Does Georgia Tax Social Security Disability

The taxable portion is subtracted on schedule 1 of form 500.

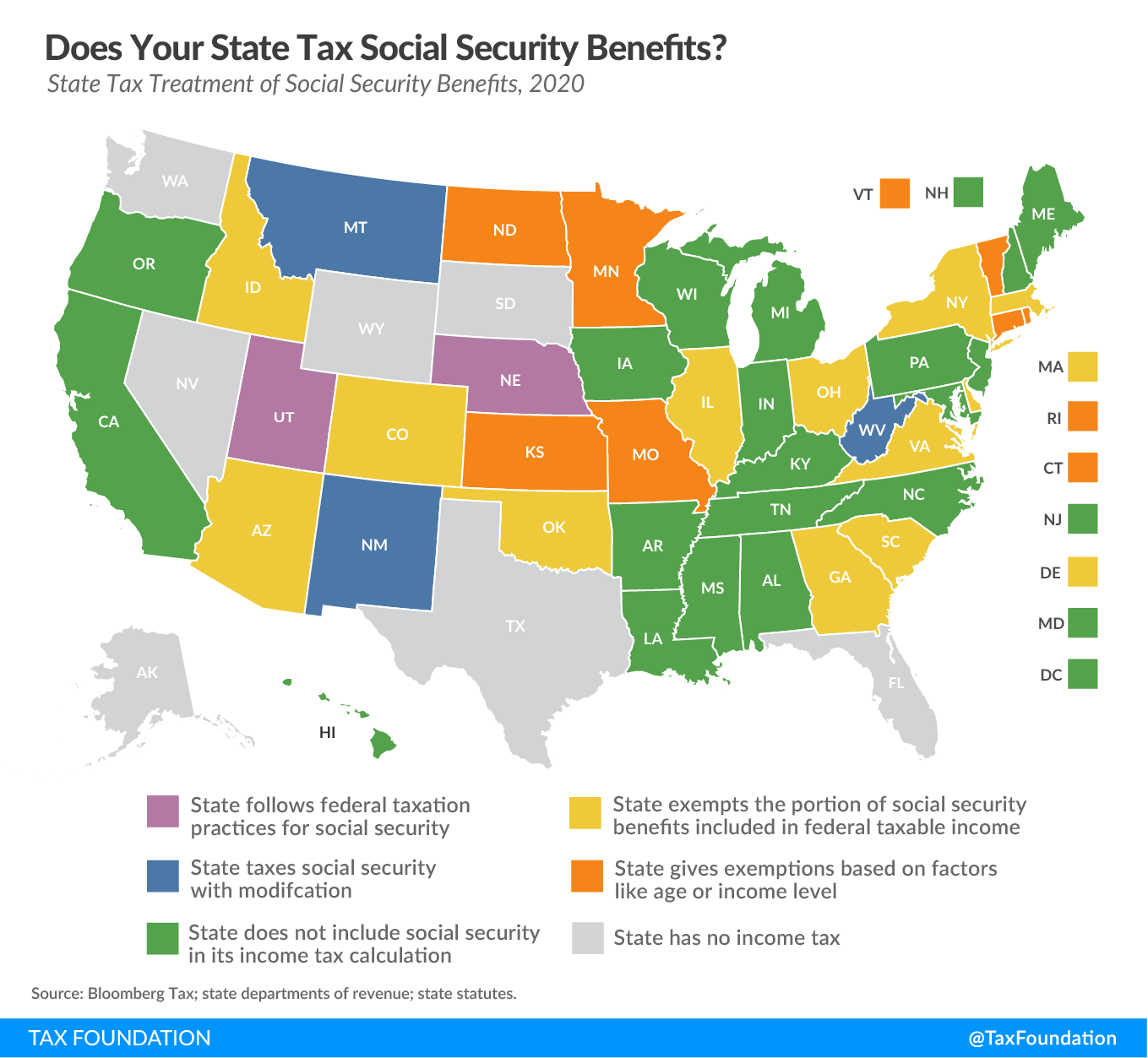

Does georgia tax social security disability. Does georgia offer any income tax relief for retirees. Some states with no social security taxation can still be tax heavy charging a lot in property taxes sales taxes or income taxes or a combination of those. Does georgia tax social security.

