Does Georgia Tax Social Security Payments

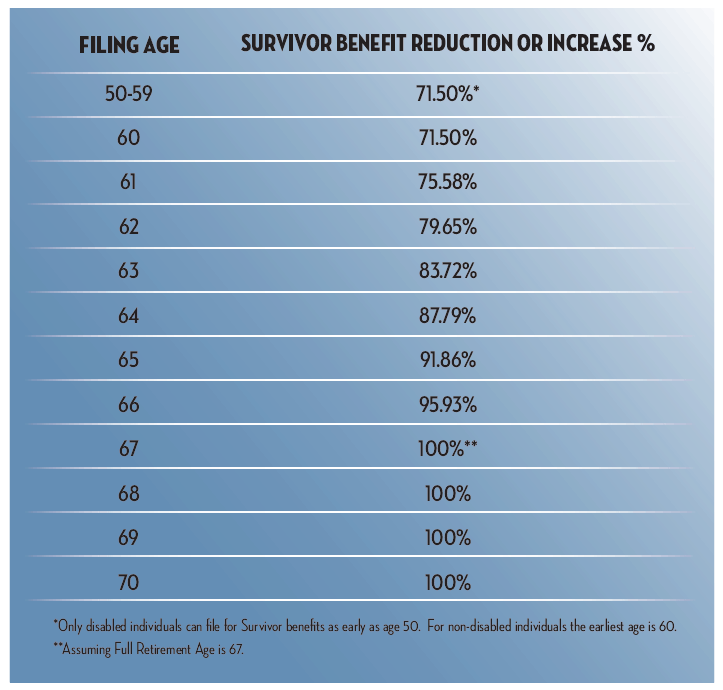

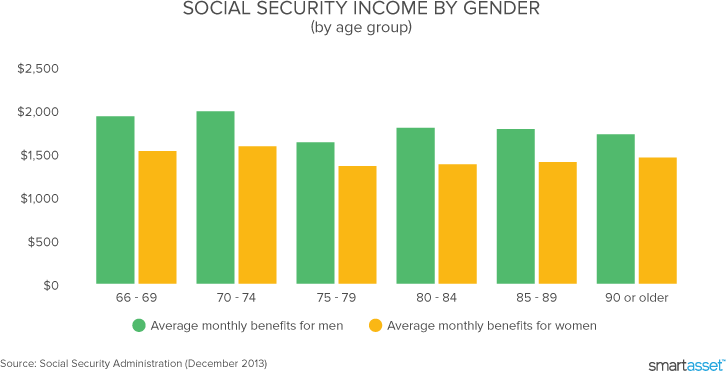

You would pay taxes on 85 percent of your 18000 in annual benefits or 15300.

