Georgia State Tax Rate 2019

The tax rate for the first.

Georgia state tax rate 2019. State of georgia government websites and email systems use georgiagov or gagov at the end of the address. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Popular online tax services.

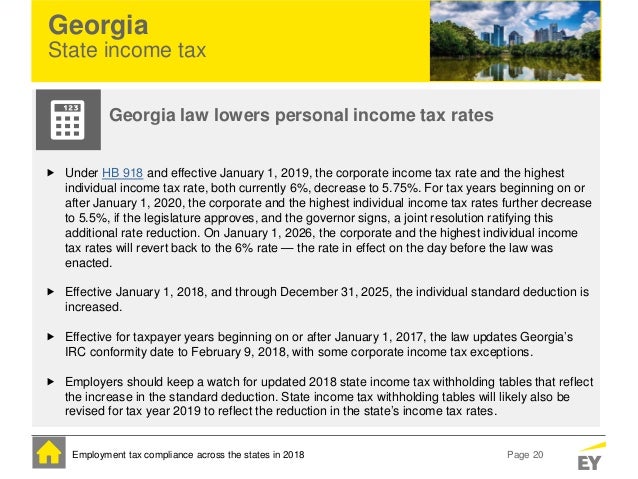

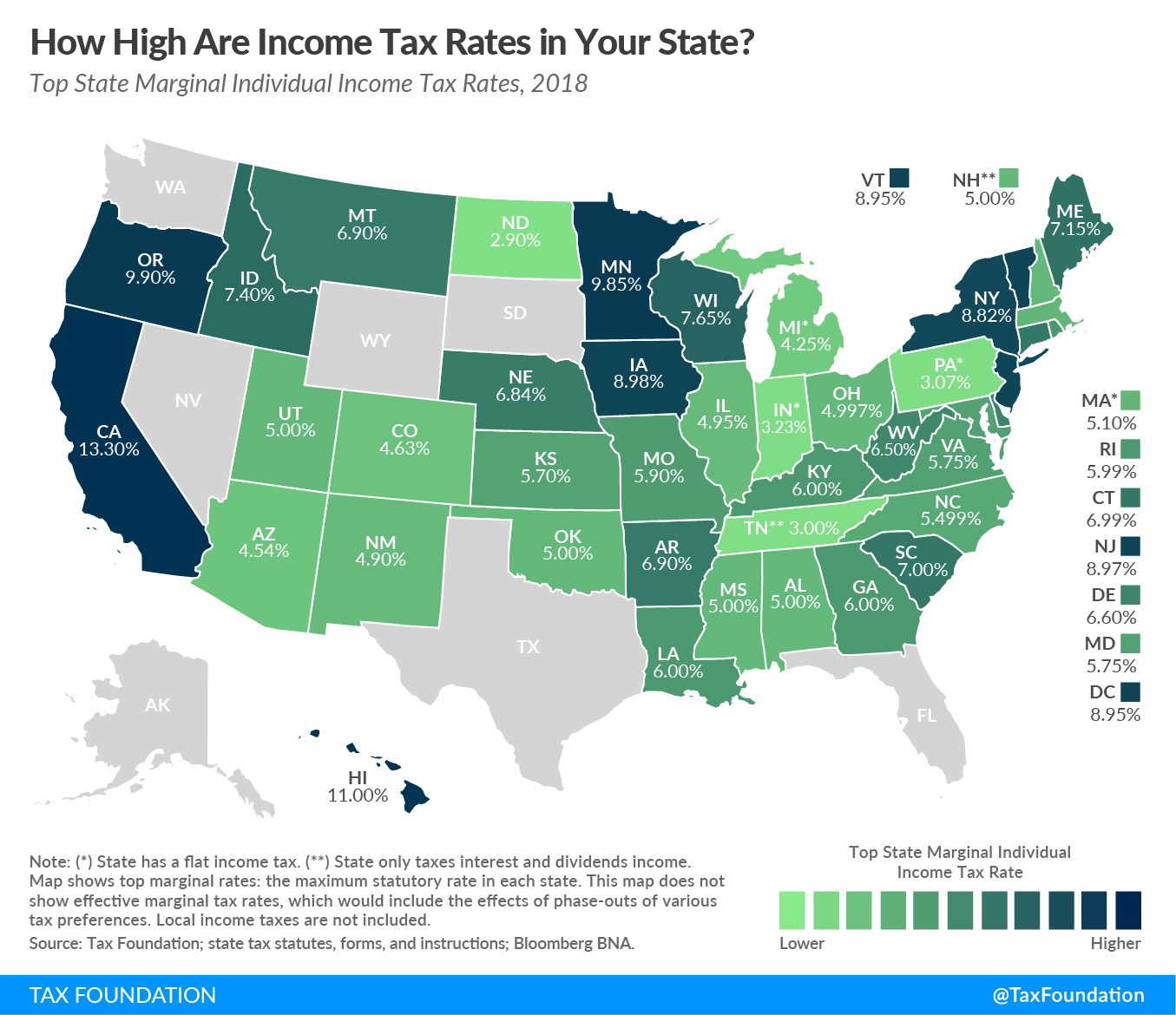

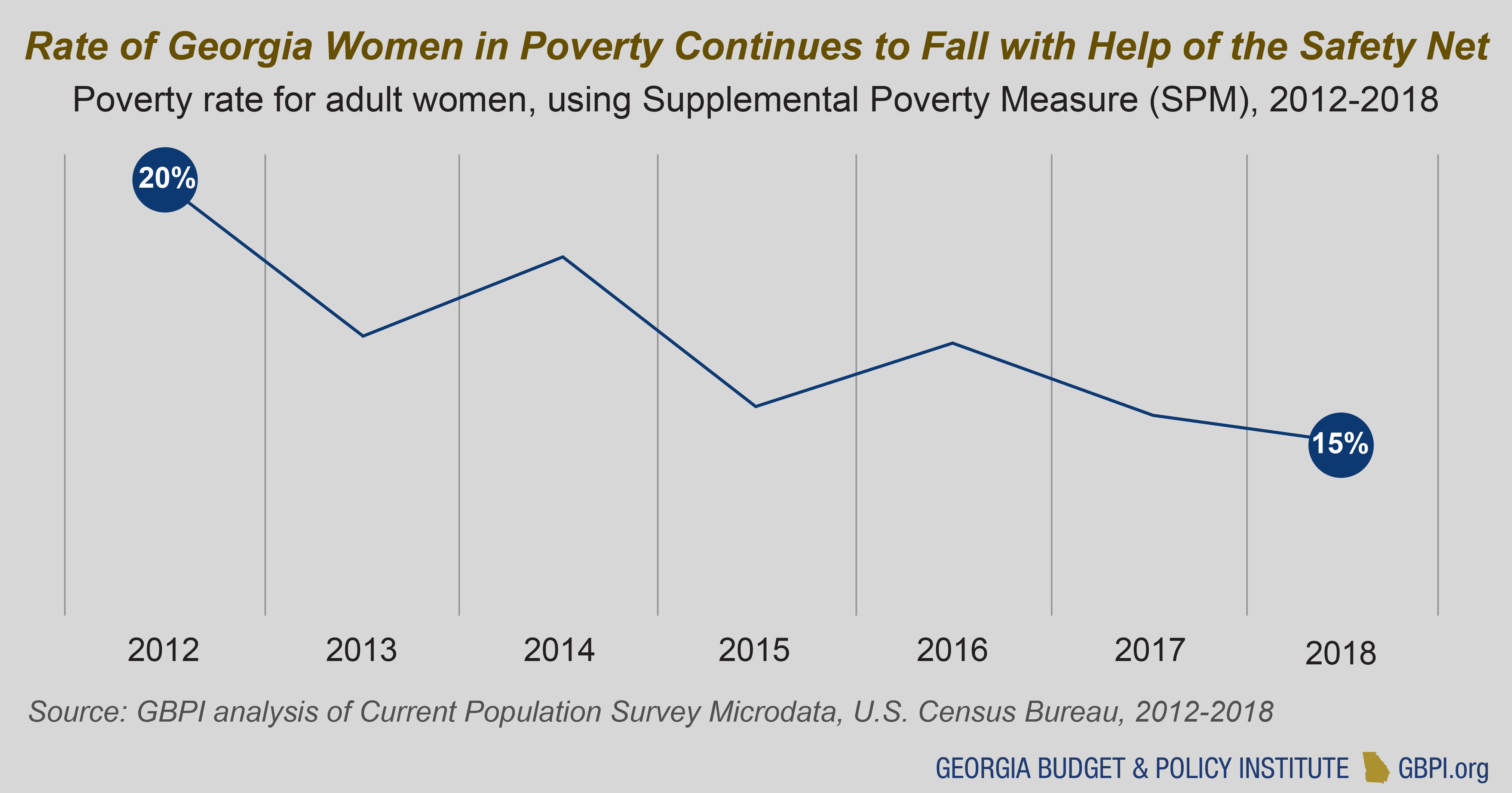

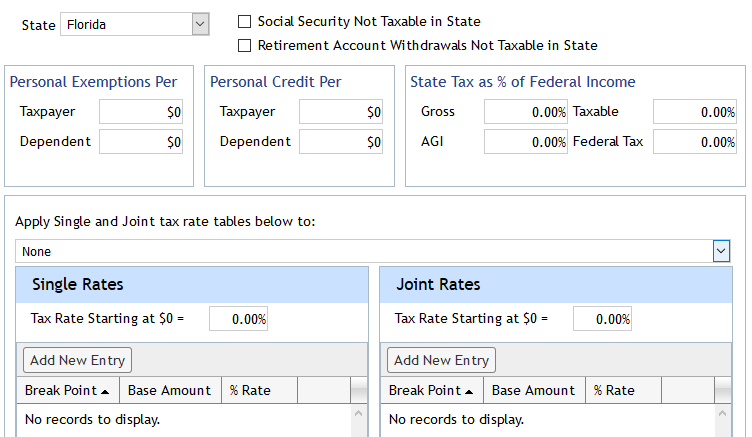

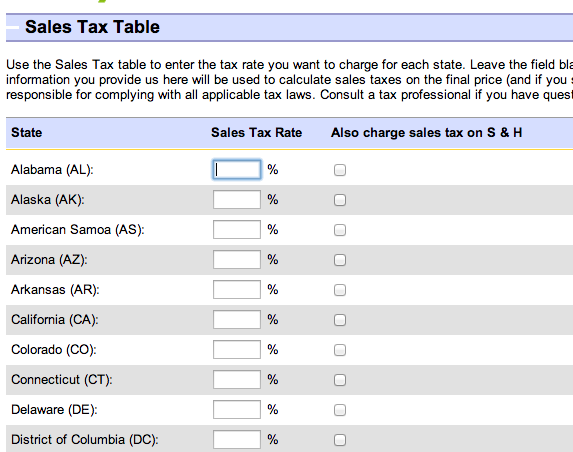

This years individual income tax forms. Georgia sales and use tax rate chart effective january 1 2019 code 000 the state sales and use tax rate is 4 and is included in the jurisdiction rates below. Georgia has six marginal tax brackets ranging from 1 the lowest georgia tax bracket to 575 the highest georgia tax bracket.

