Georgia Resale Certificate Online

Georgia tax exemption georgia resale certificate georgia sale and use tax georgia wholesale certificate etc.

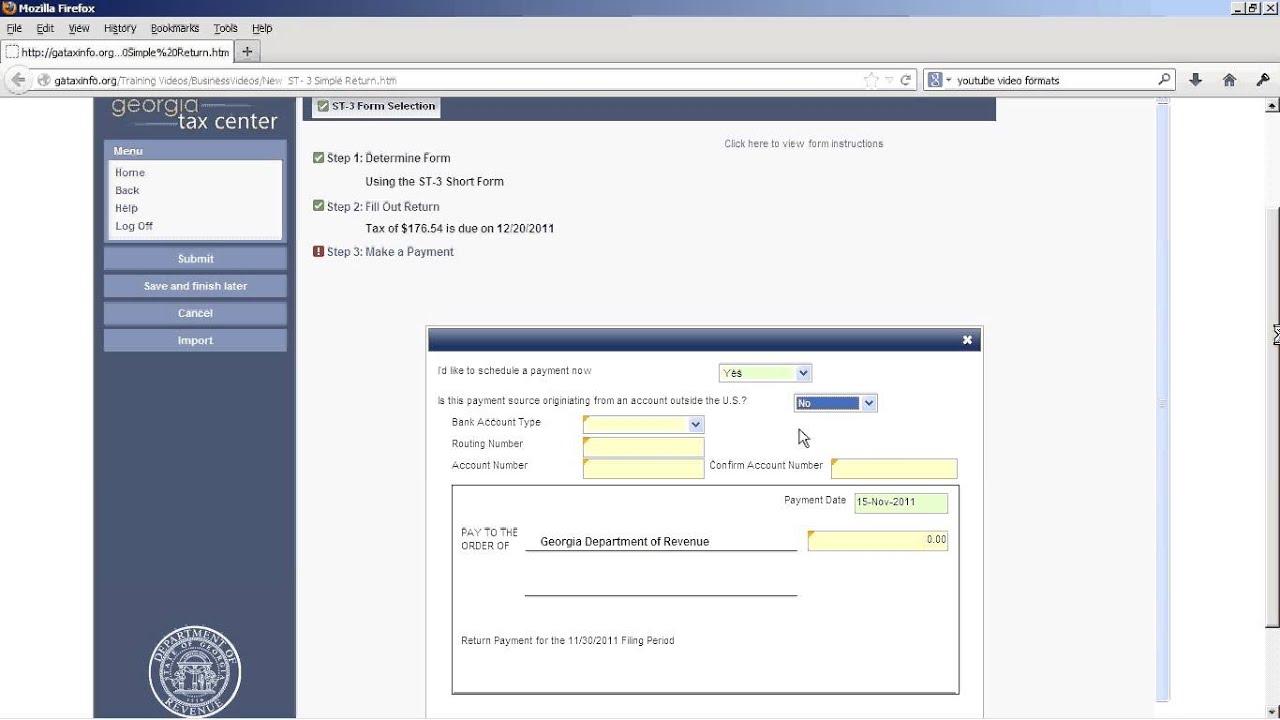

Georgia resale certificate online. Using a georgia resale certificate isnt too difficult. Need to establish a login. State of georgia government websites and email systems use georgiagov or gagov at the end of the address.

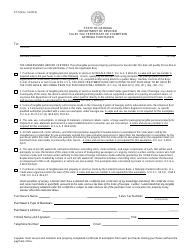

Local state and federal government websites often end in gov. St 5 certificate of exemption. Has a valid sales tax number at the time of purchase and has listed the number on the certificate.

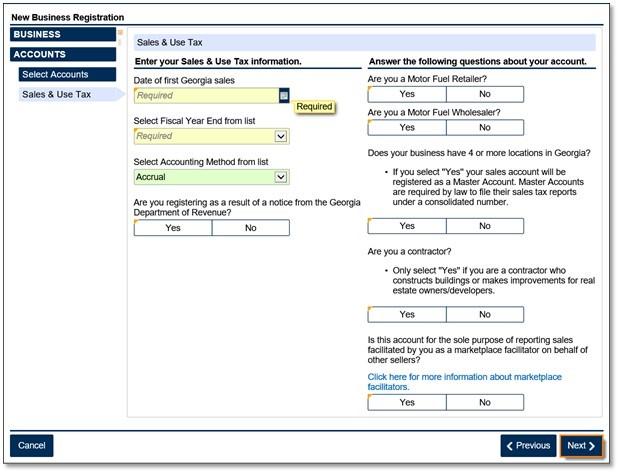

St 5 sales tax certificate. Wholesale companies in georgia require a sales tax resale certificate. Effective march 8th 2018 sales tax certificates.

Personal property obtained under this certificate is subject to sales and use tax if the purchaser uses or consumes the property in any. Is engaged in the business of selling tangible personal property. Before sharing sensitive or personal information make sure youre on an official state website.

A sales and use tax number is. Even online based businesses shipping products to georgia residents must collect sales tax. Youll need to print out georgia department of revenue form st 5 sales tax certificate of exemption and fill it out.

If you go to a wholesaler and buy a computer you plan to sell like ebay you may purchase the item without paying state sales tax. Make sure you use the first checkbox to note that youre using this certificate to gain exemption for the purpose of resale. On a sale for resale a certificate relieves the seller from the burden of proof if the seller takes in good faith a properly completed certificate from a purchaser who.

48 8 2 must register for a sales and use tax number and certificate of registration regardless of whether all sales will be online out of state wholesale or exempt from tax. Also known as. Georgia sales tax resale certificate example.

Any individual or entity meeting the definition of dealer in ocga. State of georgia department of revenue sales tax certificate of exemption. Will arrive via mail unless you opt in for electronic correspondence.

Items must be for resale or qualified business use.

.png?width=800&name=Copy%20of%20Georgia%20Tax%20Rates%20(1).png)

.png?width=800&name=Sales%20Tax%20Blog%20Images%20(2).png)