Georgia Homeschool Tax Credit

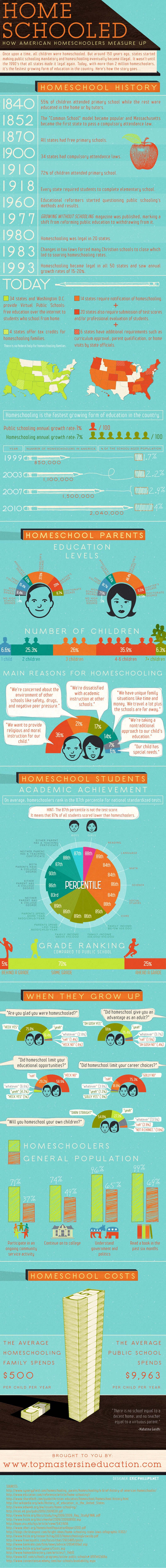

The subtraction works like an expense deduction and is worth up to 1625 per qualifying child in grades k6 and 2500 for a qualifying child in grades 712.

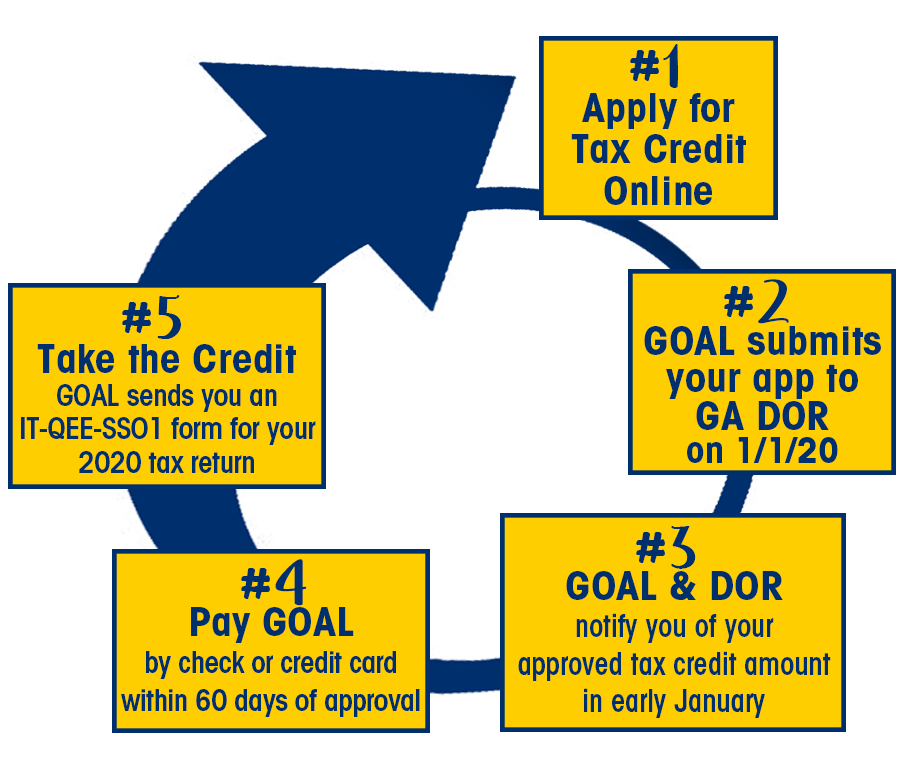

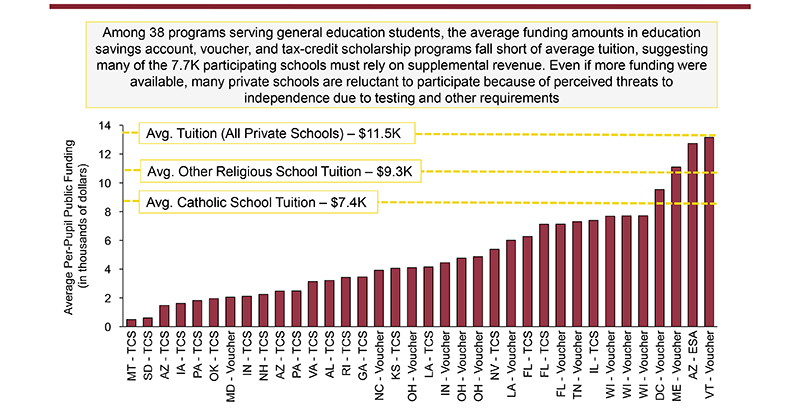

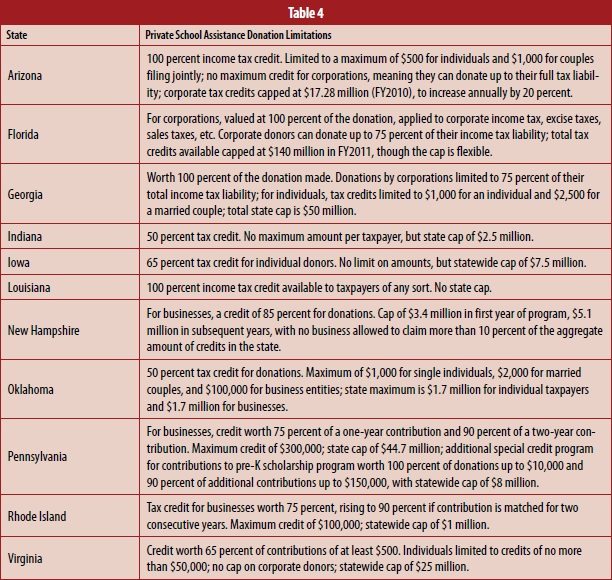

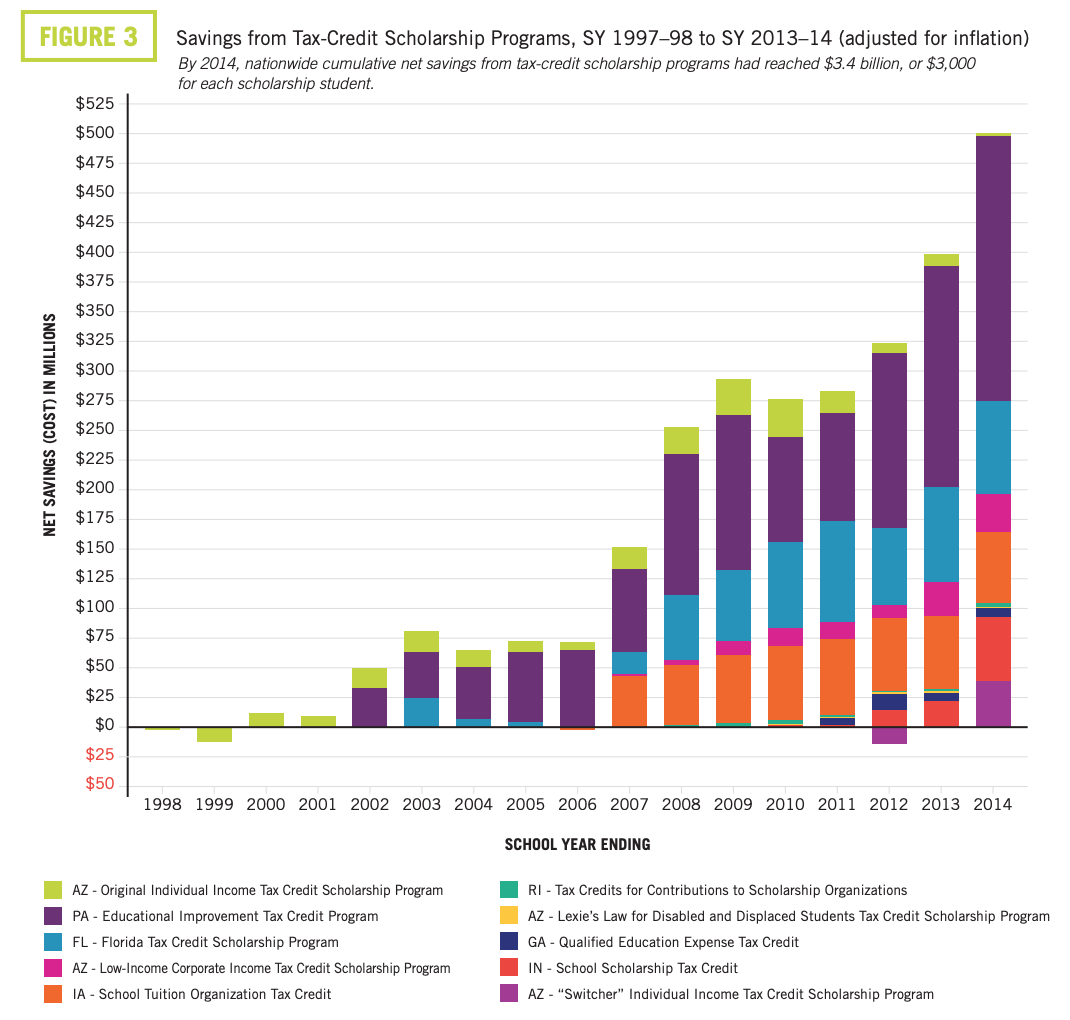

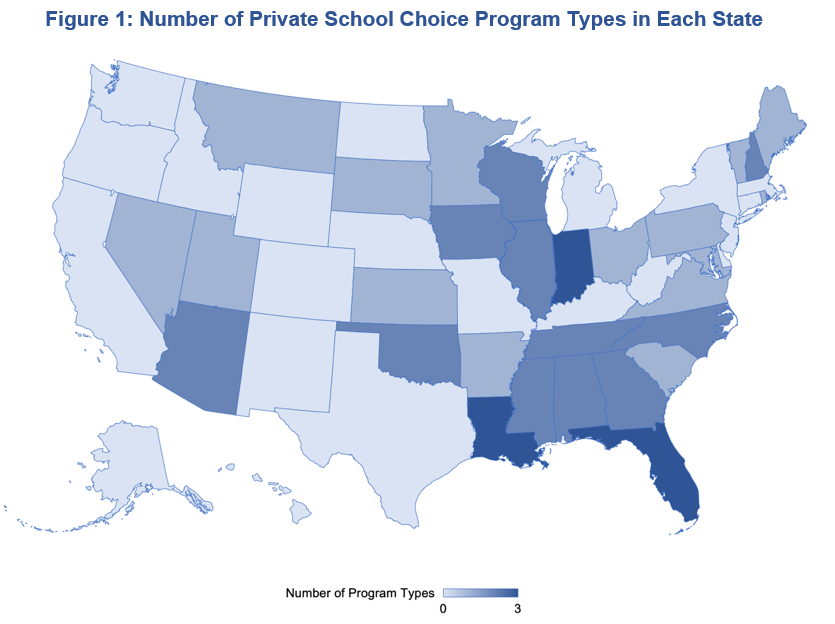

Georgia homeschool tax credit. Georgia tax credit program the georgia private school tax credit law allows eligible private citizens and corporations to receive tax credits for donations to student scholarship organizations ssos. Georgias qualified education expense tax credit a tax credit scholarship program was enacted and launched in 2008 to help students in public school access schools that best fit their needs. 20 2a 1 thru 20 2a 7.

Learn more about the programs details on this page including eligibility funding regulations legal history and more. Georgia tax center information tax credit forms. Qualified education expense tax credit.

Il does offer a tax credit max of 500 ithink for certain homeschooling expenses. Ssos will provide student scholarships to parents of eligible children who plan to attend private schools. C2020 georgia department of education.

Income tax credit policy bulletins. Income tax credit utilization reports. Georgia tax credit program click the link above for information about the georgia tax credit programstudent scholarship organizations.

This tax credit means that you can deduct money off of what you owe in taxes for each dependent child in your household. Georgia tax center help individual income taxes register new business business taxes refunds information for tax professionals. On the indiana.

