Georgia Sales Tax Certificate Copy

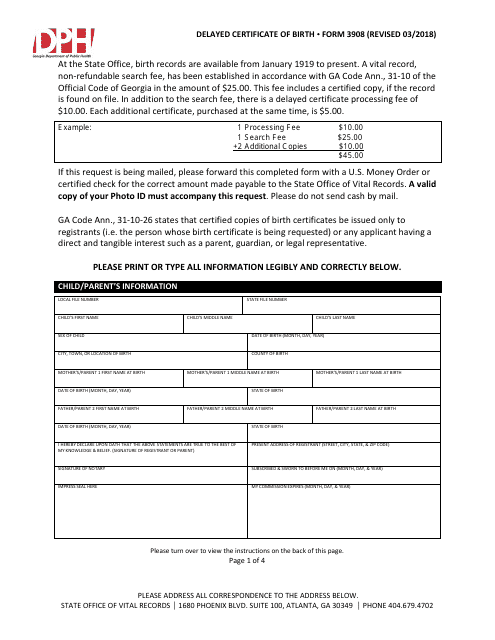

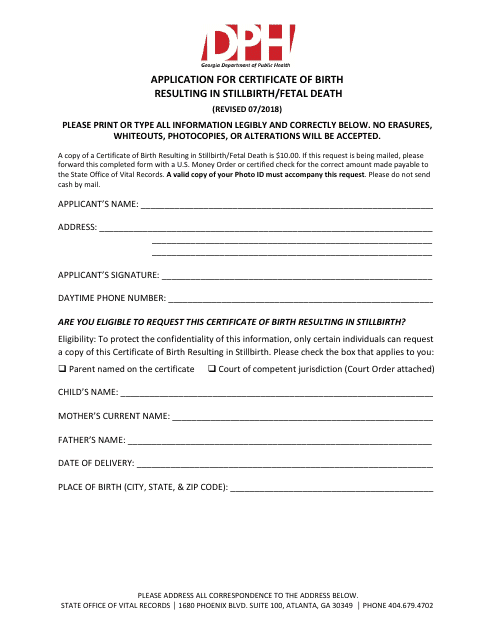

Effective march 8th 2018 sales tax certificates.