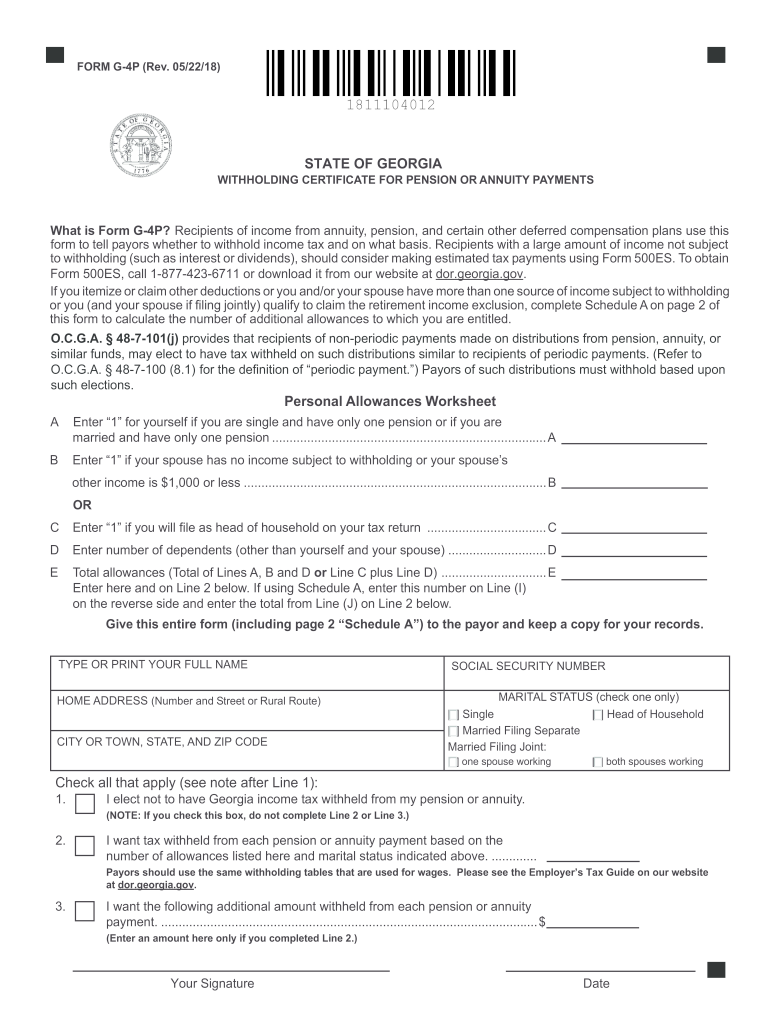

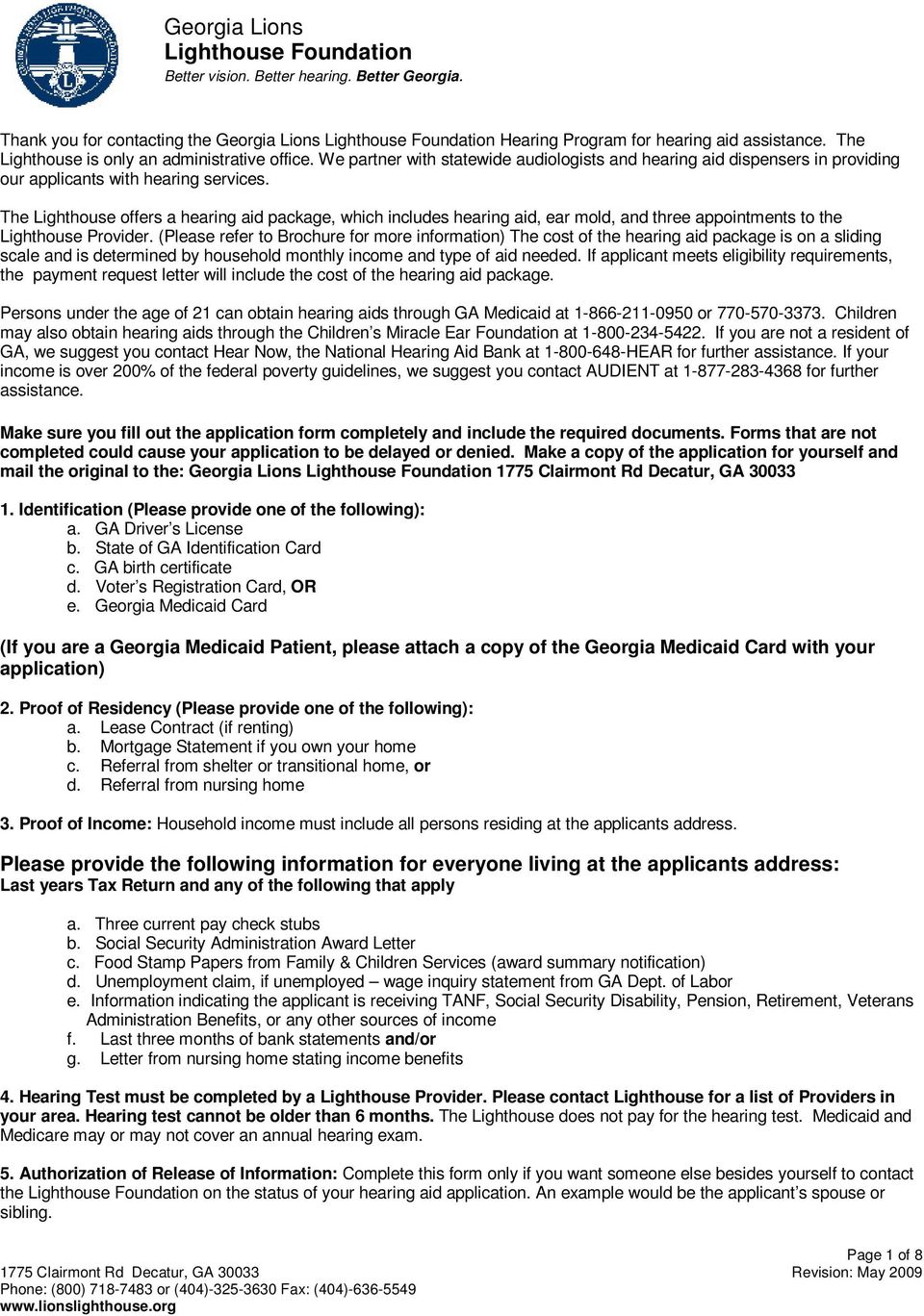

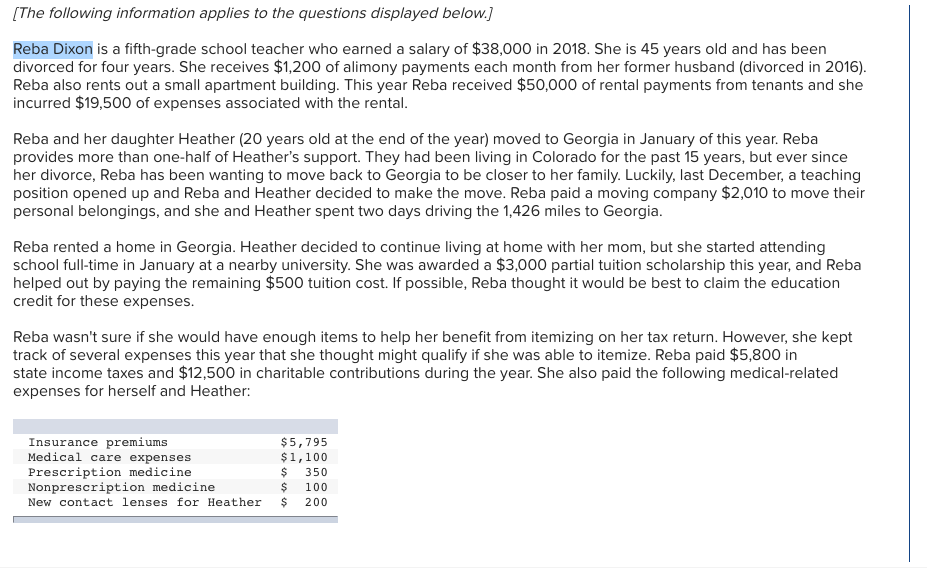

Does georgia tax social security payments. Always look at the big picture. Georgia has no inheritance or estate taxes. Georgia does not tax social security retirement benefits and provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older.