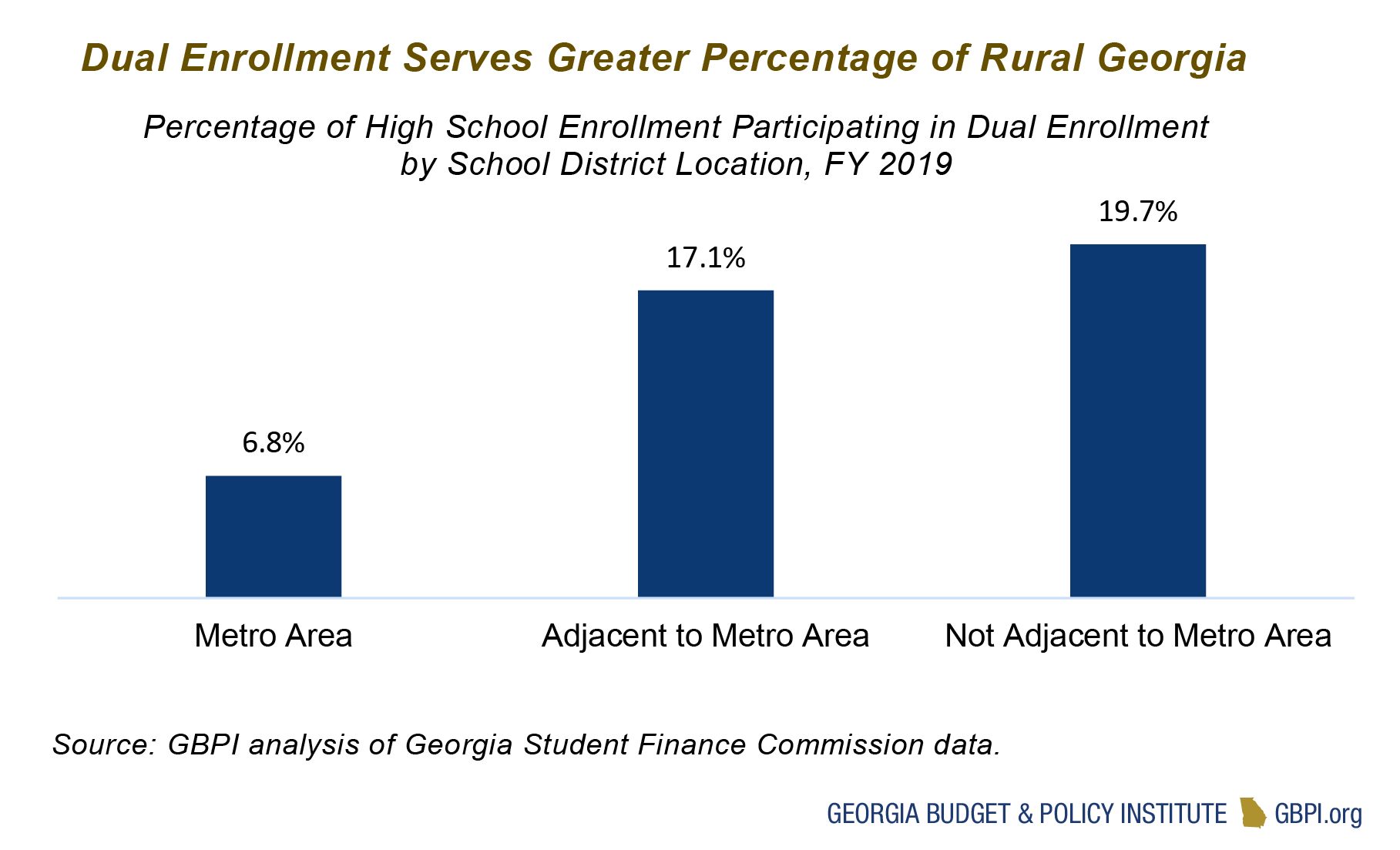

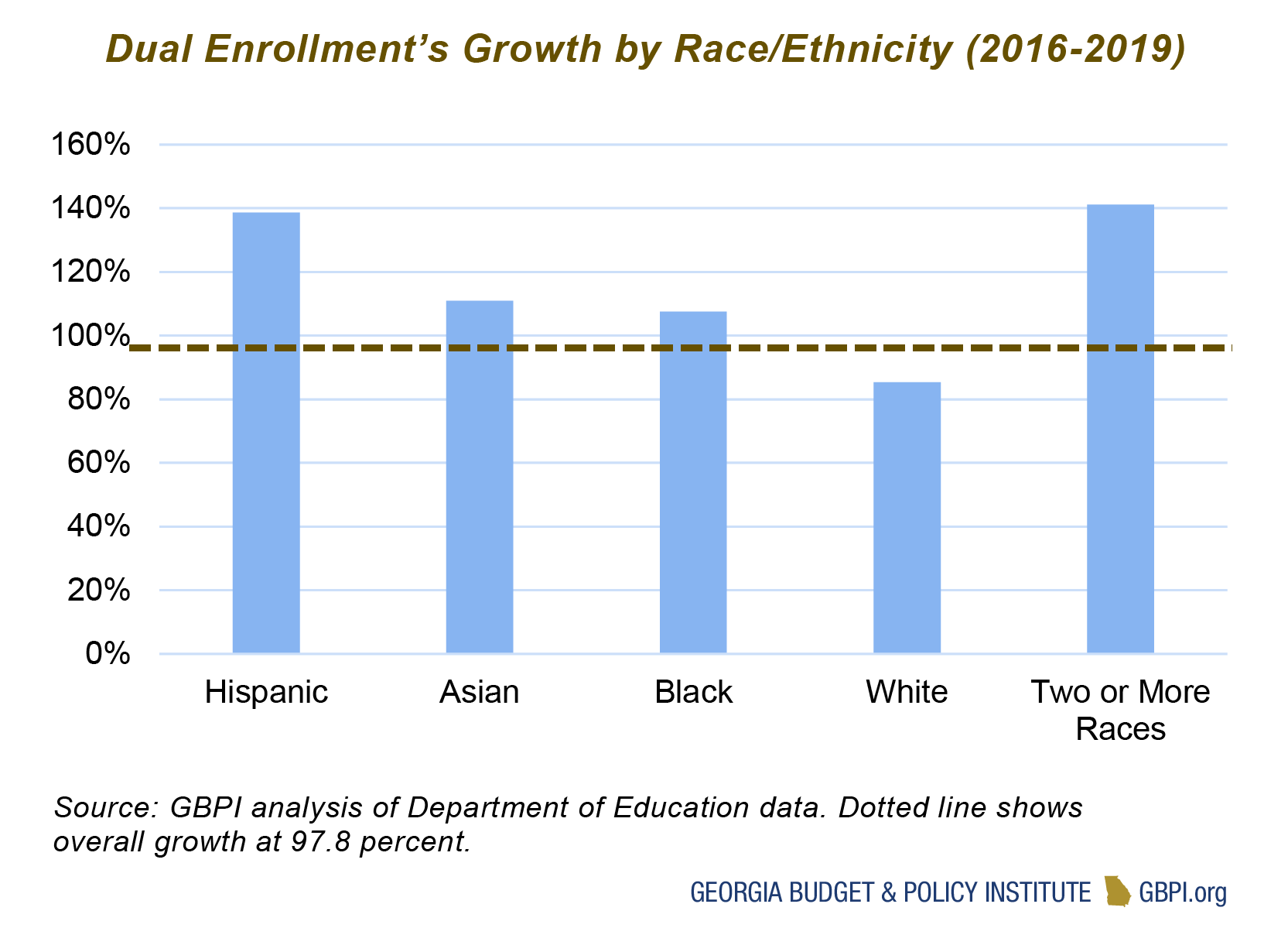

Nothing in georgia but we have a good dual enrollment program. Faq for general business credits. Qualified education expense tax credit qualified education expense tax credit 2020 qee 2020 qualified education expense tax credit cap status 7 31 20pdf 22173 kb 2020.

For more information about the child tax credit refer to this article. Income tax letter rulings. The credit on the other hand reduces your taxes owed limited at 75 of your expenses and there is an income cap.