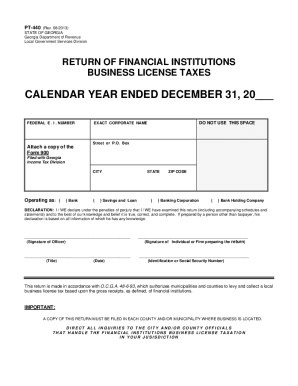

Georgia State Tax Form 2020

Search for income tax statutes by keyword in the official code of georgia.

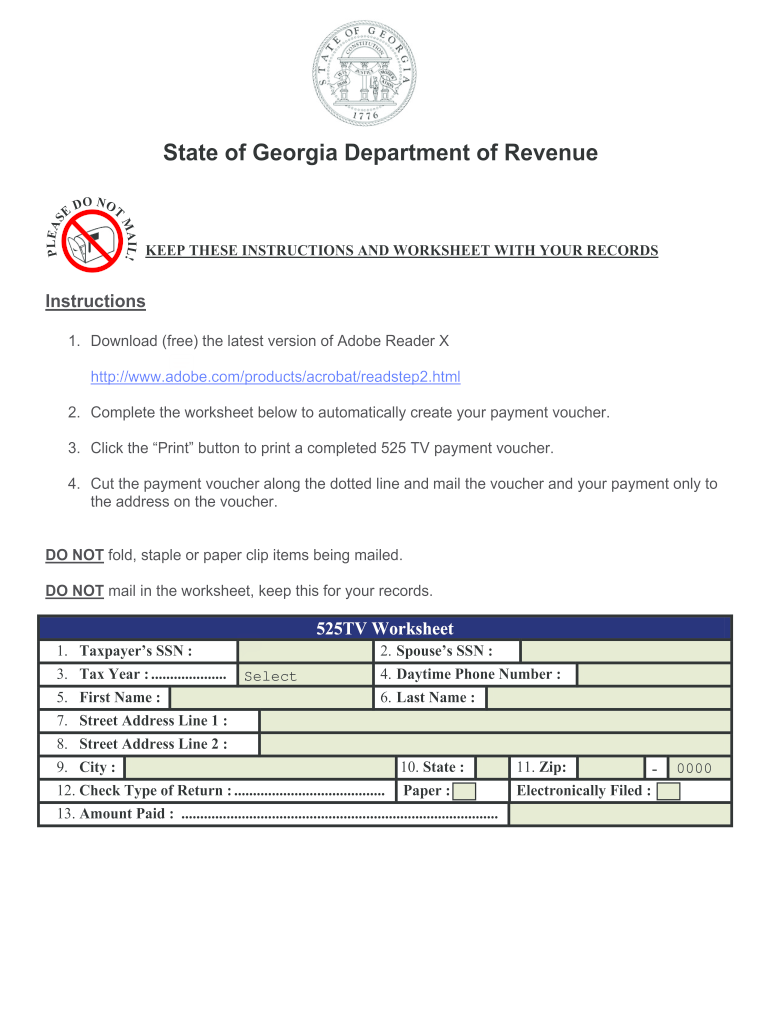

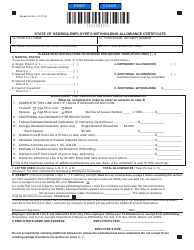

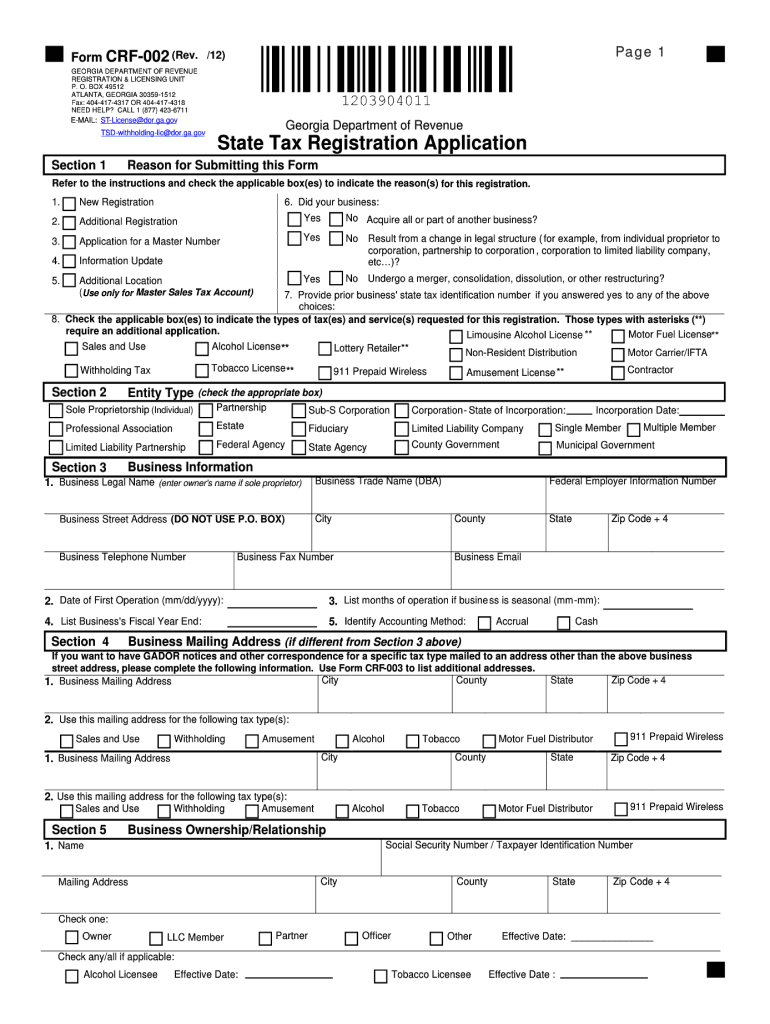

Georgia state tax form 2020. State of georgia department of revenue p l e a s e d o n o t m a i l. Georgia tax forms are