Georgia Department Of Revenue Building

Register a business with georgia department of revenue.

Georgia department of revenue building. State of georgia government websites and email systems use georgiagov or gagov at the end of the address. Department of labor unemployment insurance new hire reporting program. Voting during covid 19 georgia is taking steps to protect the health of voters and poll workers.

44 12 217 the state revenue commissioner gives notice that they will release for sale abandoned securities currently being held by the georgia department of revenue. What i did have to do though was simply pick up a liquor license. Small business administration georgia state agencies and organizations department of administrative services georgia code first stop business information center.

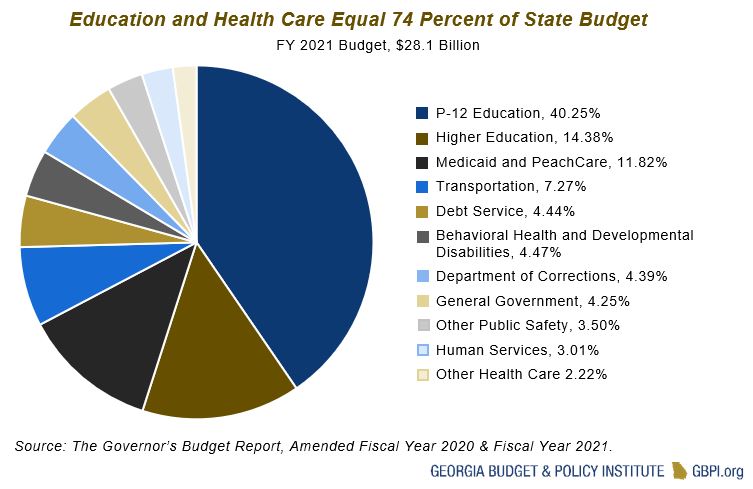

According to the georgia department of revenue the rd tax credit saved georgia companies 116 million in taxes from 2011 to 2014. Before sharing sensitive or personal information make sure youre on an official state website. 3 reviews of georgia dept of revenue youre like aww snap did jonathan have to vist the department of revenue because he owed back taxes nah man.

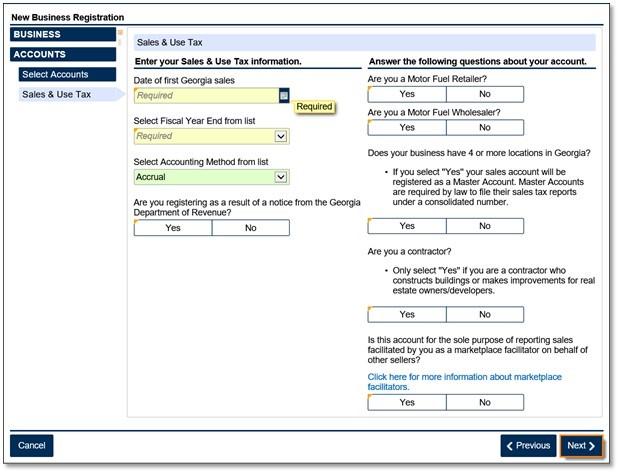

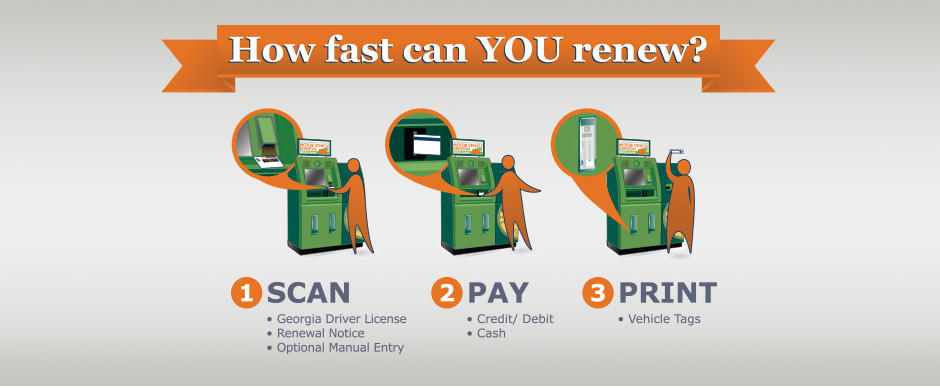

If your credits exceed your corporate tax liability the excess can be applied to your payroll withholding liability or carried forward for up to 10 years. The georgia department of revenue can help you register to pay business related taxes get alcohol or tobacco related permitslicenses register company vehicles and understand your responsibilities regarding state withholding taxes if you have employees. Due to covid 19 customers will be required to schedule an appointment.

Vote by mail to avoid person to person contact. Local state and federal government websites often end in gov. The department of revenue has resumed in person customer service as of monday june 1 2020.

State of georgia government websites and email systems use georgiagov or gagov at the end of the address. Request an absentee ballot. Starting a business in georgia is an exciting venture.

I pay my fair share. Local state and federal government websites often end in gov. Check your registration status.

These sales tax exemptions are defined in ocga. 48 8 3 and several key exemptions are outlined in the table below. Georgia helps companies lower their cost of doing business by offering the ability to purchase various types of goods and services tax free.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19860899/JTP_1669.jpg)