Does Georgia Tax Social Security And Pensions

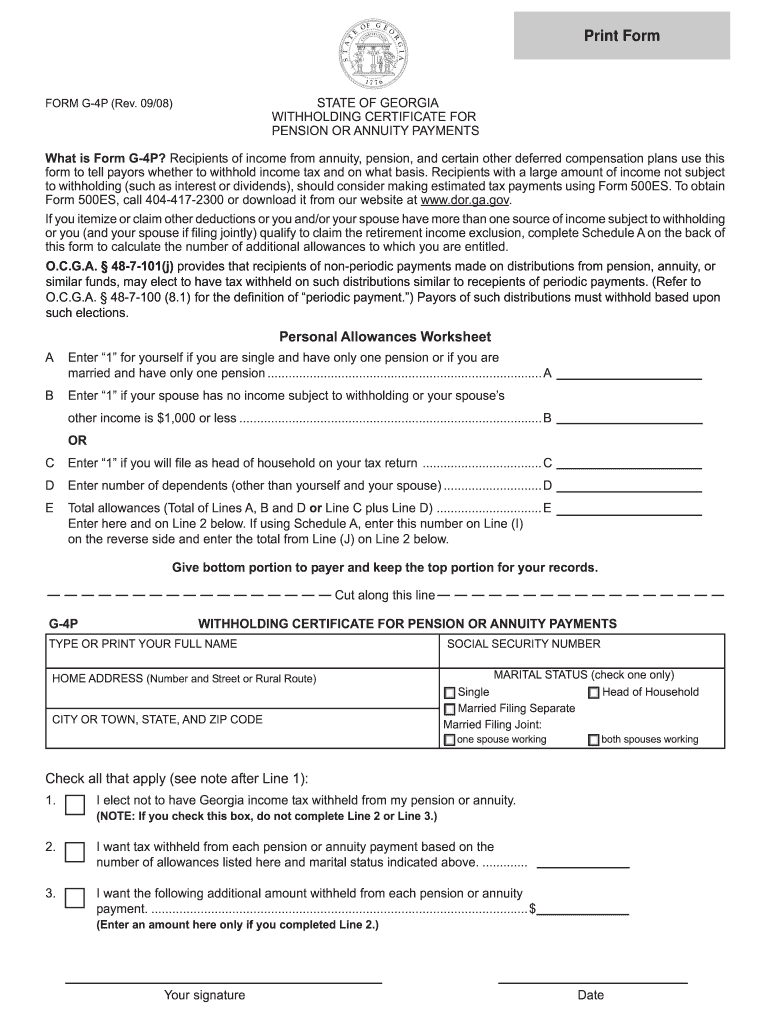

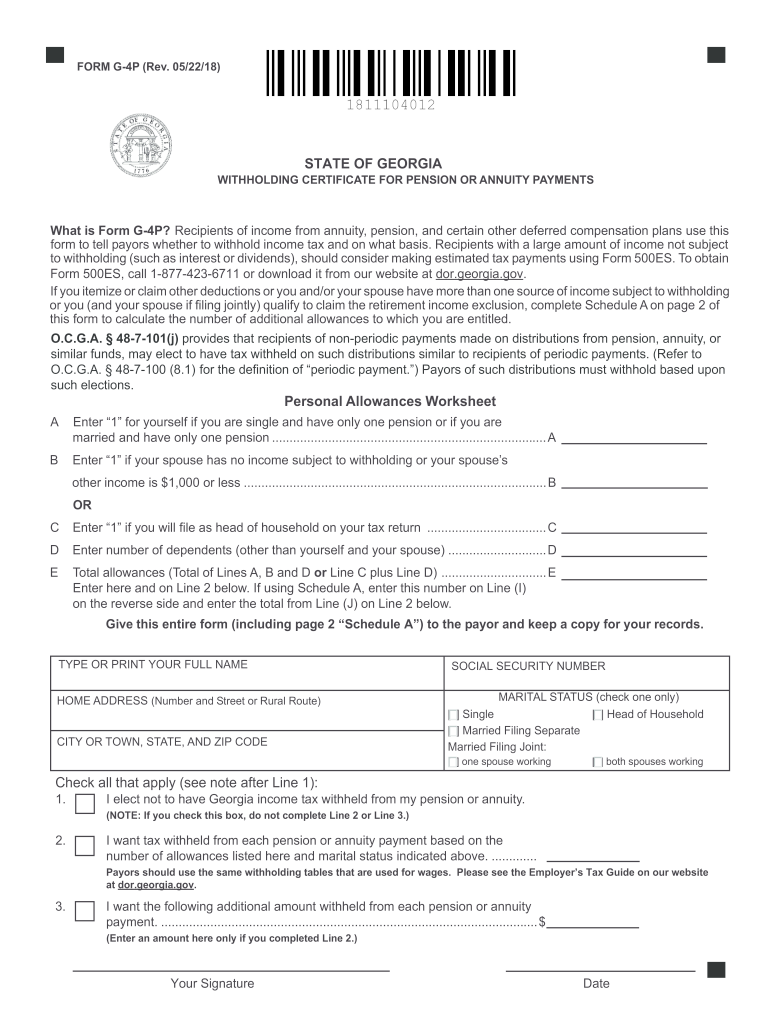

The taxable portion is subtracted on schedule 1 of form 500.

