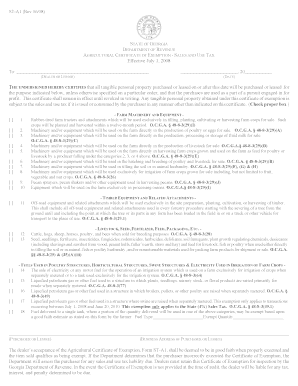

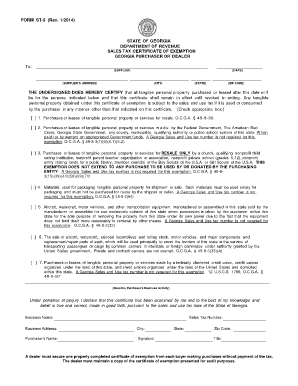

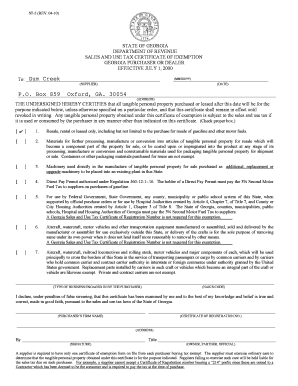

Georgia Resale Certificate St 5

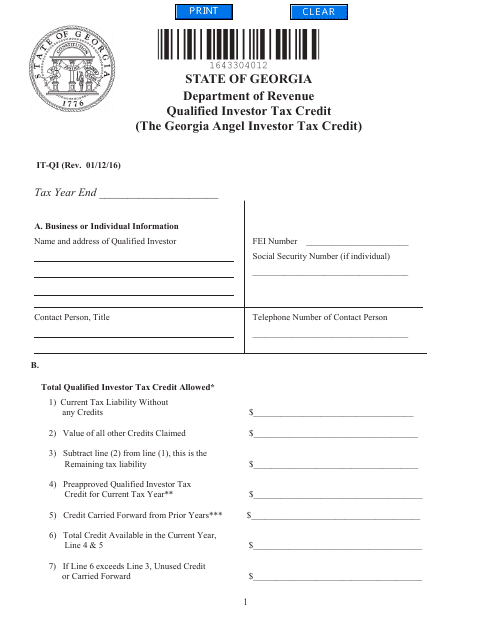

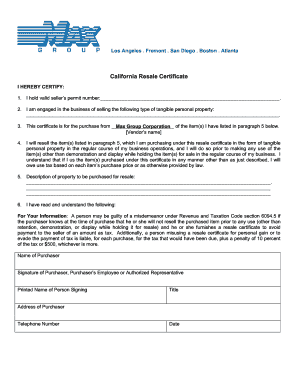

Has a valid sales tax number at the time of purchase and has listed the number on the certificate.

