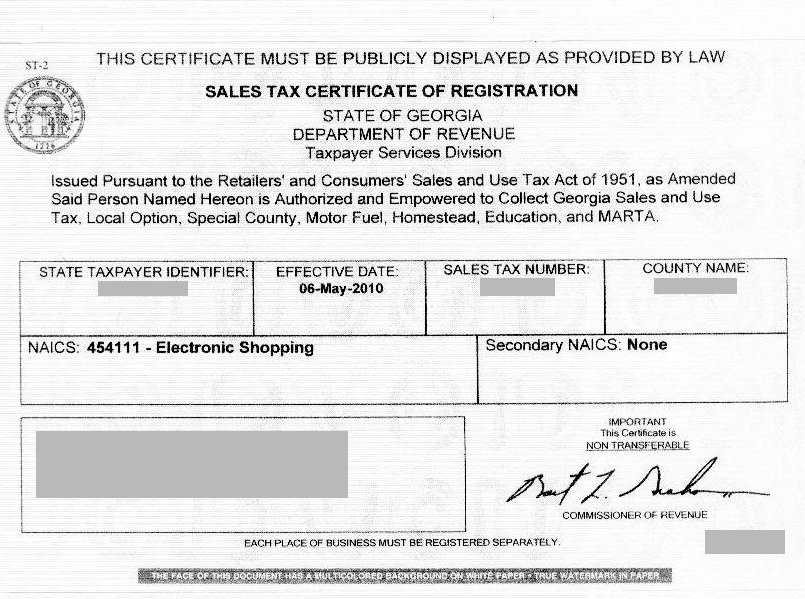

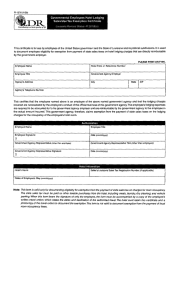

Georgia Sales Tax Certificate Verification

Because georgia is a member of this agreement buyers can use the multistate tax commission mtc uniform sales tax certificate when making qualifying sales tax exempt purchases from vendors in georgia.

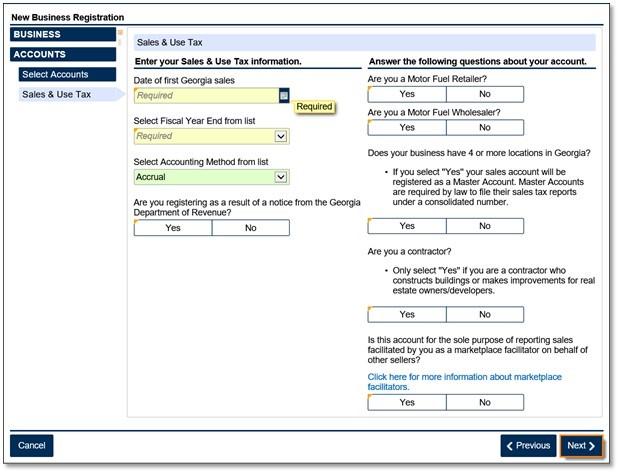

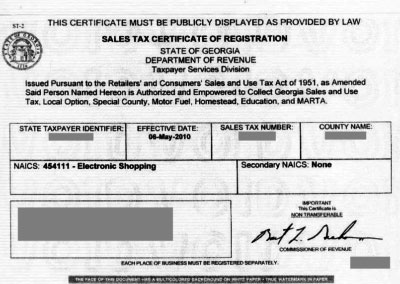

Georgia sales tax certificate verification. 3 oversee property tax administration involving 109. Will no longer use color bonded certificate paper with a watermark will now use plain white stock paper are available for viewing and printing through the georgia tax center after login. Sales and use tax.

Need to establish a login. In general a seller should only accept a certificate of exemption when the certificate is. Sales use taxes fees excise taxes save citizenship verification local government central assessment digest compliance.

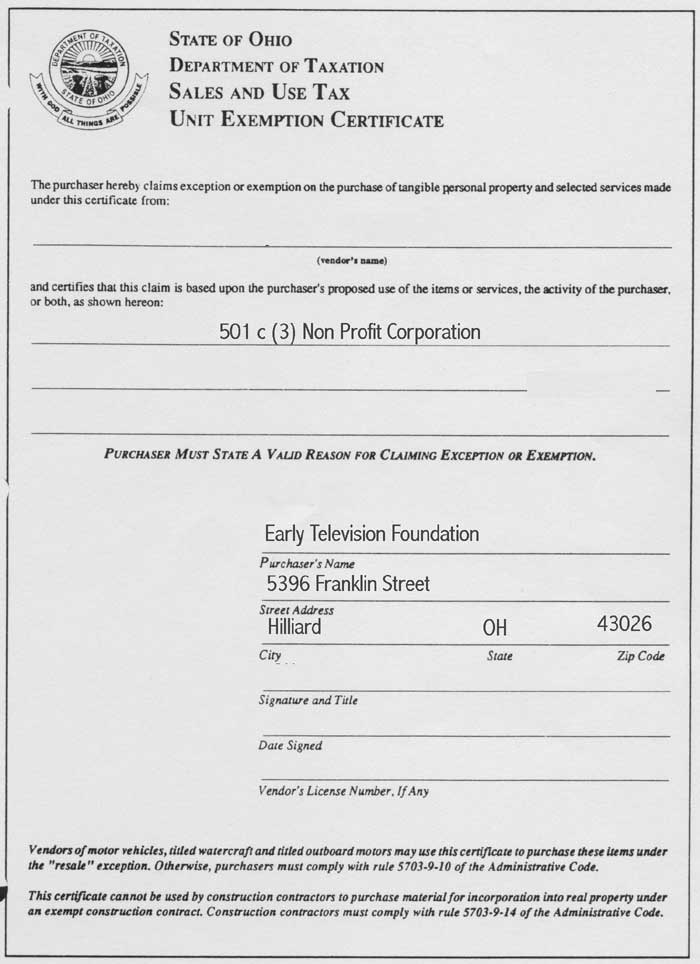

Georgia tax center help individual income taxes register new business. California click verify a permit license or account now read here for more on california resale certificates. Arkansas click inquiries validate sales tax permit.

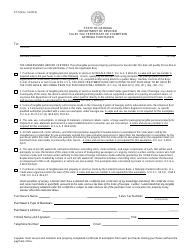

Florida department of revenue the florida department of revenue has three primary lines of business. All sales are subject to sales tax until the contrary is established. Any individual or entity meeting the definition of a dealer in ocga.

48 8 2 must register for a sales and use tax number and certificate of registration regardless of whether all sales will be online out of state wholesale or exempt from tax. St 5 sales tax certificate of exemption 18086 kb department of revenue. Georgia is a member of the streamlined sales and use tax agreement an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states.

Cross a community service board located in this state georgia department of community affairs regional commissions or specific qualified authorities provided with a sales tax exemption under georgia law. Will arrive via mail unless you opt in for electronic correspondence. A sales and use tax number is not required for this exemption.

Use either the resellers permit id number or streamlined sales tax number. 2 enforce child support law on behalf of about 1025000 children with 126 billion collected in fy 0607. 1 administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

Sales use tax import return filing and remittance requirements this is a link to rule 560 12 1 22 on the georgia secretary of states website sales tax id verification tool. Any individual or entity meeting the definition of dealer in ocga. 48 8 2 is required to register for a sales and use tax number regardless of whether all sales will be online out of state wholesale or exempt from tax.

Effective march 8th 2018 sales tax certificates.

Http Media Straffordpub Com Products Exemption Certificate Management In Sales Tax Compliance 2011 05 12 Presentation Pdf