Georgia Ammo Tax

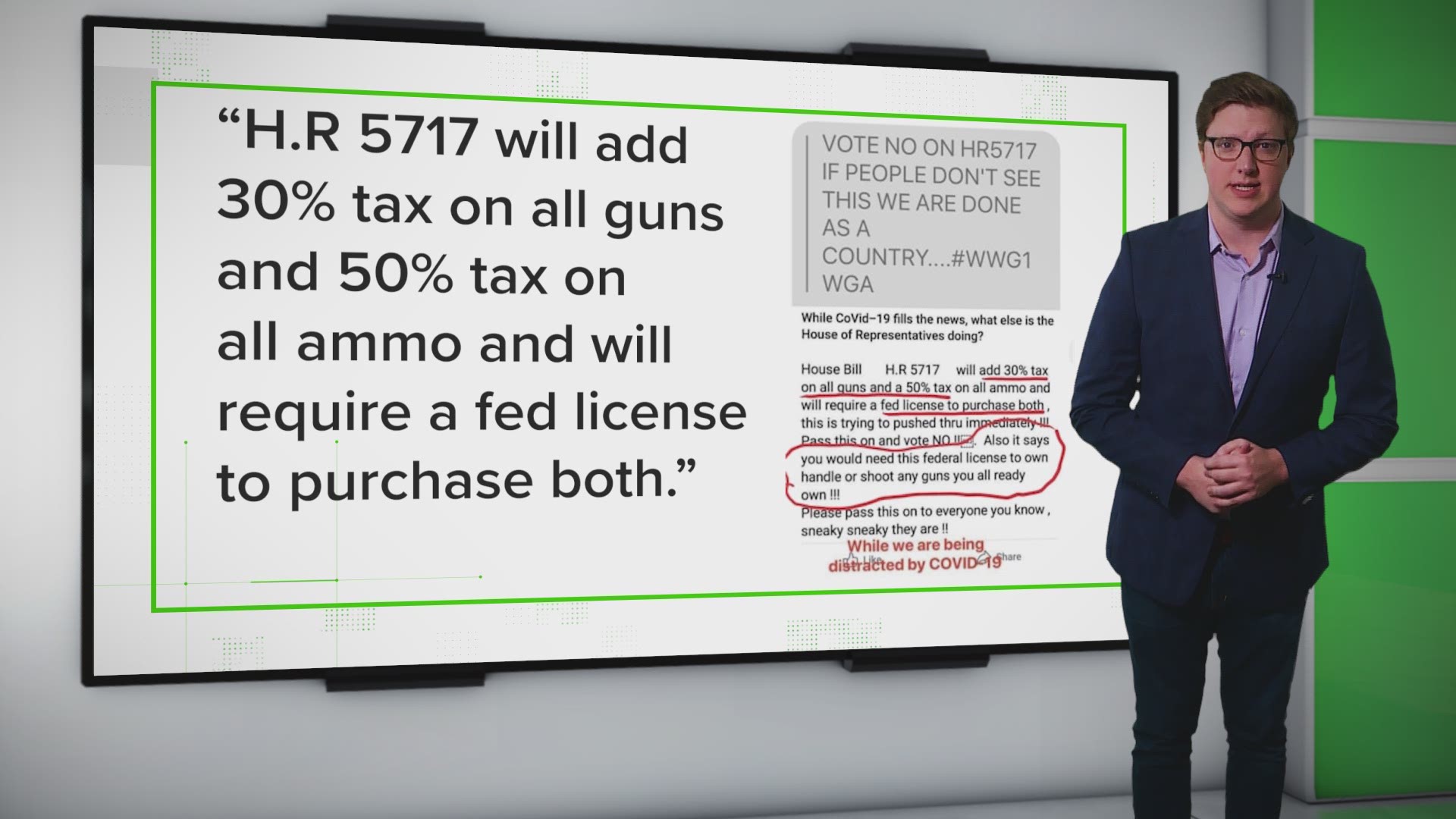

The bill aims to not only impose a 30 percent tax on all guns but also a 50 percent tax on all ammo.

Georgia ammo tax. The bills intent is to end the epidemic of gun violence and. Hank johnson d ga introduced in january hr. This is trying to get pushed through immediately.

556mm green tipped ammo. 5717 would implement a 30 tax on all gun sales and 50 tax on all ammunition sales. Johnson on january 30th introduced the gun violence prevention and community safety act alongside a slew of other prohibitions.

Jillian gilchrest d west harford when asked whether her proposal to tax gun ammunition by 35 is a punishment on lawful gun owners. If you are looking for bulk ammunition you came to the right website. Bulk ammo for sale online.

Pass it on and. My last order was for 300 rds. 119 delivered zero sales taxes in my state and it comes with a 15 dollar plano with cabelas name on it 50 cal.

This 1099 g form is for taxpayers who itemized deductions and received a refund credit or offset. 33 cents a round when one removes my cabelas discount and cost of storage box. 5717 known as the gun violence prevention and community safety act of 2020 is suggesting to tax ammunition by 50 percent.

Check out our massive selection of in stock ammunition. Only this time the ineffective gun ban 20 is being accompanied by a proposed 30 firearm sales tax and 50 yes fifty percent ammunition sales tax. Taxpayers now can search for their 1099 g and 1099 int on the georgia tax center by selecting the view your form 1099 g or 1099 int link under individuals.

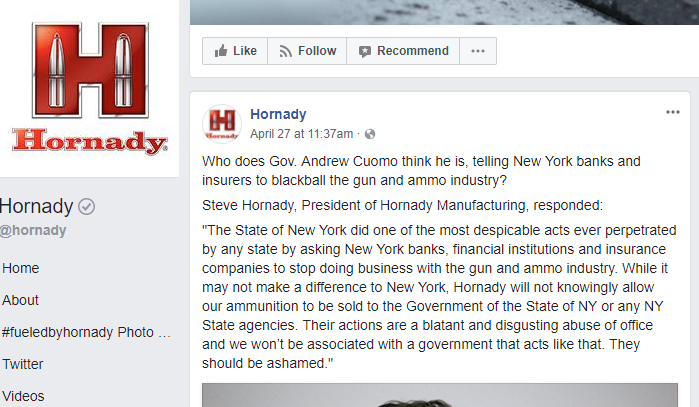

Hr 5717 will add a 30 percent tax on all guns and a 50 percent tax on all ammo and will require a fed license to purchase both. We would like to show you a description here but the site wont allow us. Now thats a good deal on some very good ammo.

For individuals the 1099 g will no longer be mailed. A spokesperson from johnsons office said the bills intent is to end the epidemic of. 5717 a bill that would strengthen.

An emotional scolding from state rep.