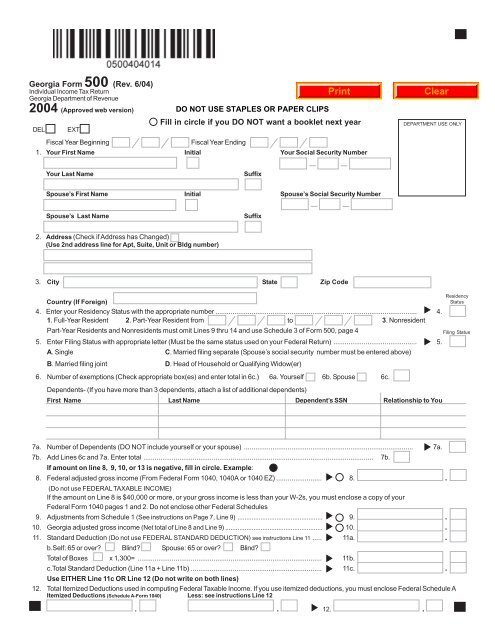

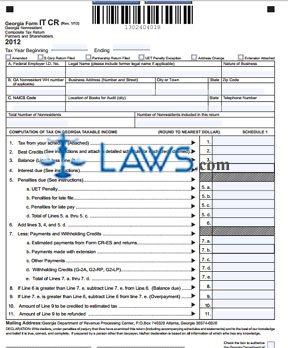

Georgia State Income Tax Return Status

However the brackets top income level is 7000 for single filers which means the majority of taxpayers in georgia pay the top rate.

Georgia state income tax return status. Waiting for your state tax refund. While georgia state tax rates are progressive they increase at a modest rate. Locating your georgia state refund.

