Georgia Department Of Revenue Check My Refund

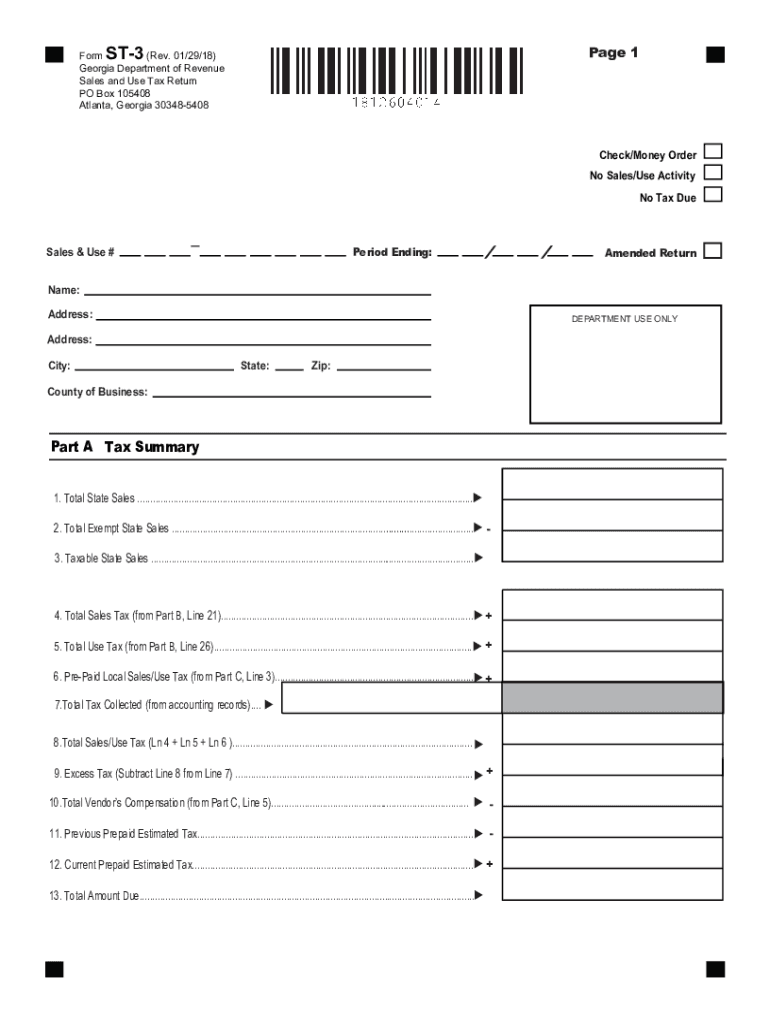

What are my payment options.

