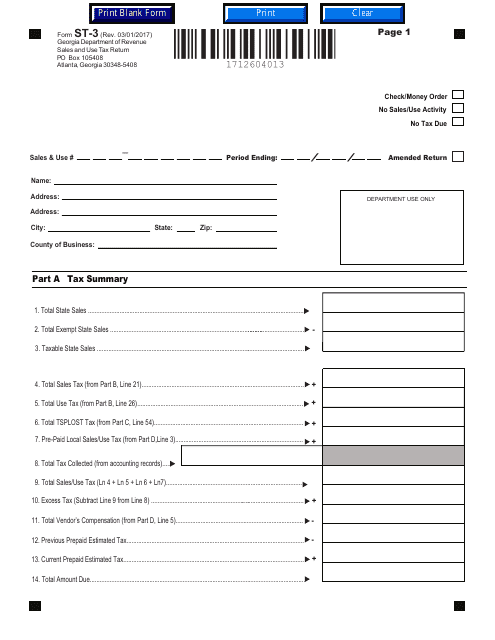

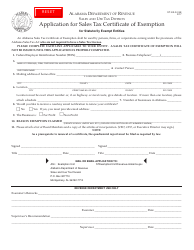

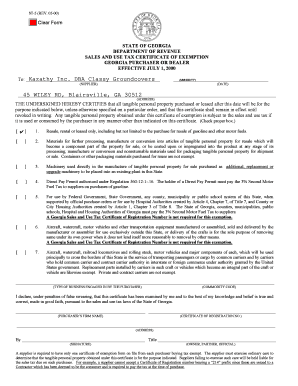

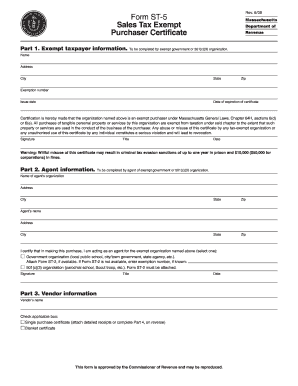