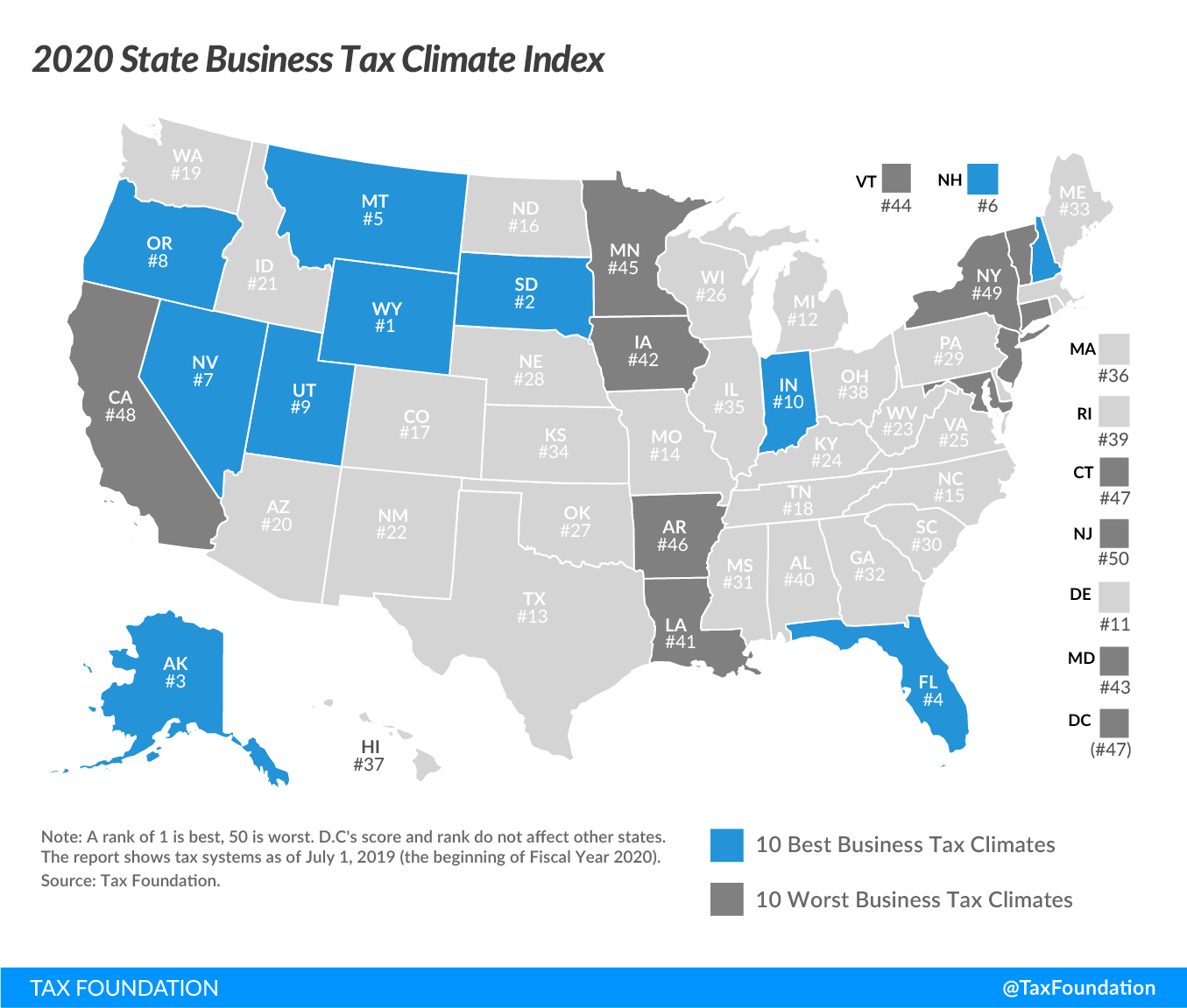

Local state and federal government websites often end in gov. The 2020 state personal income tax brackets are updated from the georgia and tax foundation data. Georgia tax forms are sourced from the georgia income tax forms page and are updated on a yearly basis.

Georgia income tax forms are generally published at the end of each calendar year which will include any last. Before the official 2020 georgia income tax rates are released provisional 2020 tax rates are based on georgias 2019 income tax brackets. County rates in georgia range from less than 050 to over 180.

Georgias income tax rates were last changed two years ago for tax year 2018 and the tax brackets were previously changed in 2009. Filing requirements for full and part year residents and military personnel. Filing state taxes the basics.

