Georgia Power Electric Vehicle Rebate

Georgia power customers may be eligible to receive up to a 250 rebate for installing a level 2 charger in their home.

Georgia power electric vehicle rebate. All electric and plug in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Know that georgias green driver incentives and related laws might change as. The credit amount will vary based on the capacity of the battery used to power the vehicle.

To encourage nighttime ev charging. Charging customers who purchase qualified residential charging equipment between january 1 2018 and december 31 2020 may receive a tax credit of up to 1000. You can also explore the different electric vehicle technologies available to consumers like you.

From the latest in electric vehicle trends to answers to your frequently asked questions discover whats new in the world of electric transportation. But for even greater savings try georgia powers plug in electric vehicle rate. Rebates are available through december 31 2019.

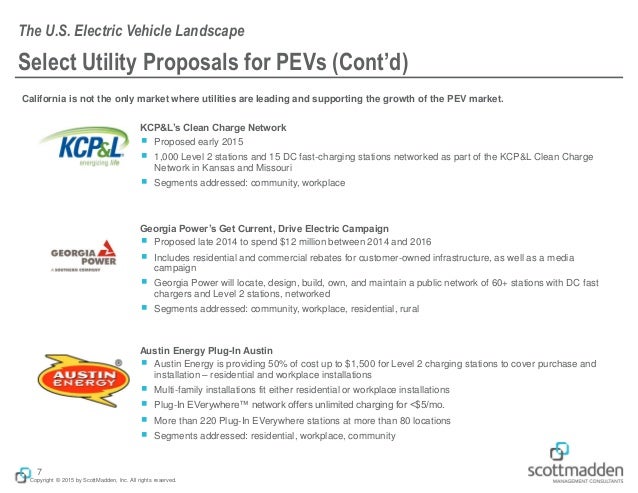

Administered by cse for the california air resources board the clean vehicle rebate project cvrp offers up to 7000 in electric vehicle rebates for the purchase or lease of new eligible zero emissions and plug in hybrid light duty vehicles. In georgia the state legislature ended the 5000 credit for bevs in 2016 but it is currently evaluating new incentives for vehicles and charging equipment. Several states and local utilities offer additional electric vehicle and solar incentives for customers often taking the form of a rebate.

Submit a rebate request form with a copy of paid installation and charger invoices within 60 days after the ev charger has been installed. Read on to find out how driving a fuel efficient vehicle such as a hybrid electric car ev or alternative fuel vehicle afv can help you cut back on global warming and what you spend on your vehicle. For more information including eligible evse and how to apply see the georgia power electric vehicles website.

This rate offers lower prices from 11 pm. Georgia power is committed to growing electric vehicle infrastructure for all georgians and is providing incentives in order to do so. Federal tax credits for new all electric and plug in hybrid vehicles federal tax credit up to 7500.

If you drive an electric vehicle you already know that fueling your car with electricity is much cheaper than gasoline or diesel. Georgia power customers may be eligible to receive up to a 250 rebate for installing a level 2 charger in their home. Electric vehicle supply equipment evse rebate georgia power georgia power offers residential customers a 250 rebate for level 2 evse installed between january 1 2020 and december 31 2020.

/__opt__aboutcom__coeus__resources__content_migration__treehugger__images__2013__05__getting-paid-to-drive-electric-car-013ed50a0c7f4a25818b900716bfd751.jpg)