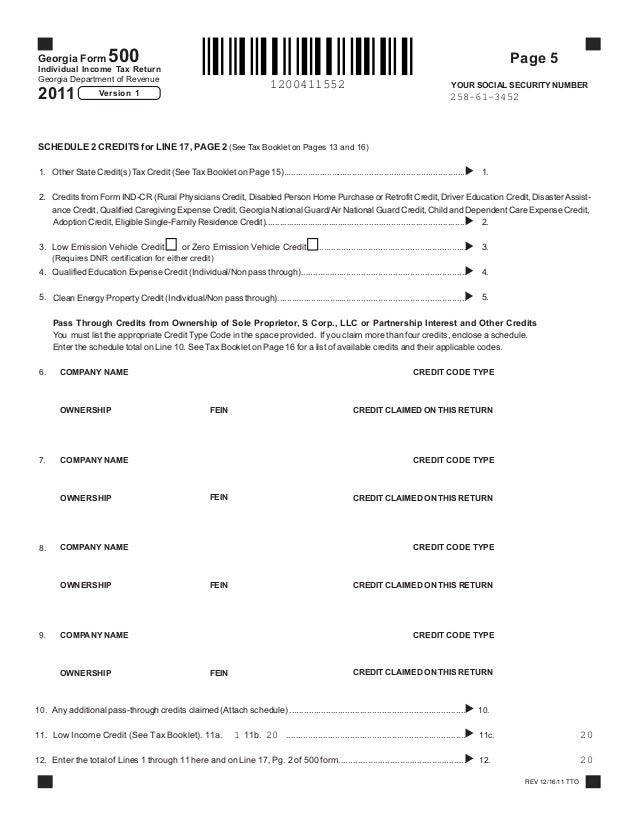

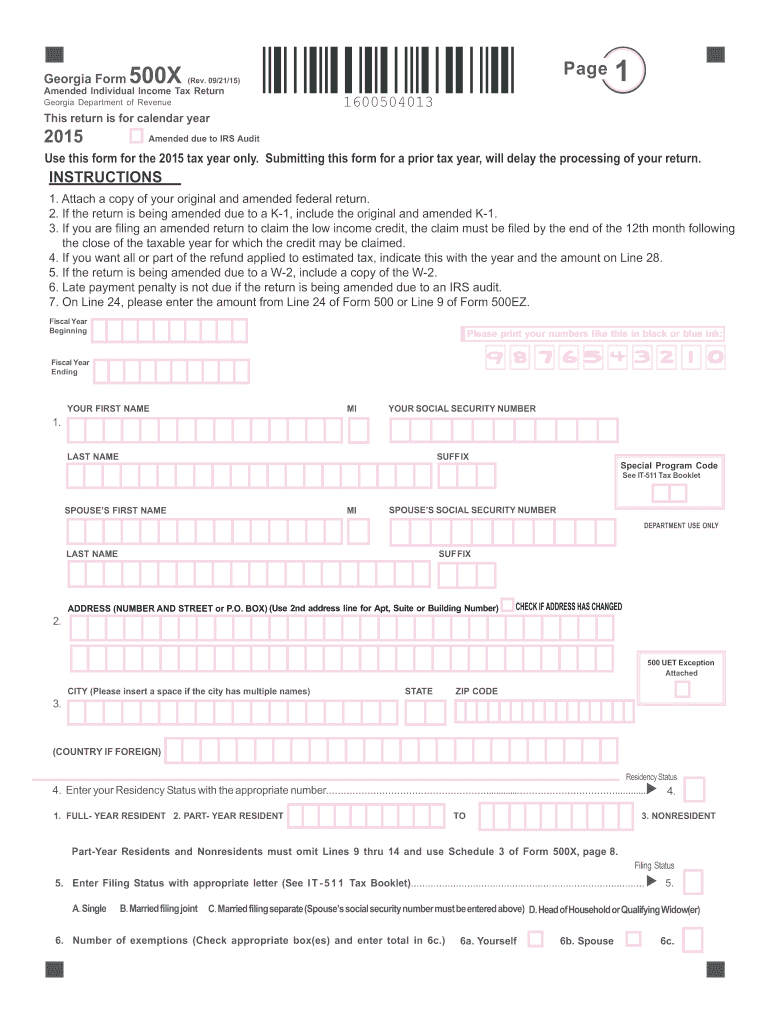

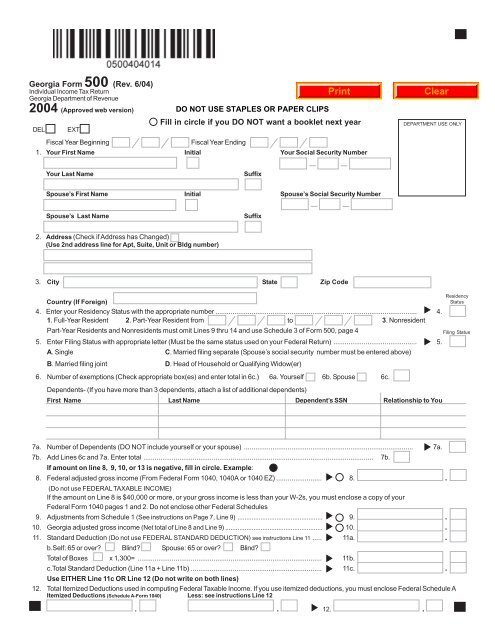

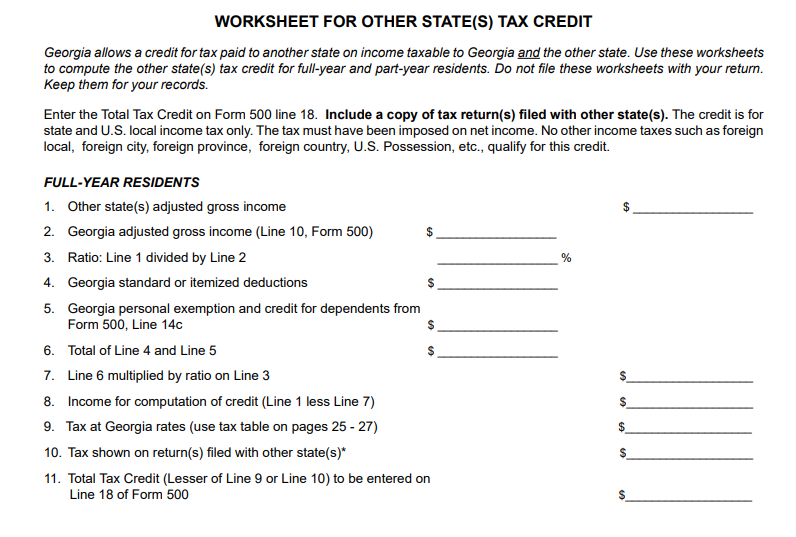

Georgia State Tax Form 500

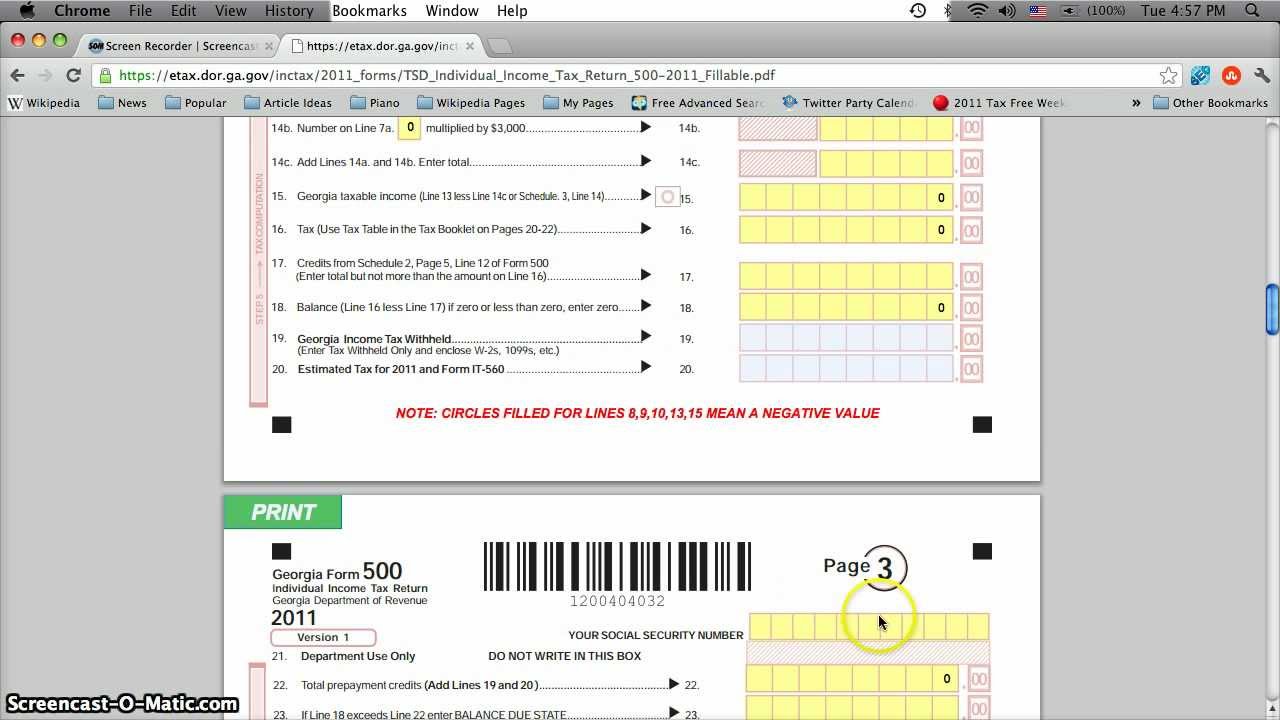