sourced from the georgia income tax forms page and are updated on a yearly basis. Filing state taxes the basics.

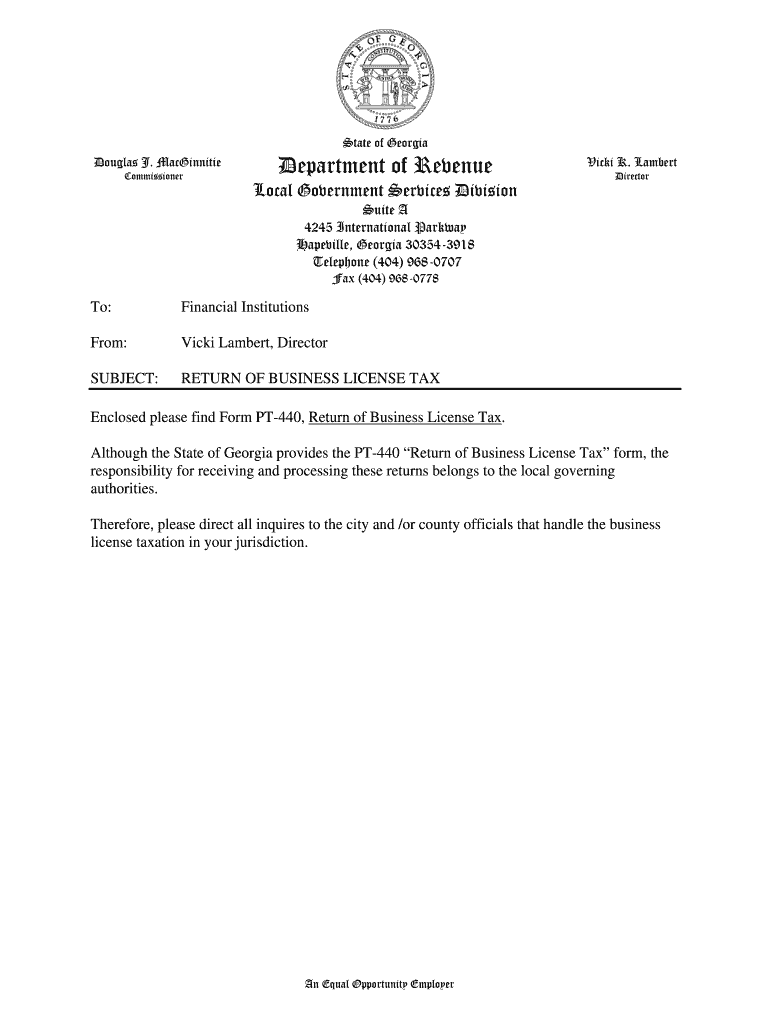

State of georgia government websites and email systems use georgiagov or gagov at the end of the address. Local state and federal government websites often end in gov. Form 500 is the general income tax return form for all georgia residents.