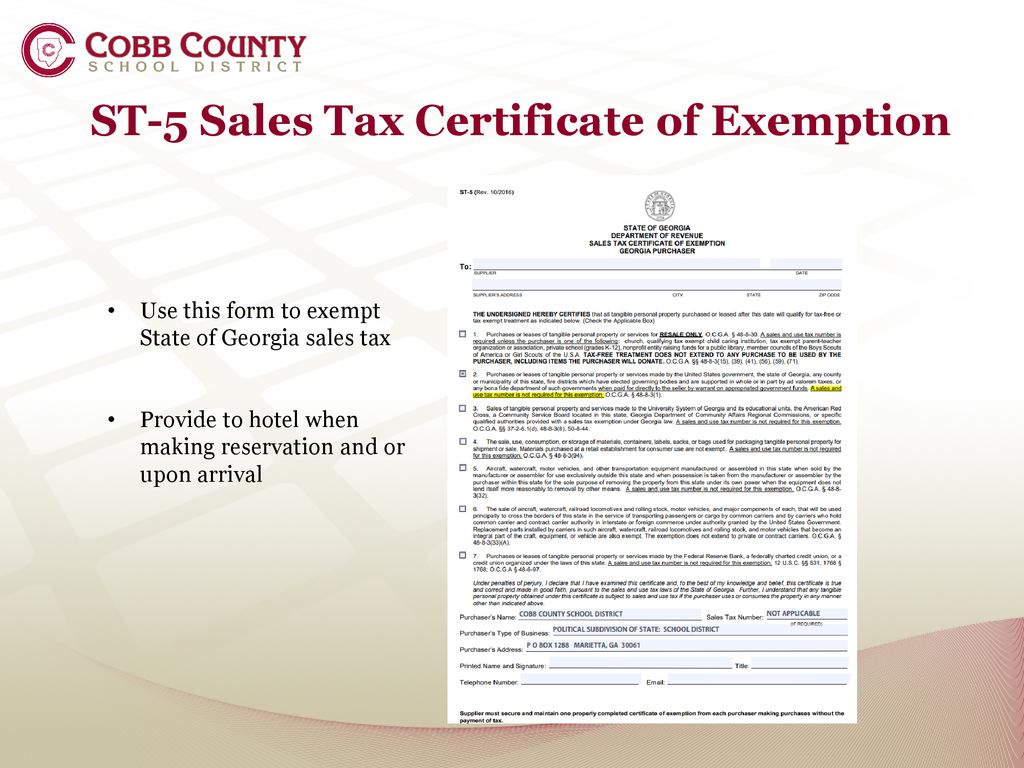

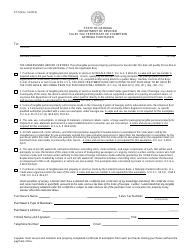

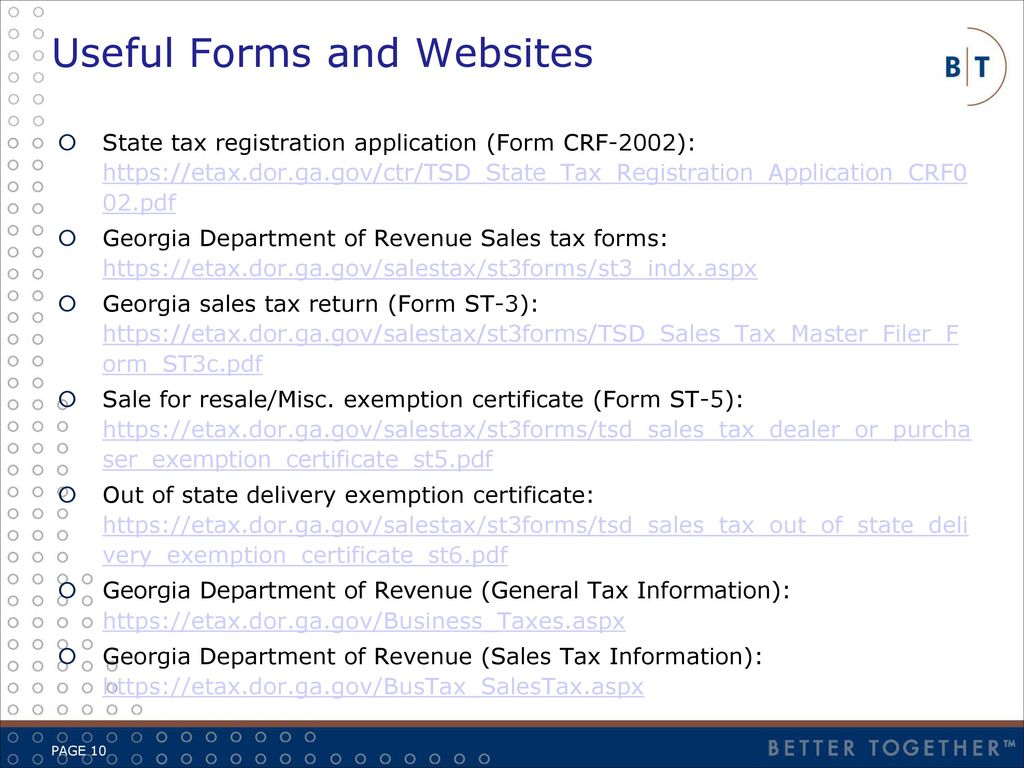

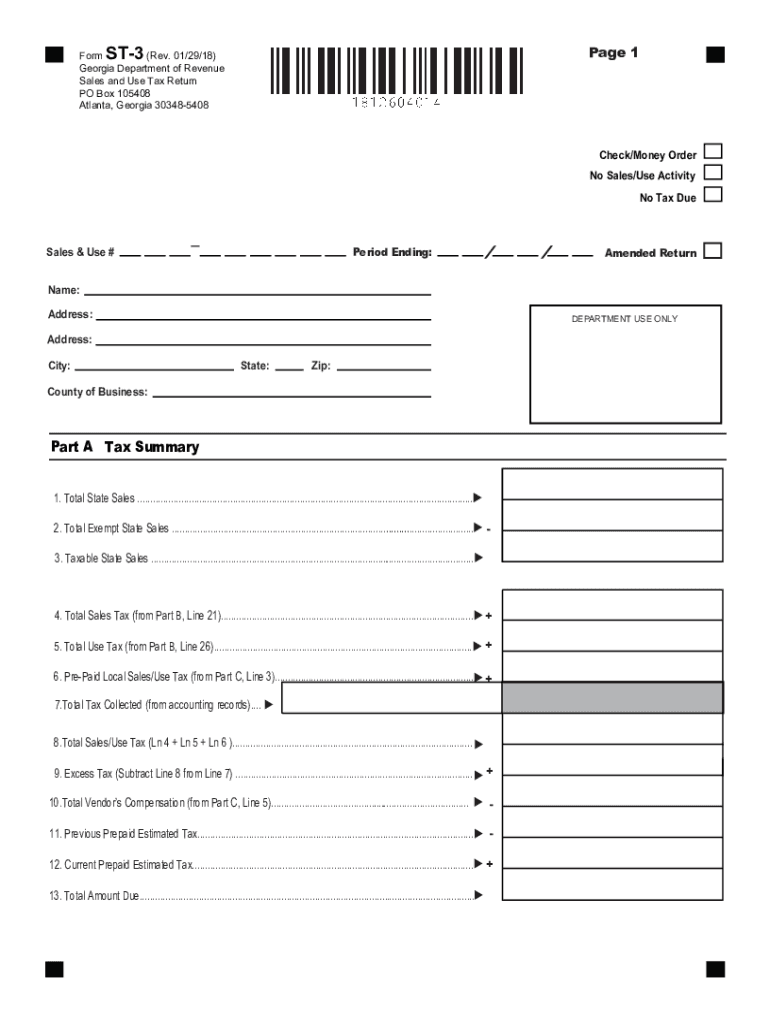

Georgia Sales Tax Certificate Of Exemption Form St 5

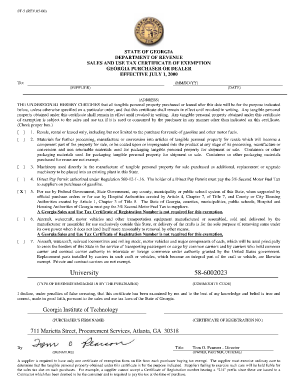

Georgia sales and use tax certificate of exemption st 5 step 6.