Income tax form 500.

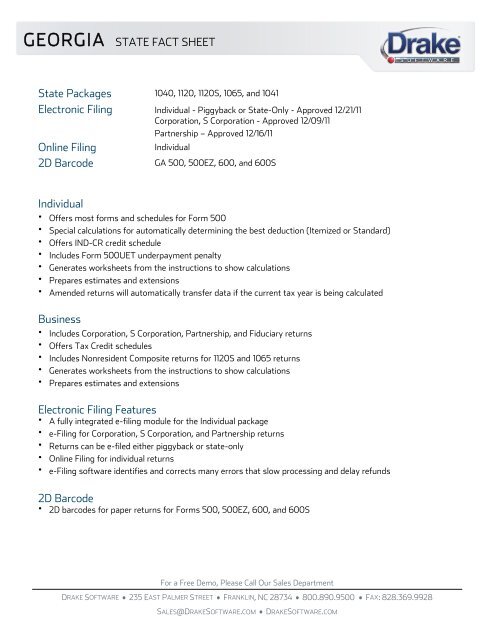

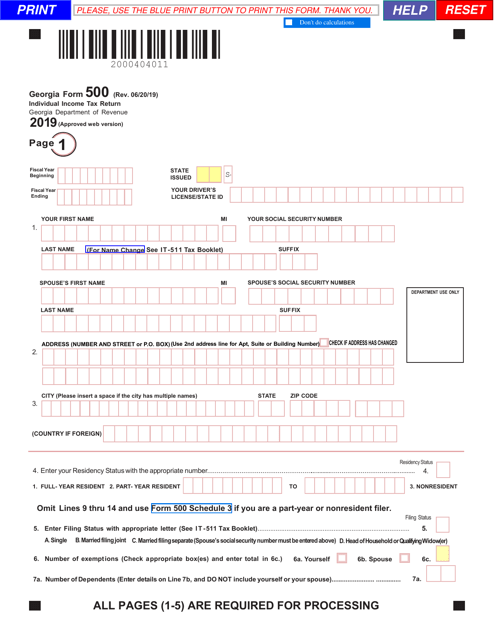

Georgia state tax form 500. Ndividual income tax return. State of georgia government websites and email systems use georgiagov or gagov at the end of the address. This form is for income earned in tax year 2019 with tax returns due in april 2020we will update this page with a new version of the form for 2021 as soon as it is made available by the georgia government.