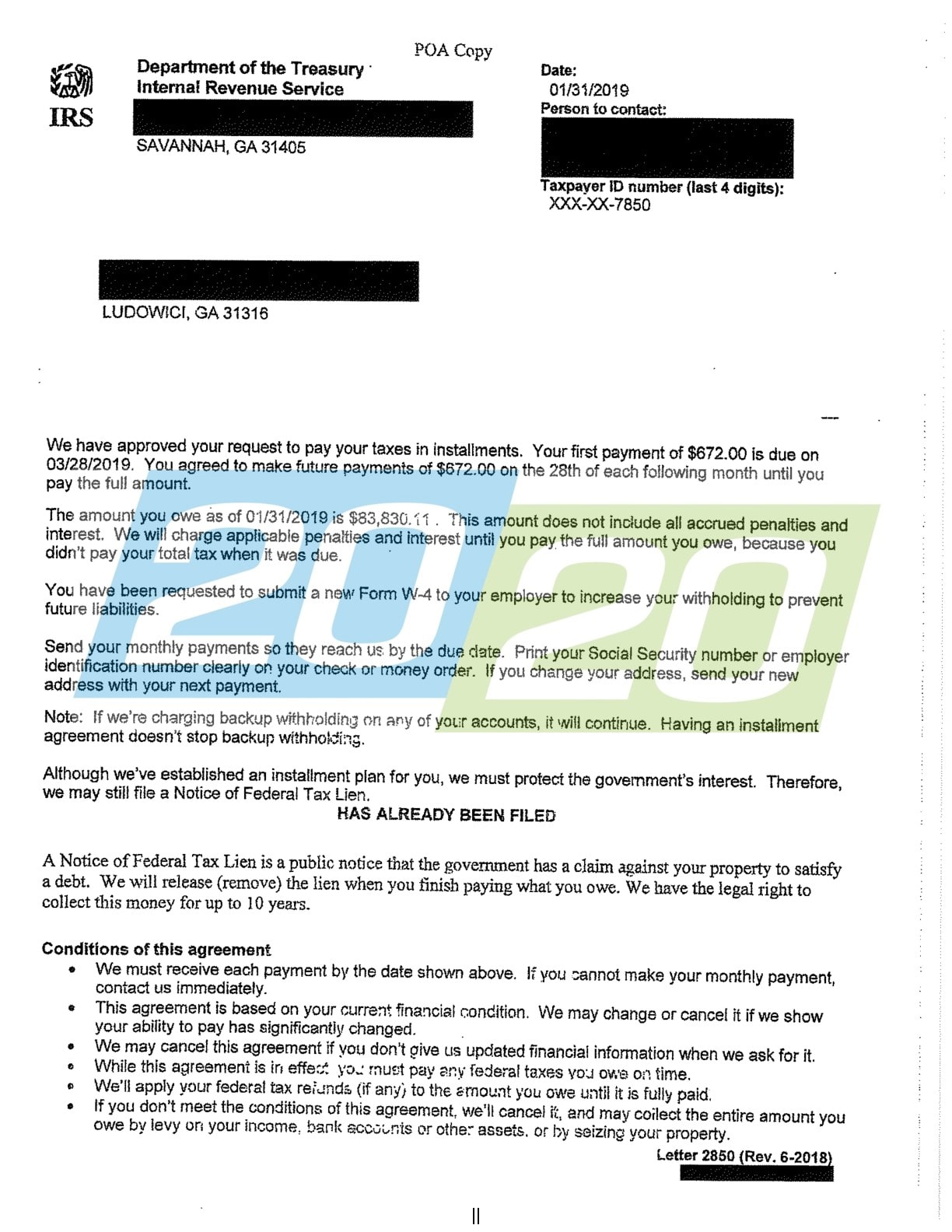

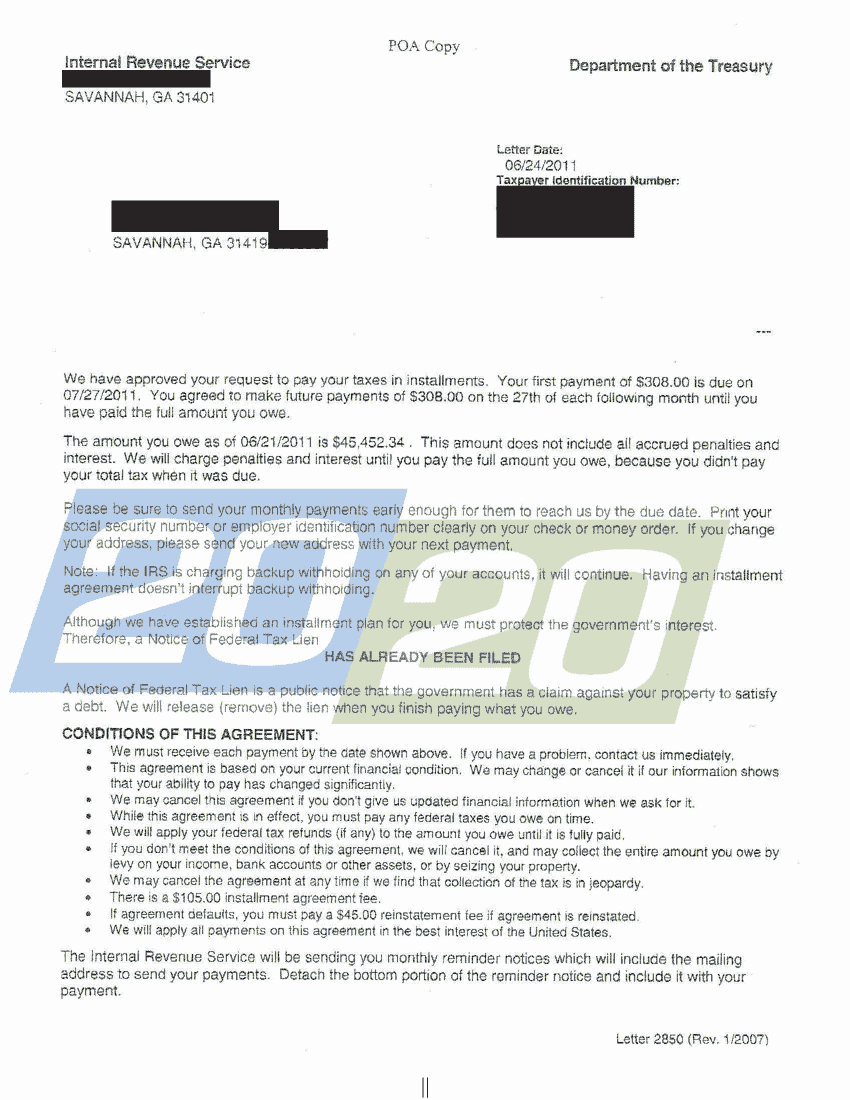

Taxable social security and railroad retirement on the federal return are exempt from georgia income tax. For purposes of determining how the internal revenue service treats your social security payments income means your adjusted gross income plus nontaxable. If your combined income was more than 34000 you will pay taxes on up to 85 of your social security benefits.

