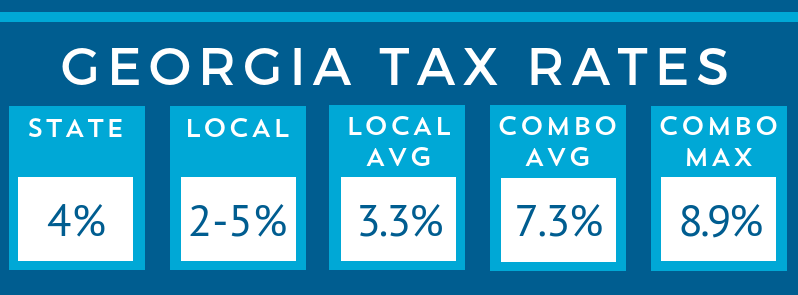

Georgia Resale Certificate Out Of State

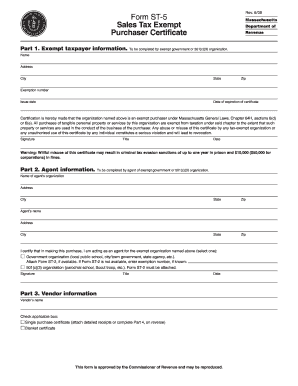

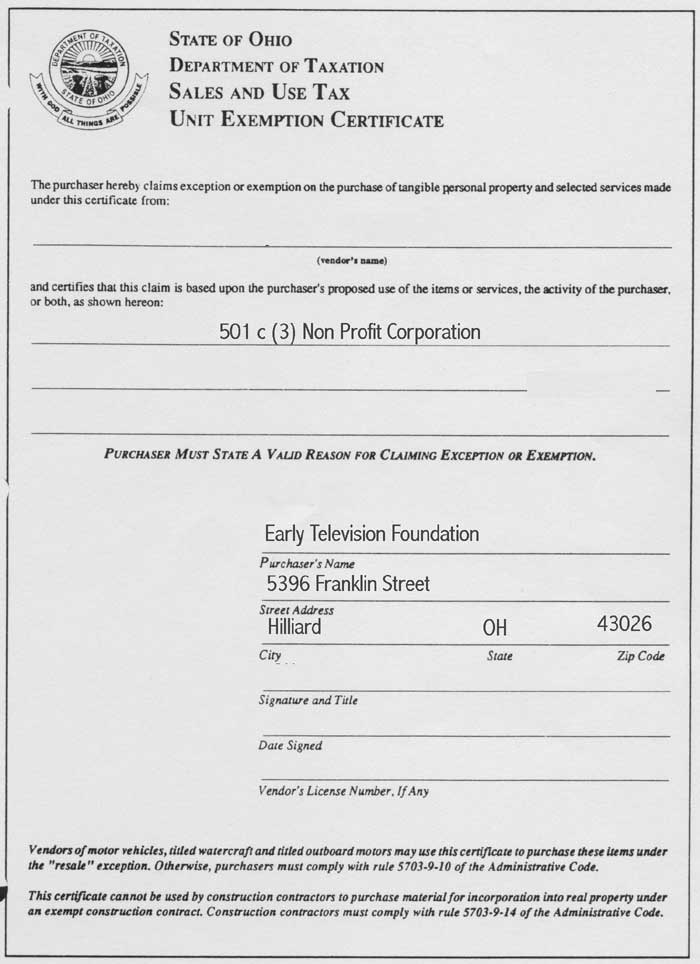

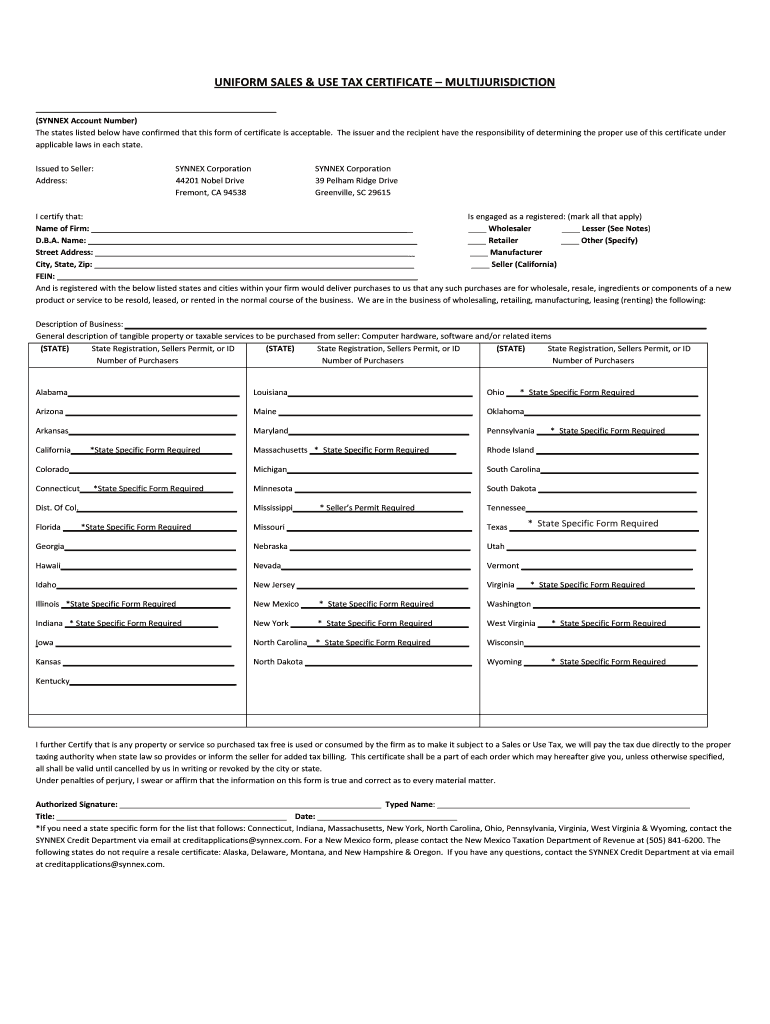

In general the uniform sales and use tax multi jurisdictional certificate of exemption or the certificate of exemption from the purchasers home state bearing the purchasers resale registration number will serve as sufficient proof that the transaction is not a taxable retail sale.

Georgia resale certificate out of state. And since you are a retailer you may also find yourself in the position of accepting a resale certificate from one of your buyers. Personal property obtained under this certificate is subject to sales and use tax if the purchaser uses or consumes the property in any. How to accept a resale certificate properly also varies by state.