Georgia department of. Call 1 800 georgia to verify that a website is an official website of the state of georgia. Local state and federal government websites often end in gov.

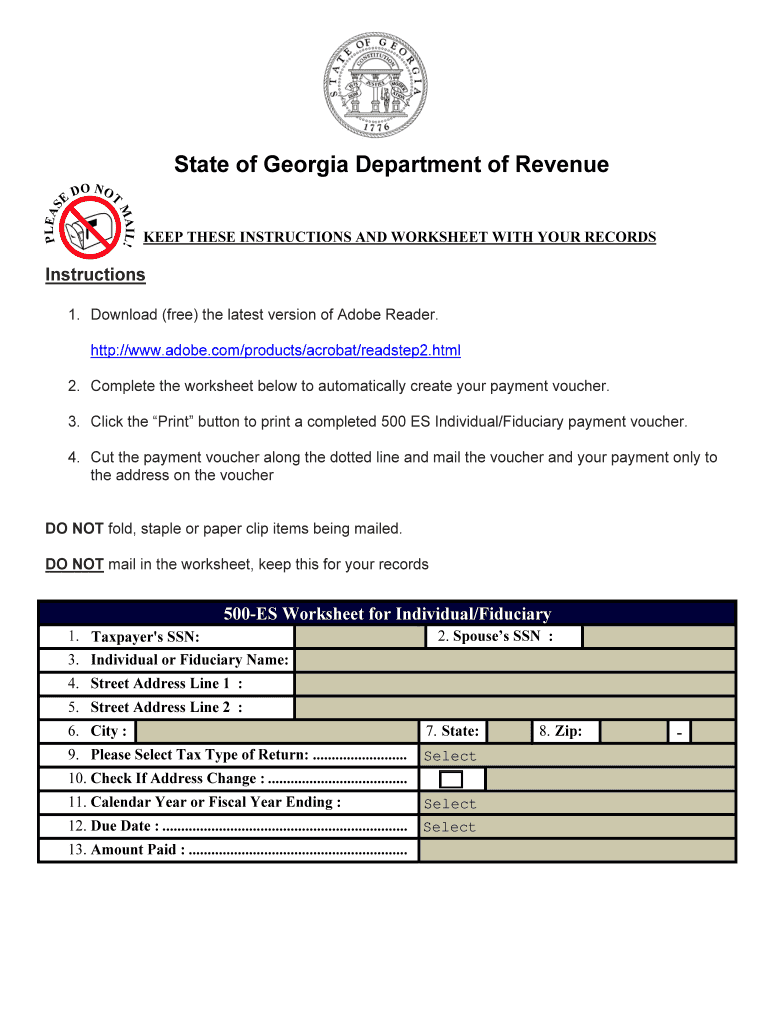

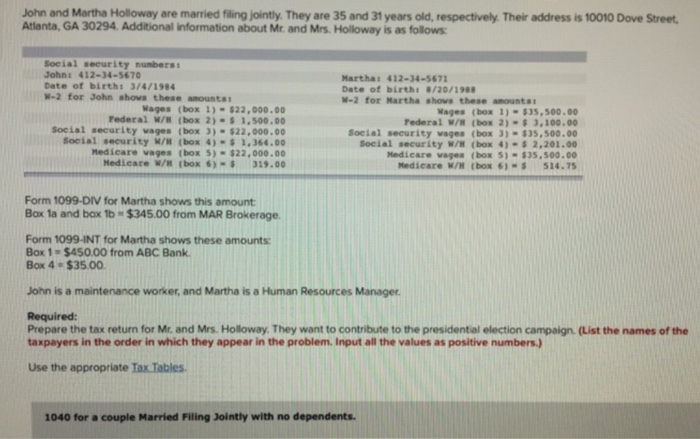

Local state and federal government websites often end in gov. If you owe add lines 27 30 thru 39. Georgia state income tax form 500 must be postmarked by july 15 2020 in order to avoid penalties and late fees.

