Georgia Agriculture Tax Exemption

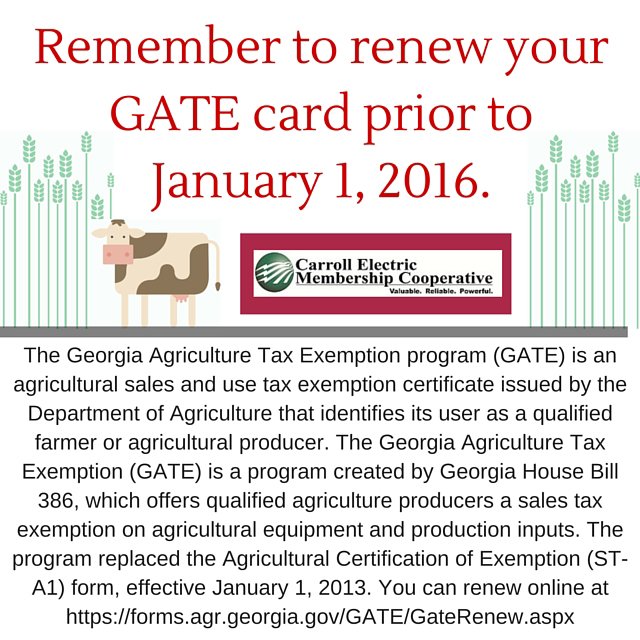

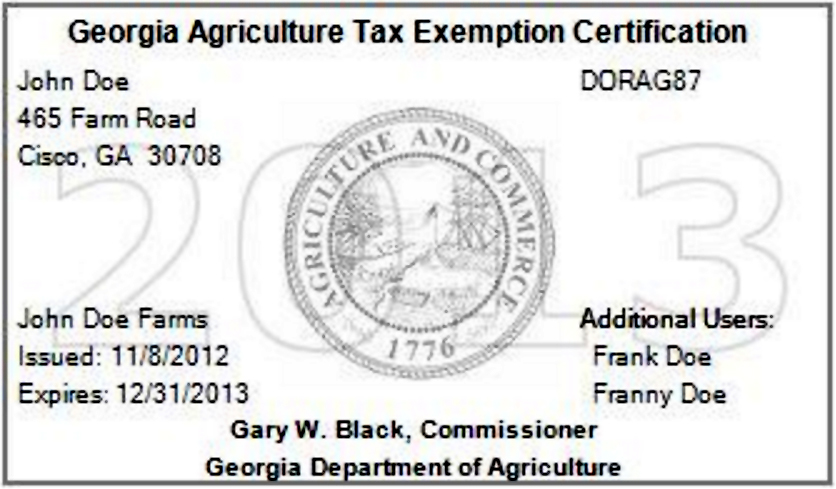

With the exception of the georgia agricultural tax exemption gate certificate which expires on an annual basis.

Georgia agriculture tax exemption. To receive the homestead exemption for the current tax year the homeowner must have owned the property on january 1 and filed the homestead application by the same date property tax returns are due in the county. Dealer or lessor date the undersigned hereby certifies that all tangible personal property purchased or leased on or after this date will. You may email your questions or comments directly to farmtaxatagrgeorgiagov.