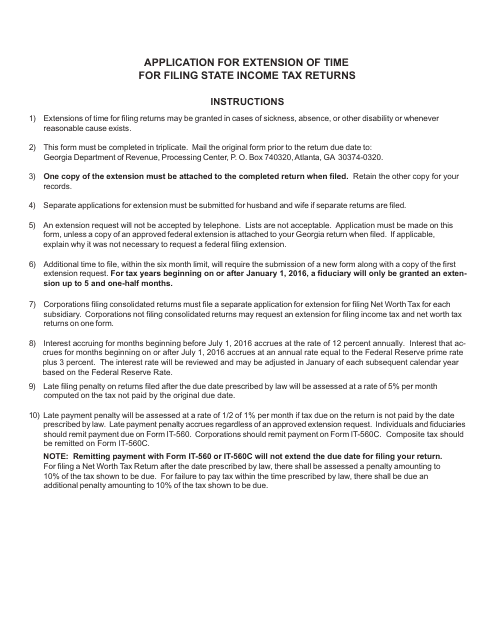

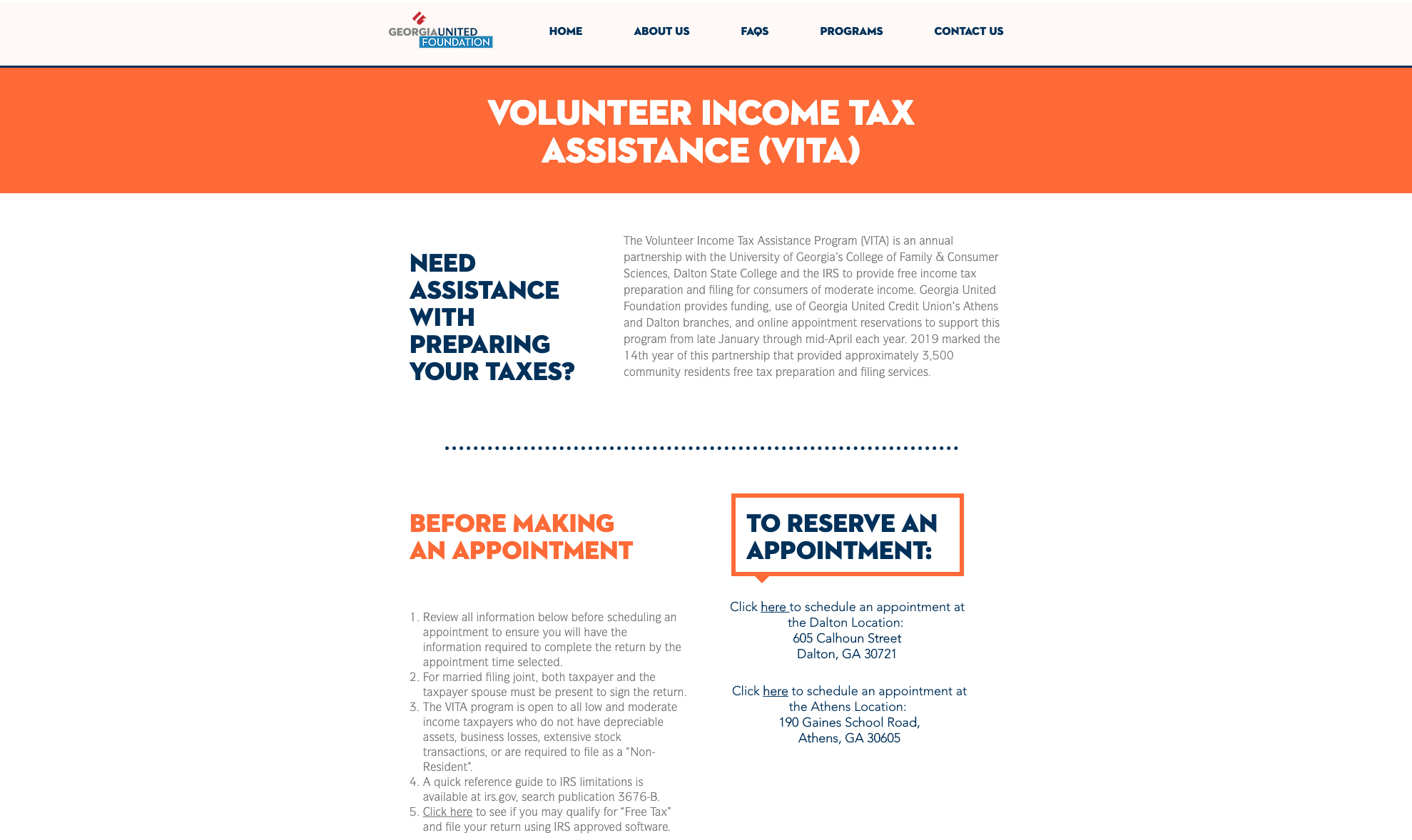

Please allow 90 business days to process a return and issue a refund. Before you check your state income tax refund please make sure your state tax return has been accepted. The department of revenue is protecting georgia taxpayers from tax fraud.

Georgia department of revenue issues most refunds within 21 business days. Just fill in your social security number or individual taxpayer identification number expected refund amount and the filing tax year and you can get instant information about your refund. Go to the wheres my refund page on the departments website.

It may take up to 90 days from the date of receipt by dor to process a return and issue a refund. On the first page you will see if your state income tax return got accepted by the state tax agency or department or not. Click the check the status of your refund link.

