Georgia Lottery Winnings

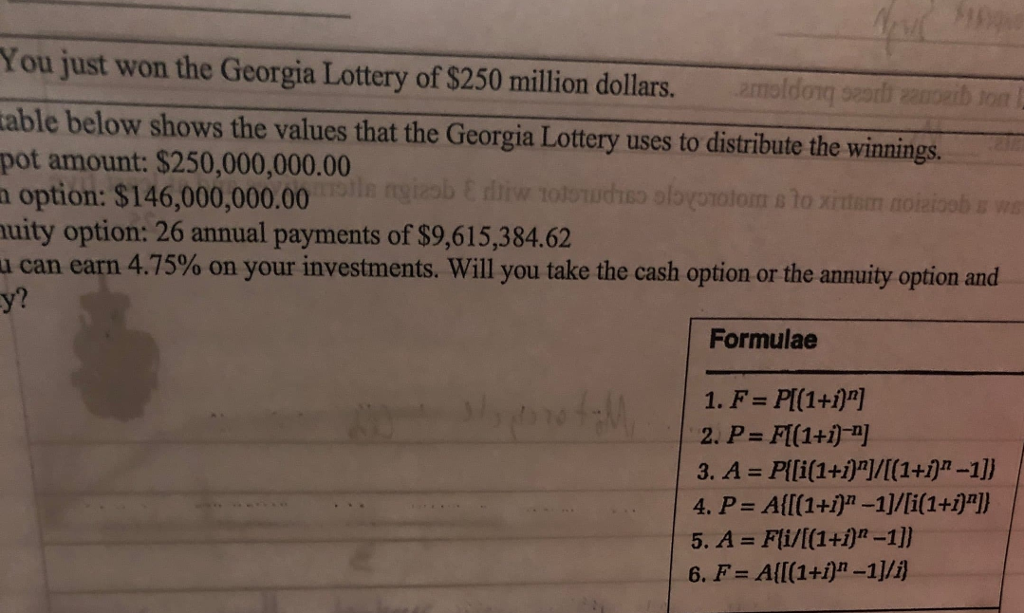

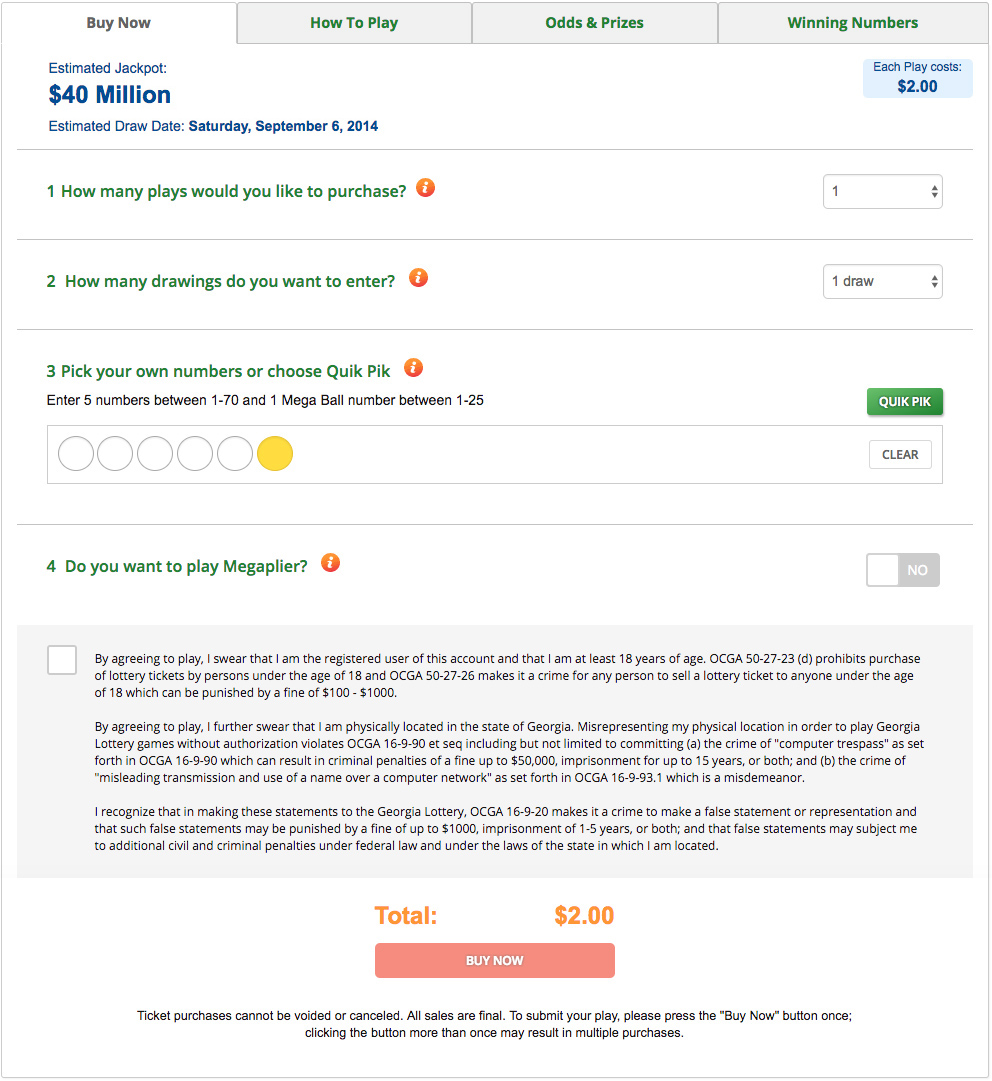

For example lets say you elected to receive your lottery winnings in the form of annuity.

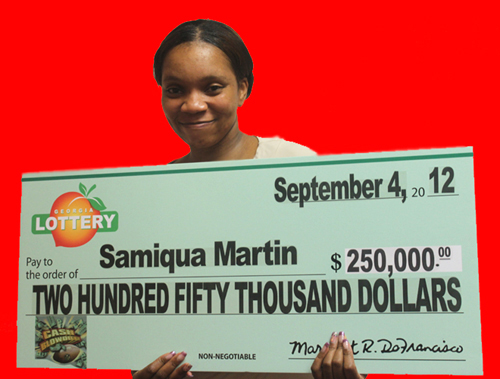

Georgia lottery winnings. Georgia lottery corporation po. Georgia lottery players are enjoying a winning streak with triples and quads falling in cash 3 and cash 4 within the past week. That means your winnings are taxed the same as your wages or salary.