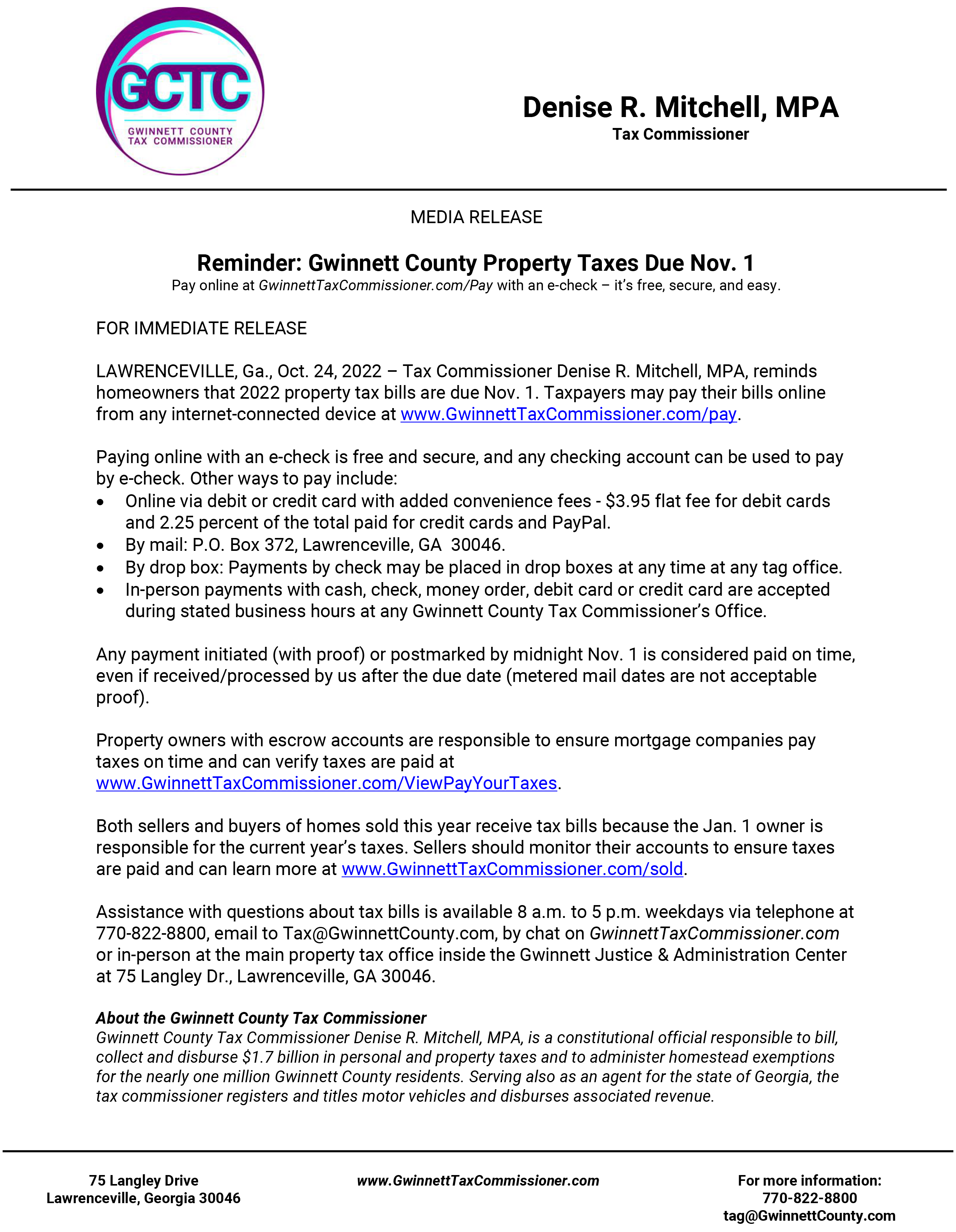

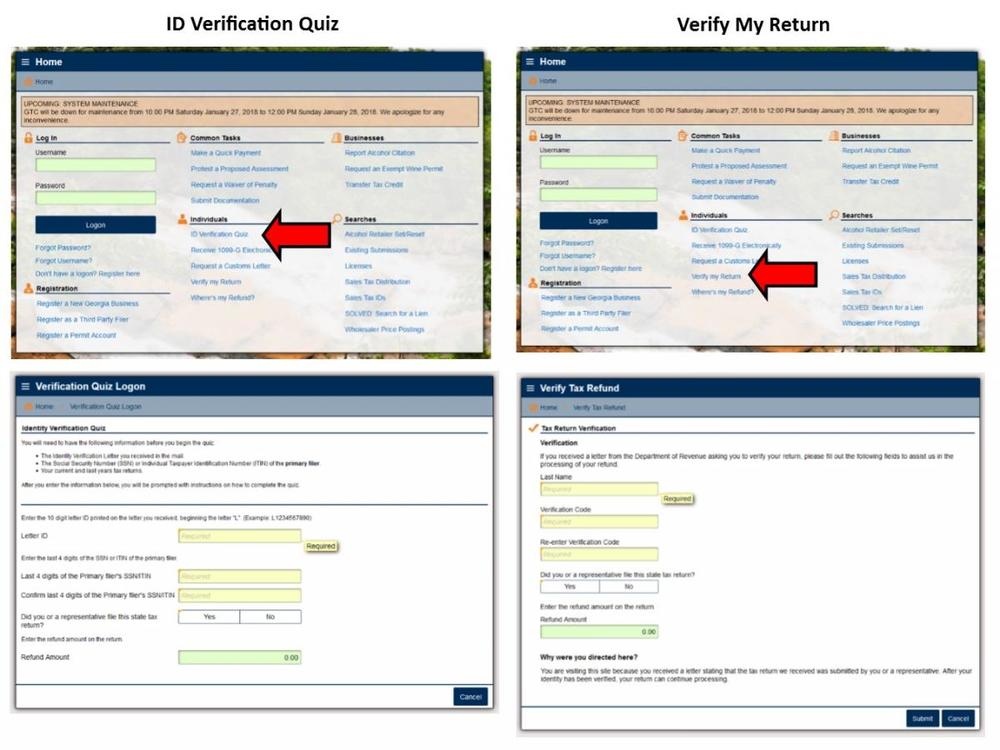

Georgia department of revenue check my refund. The department of revenue is protecting georgia taxpayers from tax fraud. Who it may affect taxpayers who had their 2017 tax year refund issued to them on or before february 16 2018. Refunds information for tax professionals audits.

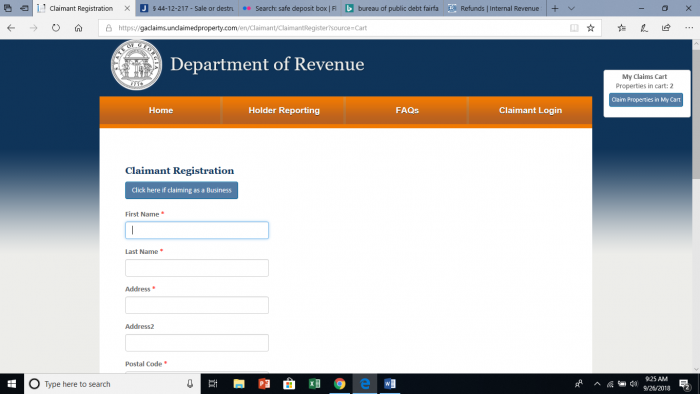

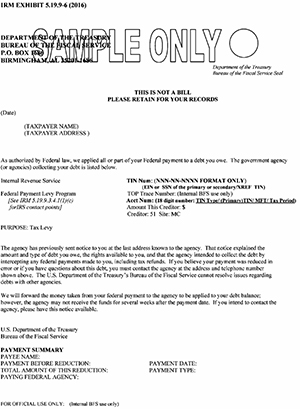

We will begin accepting returns january 27 2020. File my return instructions forms and more approved software vendors wheres my refund. What you need to know the georgia department of revenue recently sent a follow up letter titled refund claim from our taxpayer services division regarding your refund for the 2017 tax year example of the letter is below please disregard this letter.