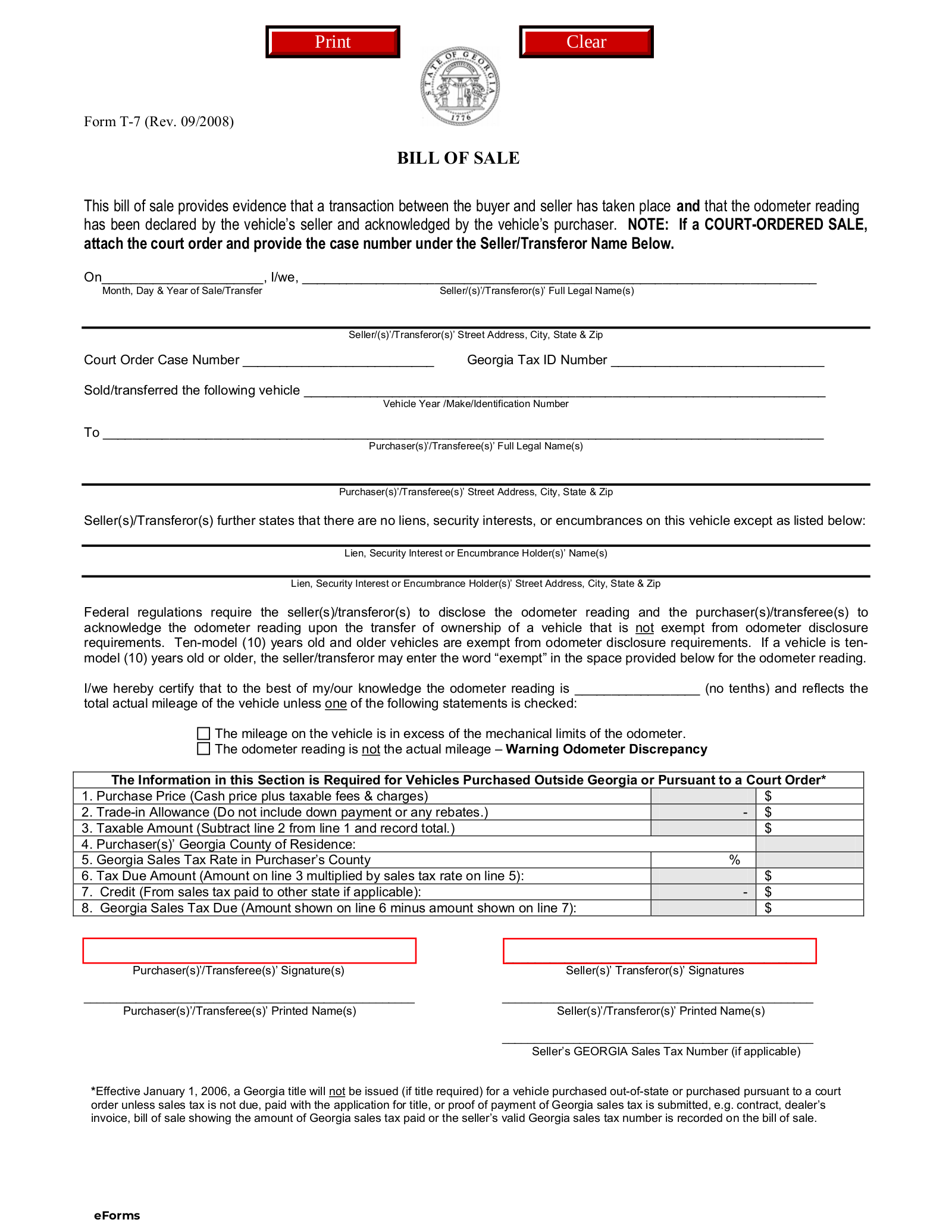

Georgia sales tax certificate copy. Tips for completing the sales and use tax return on gtc. Sales and use tax faq. A dealers certificate of registration must be conspicuously displayed at all times at the place for which the certificate is issued.

Will arrive via mail unless you opt in for electronic correspondence. Wholesale trade shows and merchandise marts require a copy before letting you participate. Sales tax instructional documents.