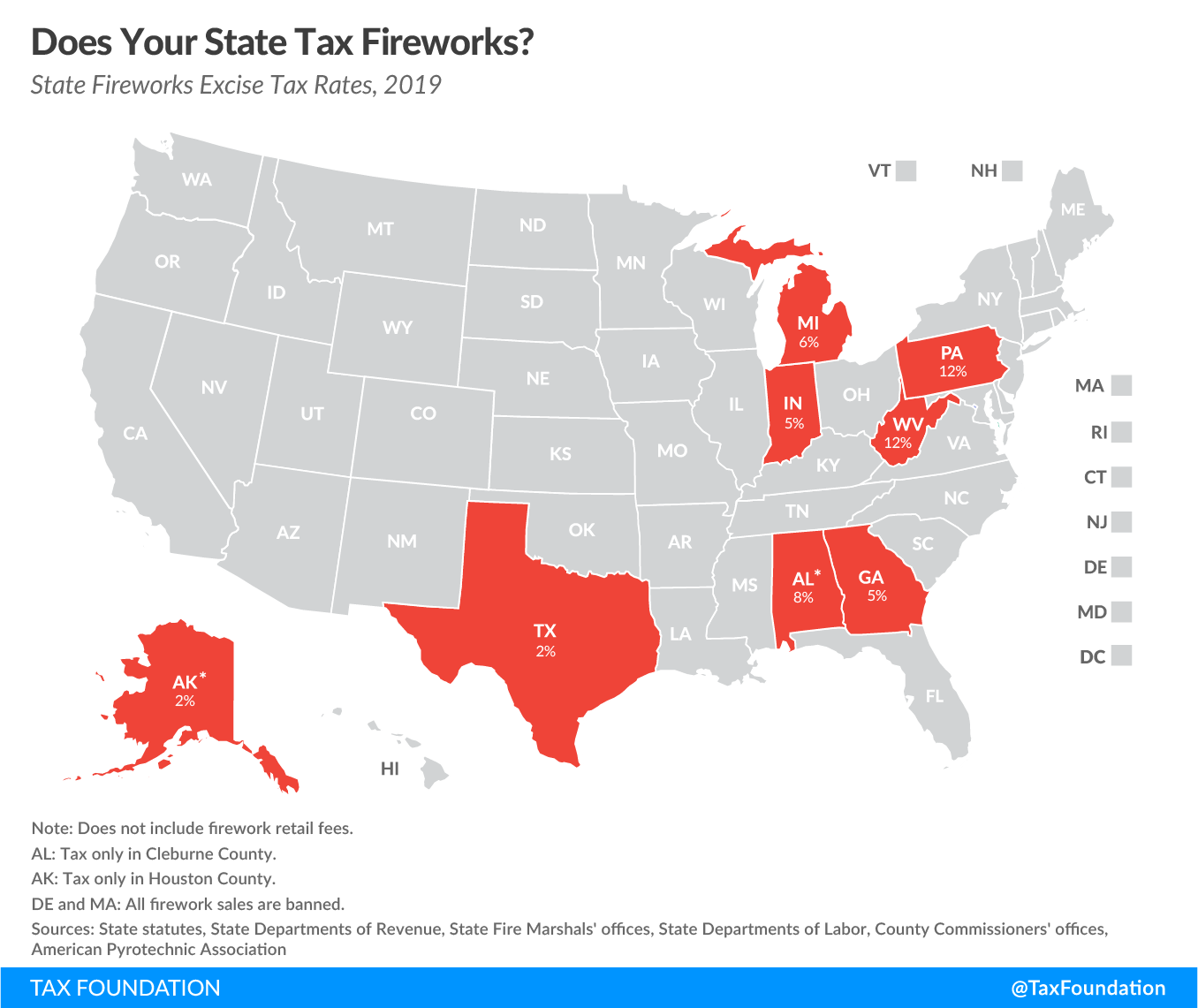

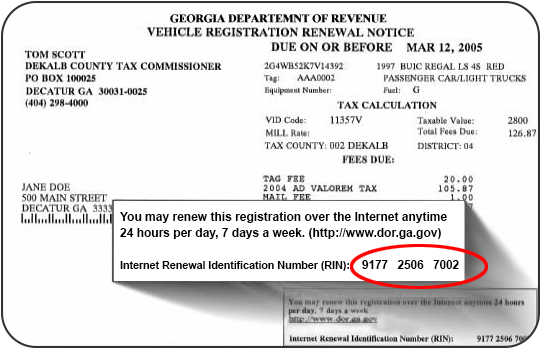

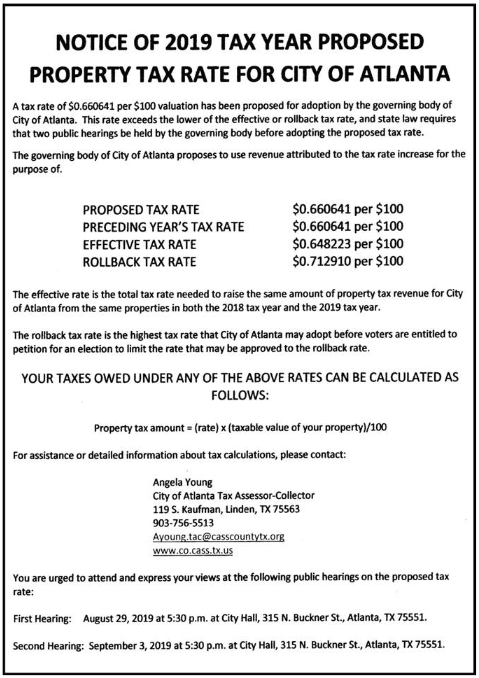

The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 6 because the 1 2nd lost and the 1 tsplost do not apply. 2019 georgia state tax rate schedule published by the georgia department of revenue. Sales tax rates general.

