Georgia Resale Certificate Form

In general a seller should only accept a certificate of exemption when the certificate is.

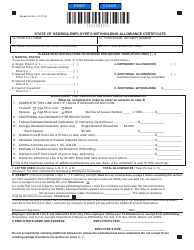

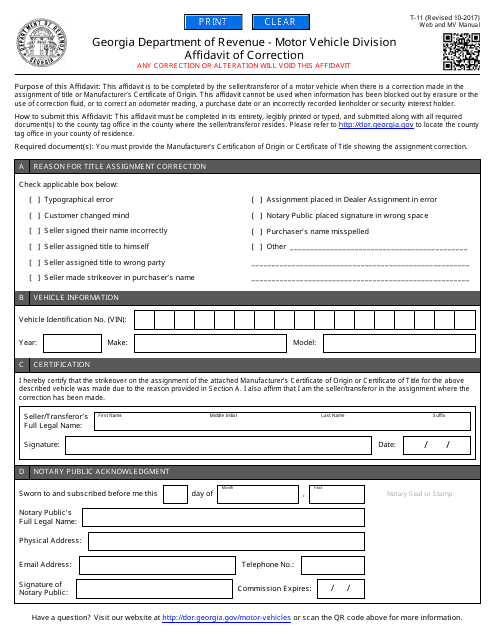

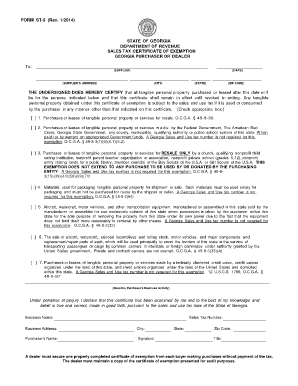

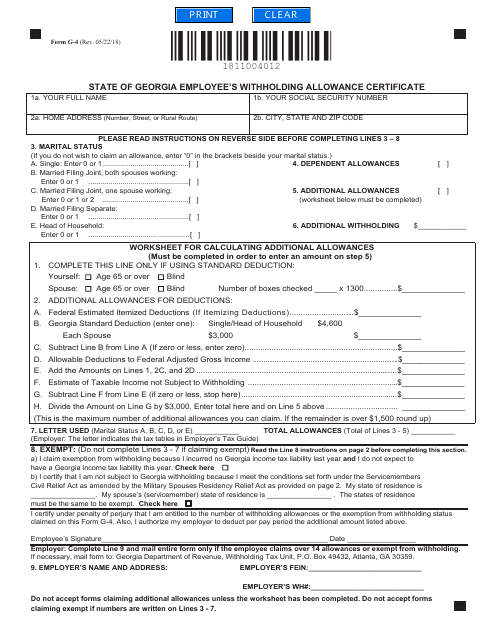

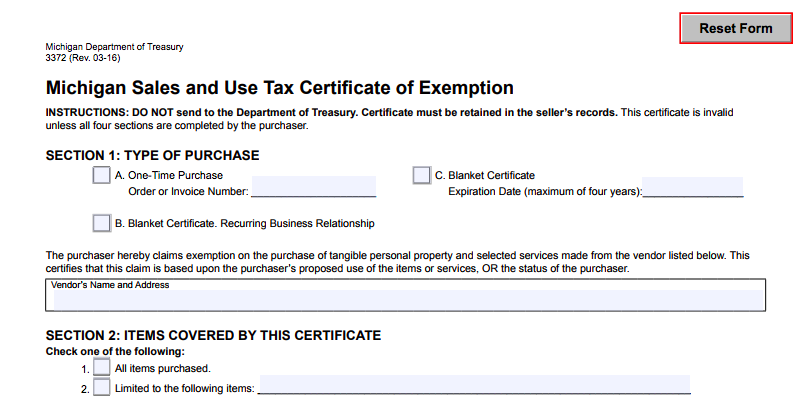

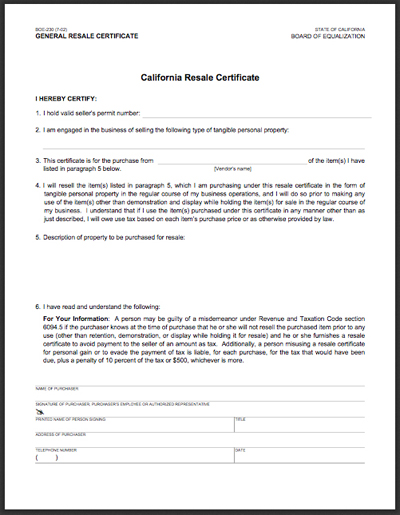

Georgia resale certificate form. State 12 4105 and 12 41114 and regulations and administrative pronouncements pertaining to resale certificates. Personal property obtained under this certificate is subject to sales and use tax if the purchaser uses or consumes the property in any. Make sure you use the first checkbox to note that youre using this certificate to gain exemption for the purpose of resale.