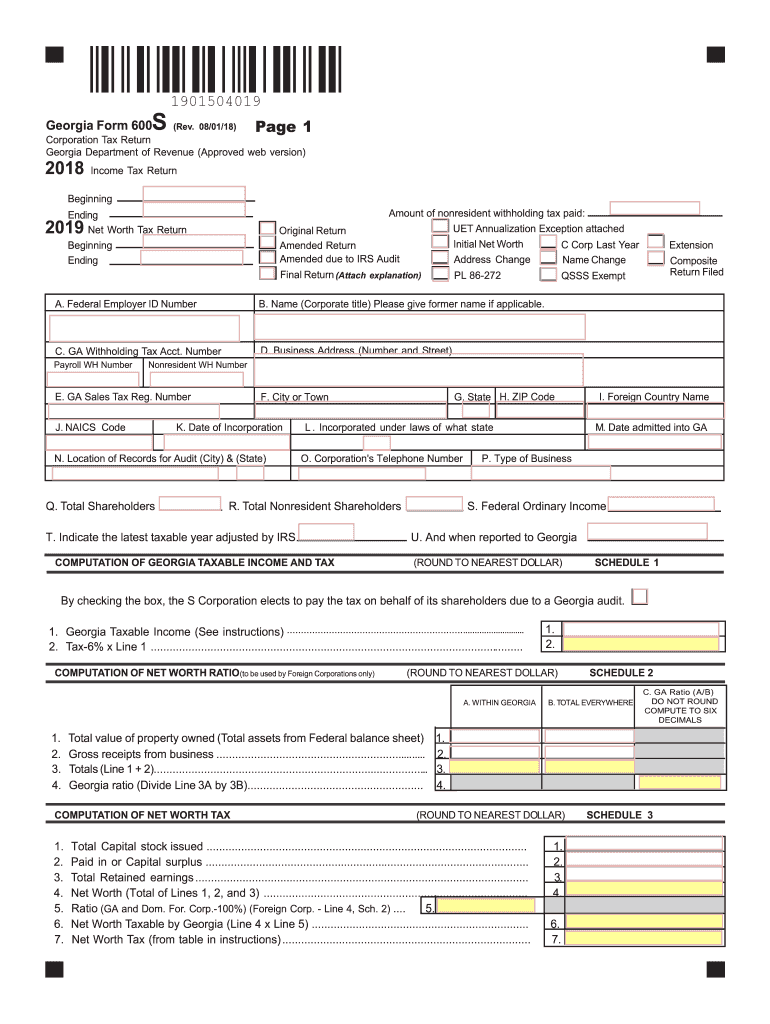

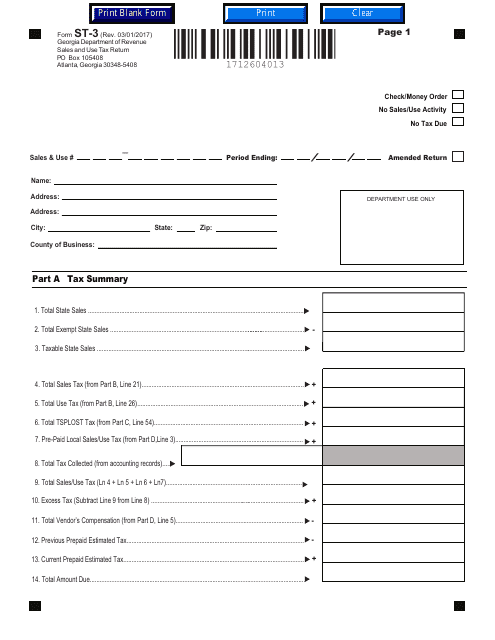

Georgia state tax refund status information. As part of the department of revenue effort to protect georgia taxpayers from tax fraud the following business practices are in effect for 2018. Income tax return processing will begin february 1 2018.