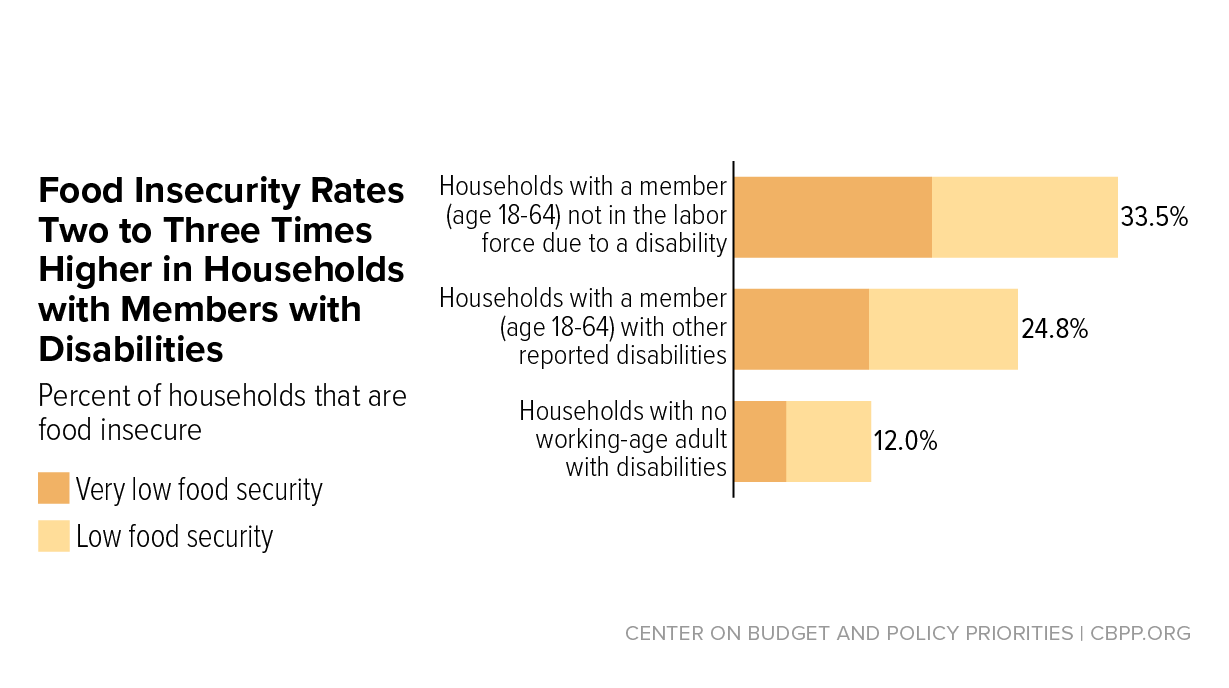

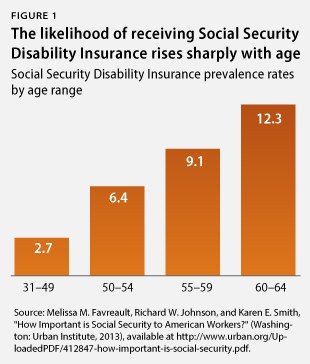

In addition to a moderate climate and year round warm weather the state of georgia offers tax breaks for seniors including generous exclusions on retirement income. Always look at the big picture. Laurence attorney social security disability benefits ssdi can be subject to tax but most disability recipients dont end up paying taxes on them because they dont have much other income.