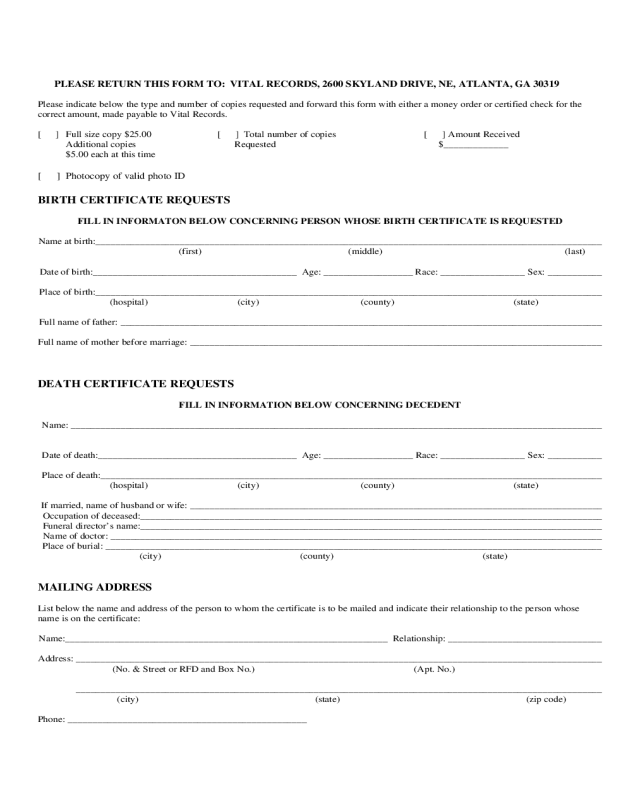

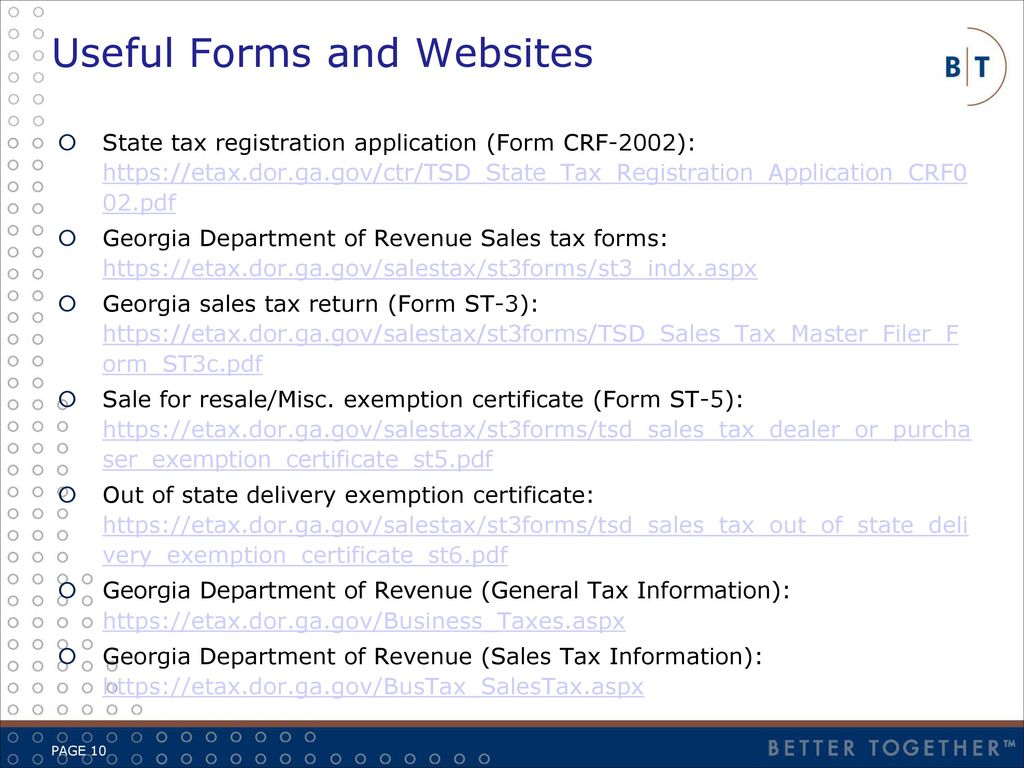

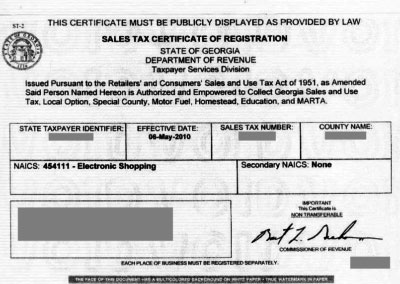

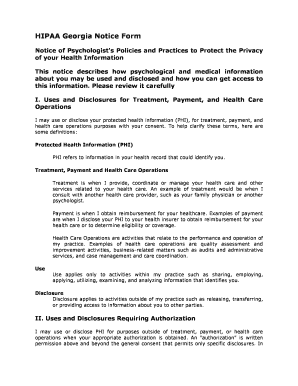

Before sharing sensitive or personal information make sure youre on an official state website. In georgia you are required to obtain a sales tax certificate of registration also knows as a state resale certificate for a number of reasons. The burden of proof that a sale is not subject to tax is upon the person who makes the sale unless the seller in good faith takes from the purchaser a valid certificate of exemption.

The purchase of a taxable service for resale. All sales are subject to sales tax until the contrary is established. State of georgia government websites and email systems use georgiagov or gagov at the end of the address.