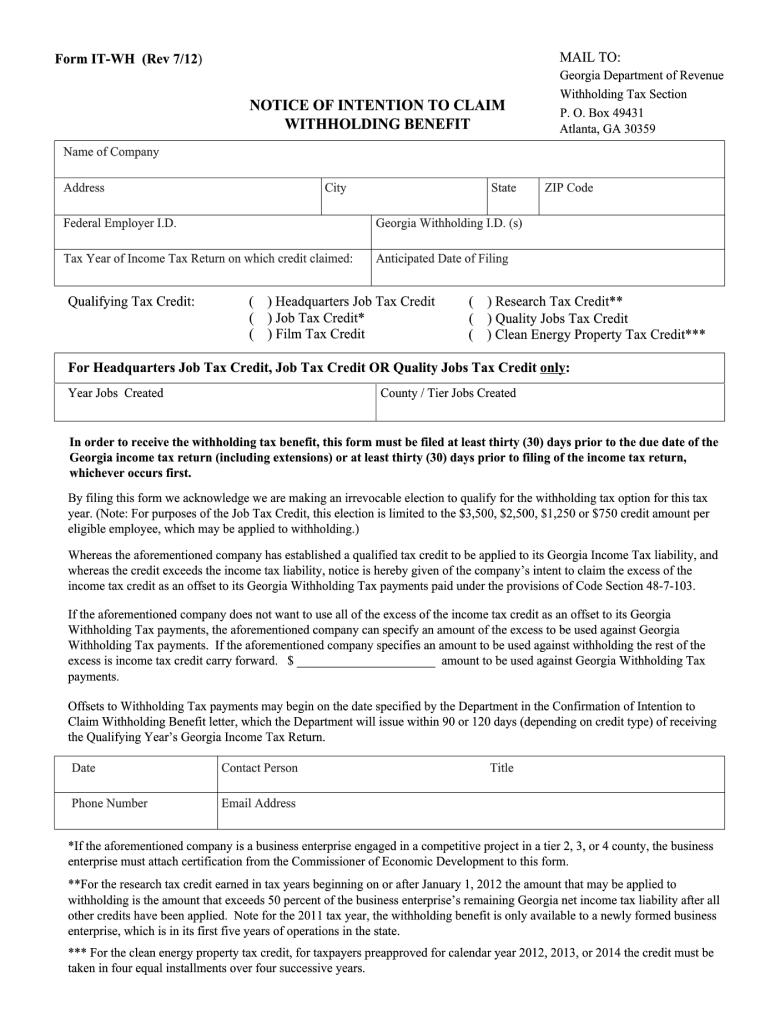

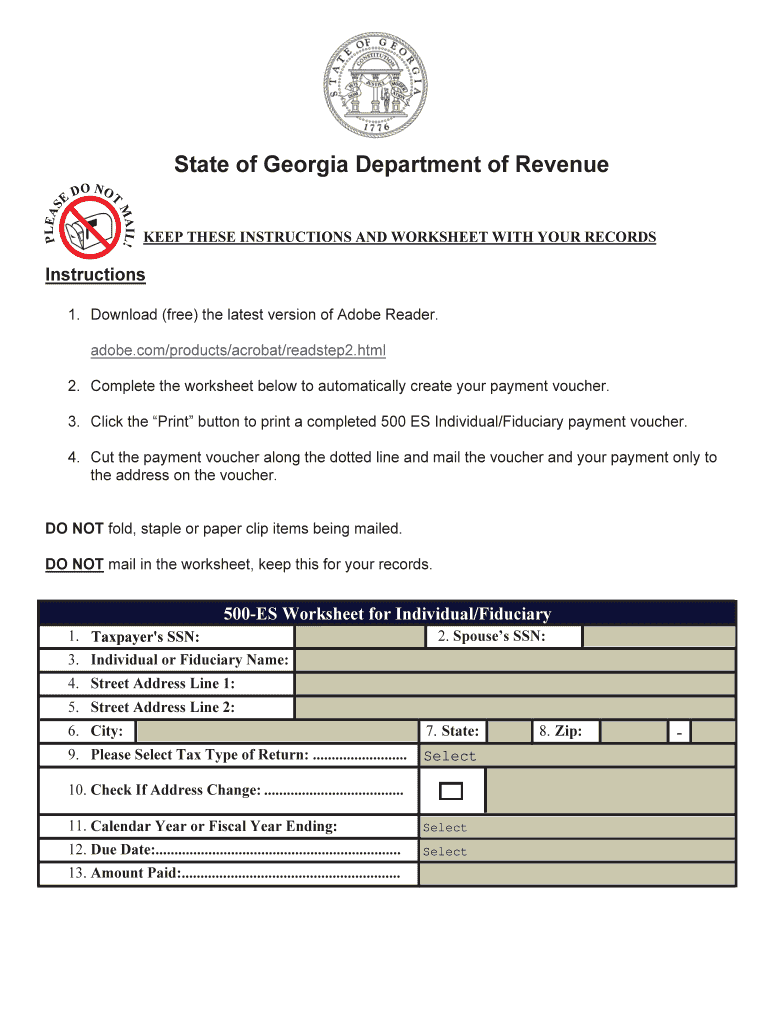

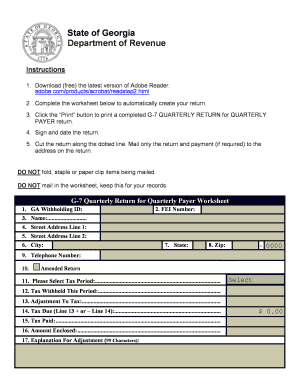

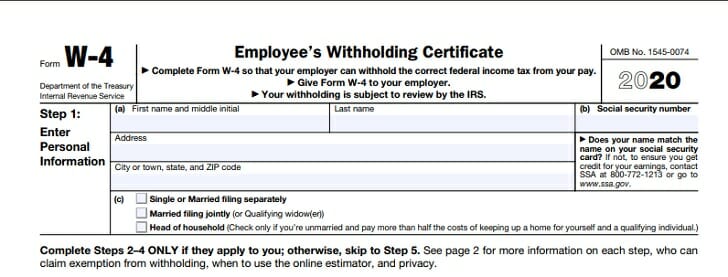

Estimated quarterly tax return. Your employer withheld 500 of georgia income tax from your wages. Exemption amount for tax year 2020.