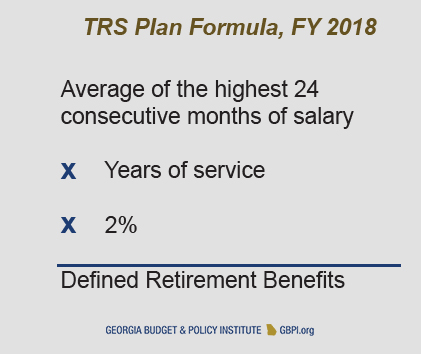

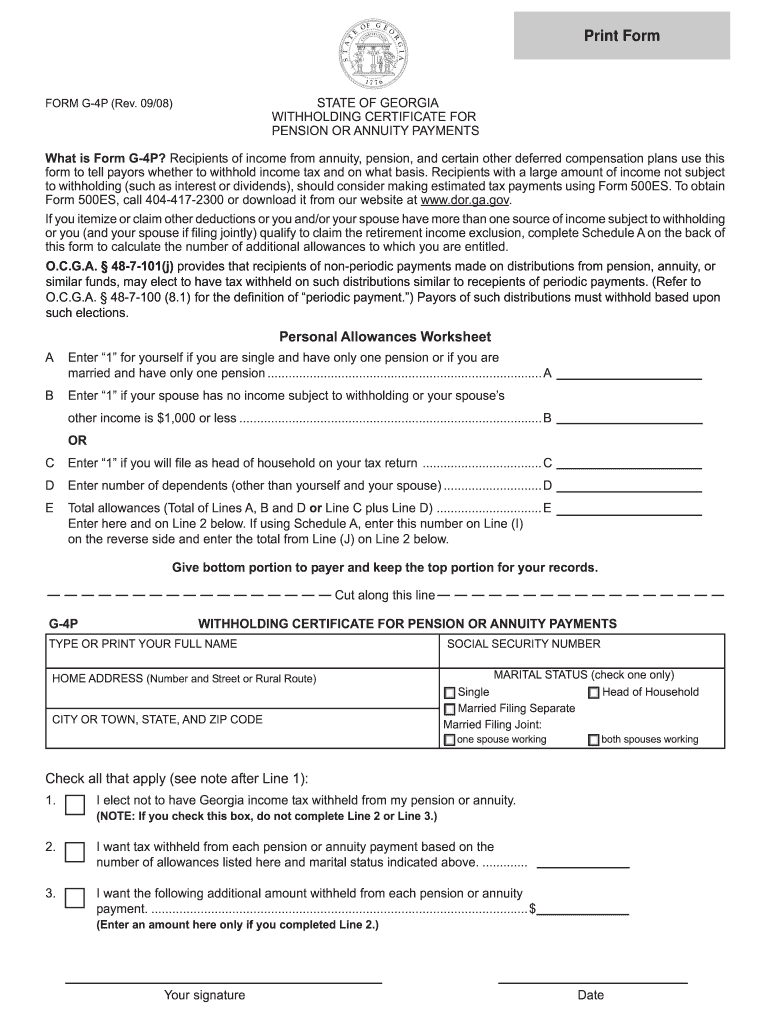

Are pensions taxable in georgia. File a federal tax return as an individual and your combined income is between 25000 and 34000 you may have to pay income tax on up to 50 percent of your benefits. A retirement exclusion is allowed provided the taxpayer is 62 years of age or.