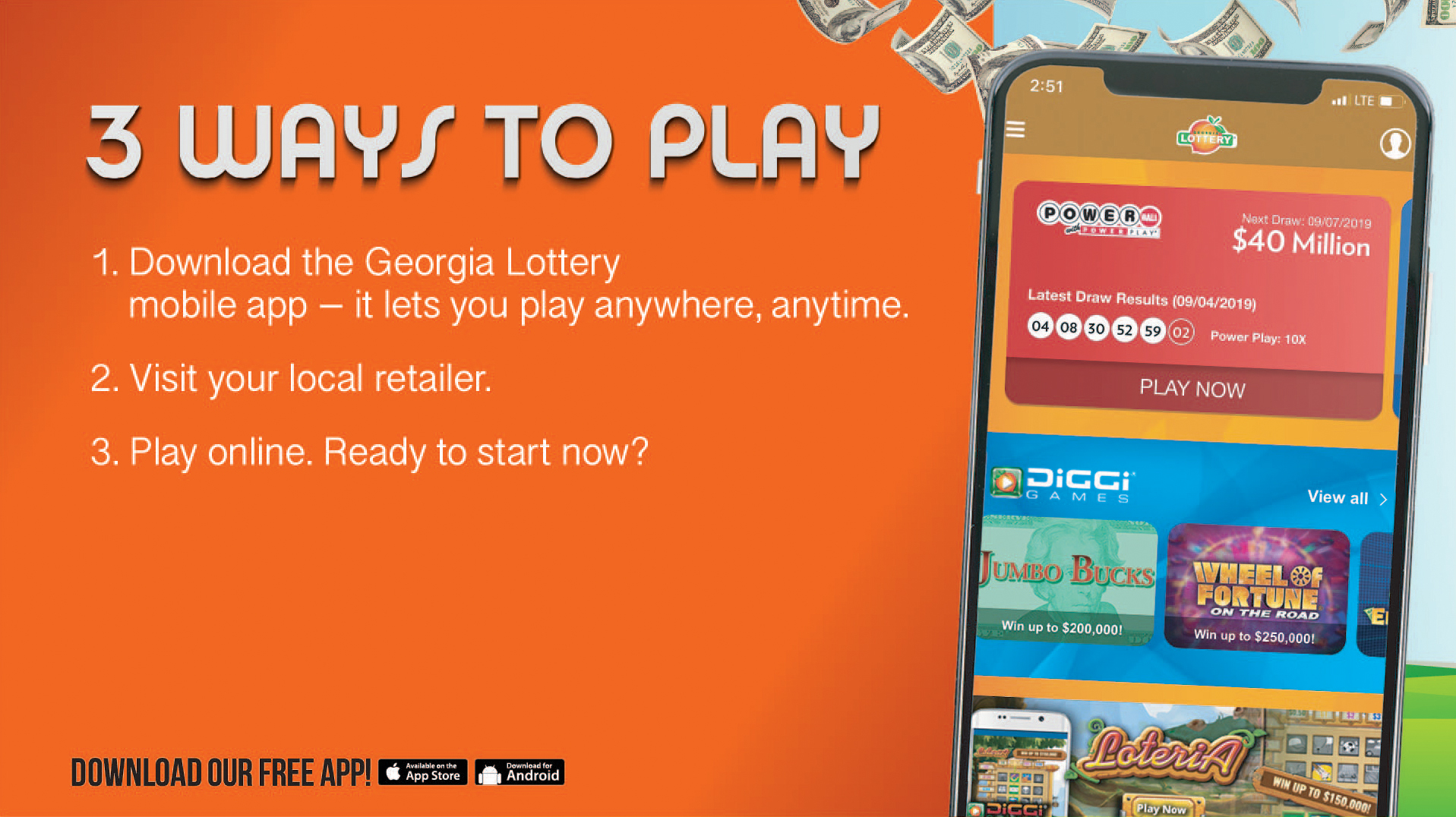

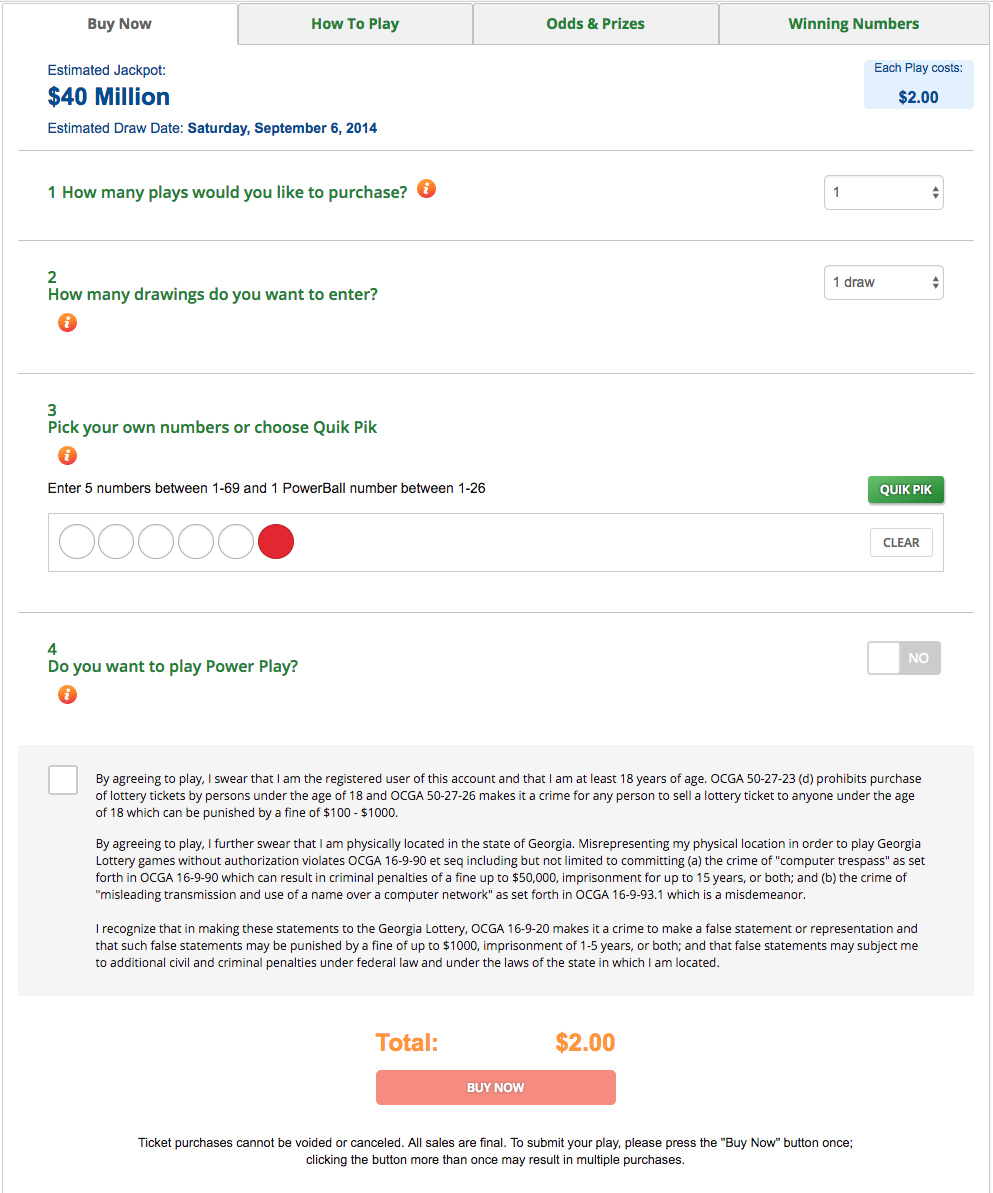

Thursday june 14 2018 106 pm more georgia lottery news. Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. Its the georgia lottery in the palm of your hand.

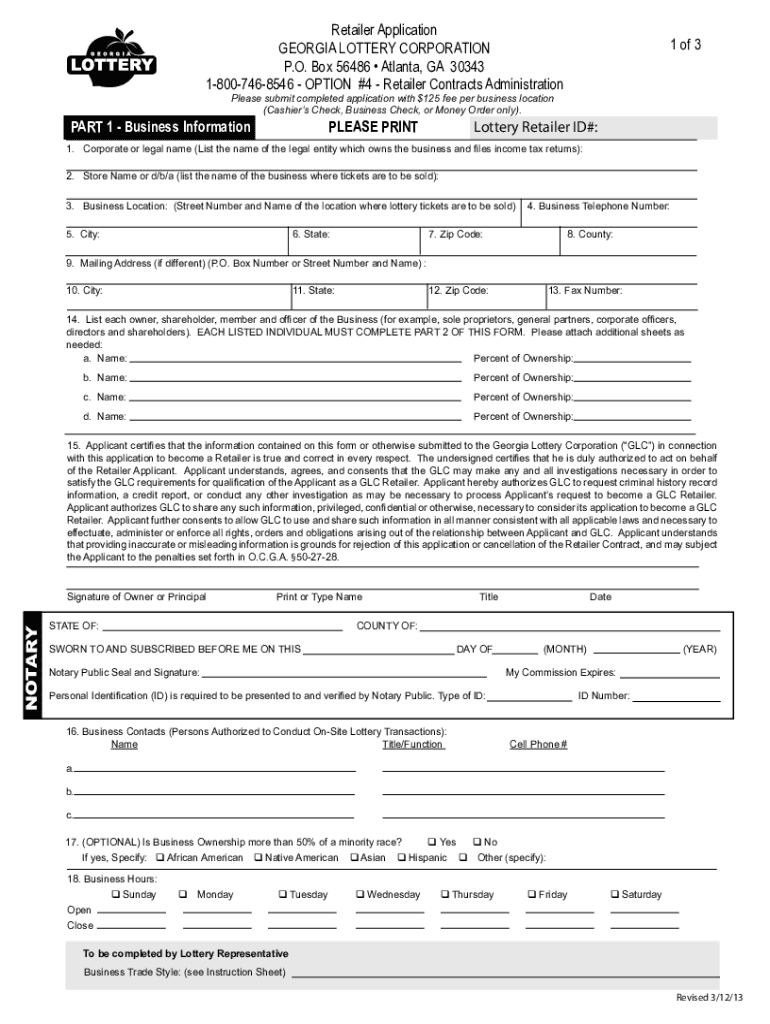

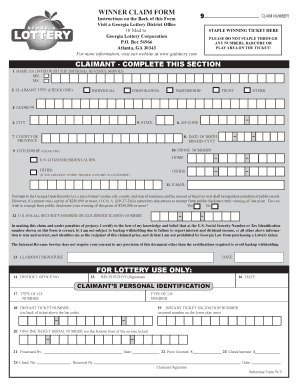

How to claim watch the drawings. All prizes can be claimed by mail to. Georgia lottery claim centers at headquarters are open monday through thursday 900 am.

Download georgia lottery mobile app. View the drawings for florida lotto powerball jackpot triple play fantasy 5 pick 5 pick 4 pick 3 and pick 2 on the florida lotterys official youtube page. All draw game prizes must be claimed at a florida lottery retailer or florida lottery office on or before the 180th day after the winning drawing.

The georgia lottery is also required to report the names of winners of prizes above 600 to both the georgia department of revenue and the internal revenue service. And you must report the entire amount you receive each year on your tax return. Lottery winnings in georgia are subject to all applicable state and federal income taxes as well as withholdings.

Box 56966 atlanta ga 30343. Visit our tax information section to find more details.