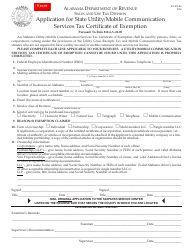

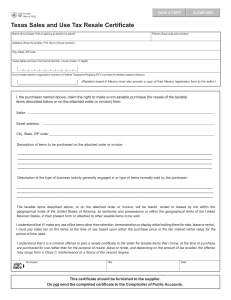

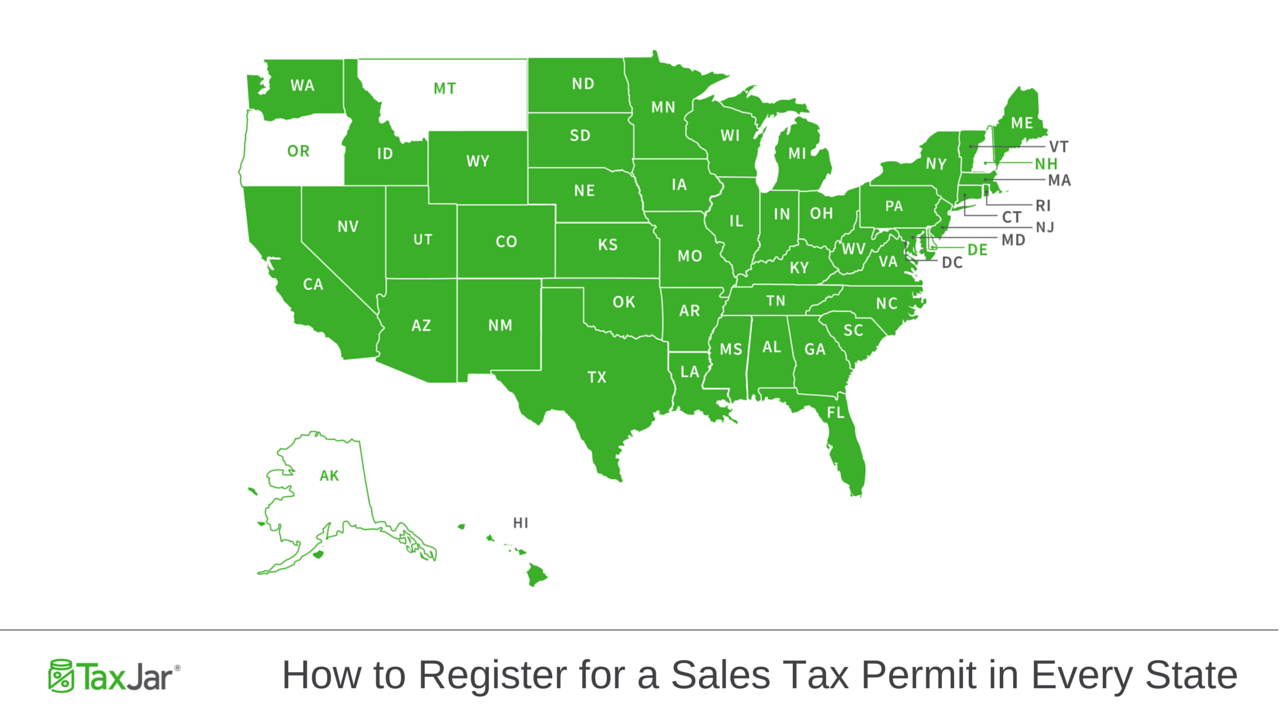

Because georgia is a member of this agreement buyers can use the multistate tax commission mtc uniform sales tax certificate when making qualifying sales tax exempt purchases from vendors in georgia. Also wholesale companies require a georgia state sales tax certificate number to open a commercial account. However information secured by the commissioner as a result of the administration of any tax or charge is confidential and privileged.

St 5 sales tax certificate of exemption 18086 kb department of revenue. Any individual or entity meeting the definition of dealer in ocga. Georgia tax center help individual income taxes register new business.

Will no longer use color bonded certificate paper with a watermark will now use plain white stock paper are available for viewing and printing through the georgia tax center after login. In general a seller should only accept a certificate of exemption when the certificate is. Need to establish a login.