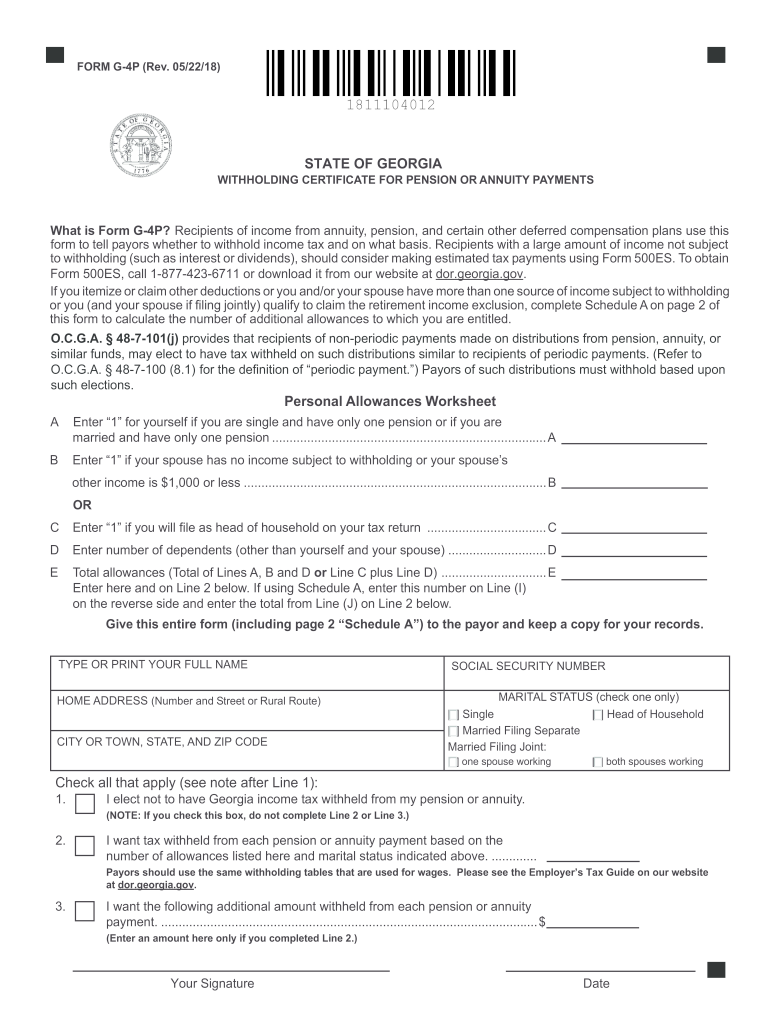

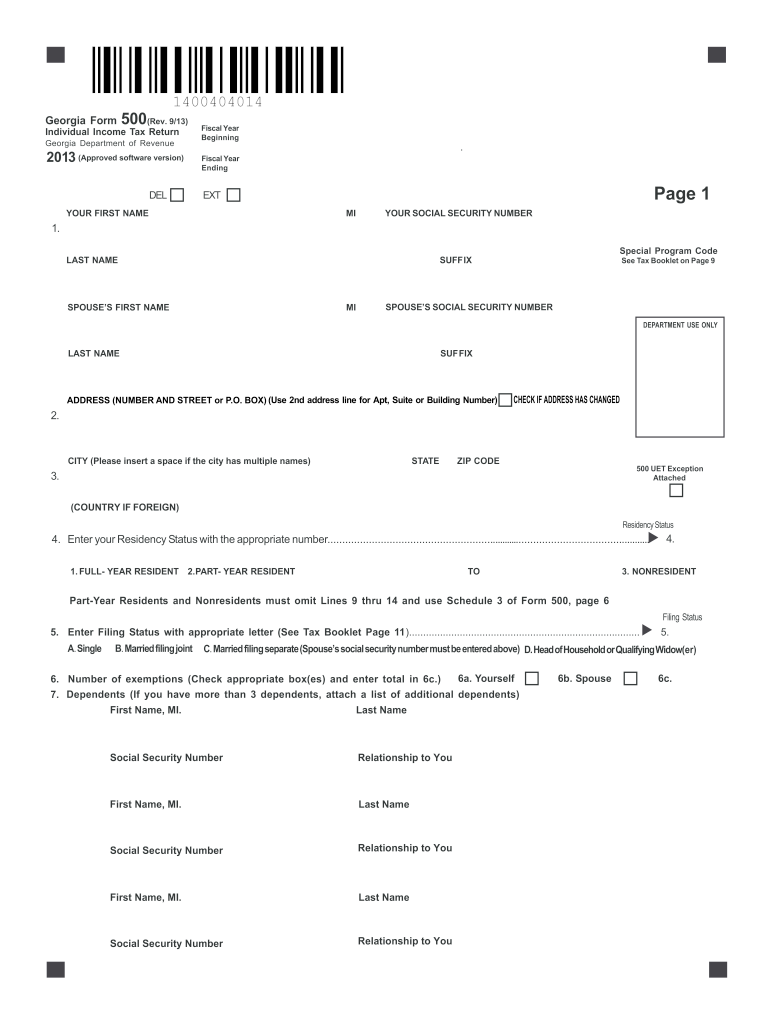

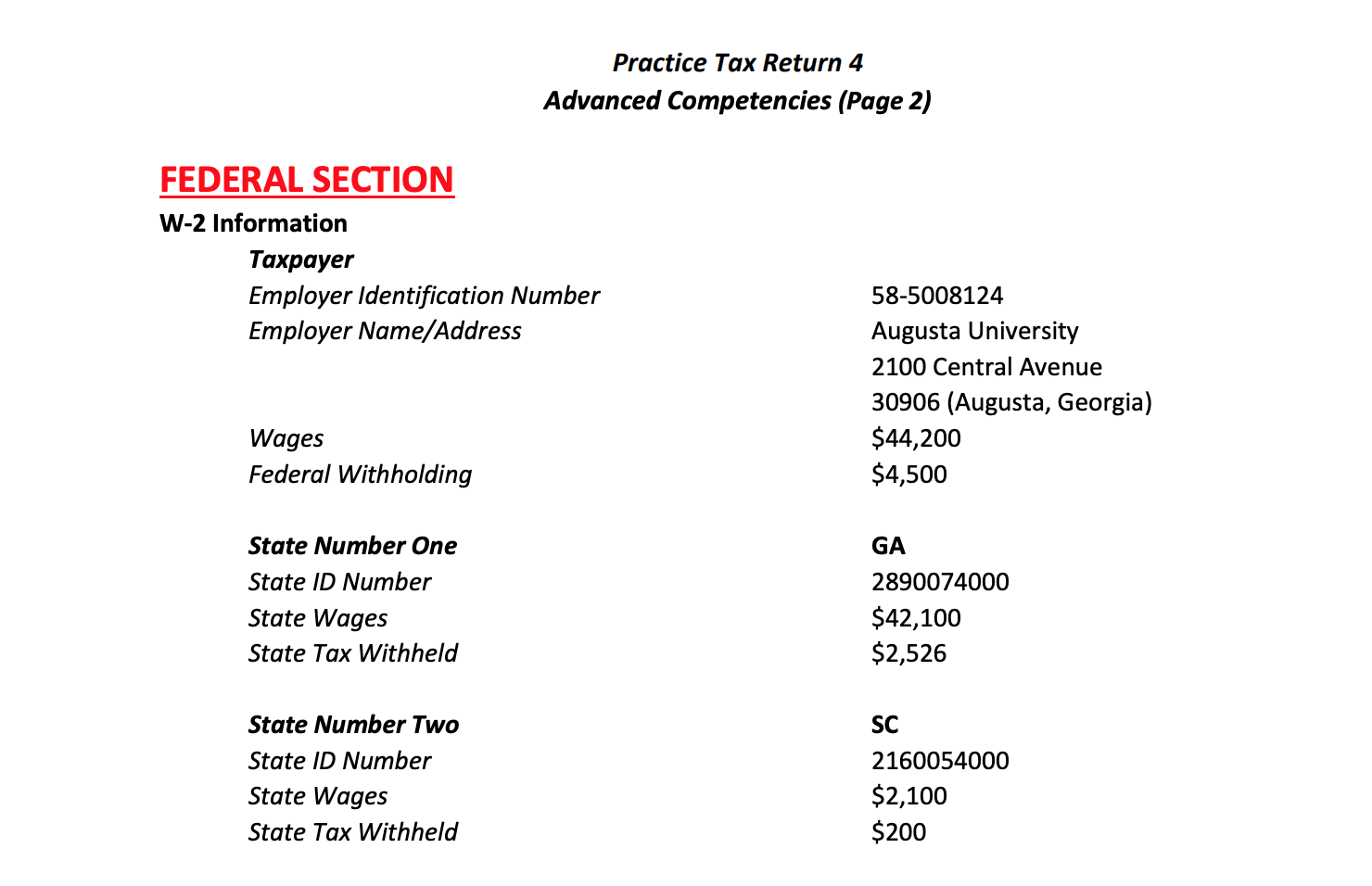

See the latest tax info in our 2017 update. When filing use the same filing status and due date that was used on the federal income tax return. The information updated daily.