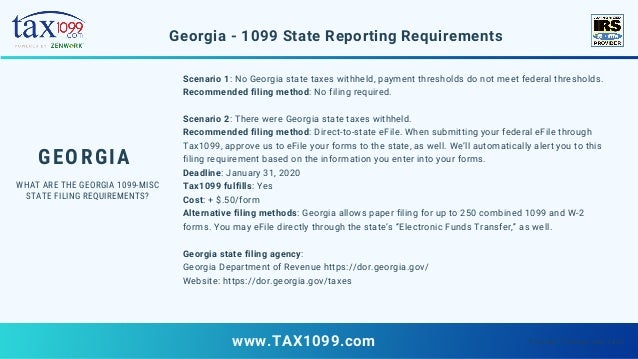

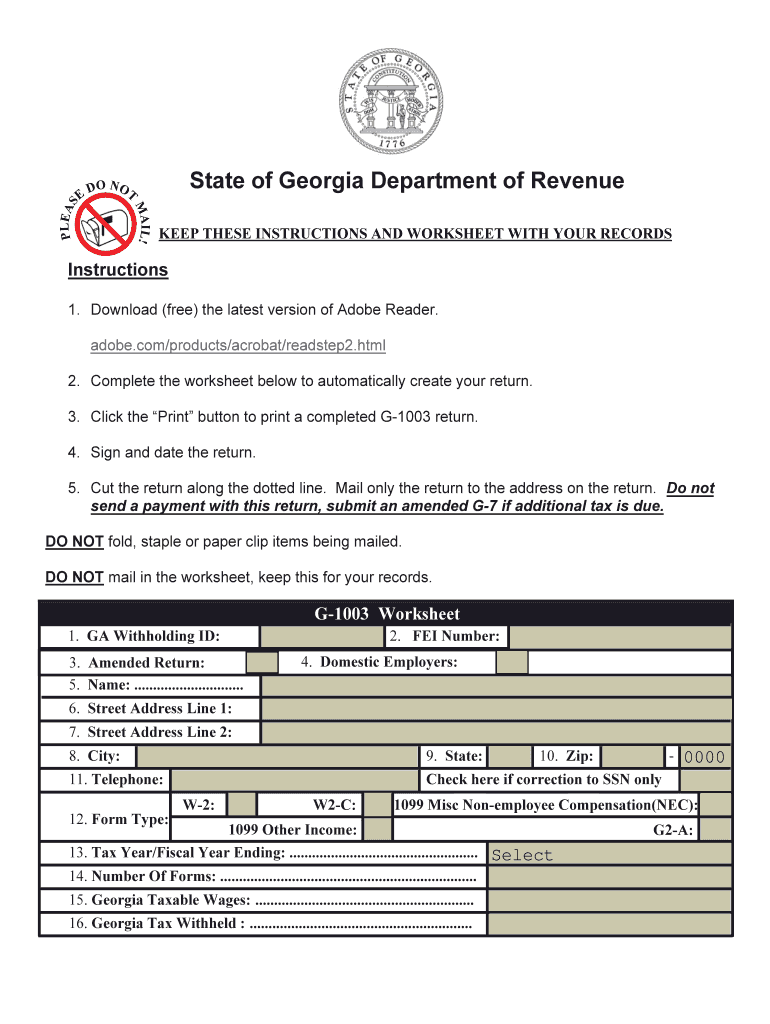

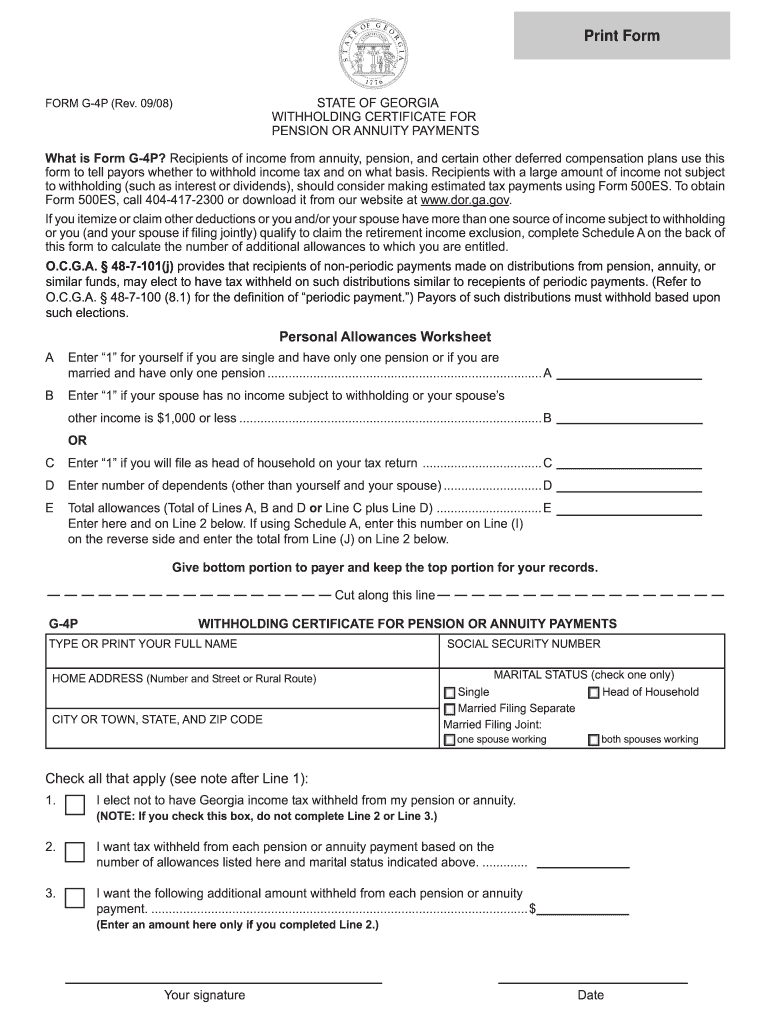

This years individual income tax forms. Calendar year 2019 forms w 2 along with the annual reconciliation return form g 1003 and forms 1099 where georgia income tax was withheld must be filed with the department by january 31 2020. Call 1 800 georgia to verify that a website is an official website of the state of georgia.

Local state and federal government websites often end in gov. Popular online tax services. Therefore you do not qualify to claim exempt.