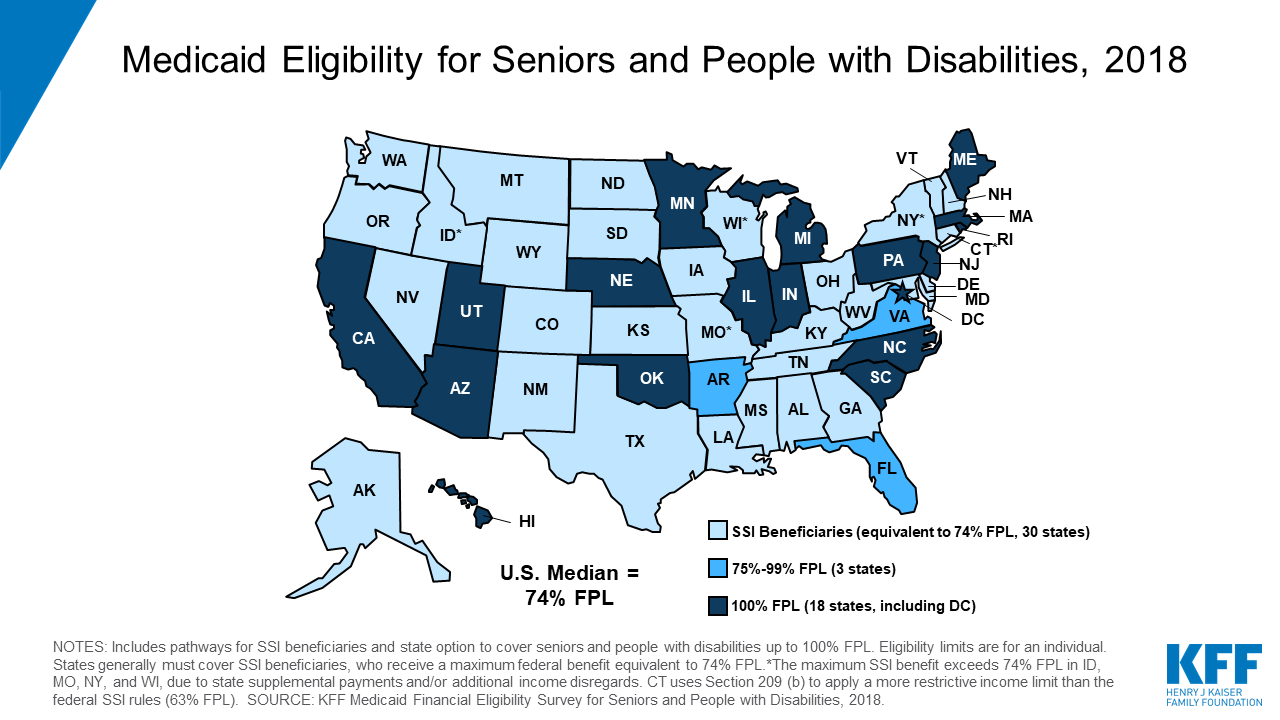

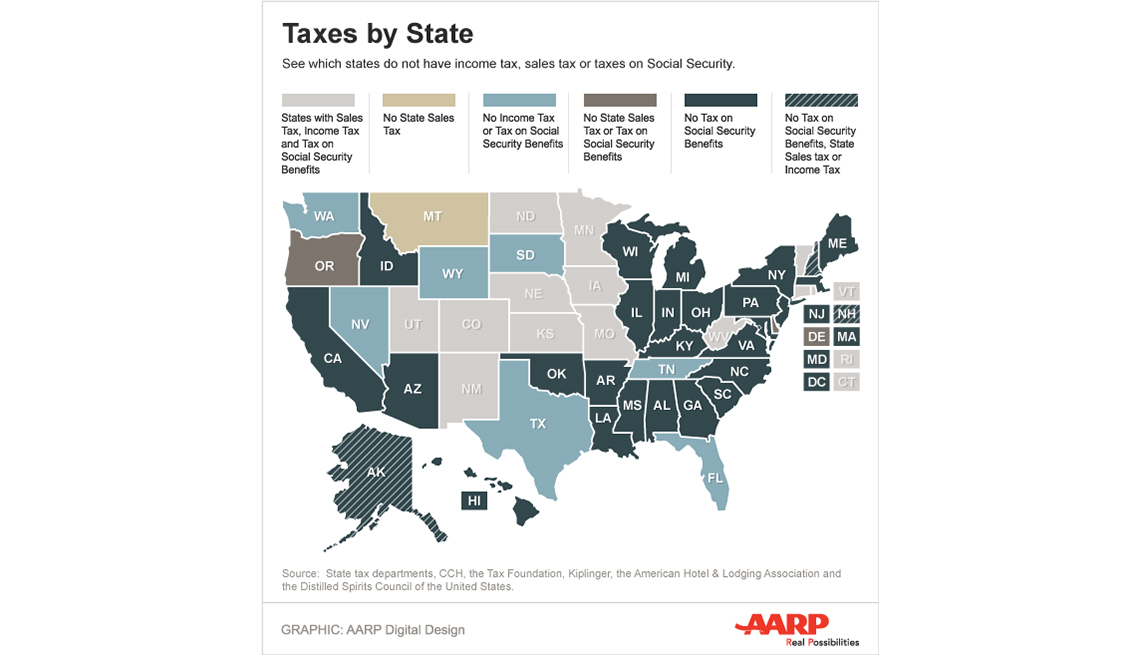

The following states do impose income taxes. Georgia does not tax social security retirement benefits and provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older. The federal government does tax up to 85 of social security benefits depending on your income but 37 states tax exempt social security income.