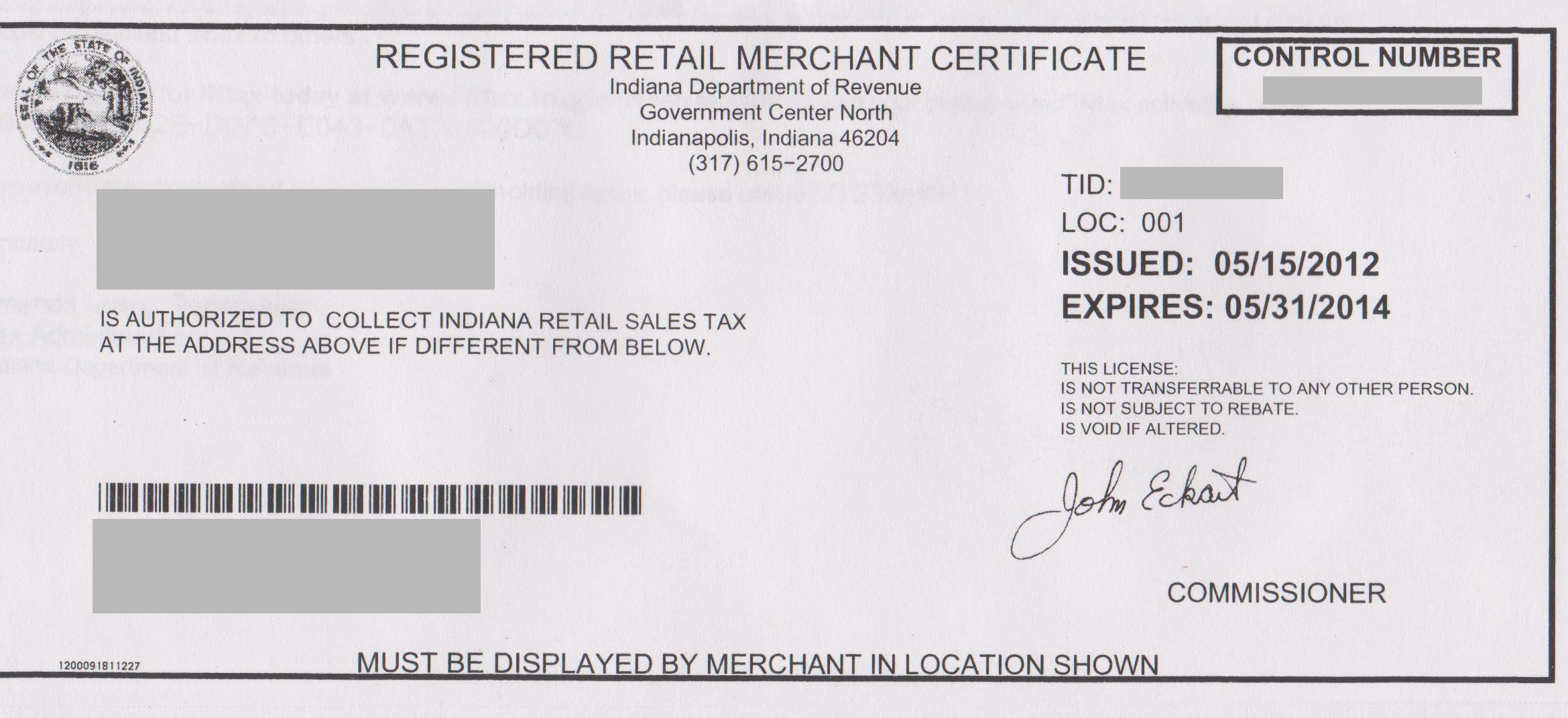

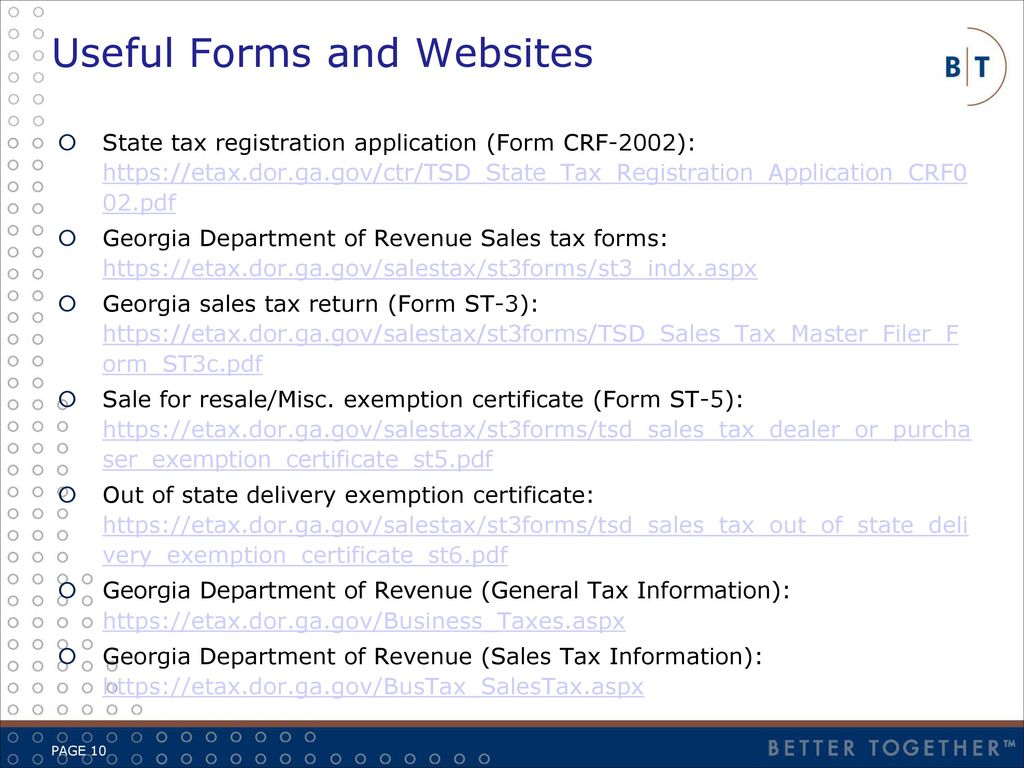

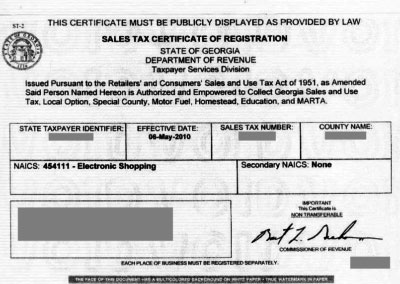

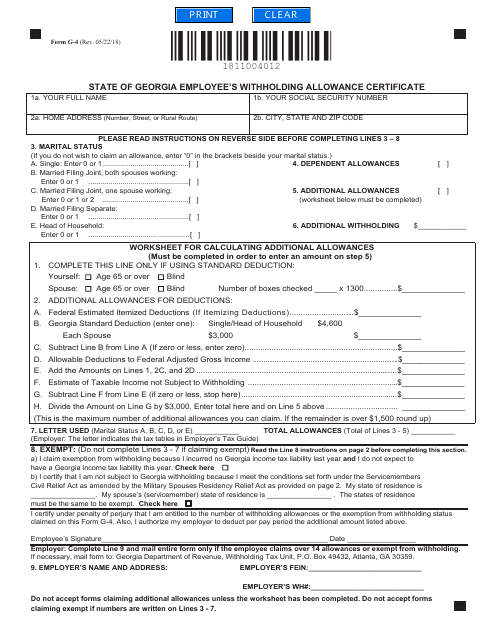

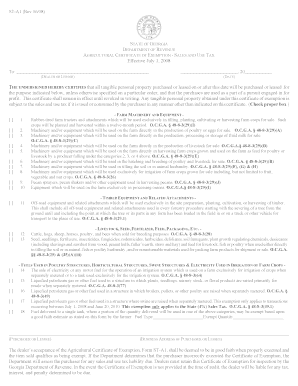

State of georgia department of revenue sales tax certificate of exemption. Any individual or entity meeting the definition of dealer in ocga. A sales and use tax number is.