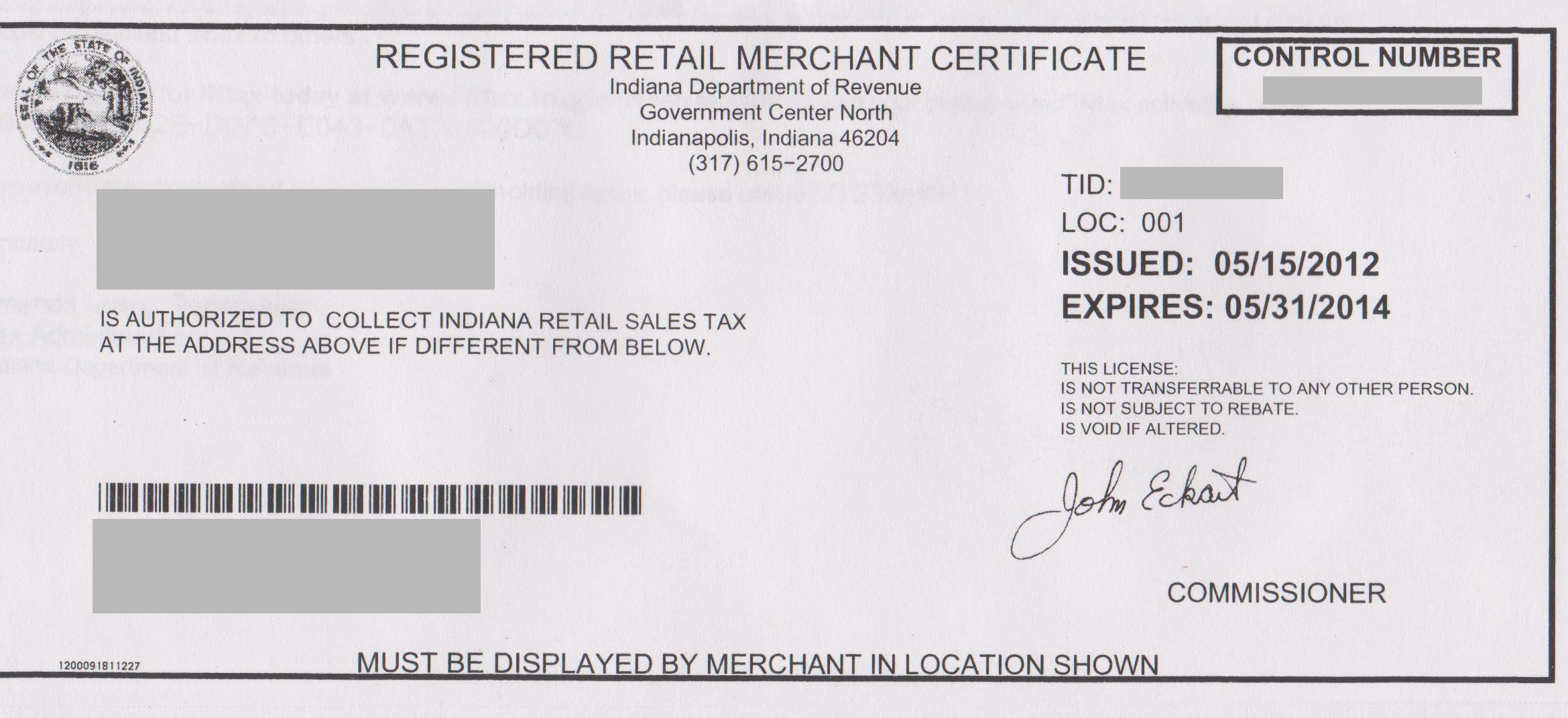

Are casual sales subject to sales tax. 48 8 2 must register for a sales and use tax number and certificate of registration regardless of whether all sales will be online out of state wholesale or exempt from tax. This certificate is not valid as an exemption certificate.