Completed form ga 5347 deceased taxpayer refund check claim. Track the status of your refund by using the georgia tax centers wheres my refund tool. You can check on the status of your current years tax refund via the georgia department of revenues website 24 hours a day seven days a week.

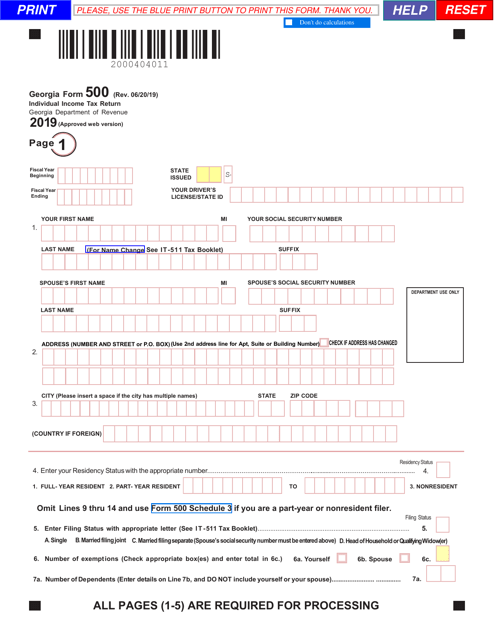

We will begin accepting returns january 27 2020.

%201.jpg)

.jpg)