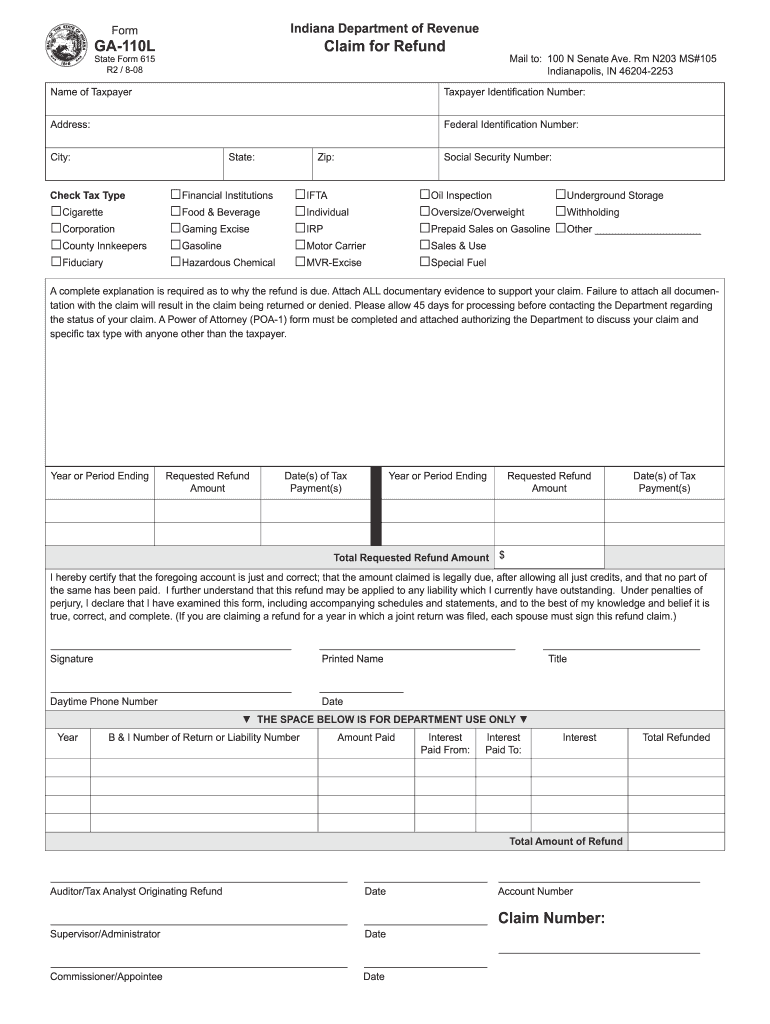

48 8 38 third party drop shipment policy. The nonresident certificate of exemption purchase of motor vehicle is intended for any non georgian residents who are buying a motor vehicle in the state of georgia. All sales are subject to sales tax until the contrary is established.