500 individual income tax return important. Georgia department of revenue. The georgia income tax rate for tax year 2019 is progressive from a low of 1 to a high of 575.

Before sharing sensitive or personal information make sure youre on an official state website. Printable georgia state tax forms for the 2019 tax year will be based on income earned between january 1 2019 through december 31 2019. Make check payable to georgia department of revenue.

Before sharing sensitive or personal information make sure youre on an official state website. Form 500 uet estimated tax penalty 500 uet exception attached 39. Income short form 500 ez.

Download 2019 individual income tax forms. Department of revenue department of revenue. We last updated georgia form 500 in february 2020 from the georgia department of revenue.

Income Tax Pro On Twitter Georgia Individual Income Tax Forms For The 2017 2018 Incometax Filing Season Have Been Published Including Georgia Form Ga 500 Form Ga 500ez Instructions Adjustments And 2018 Ga 500es Estimated

twitter.com

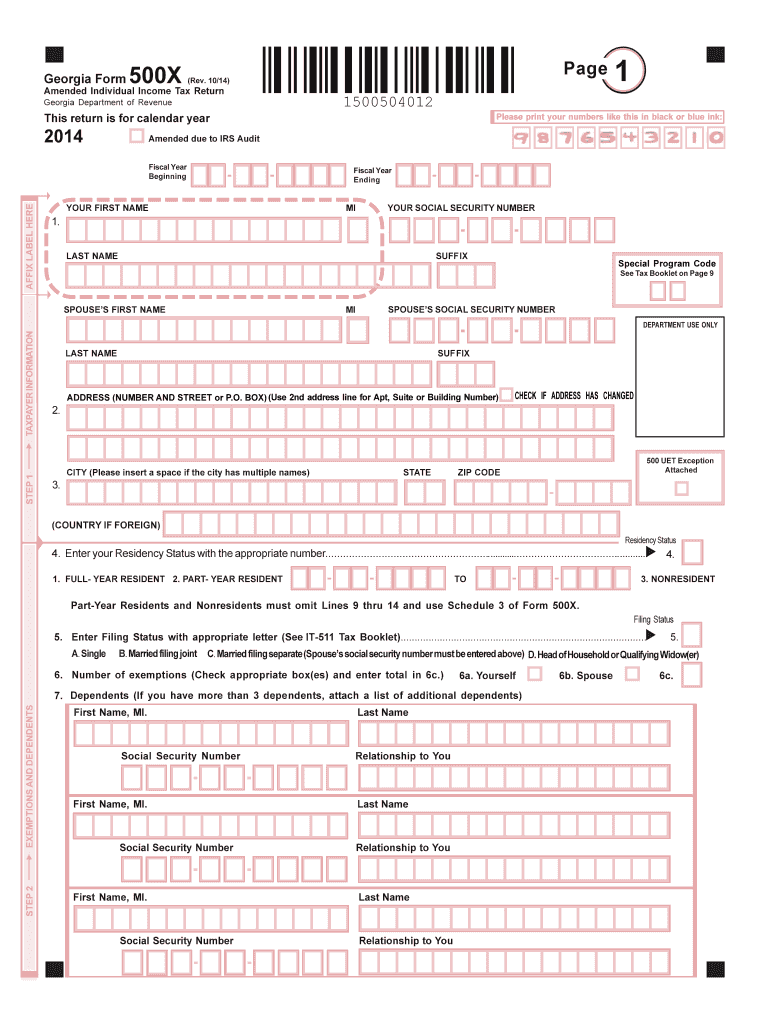

Fillable Online Georgia Income Tax Form 500 Instructions 2016 Wordpress Com Fax Email Print Pdffiller

www.pdffiller.com