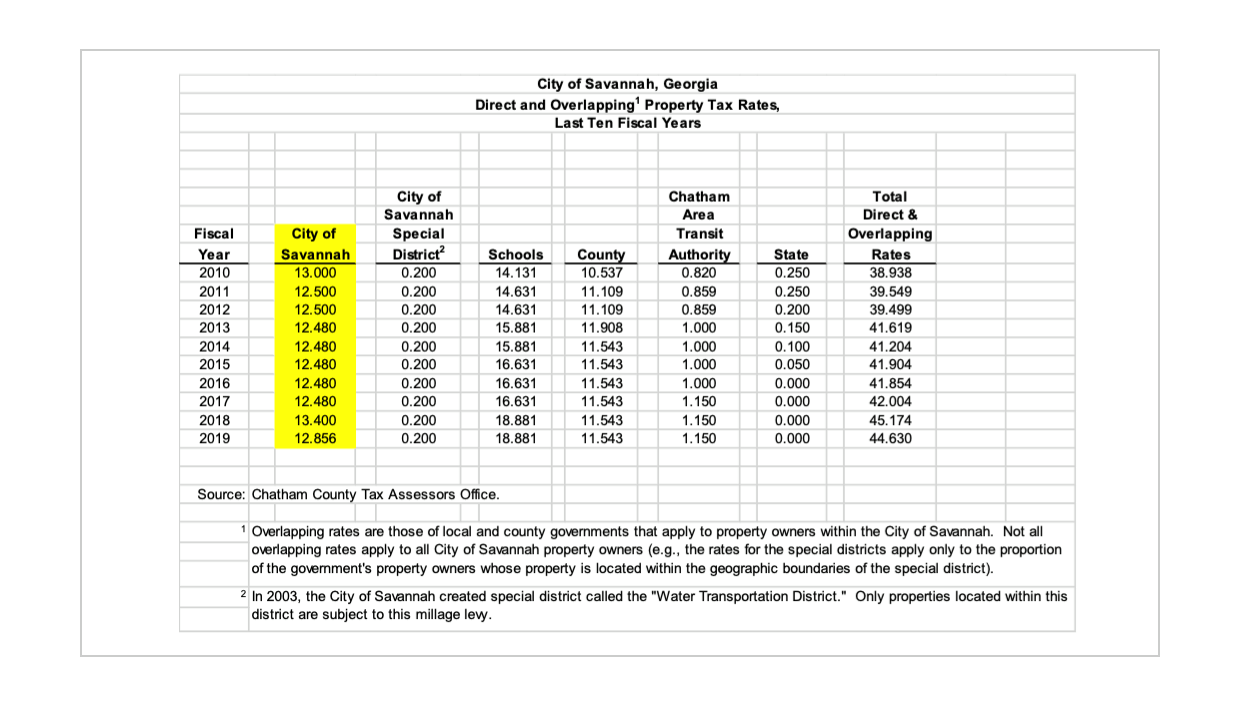

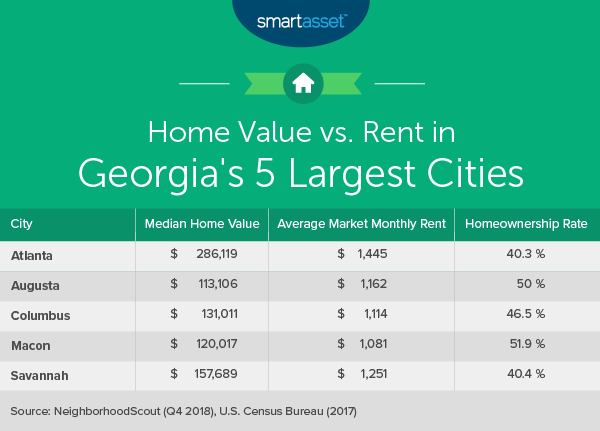

If you are considering purchasing a property in georgia or are thinking about refinancing this mortgage guide is a great place to start. The georgia department of revenue is responsible for publishing the latest georgia state tax. Please reference the georgia tax forms and instructions booklet published by the georgia department of revenue to determine if you owe state income tax or are due a state income tax refund.

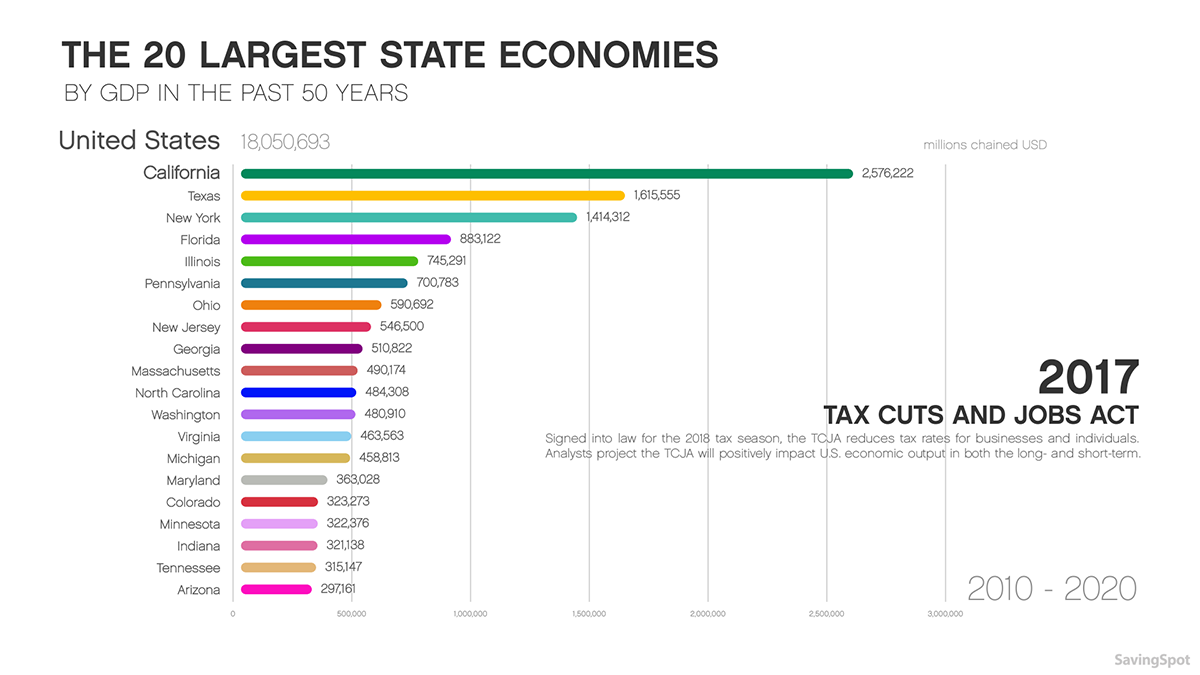

General rate chart. In fulton county the states most populous the effective property tax rate is 103. Search for income tax statutes by keyword in the official code of georgia.

In georgia different tax brackets are. Effective october 1 2018 the generally applicable tax rate in ware county is 9 state sales tax at the statewide rate of 4 plus 5 local sales taxes at a rate of 1 each. Includes short and long term 2019 federal and state capital gains tax rates.

The capital gains tax calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3.png)

/best-and-worst-states-for-sales-taxes-3193296_final-5833bed0517f402abab0d55179d65e7d.png)