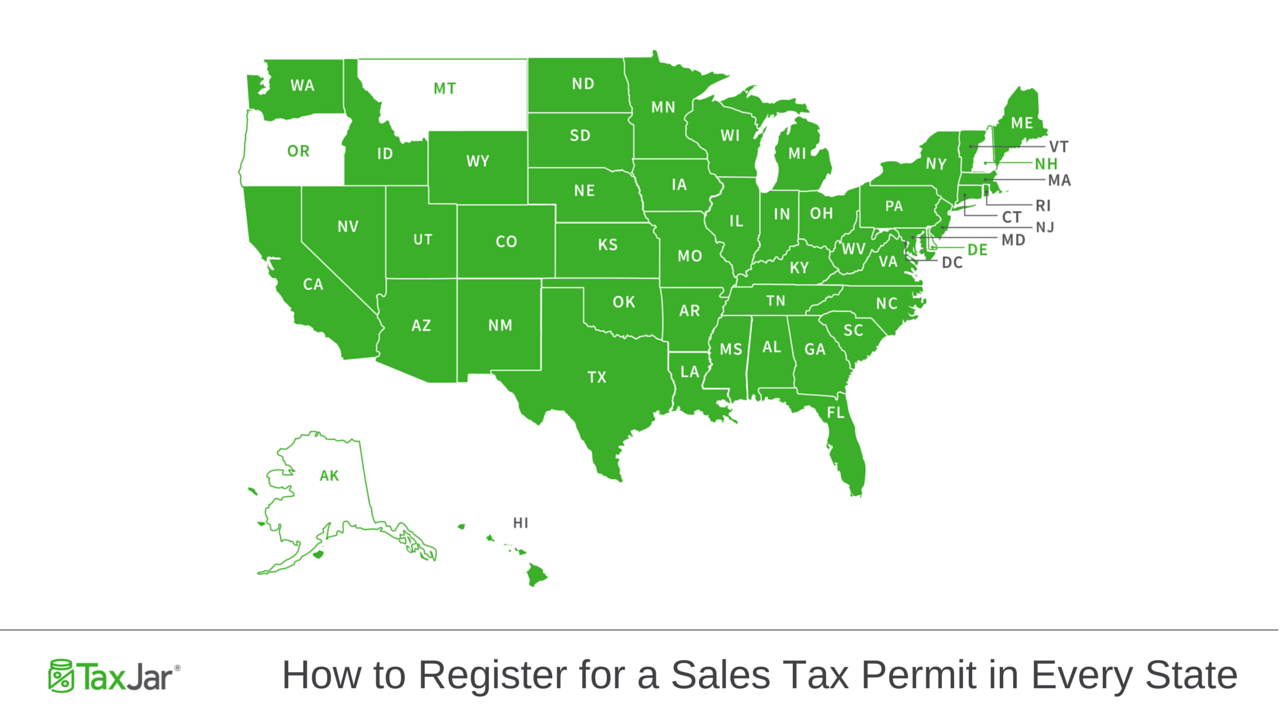

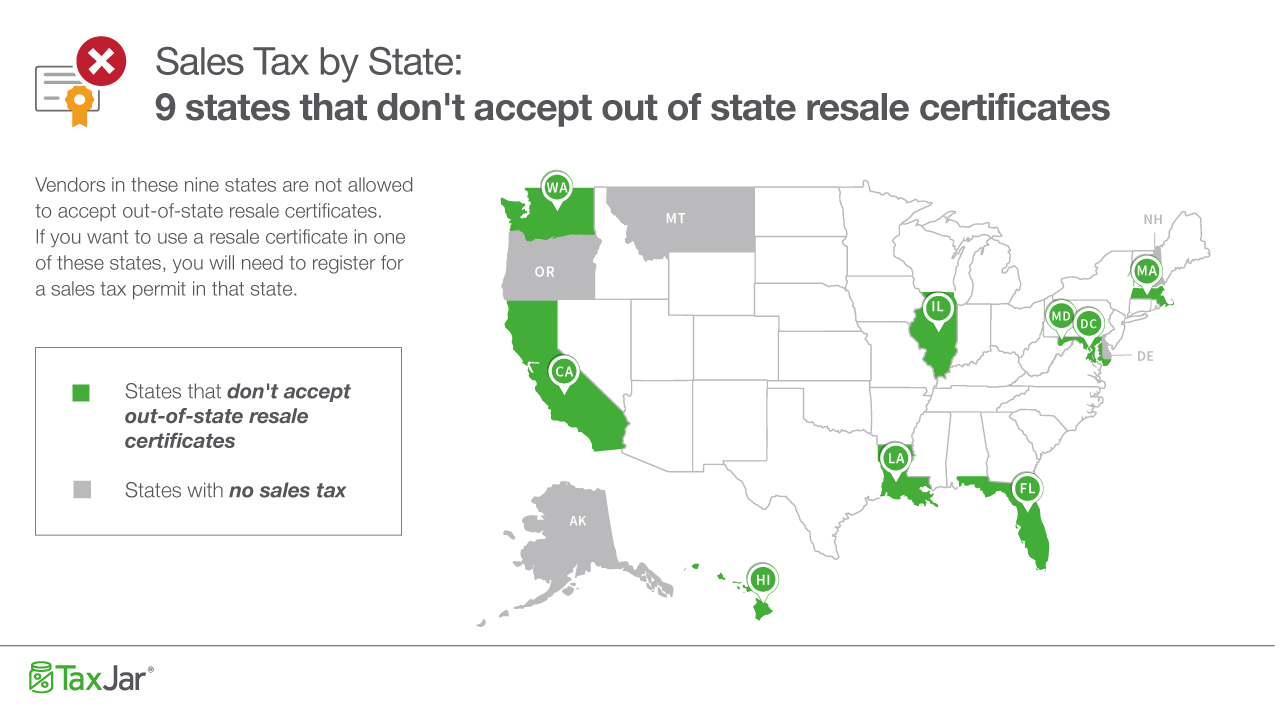

There are ten states that currently do not accept out of state resale certificates. However just like with anything sales tax related how to use a resale certificate varies from state to state. A seller takes a certificate in good faith when he takes a certificate that is.

As it turns out some states wont accept an out of state resale certificate. The burden of proof that a sale is not subject to the tax is on the person who makes the sale unless he in good faith takes from the purchaser a valid certificate of exemption. The certificate of exemption out of state delivery is used specifically for out of state deliveries.

These ten states include alabama california florida hawaii illinois louisiana maryland massachusetts and washington along with washington dc. Local state and federal government websites often end in gov. State of georgia government websites and email systems use georgiagov or gagov at the end of the address.

48 8 2 must register for a sales and use tax number and certificate of registration regardless of whether all sales will be online out of state wholesale or exempt from tax. State of georgia government websites and email systems use georgiagov or gagov at the end of the address. Local state and federal government websites often end in gov.

On a sale for resale a certificate relieves the seller from the burden of proof if the seller takes in good faith a properly completed certificate from a. Purchases or leases of tangible personal property or services for resale only.