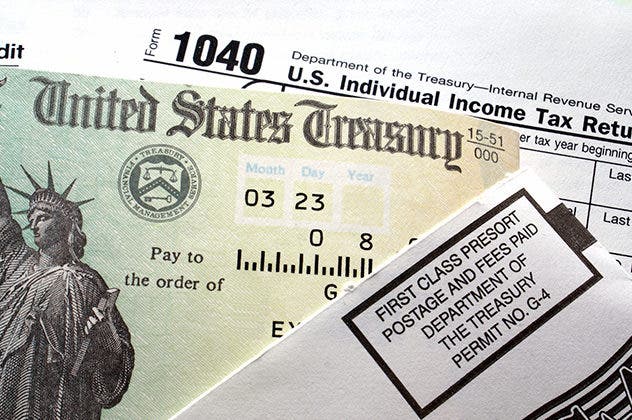

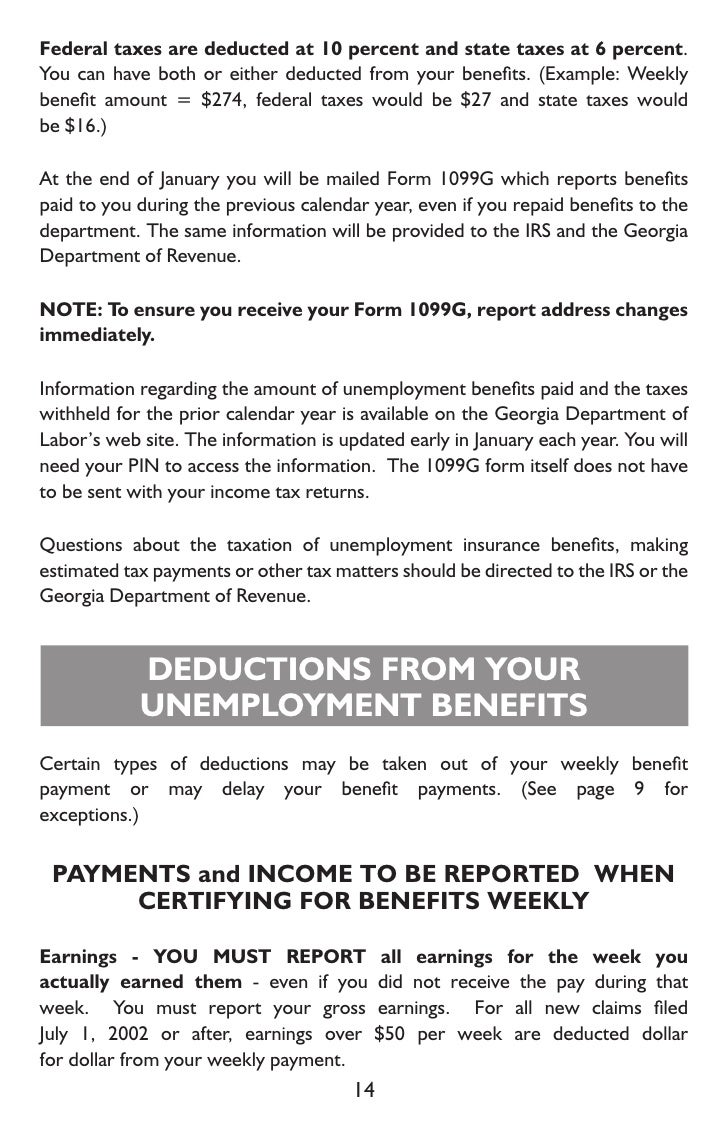

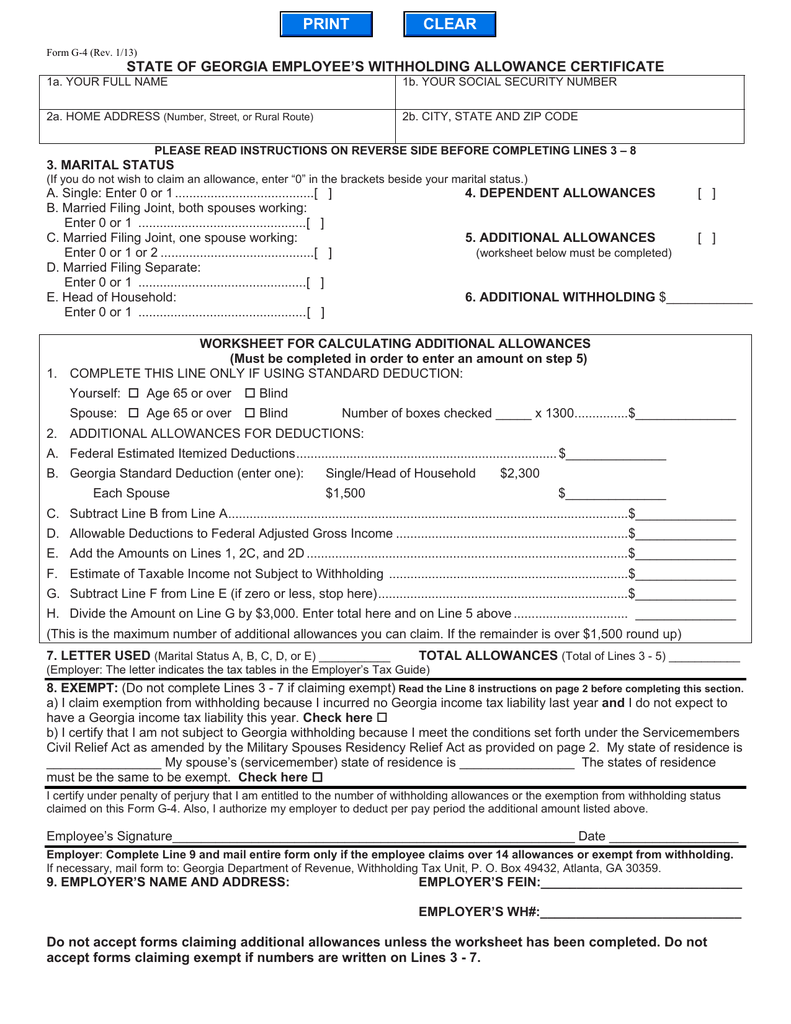

Send copies of the above documents along with your original refund check to. How can we help. Georgia individual income tax is based on the taxpayers federal adjusted gross income adjustments that are required by georgia law and the taxpayers filing requirements.

Social security number or itin. An income tax return refund is the result of too much tax withholding estimated tax payments by a taxpayer throughout a tax year. Your exact refund amount.

Name change decree from superior court. Twitter page for georgia department of revenue. To have a refund check reissued in your changed name submit a copy of two of the following accepted documents.