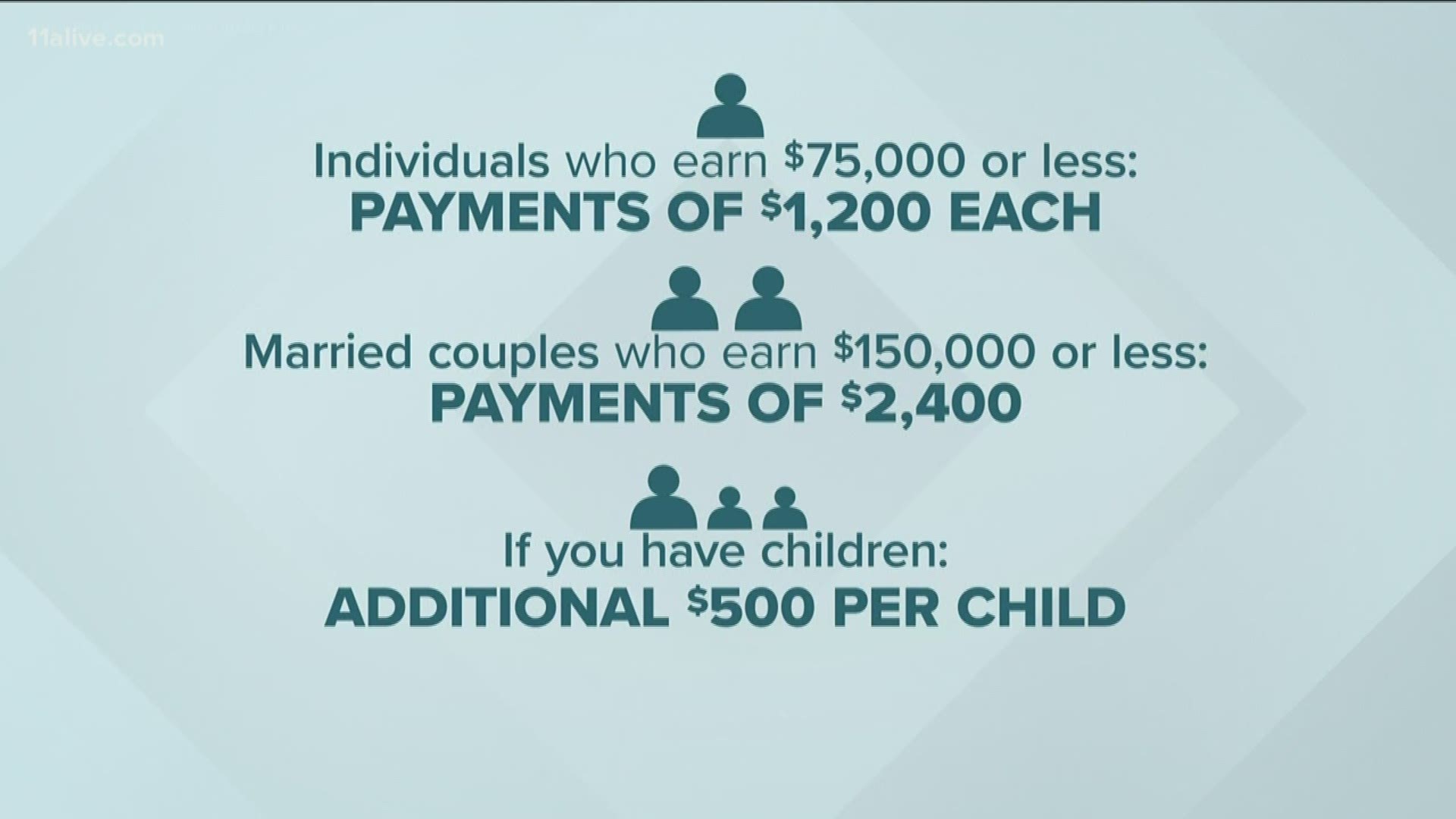

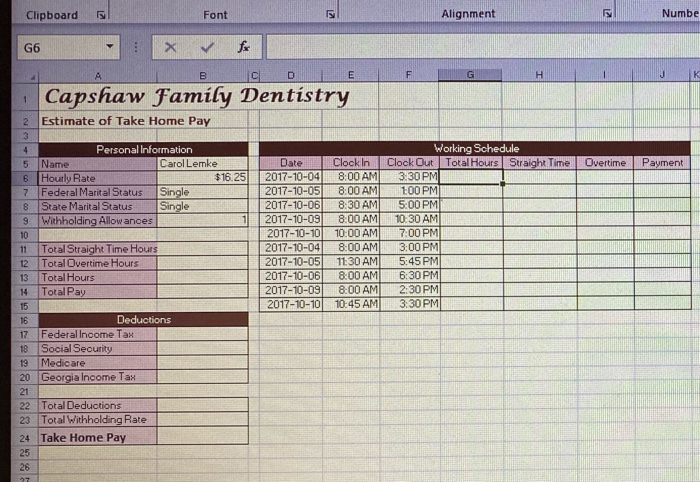

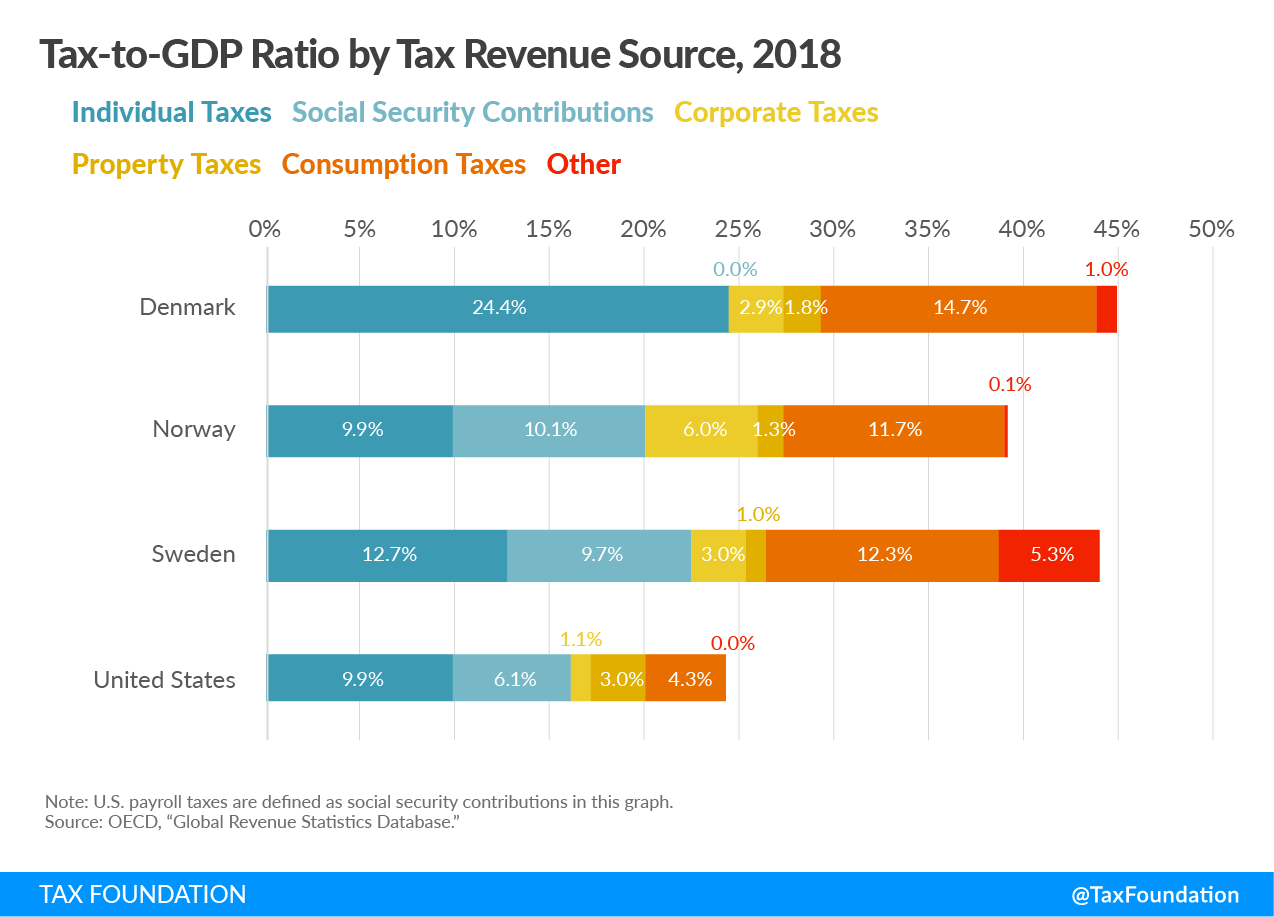

Does georgia offer any income tax relief for retirees. The states sales tax rates and property tax rates are both relatively moderate. A typical worker making 40000 a year would pay 2480 in social security payroll taxes while high income employees would top out at the 853740 maximum tax for 2020.