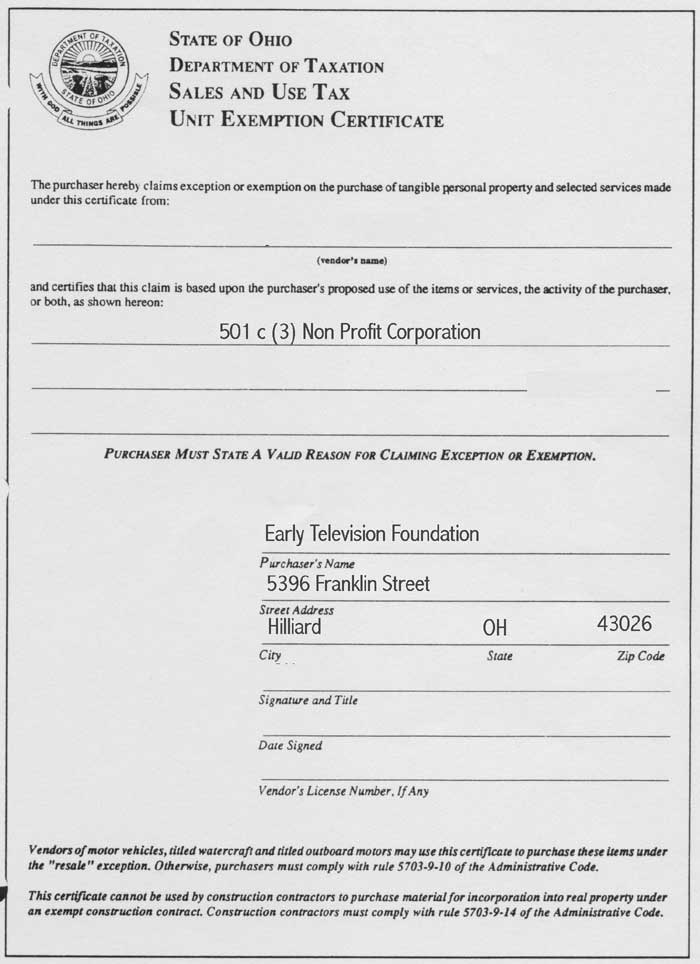

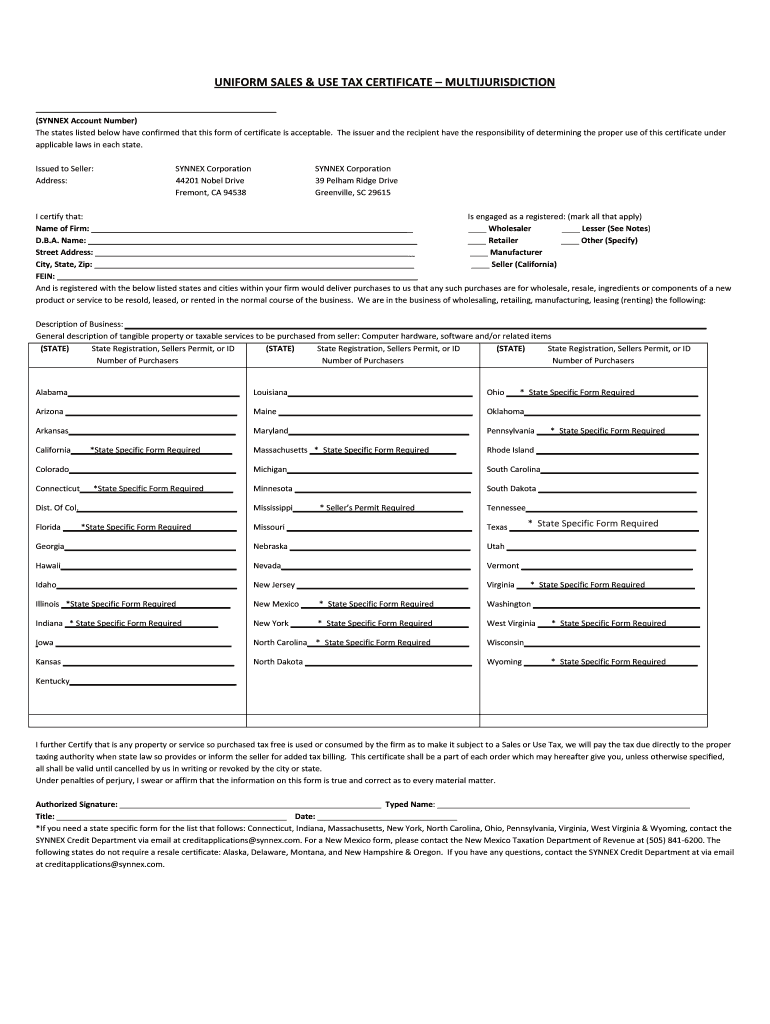

Its use is limited to use as a resale certificate subject to conn. A sales and use tax number is. Purchases or leases of tangible personal property or services for resale only.