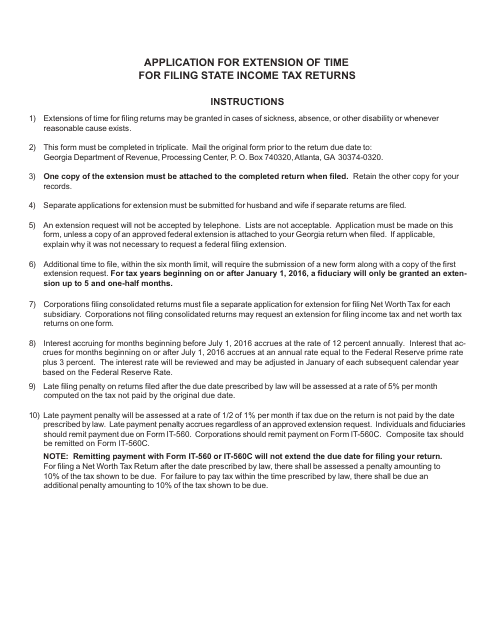

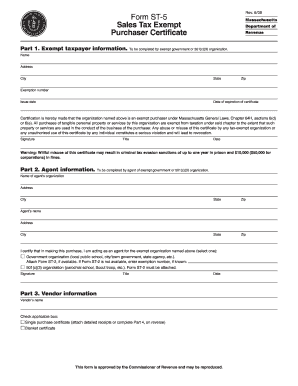

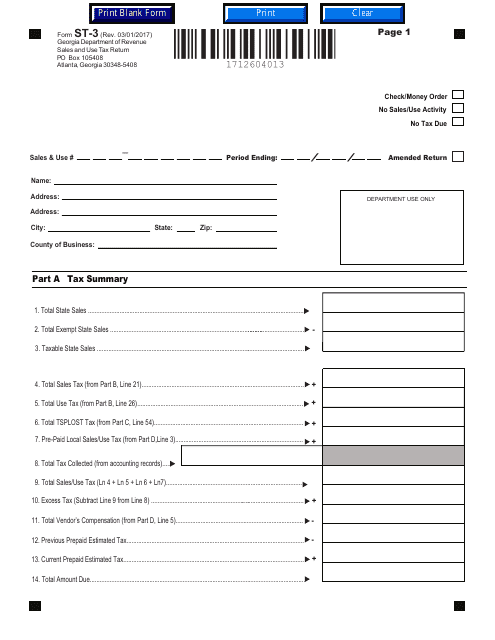

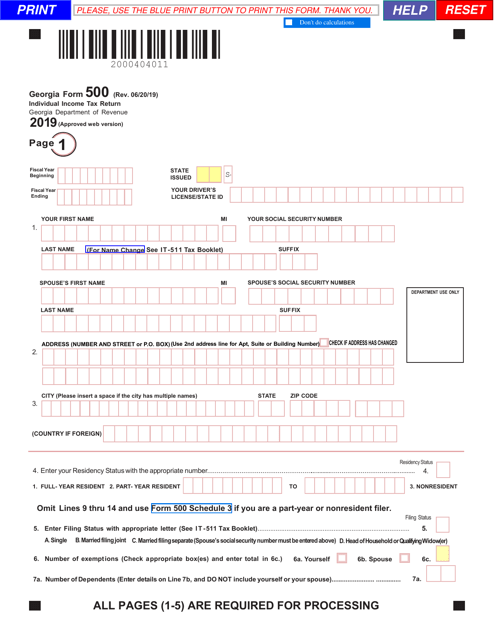

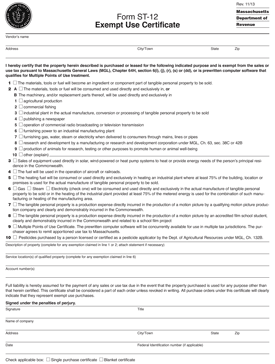

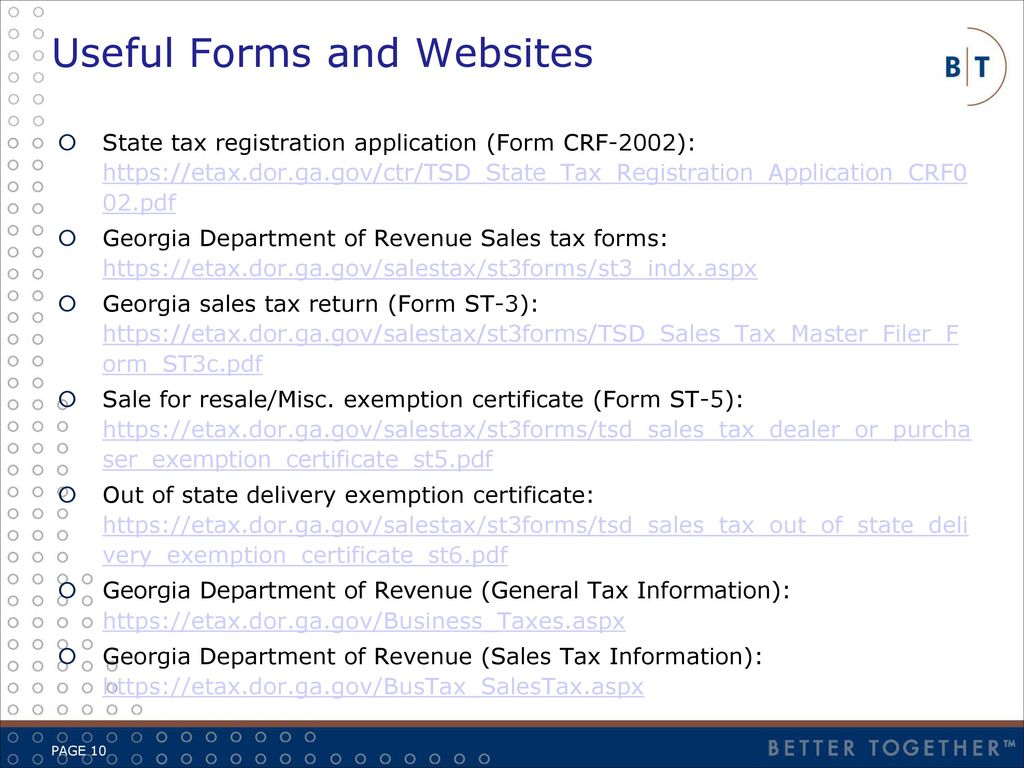

Georgia resale certificate st 5. St 5 sst exemption certificate 062014 georgia department of revenue certificate of exemption georgia streamlined sales and use tax agreement this is a multi state form. Georgia sales and use tax certificate of exemption st 5 step 6. St 5 certificate of exemption.