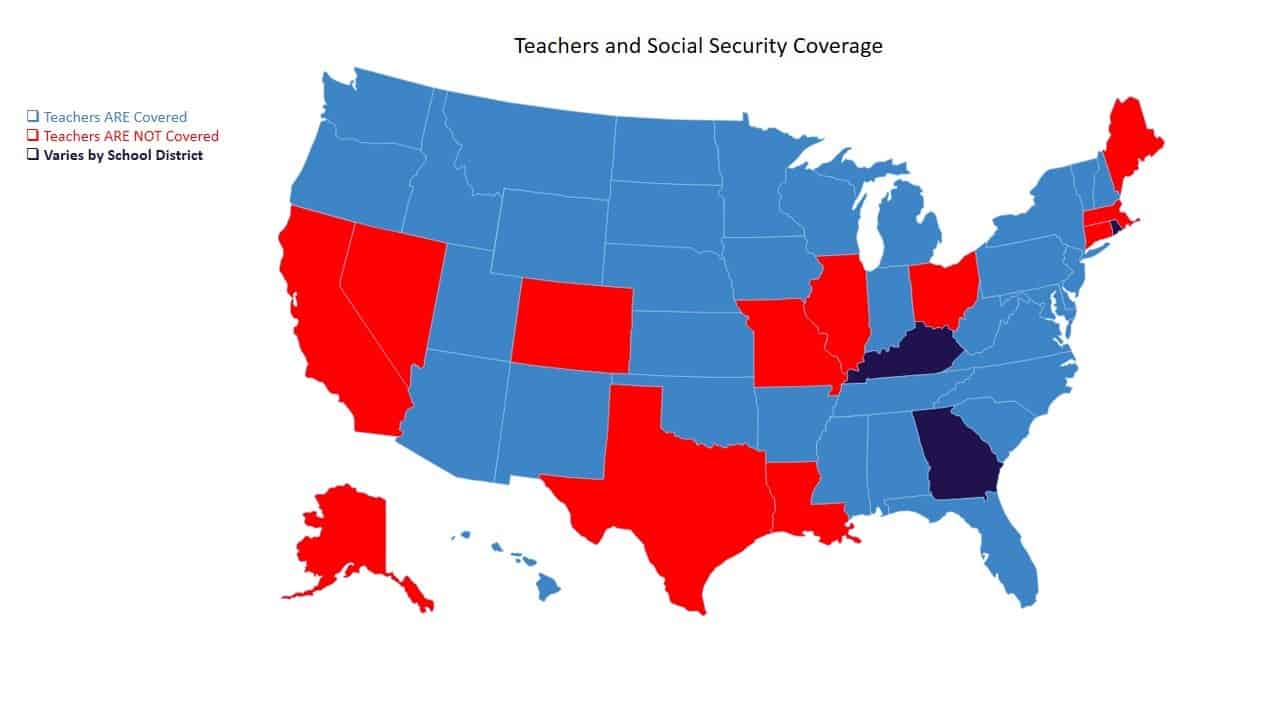

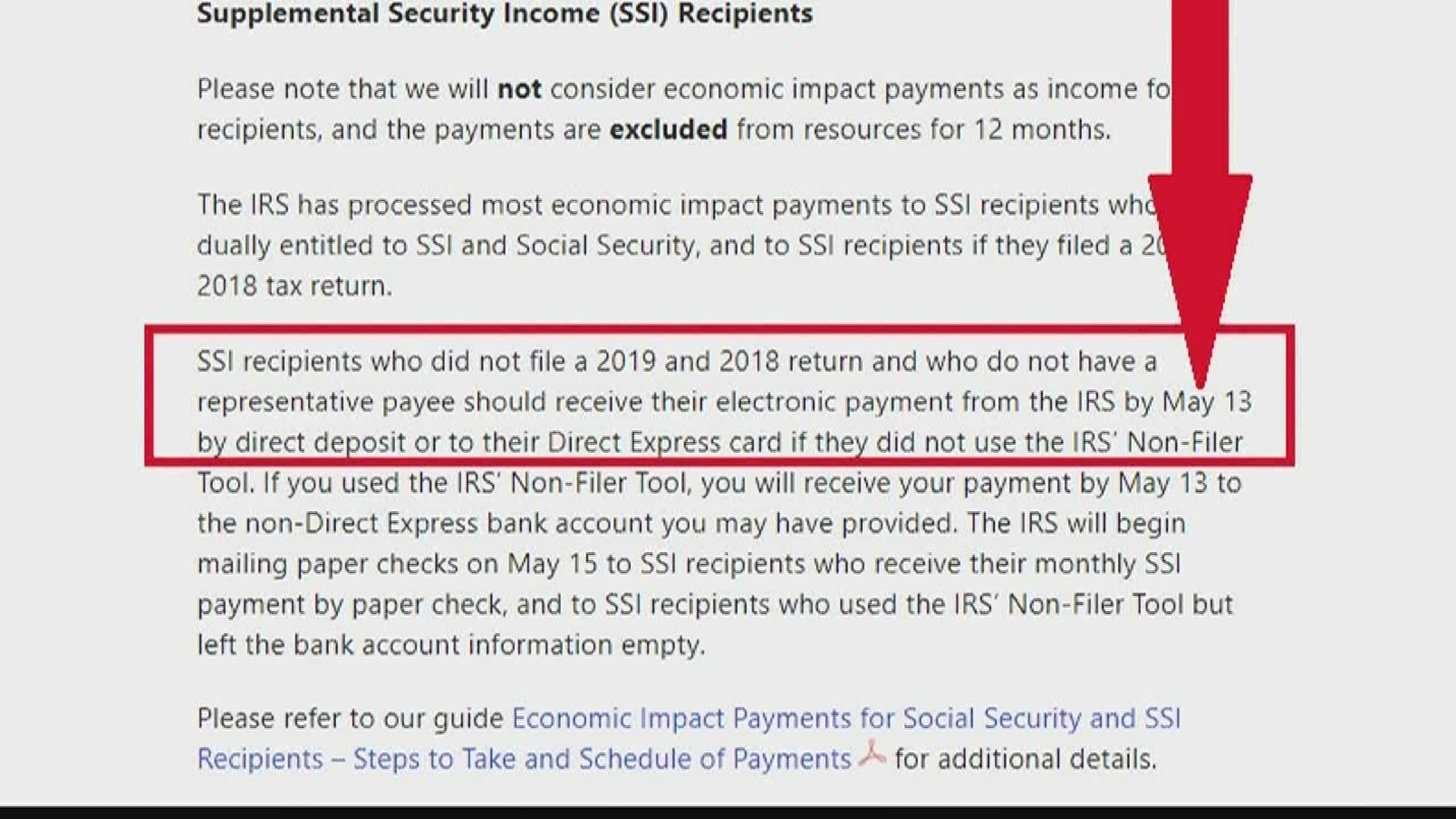

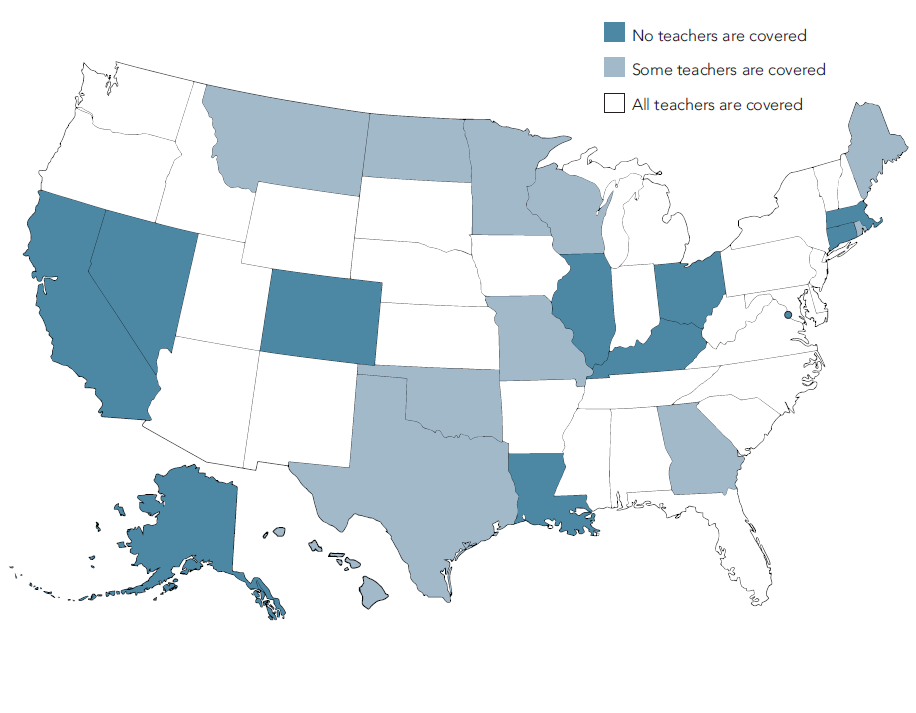

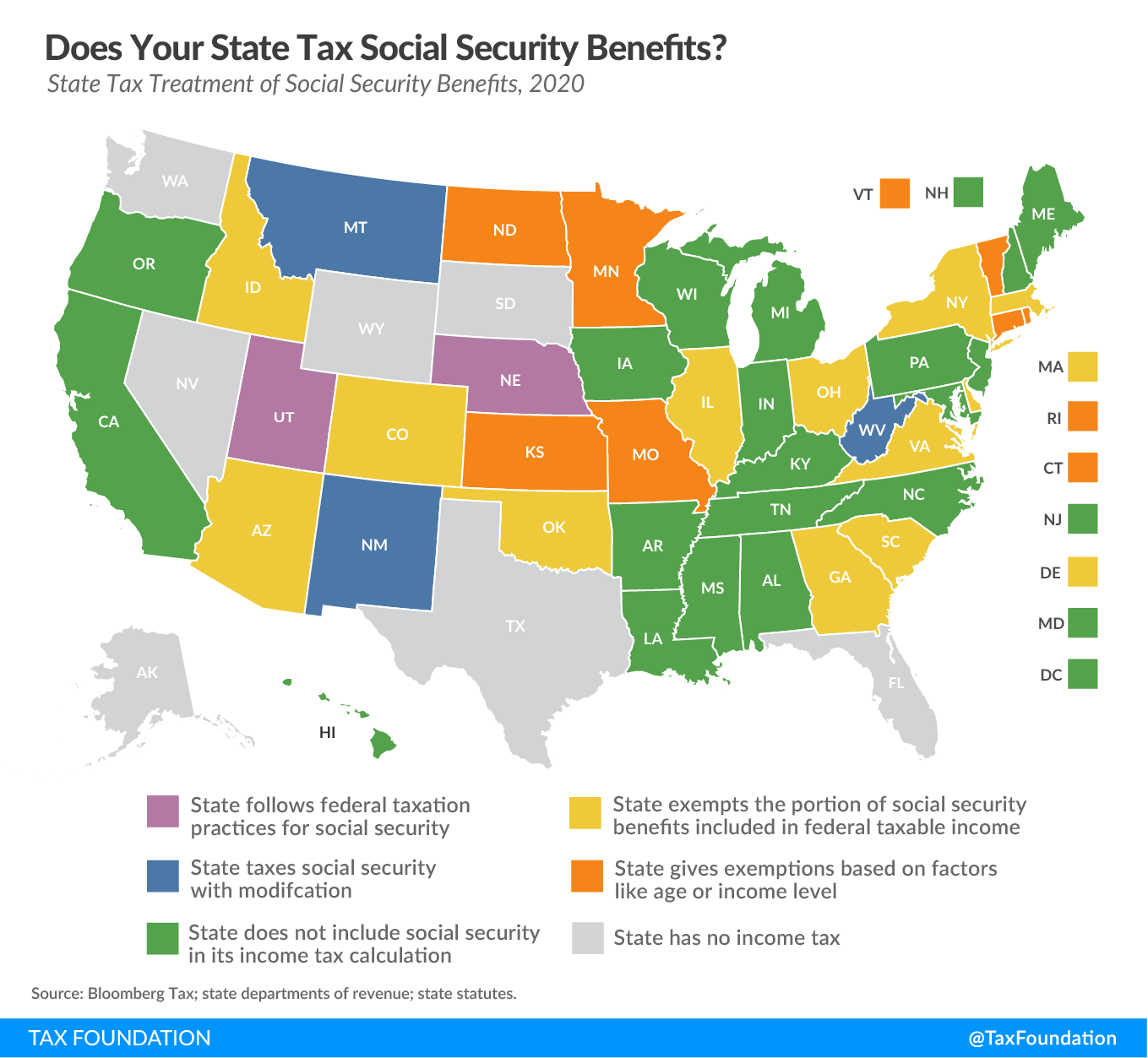

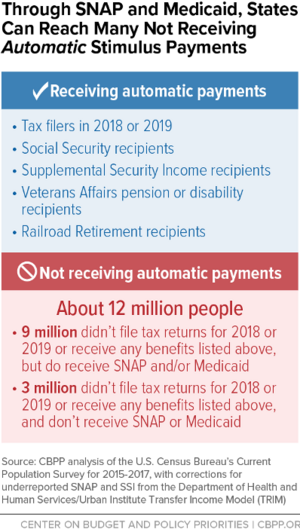

The federal government does tax up to 85 of social security benefits depending on your income but 37 states tax exempt social security income. An estimated 60 of retirees will owe no federal income taxes on their social security benefits what you need to know about how your social security benefits will be taxed in retirement. In addition to a moderate climate and year round warm weather the state of georgia offers tax breaks for seniors including generous exclusions on retirement income.

You will pay tax on only 85 percent of your social security benefits based on internal revenue service irs rules. Does georgia tax social security. Keep in mind this list doesnt necessarily mean these states are the most tax friendly or best states to retire as some states still have other state income taxes sales tax or 401k or pension taxes.

For the 2019 and 2020 tax years single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their social security benefits.

%201.jpg)

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-452705347a6e49ed8e82ca42d0a5cfa2.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/14724117/Undocumented_immigrant_tax_contributions2.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-144560286-577404875f9b5858752b6d6d-1a80d8ccaca4477c86b8b840a36f8868.jpg)

.jpg)