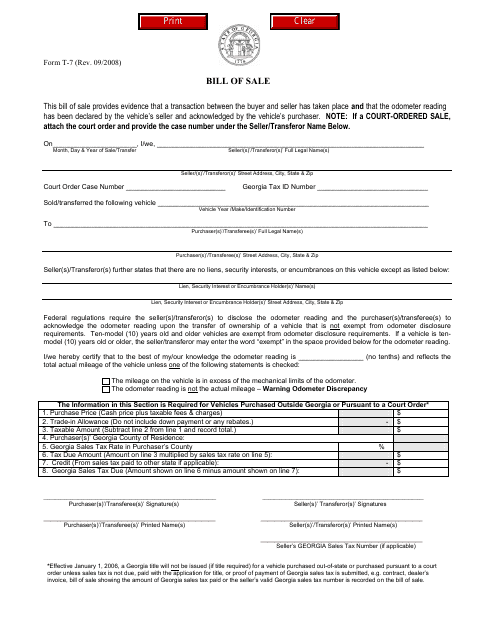

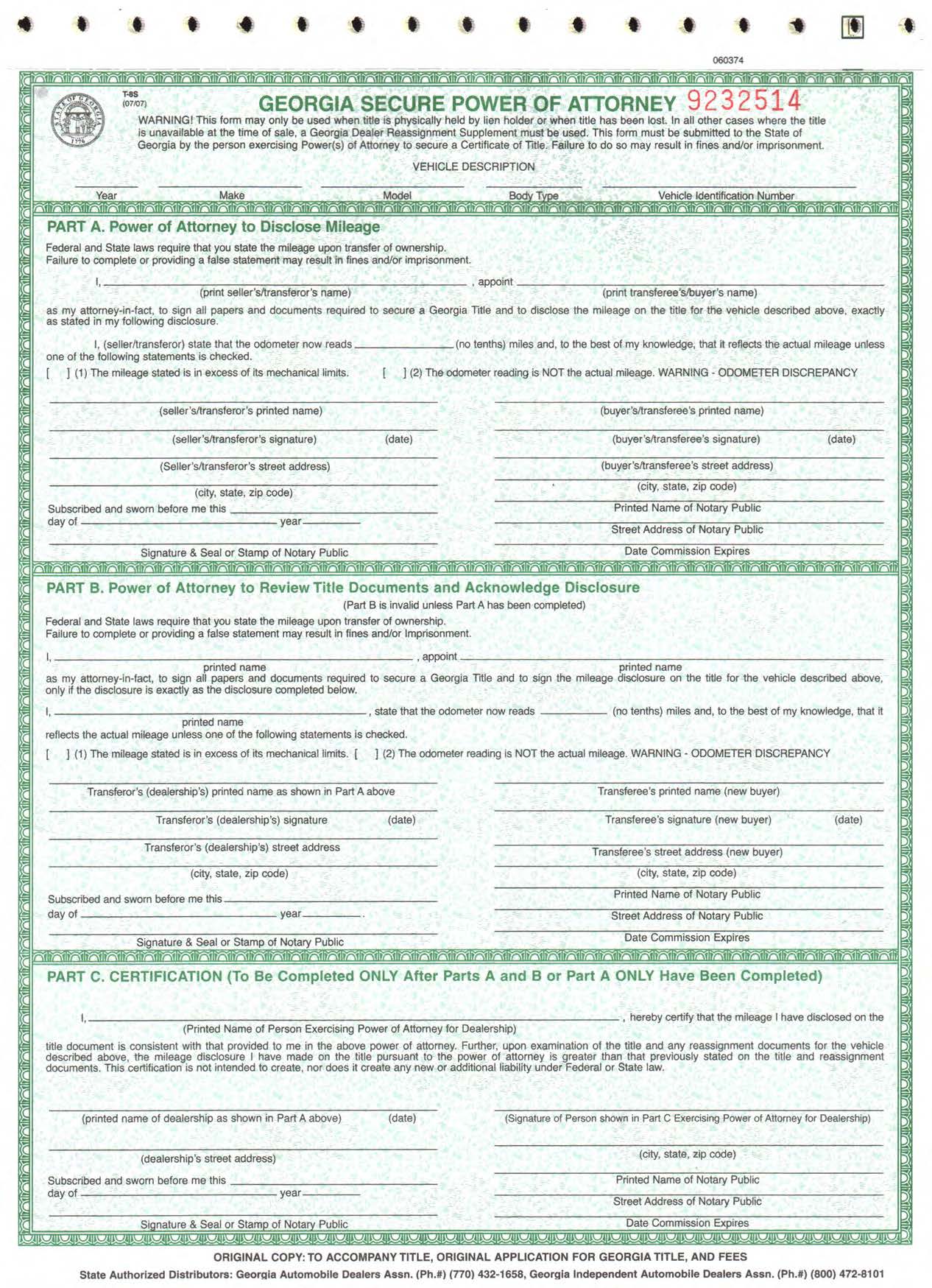

The gov means its official. Sales use tax import return. 48 8 2 must register for a sales and use tax number and certificate of registration regardless of whether all sales will be online out of state wholesale or exempt from tax.

Local state and federal government websites often end in gov. St 5 certificate of exemption. If you have quetions about the online permit application process you can contact the department of revenue via the sales tax permit hotline 877 423 6711 or by checking the permit info website.