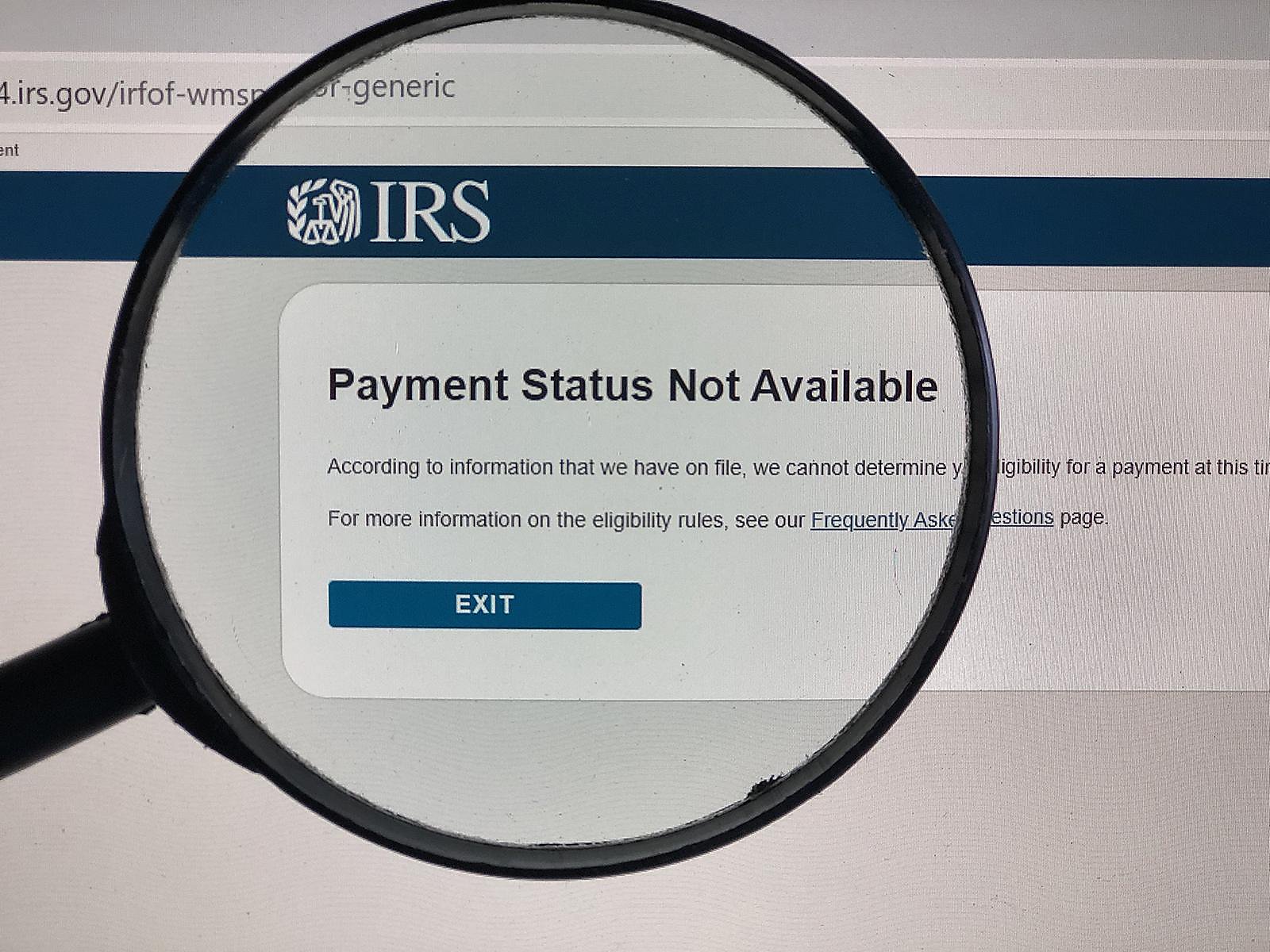

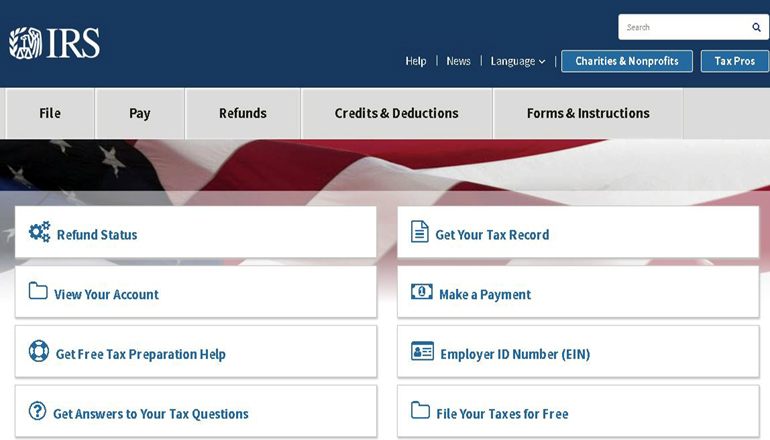

Generally the irs issues most refunds in less than 21 days but some may take longer. The department of revenue has resumed in person customer service as of monday june 1 2020. Ia 81 replacement check request form.

Download the irs2go app to check your refund status. Additionally taxpayers can still conduct all business with the department via online services telephone or designated secure lockbox locations. It may take up to 90 days from the date of receipt by dor to process a return and issue a refund.

You can check the status of your tax refund using the georgia tax center. Your exact whole dollar refund amount you can start checking on the status of you return within 24 hours after the irs received your e filed return or four weeks after mailing a paper return. Due to covid 19 customers will be required to schedule an appointment.

What you will need. Tax refund processing times vary and depend on the accuracy of the original return but youll get your refund more quickly if you file your return electronically. Facebook page for georgia department of revenue.

Formia 81replacementcheck requestpdf 6101 kb department of revenue. 24 hours after e filing.

.jpg)

:max_bytes(150000):strip_icc()/where-s-your-tax-refund-3193203-v4-5b688dc546e0fb004fc28d4e.png)