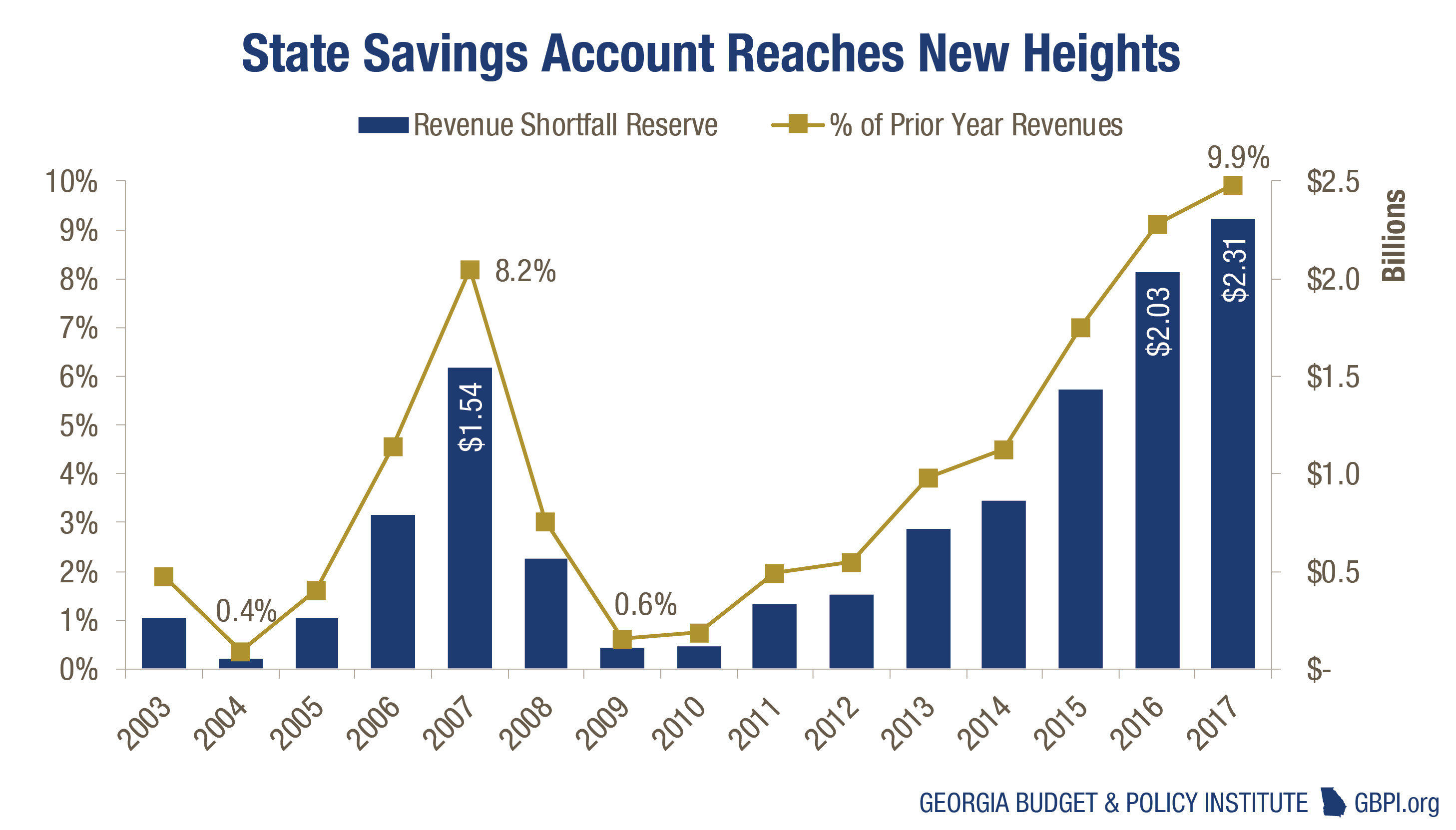

Georgia Revenue Estimate

It may take up to 90 days from the date of receipt by dor to process a return and issue a refund.

Georgia revenue estimate. State of georgia government websites and email systems use georgiagov or gagov at the end of the address. Estimated tax work sheet and tax rates estimated tax work sheet and tax rates. Applying for a business license secretary of state corporations division department of economic development.