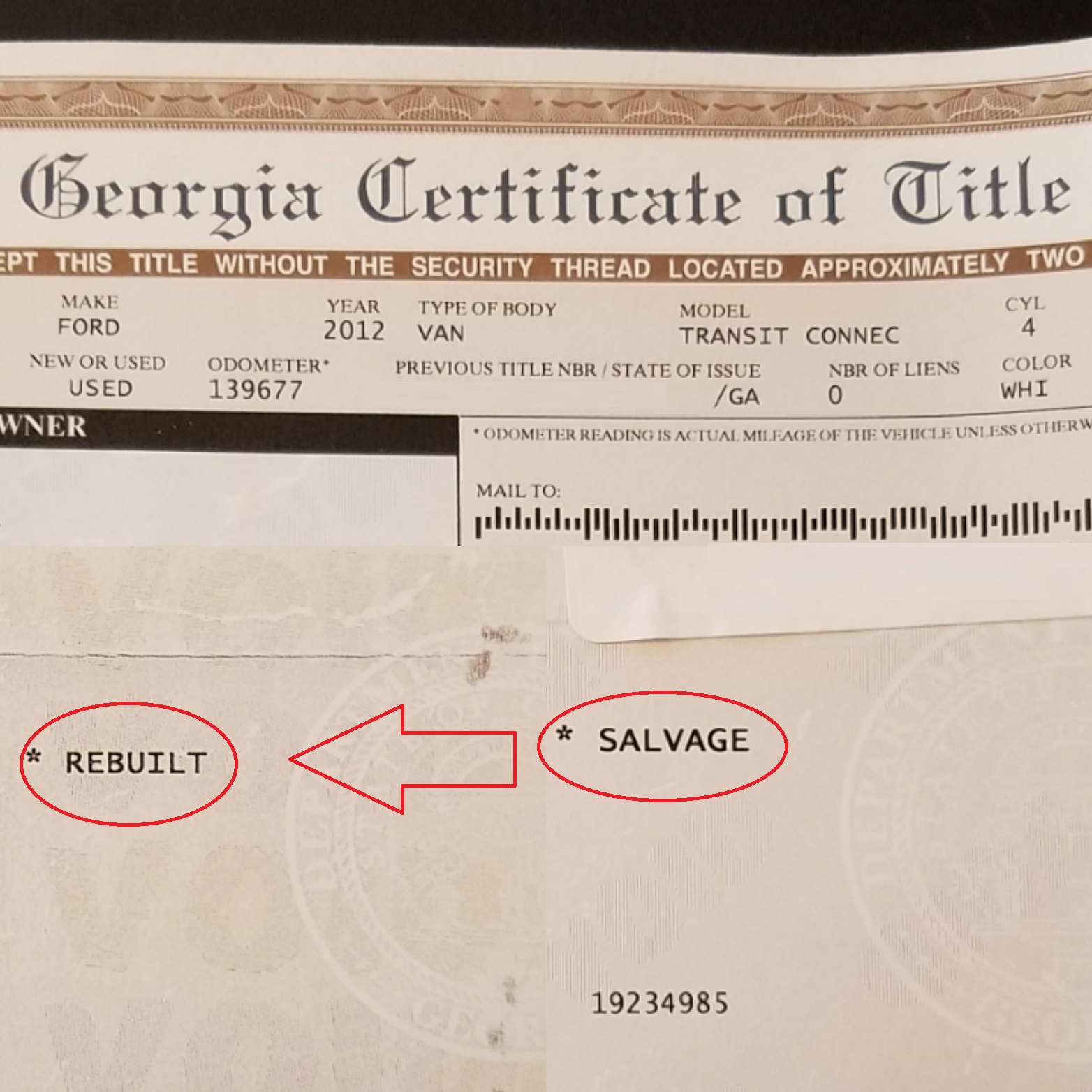

Georgia sales tax resale certificate example. The burden of proof that a sale is not subject to tax is upon the person who makes the sale unless the seller in good faith takes from the purchaser a valid certificate of exemption. Sales and use tax.

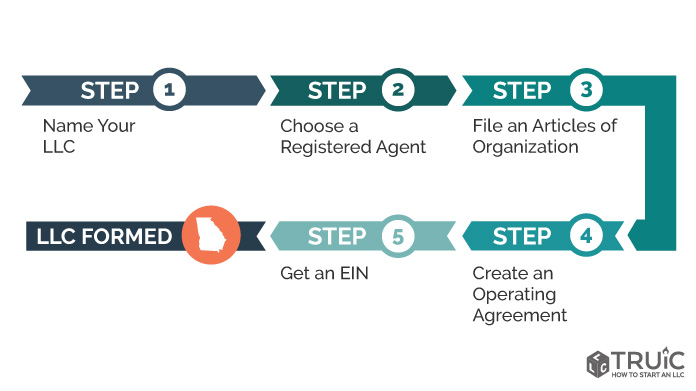

You can easily acquire your georgia sales and use tax certificate of registration online using the georgia tax center website. Calculating tax on motor fuel. Sales use taxes fees excise taxes save citizenship verification local government central assessment.