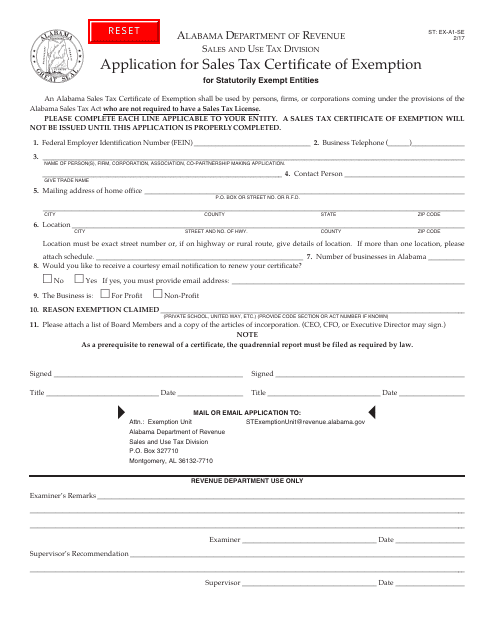

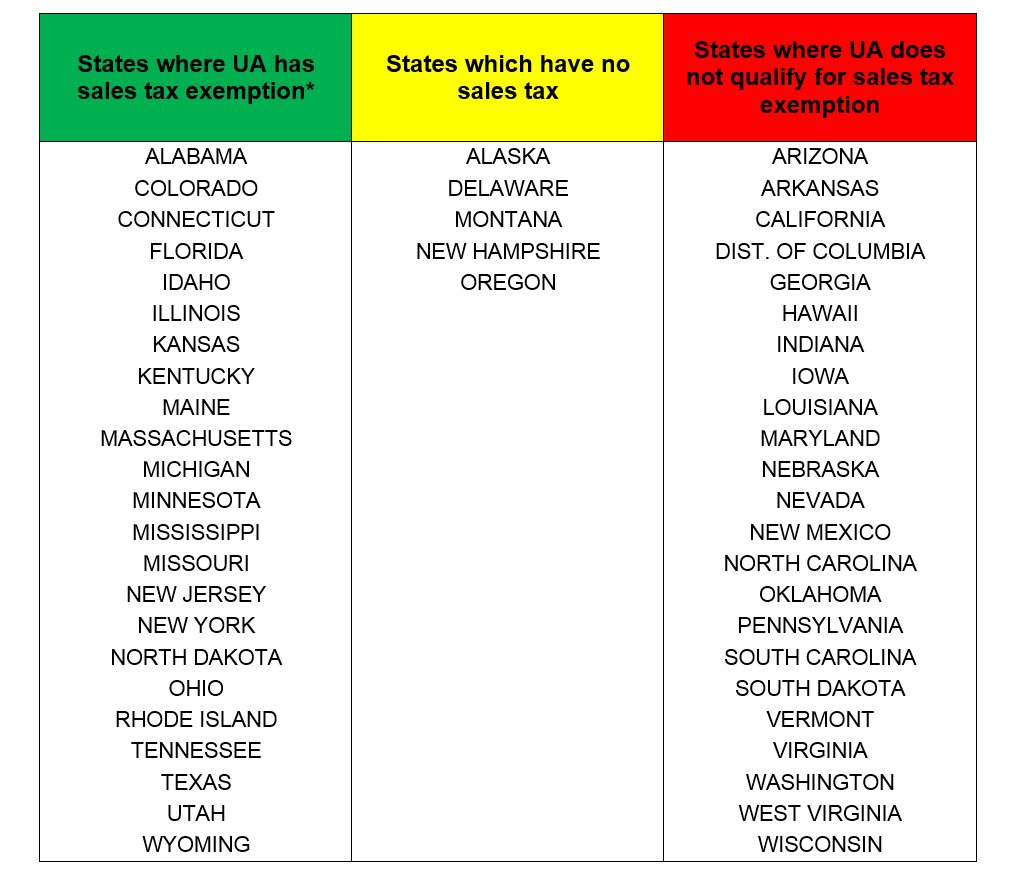

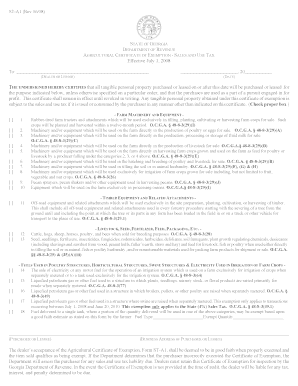

Georgia sales tax certificate of exemption form st 5. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise. Not all states allow all exemptions listed on this form. The fourth statement concerns materials used in packaging and handling property.