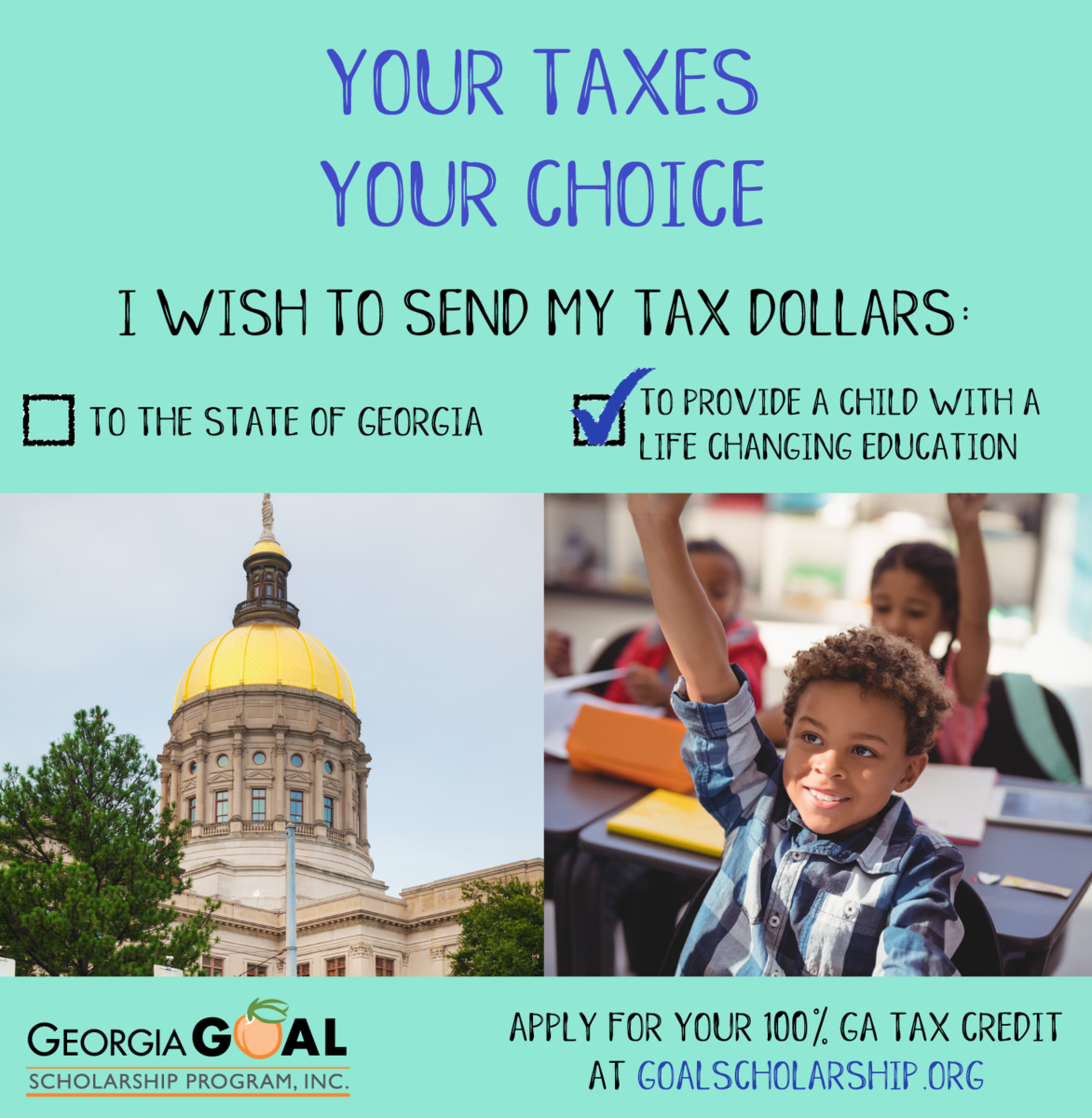

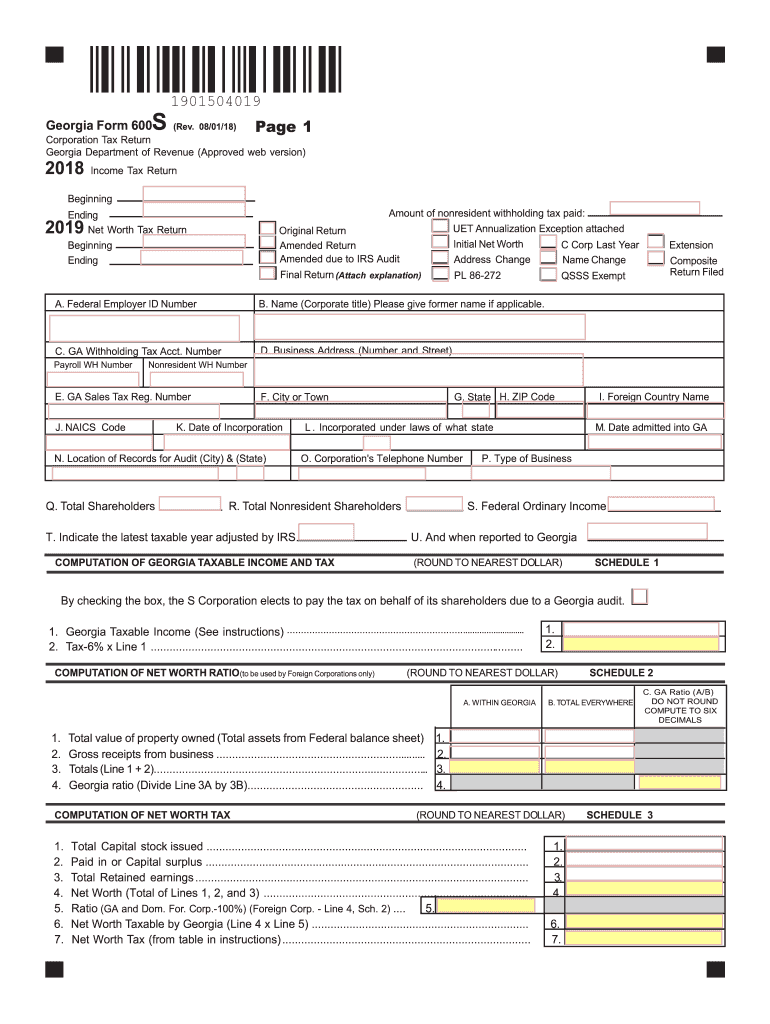

Fiduciary income tax 2020 2019 2018 2017 2016 2015. Filing requirements for full and part year residents and military personnel. Before the official 2020 georgia income tax rates are released provisional 2020 tax rates are based on georgias 2019 income tax brackets.