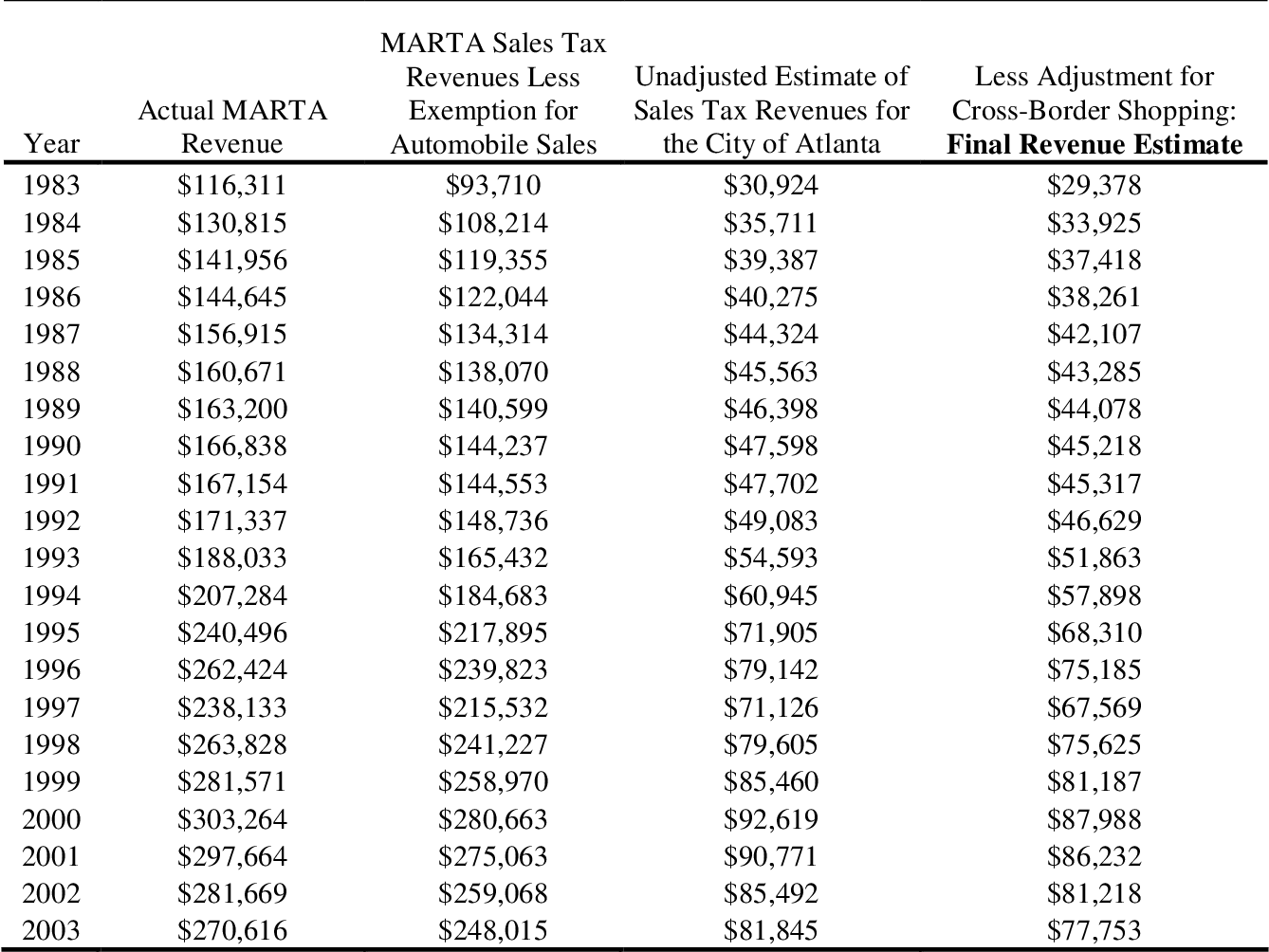

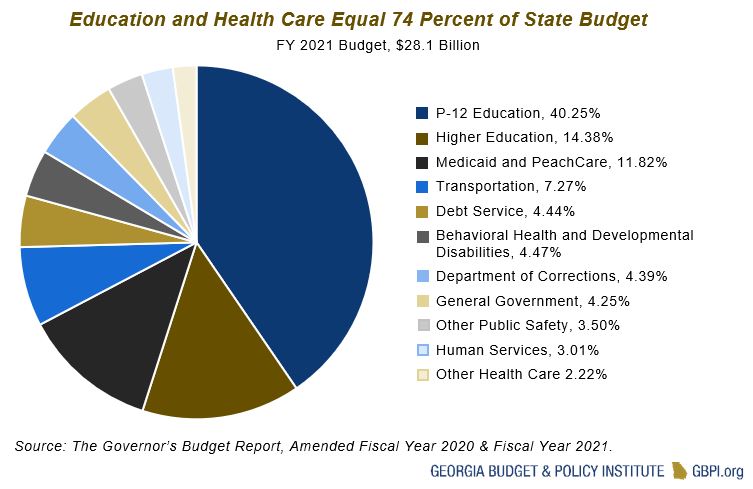

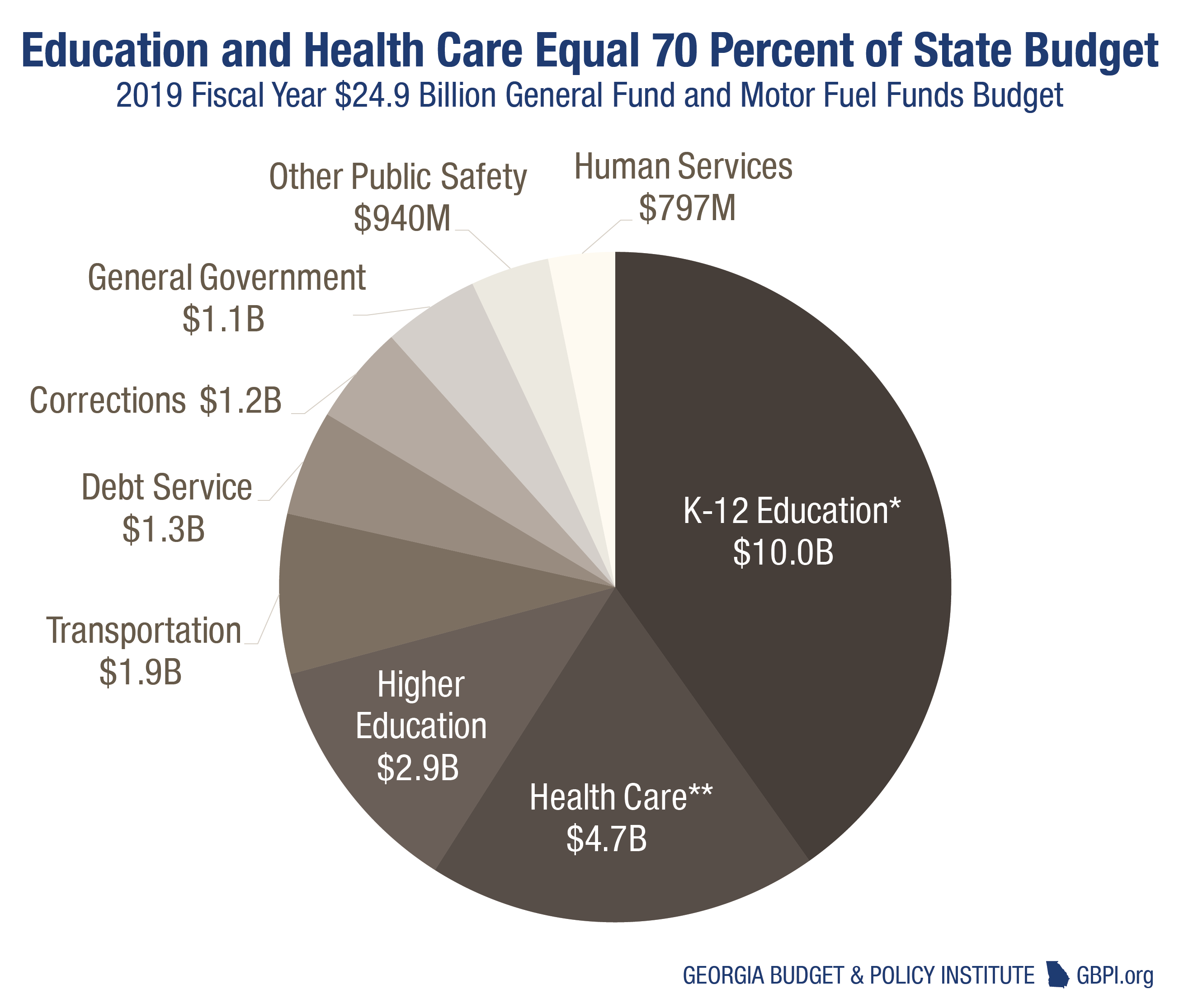

While georgia has one of the lowest statewide sales taxes in the country among states that have a sales tax atlanta has its own city sales tax of 115 and counties can assess their own sales taxes of up to 5. State tax liens estimated tax and assessments only at this time paper forms. Georgia tax center help individual income taxes register new business business taxes refunds information for tax professionals.

Individual go to the georgia tax center under common tasks click on make a quick payment review the request details and click next for customer type select on individual and click next for your id type select the box for social security. We will begin accepting returns january 27 2020. The department of revenue is protecting georgia taxpayers from tax fraud.

Click next complete id information and click next complete the payor information and click next. In georgia taxpayers can claim a standard deduction of 4600 for single filers and 6000 for joint filers. Small business events in your area.

The department of revenue has resumed in person customer service as of monday june 1 2020. Before sharing sensitive or personal information make sure youre on an official state website. 2012 500 es estimated tax for individuals and fiduciaries 52772 kb 2011 500 es estimated tax for individuals and fiduciaries 2153 kb 2010 500 es estimated tax for individuals and fiduciaries 2153 kb.

Additionally taxpayers can still conduct all business with the department via online services telephone or designated secure lockbox locations. This form is the schedule for estimating georgia income taxes. Department of labor unemployment insurance new hire reporting program.

Doing business in the state. This tax is based on the value of the vehicle. Payment with return check or money order form 525 tv extension payments form it 560 estimated tax payment form 500 es application to request a payment plan paper.

The tax must be paid at the time of sale by georgia residents or within six months of establishing residency by those moving to georgia.

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/LKHDC4BBBBE4PGWMZU6RR46NBQ.jpg)