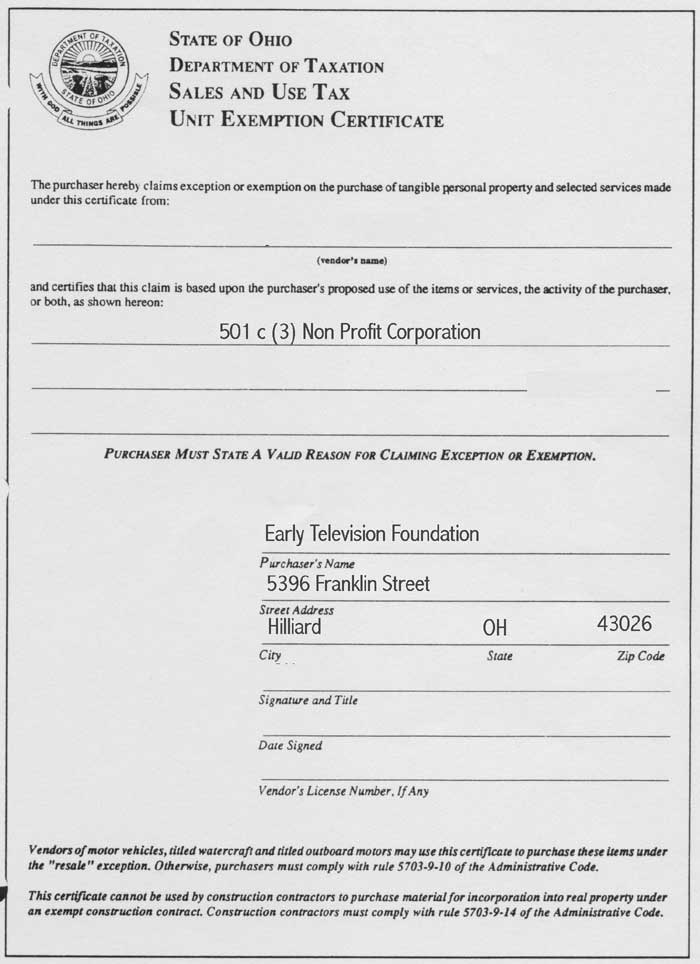

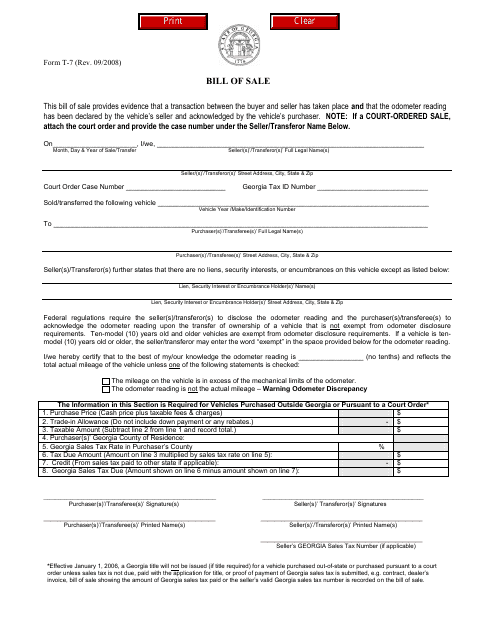

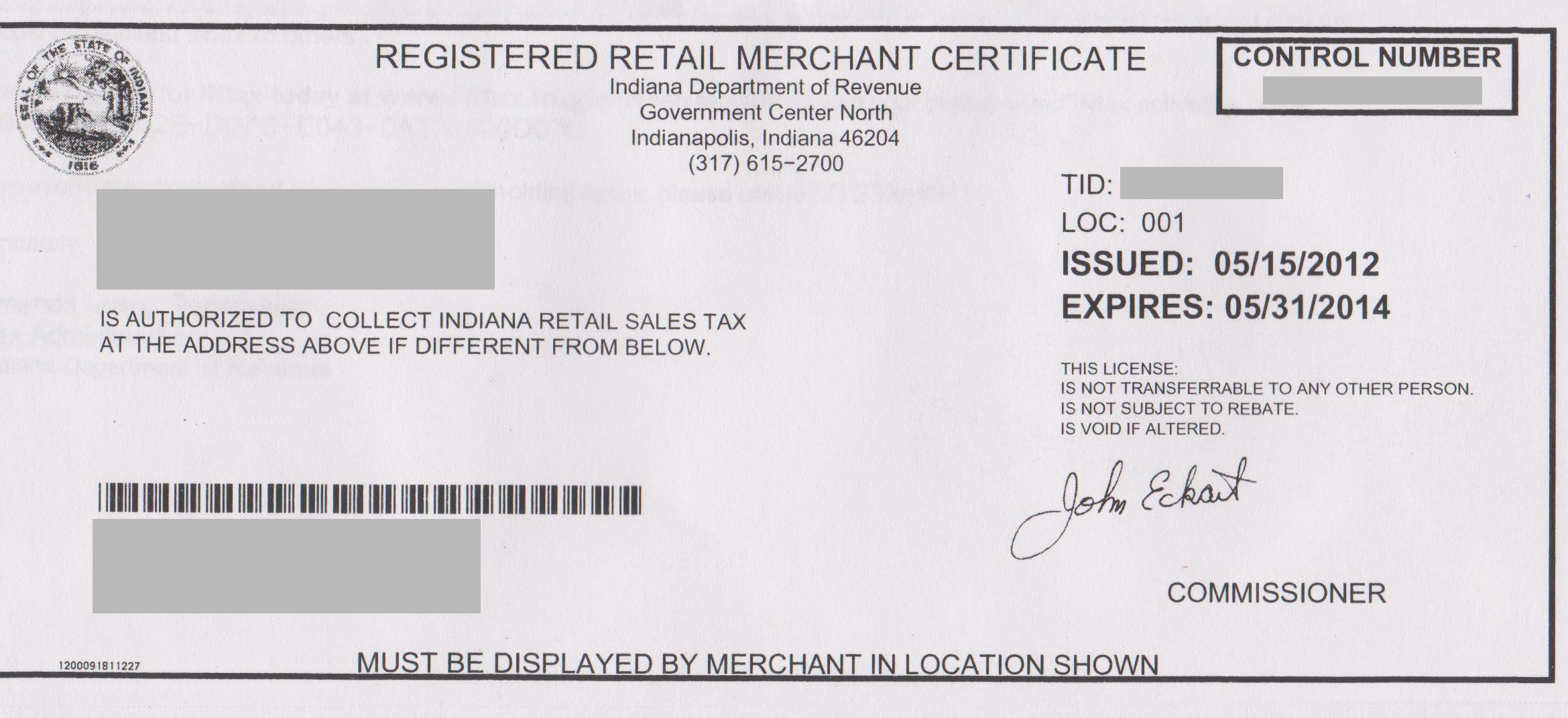

How to fill out the georgia sales tax certificate of exemption form st 5. St 5 sales tax certificate of exemption 18086 kb department of revenue. A sales and use tax number is not required for this exemption.

You will need to present this certificate to the vendor from whom you are making the exempt purchase it is up to the vendor to verify that you are indeed qualified to make a tax. 531 1768 1768. Form state of georgia department of revenue sales and use tax certificate of exemption to.

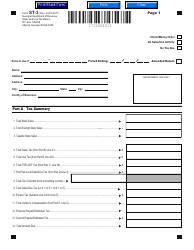

Are casual sales subject to sales tax. Facebook page for georgia department of revenue. 48 8 2 must register for a sales and use tax number and certificate of registration regardless of whether all sales will be online out of state wholesale or exempt from tax.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales tax free purchases. Under penalties of perjury i declare that i have examined this certificate and to the best of my knowledge and belief this certificate is true. Sales and use tax registration does not require renewal and remains in effect as long as the.

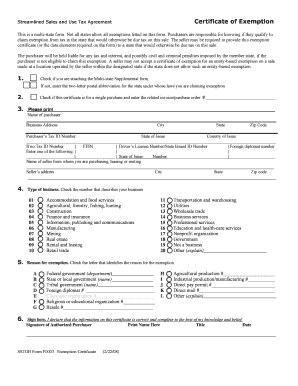

The third statement concerns purchases for resale by a church school or other qualifying nonprofit entity. St 5 sst exemption certificate 062014 georgia department of revenue certificate of exemption georgia streamlined sales and use tax agreement this is a multi state form. How to use sales tax exemption certificates in georgia.

Filling out the st 5 is pretty straightforward but is critical for the seller to gather all the information. Energy that is necessary and integral to the manufacture of tangible personal property at a manufacturing plant in this state. Any individual or entity meeting the definition of dealer in ocga.

Belief is true and correct made in good faith pursuant to the sales and use tax law of the state of georgia. The georgia department of revenue created a sales tax certificate of exemption to make things easier for documenting tax free transactions.