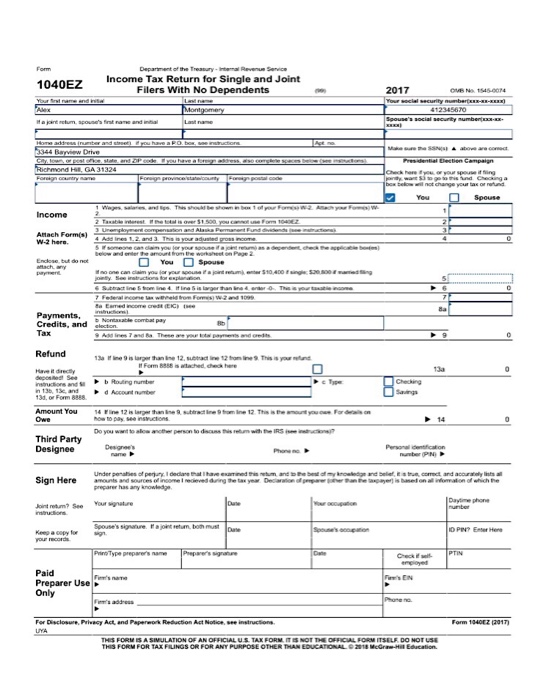

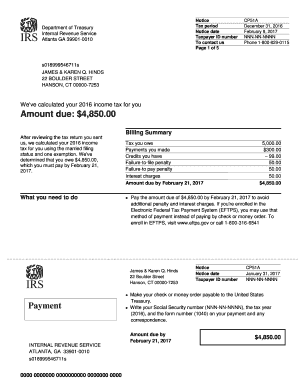

Georgia State Income Tax Return 2017

Before sharing sensitive or personal information make sure youre on an official state website.

Georgia state income tax return 2017. Please complete your federal return before starting your georgia return. Department of revenue department of revenue. Find your state tax refund status state tax department and tax agency.

500 individual income tax return 500 individual income tax return. This years individual income tax forms. Filing requirements for full and part year residents and military personnel.

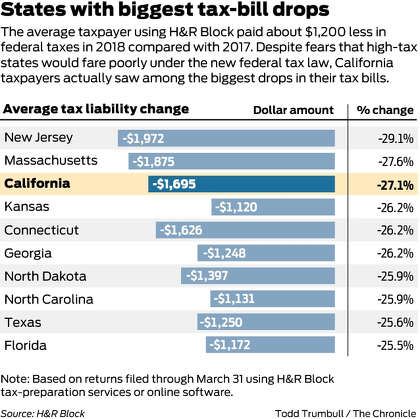

Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate. We will begin accepting returns january 27 2020. Its easy to check the status of your state tax refund using the online refund status tools on each states web site.