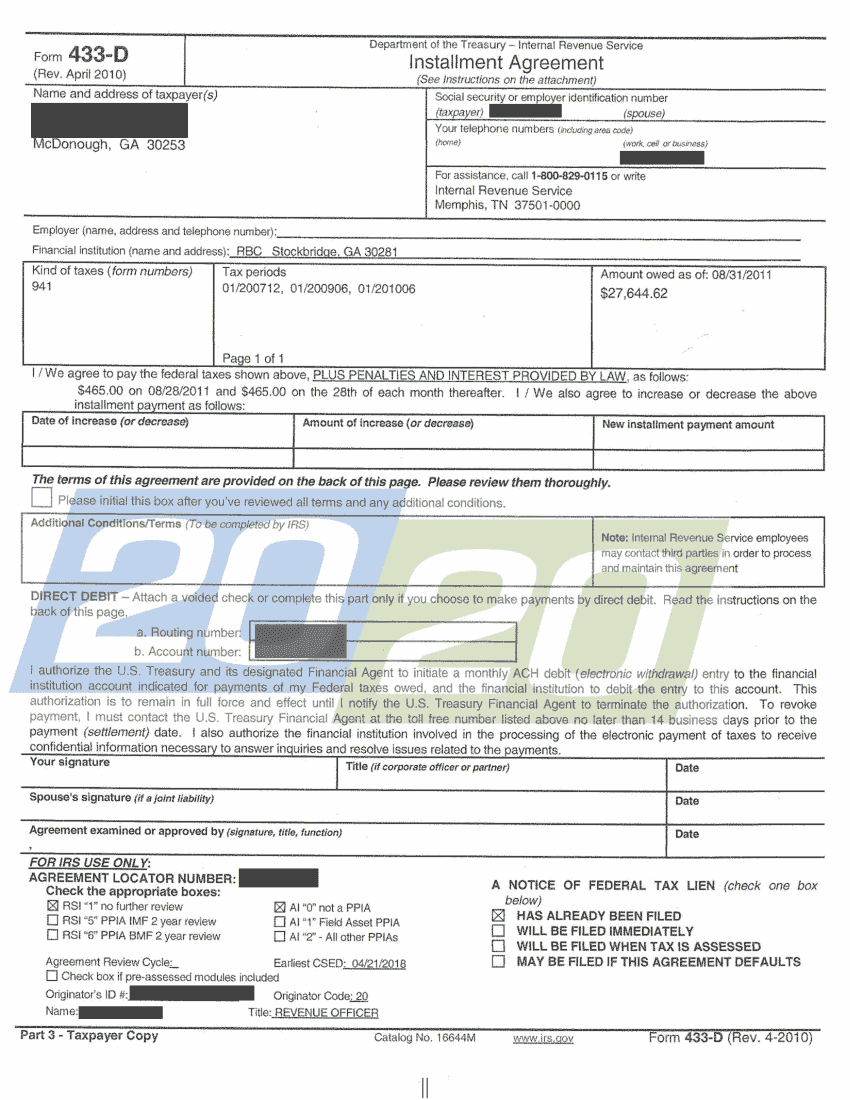

Purpose of estimated tax. Your estimated tax and the tax rate schedules are listed in the tax booklet. Department of revenue department of revenue.

Download 2019 individual income tax forms. Local state and federal government websites often end in gov. Form 500 es contains an estimated tax worksheet and a voucher for mailing quarterly estimated income tax payments.

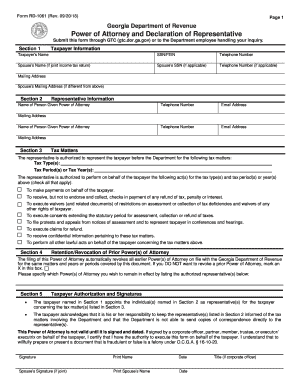

State of georgia government websites and email systems use georgiagov or gagov at the end of the address. State of georgia government websites and email systems use georgiagov or gagov at the end of the address. Before sharing sensitive or personal information make sure youre on an official state website.

Before sharing sensitive or personal information make sure youre on an official state website. Form 500 es and submit to the georgia department of revenue. Georgia employers that file and pay state withholding tax electronically and those required to file forms w 2 electronically with the social.

Your employer withheld 500 of georgia income tax from your wages. Your tax liability is the amount on line 4 or line 16. Before sharing sensitive or personal information make sure youre on an official state website.