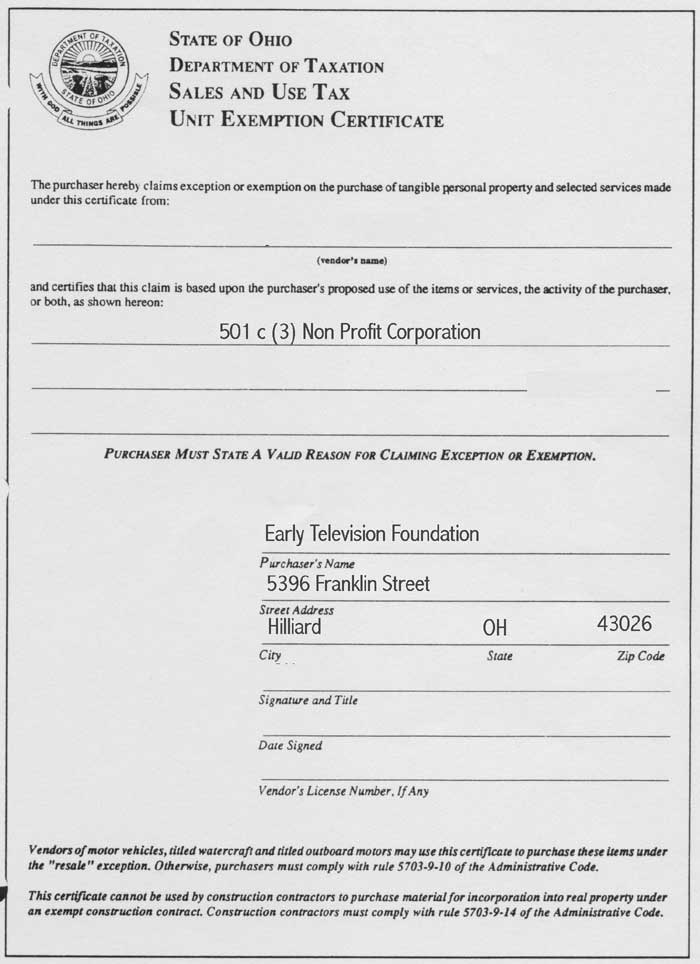

5 georgia tax exemption advisory board a board appointed by the commissioner in accordance with the official code of georgia title 48 chapter 8 section 33. Tax exemption certificate issued by the georgia department of agriculture that identifies its user as a qualified agriculture producer. Microsoft word st a1 revised 6 2008doc st a1 rev 0608 state of georgia department of revenue agricultural certificate of exemption sales and use tax effective july 1 2008 20 to.

Agricultural certificate of sales tax exemption document title. Georgia agricuture tax exemption. To contact our call center between the hours of 8am and 500pm m f dial 1 855 farm tax or.

You can print your gate id card by clicking the print button below. The georgia agriculture tax exemption gate is a program created through legislation which offers qualified agriculture producers a sales tax exemption on agricultural equipment and production inputs. Qualified farmers and agricultural producers can apply to receive a certificate showing that they are eligible for this exemption.

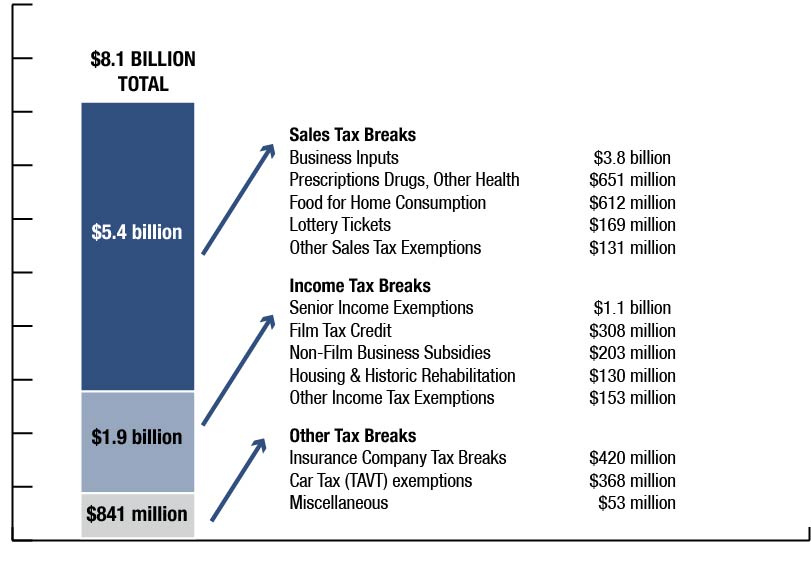

The department maintains a list of sales and use tax exemptionsthe exemptions are codified in chapter 8 of title 48 of the official code of georgia. 6 commissioner the. Exemptions offered by the state and counties.