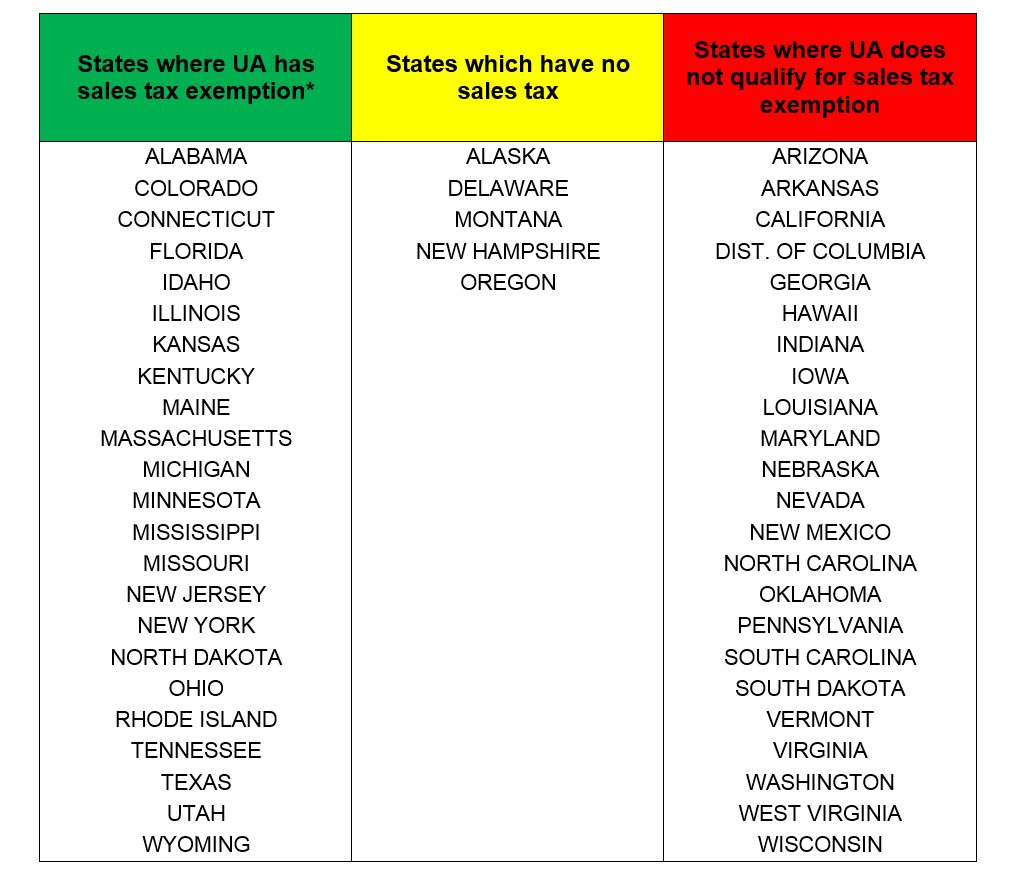

State of georgia government websites and email systems use georgiagov or gagov at the end of the address. Obtain a state sales tax resale certificate number for your business for only 12500.

.png?width=800&name=Sales%20Tax%20Blog%20Images%20(1).png)

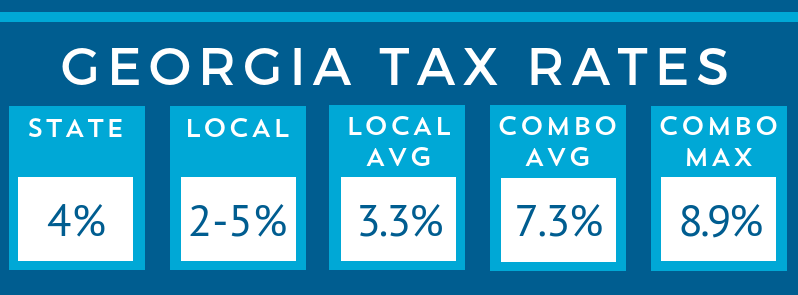

.png?width=800&name=Copy%20of%20Georgia%20Tax%20Rates%20(1).png)

-311932-edited.png?width=800&name=Copy%20of%20Georgia%20Tax%20Rates%20(2)-311932-edited.png)

.png?width=800&name=Sales%20Tax%20Blog%20Images%20(3).png)