for georgia.

Long term capital gains tax is a tax on profits from the sale of an asset held for more than a year. The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 6 because the 1 2nd lost and the 1 tsplost do not apply. Search for income tax statutes by keyword in the official code of georgia.

The states with the highest top marginal capital gains tax rates. The tax rate for the first.

2.png)

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)

:max_bytes(150000):strip_icc()/will-i-pay-tax-on-my-home-sale-2389003-v4-5b4cb96046e0fb0037e65b73.png)

/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)