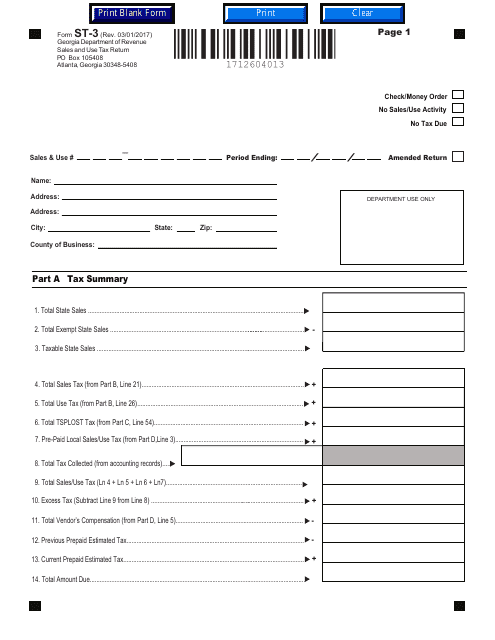

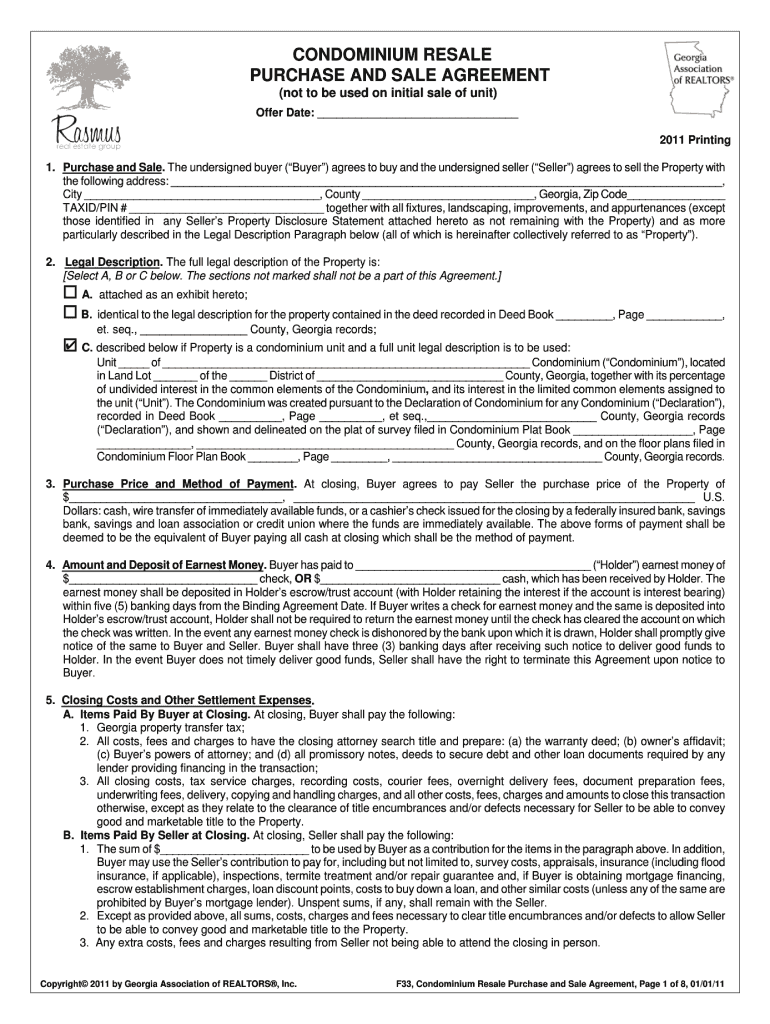

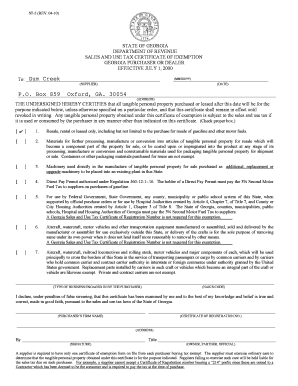

A georgia business can purchase tangible personal property for resale without paying sales tax by providing the supplier with a properly completed form st 5 certificate of exemption. Local state and federal government websites often end in gov. State of georgia department of revenue sales tax certificate of exemption.

48 8 38 third party drop shipment policy. This page explains how to make tax free purchases in georgia and lists six georgia sales tax exemption forms available for download. Any individual or entity meeting the definition of dealer in ocga.