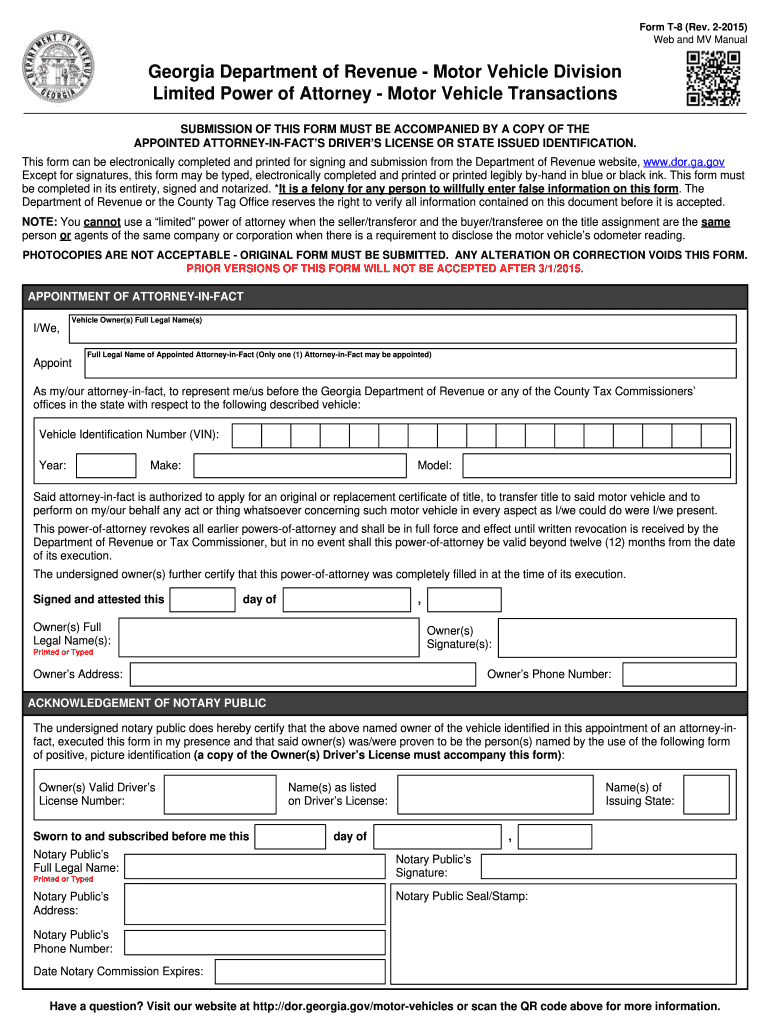

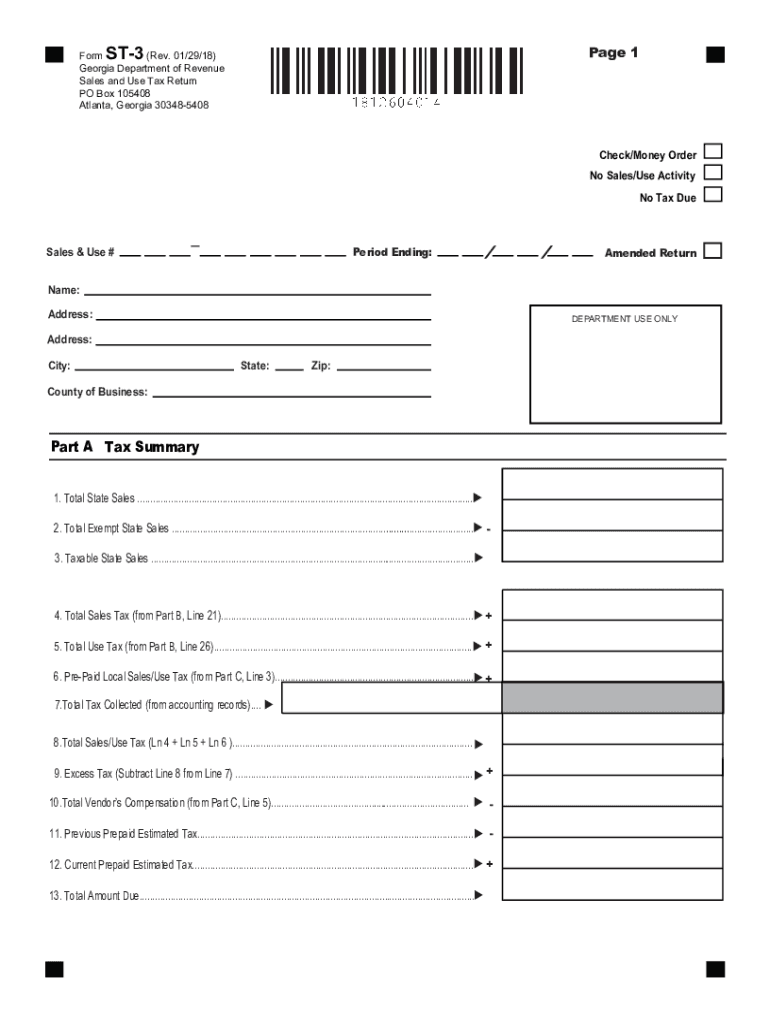

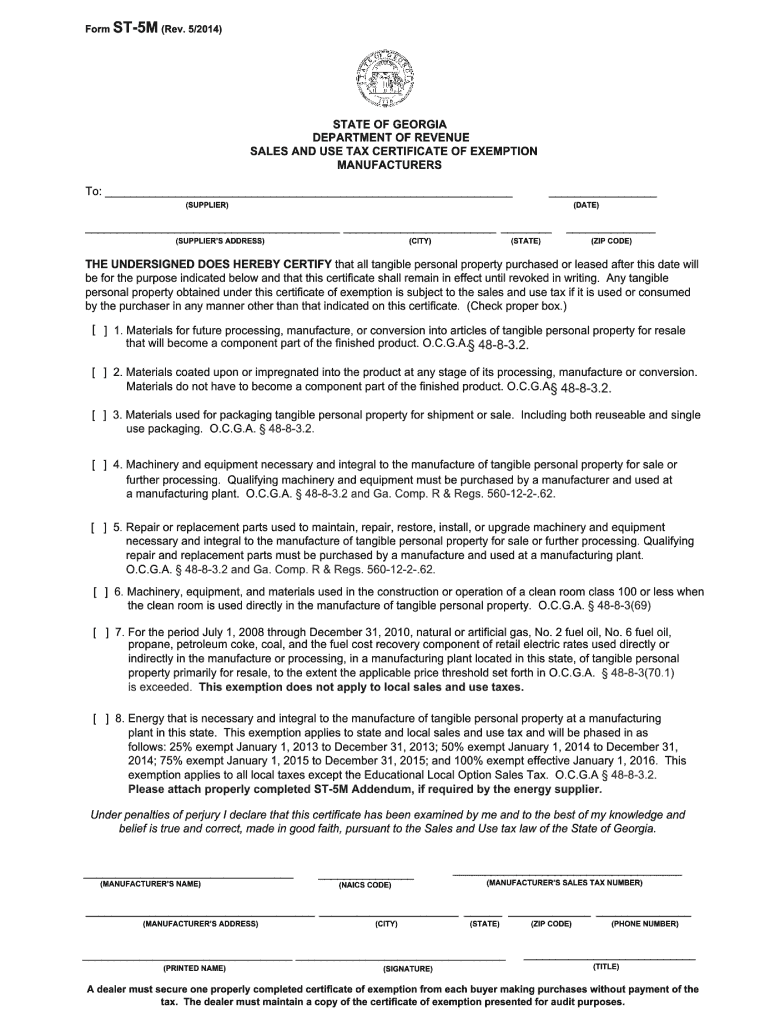

2016 2020 Form Ga Dor St 5 Fill Online Printable Fillable Blank Pdffiller

georgia-form-st-5.pdffiller.com

Georgia Fund For Children And Elderly Division Of Aging Services Georgia Department Of Human Services

aging.georgia.gov