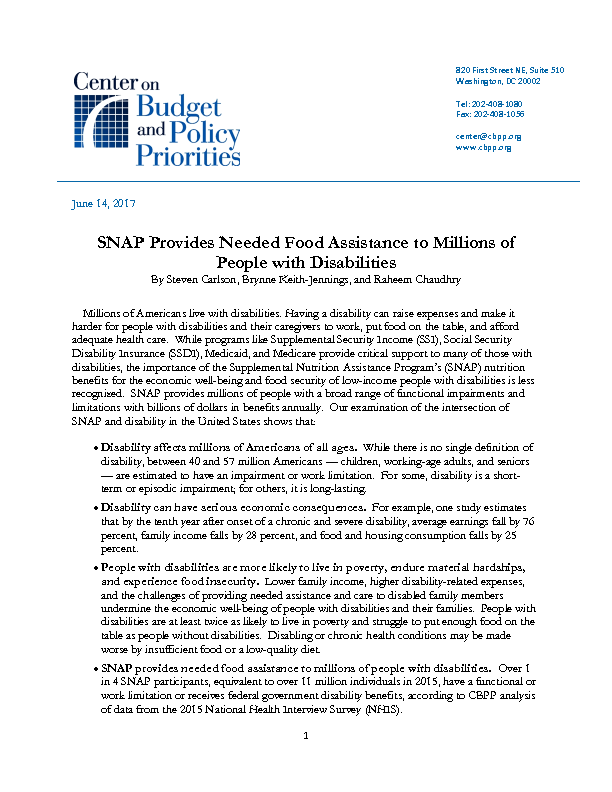

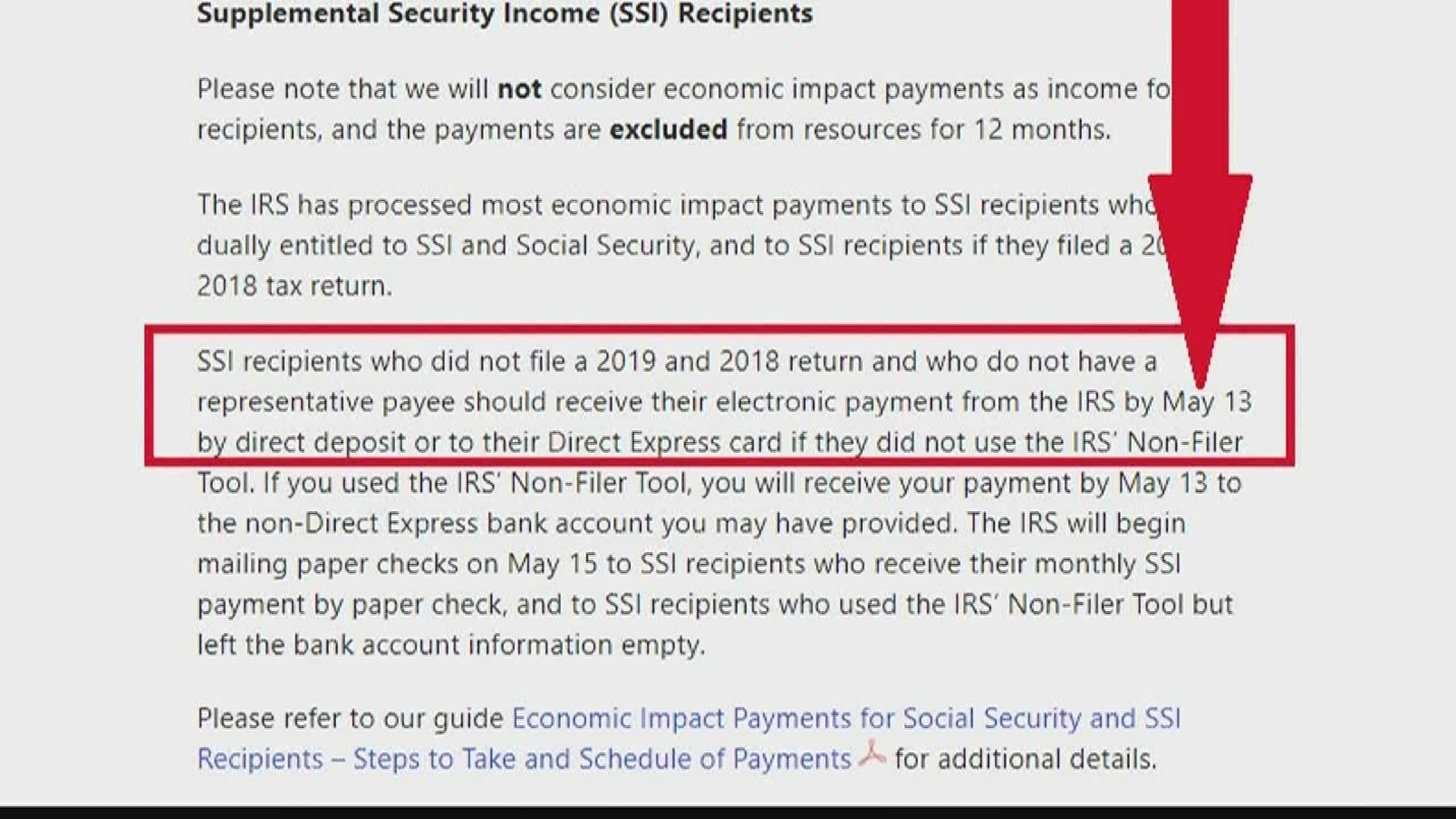

Taxable social security and railroad retirement on the federal return are exempt from georgia income tax. Social security income is exempt from state taxes as is up to 35000 of most types of. Your cost for long term disability coverage is based on your age whether you pay into social security benefit salary and whether or not you are eligible for disability coverage through any state of georgia retirement plan.

A retirement exclusion is allowed provided the taxpayer is 62 years of age or. Ltd premiums are paid with after tax dollars. Keep in mind this list doesnt necessarily mean these states are the most tax friendly or best states to retire as some states still have other state income taxes sales tax or 401k or pension taxes.

You can click on the state to be directed to its tax authority. However georgia remains among the top 10 tax friendly states for retirees as ranked by kiplinger in 2017. Are pensions taxable in georgia.