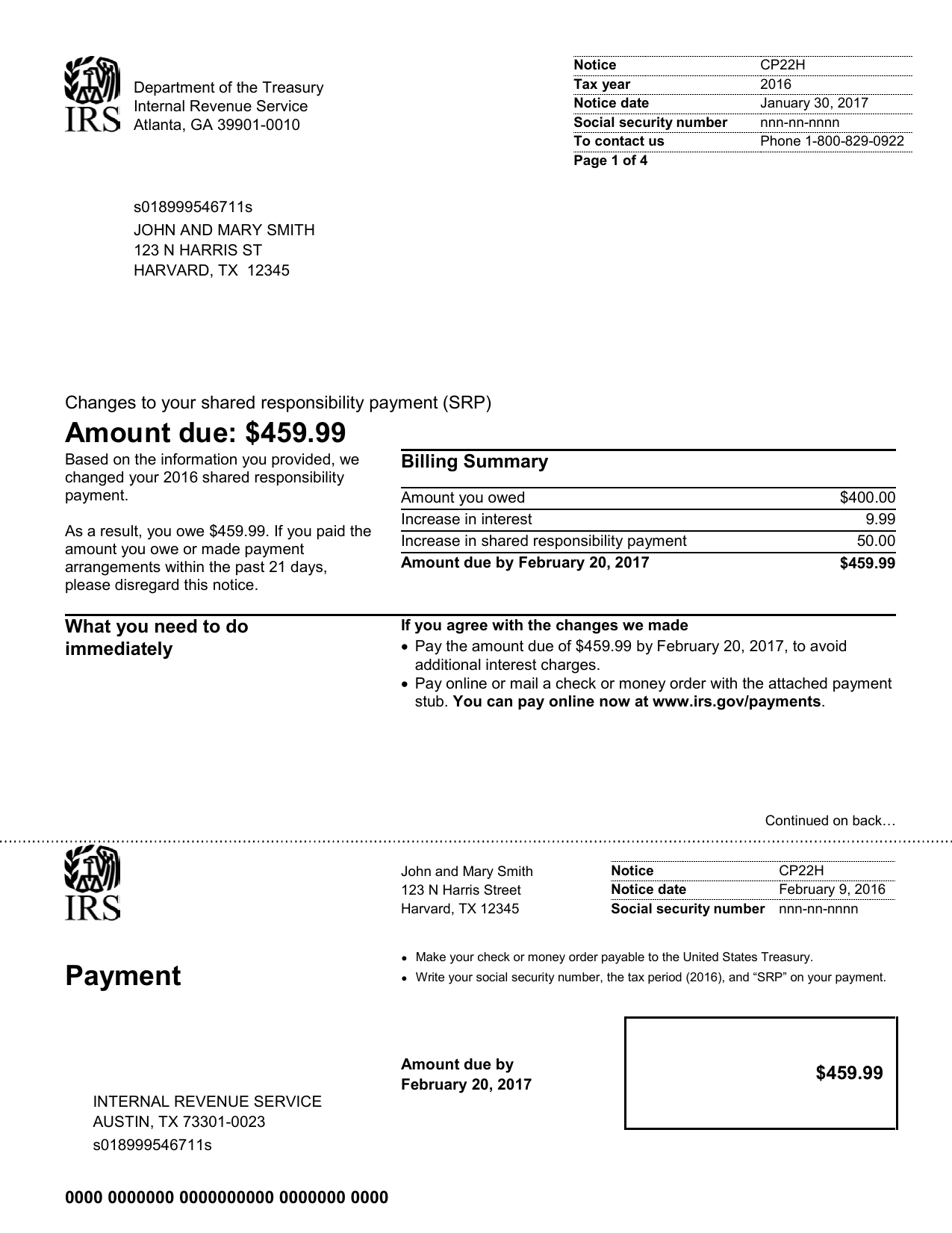

It may take up to 90 days from the date of receipt by dor to process a return and issue a refund. What else can i do. Search for income tax statutes by keyword in the official code of georgia.

Local state and federal government websites often end in gov. Your federal return contains information necessary for completing your georgia return. Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575.

State of georgia government websites and email systems use georgiagov or gagov at the end of the address. For amended fiduciary income tax returns. Popular online tax services.

Call 1 800 georgia to verify that a website is an official website of the state of georgia. When filing use the same filing status and due date that was used on the federal income tax return. Local state and federal government websites often end in gov.

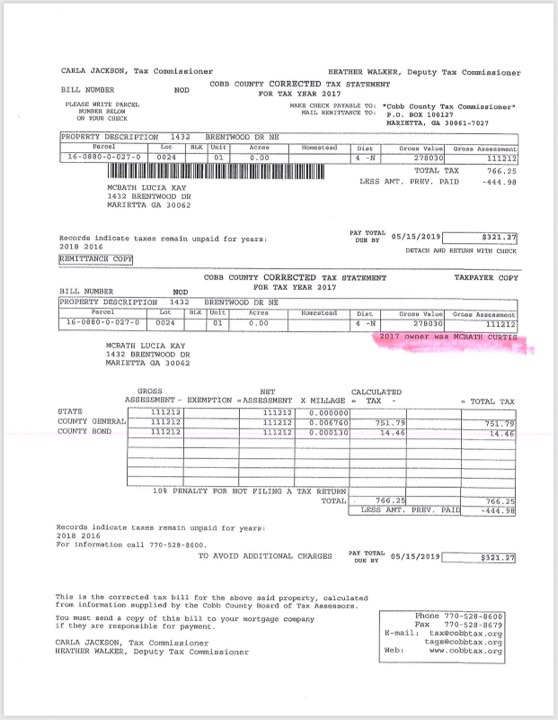

Tax refund processing times vary and depend on the accuracy of the original return but youll get your refund more quickly if you file your return electronically. 2017 500 individual income tax return 168 mb 2016 500 individual income tax return. You can check the status of your tax refund using the georgia tax center.

Department of revenue department of revenue. The georgia individual income tax is based on the taxpayers federal adjusted gross income adjustments that are required by georgia law and the taxpayers filing requirements. An income tax return refund is the result of too much tax withholding estimated tax payments by a taxpayer throughout a tax year.

Find your state and click on the link to go directly to your states refund status tool. Filing state taxes the basics. All first time georgia income tax filers or taxpayers who have not filed in georgia for at least five years will receive a paper check.

Fiduciary income tax 2020 2019 2018. To have a refund check in the name of the deceased. Call 1 800 georgia to verify that a website is an official website of the state of georgia.

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)