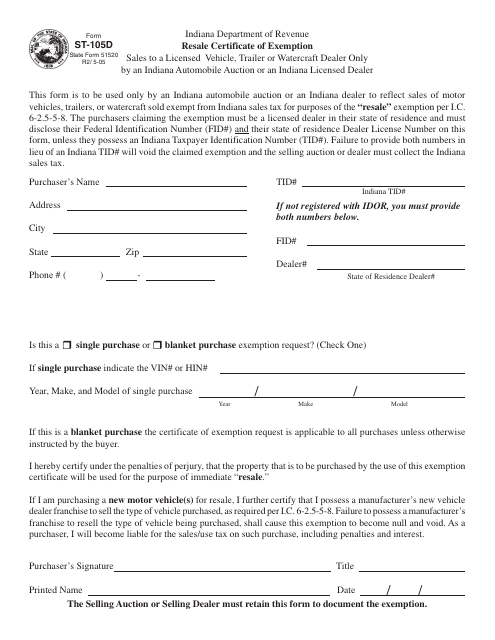

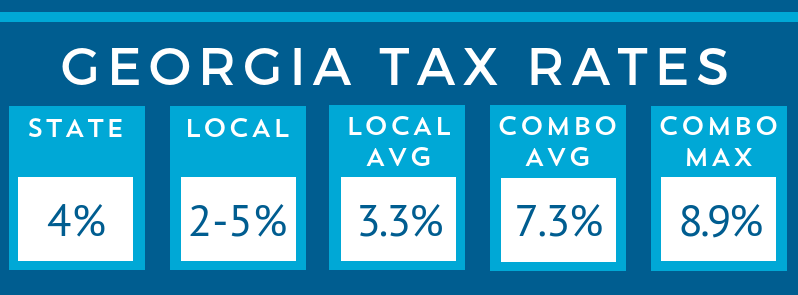

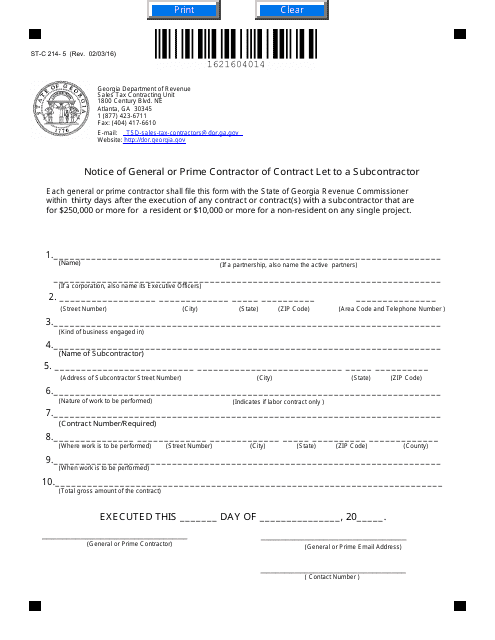

All tangible personal property purchased or leased pursuant to this certificate will be removed from the state of georgia immediately after purchase. Before sharing sensitive or personal information make sure youre on an official state website. Make sure you use the first checkbox to note that youre using this certificate to gain exemption for the purpose of resale.

102016 state of georgia department of revenue sales tax certificate of exemption georgia purchaser to. The fourth statement concerns materials used in packaging and handling property. St 5 sales tax certificate.

Filling out the st 5 is pretty straightforward but is critical for the seller to gather all the information. The third statement concerns purchases for resale by a church school or other qualifying nonprofit entity. And such purchases or leases are exempt from georgia sales tax for the reason noted below.

A georgia business can purchase tangible personal property for resale without paying sales tax by providing the supplier with a properly completed form st 5 certificate of exemption. Youll need to print out georgia department of revenue form st 5 sales tax certificate of exemption and fill it out. On a sale for resale a certificate relieves the seller from the burden of proof if the seller takes in good faith a properly completed certificate from a purchaser who.

Not all states allow all exemptions listed on this form. A sales and use tax number is. Purchases or leases of tangible personal property or services for resale only.

48 8 2 must register for a sales and use tax number and certificate of registration regardless of whether all sales will be online out of state wholesale or exempt from tax. Any individual or entity meeting the definition of dealer in ocga. Is engaged in the business of selling tangible personal property.

How to fill out the georgia sales tax certificate of exemption form st 5 the georgia department of revenue created a sales tax certificate of exemption to make things easier for documenting tax free transactions. Local state and federal government websites often end in gov. Georgia sales and use tax certificate of exemption st 5 step 7.

The purchased or leased tangible personal property is for resale.