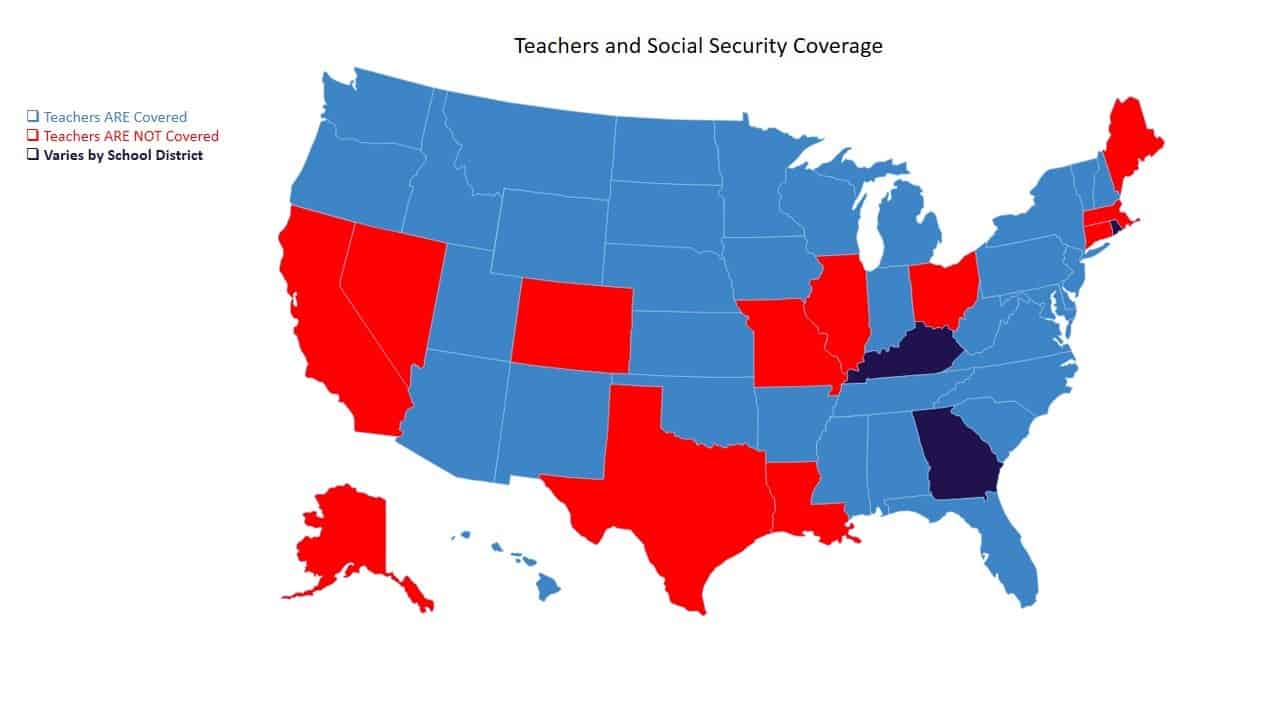

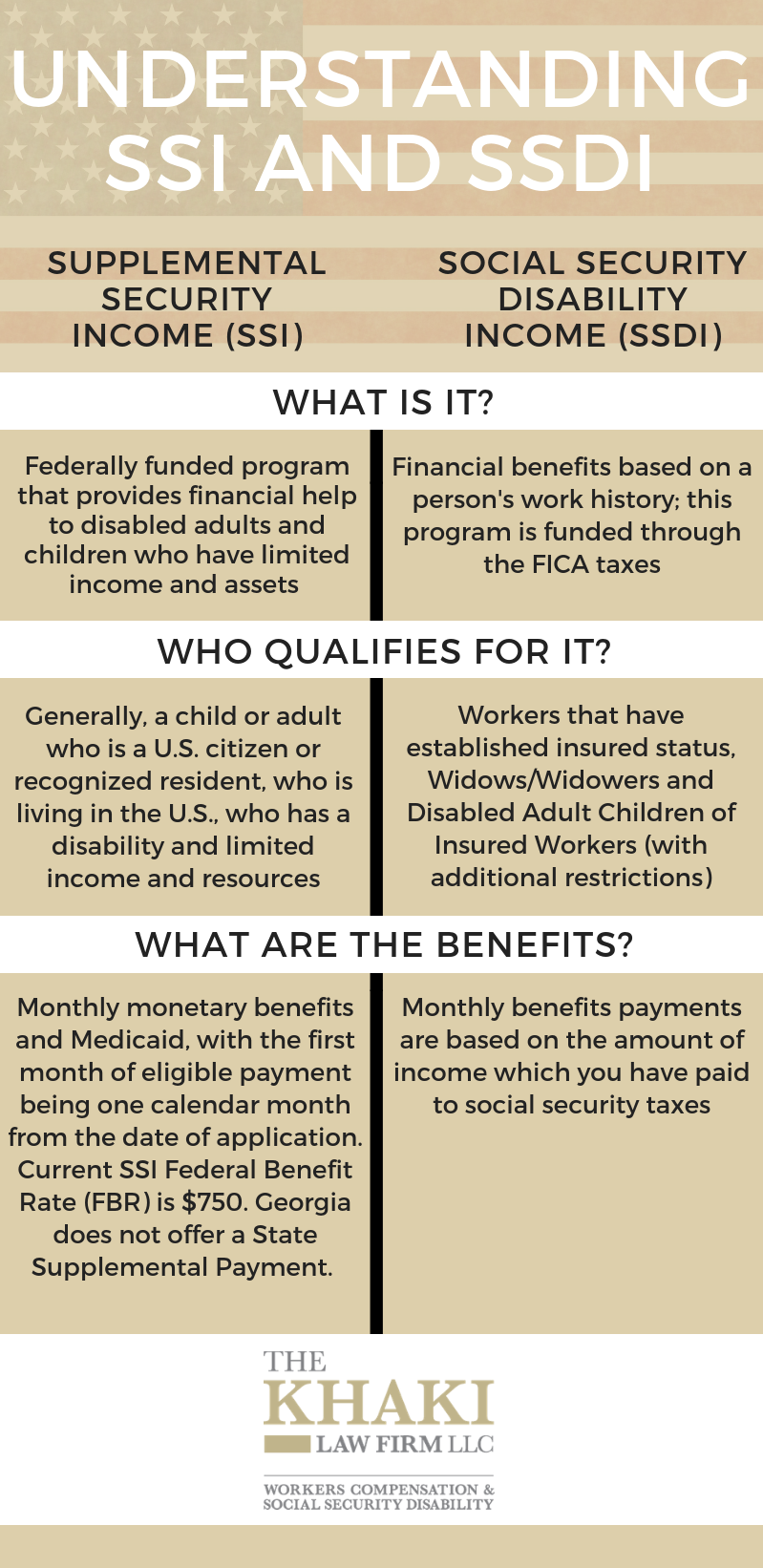

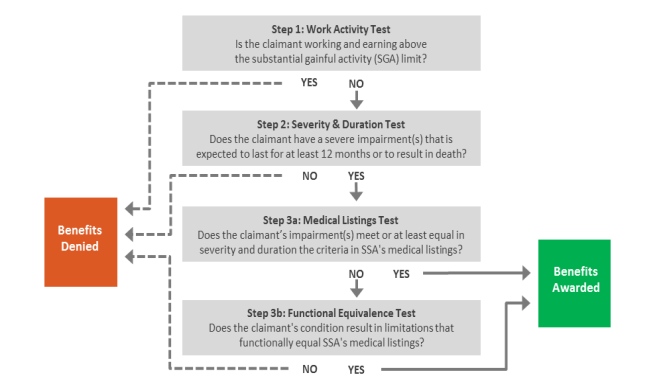

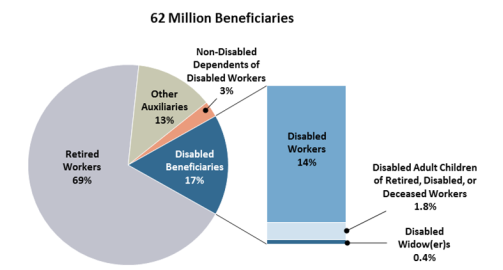

The state of georgia does not offer short term disability benefits. The social security administration ssa has manages two programs to provide disability payments to those who have been disabled and are no longer able to support themselves and their families. States that exempt social security from taxes.

Georgia has no inheritance or estate taxes. Social security disability insurance ssdi and supplemental security income ssi. The states sales tax rates and property tax rates are both relatively moderate.

Social Security Disability Insurance A Bedrock Of Security For American Workers Center For American Progress

www.americanprogress.org

Social Security Benefits Buford Georgia Asset Division Attorney Atlanta Divorce Lawyer Meriwether Tharp Llc

mtlawoffice.com

:max_bytes(150000):strip_icc()/463225827-56a9382a3df78cf772a4e056.jpg)

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

/your-identity-183299170-5b89c0f6c9e77c0082154a5f.jpg)

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/arc-anglerfish-arc2-prod-gmg.s3.amazonaws.com/public/XYUDL4OPOJC5BGVCDPRXCY6API.jpg)

/GettyImages-144560286-577404875f9b5858752b6d6d-1a80d8ccaca4477c86b8b840a36f8868.jpg)