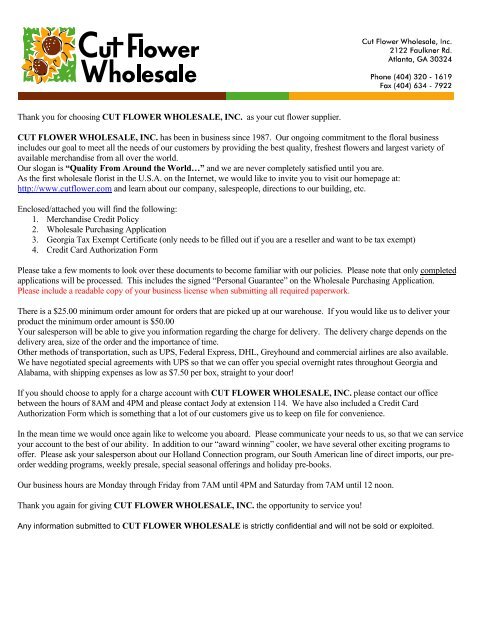

Using a georgia resale certificate isnt too difficult. Will i purchase items and resell them if the answer is yes you must have a sales tax certificate of registration to legally do business. If you are a retailer making purchases for resale or need to make a purchase that is exempt from the georgia sales tax you need the appropriate georgia sales tax exemption certificate before you can begin making tax free purchases.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsvh3s6vc3te09fgzqaqddbntkuxaokyahoee0o2cf0d Th0ekm Usqp Cau

encrypted-tbn0.gstatic.com