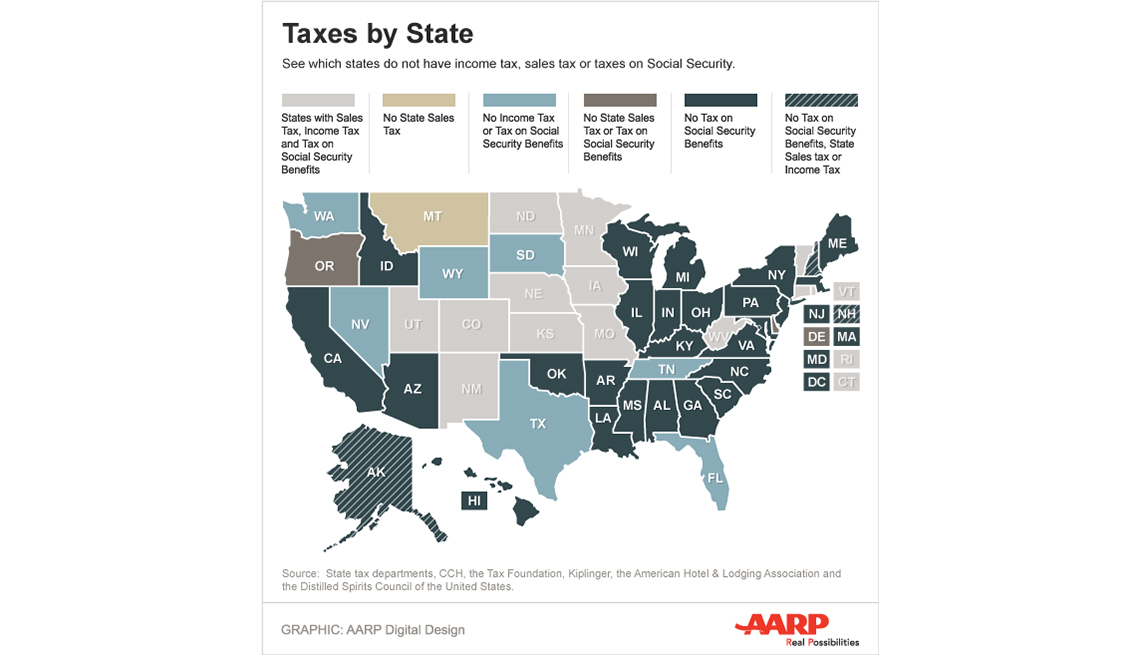

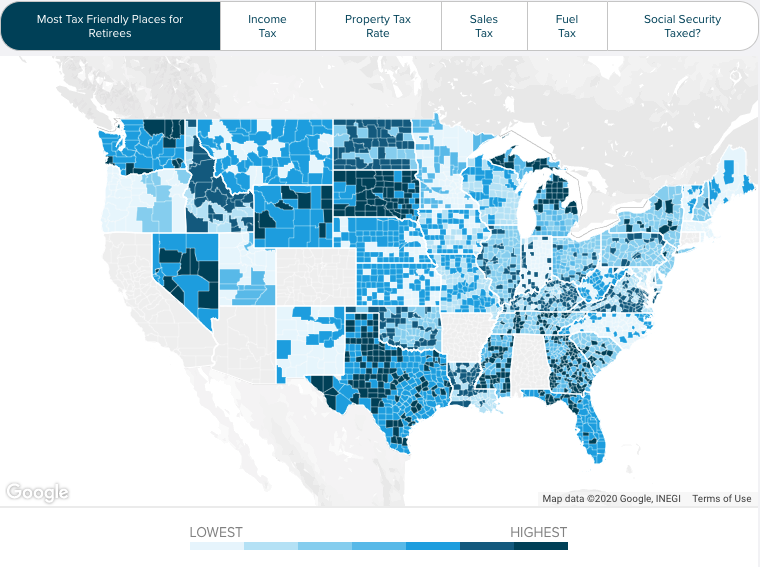

Does georgia tax social security and pensions. While georgia pensions are taxable retirees may qualify for the retirement income exclusion program which will help reduce their tax liability. Meanwhile the states sales tax rate and property tax rate are both relatively moderate and there are no inheritance or estate taxes to worry about. Hawaii does not tax social security benefits.

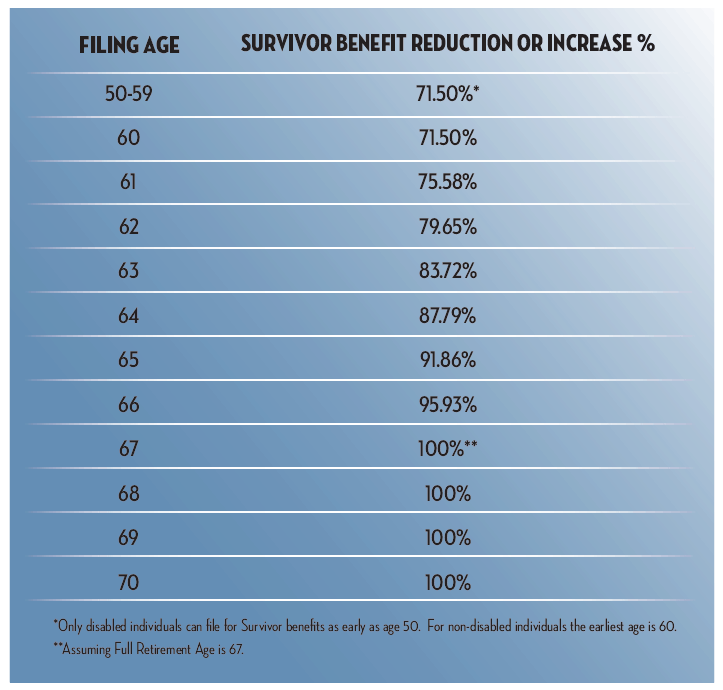

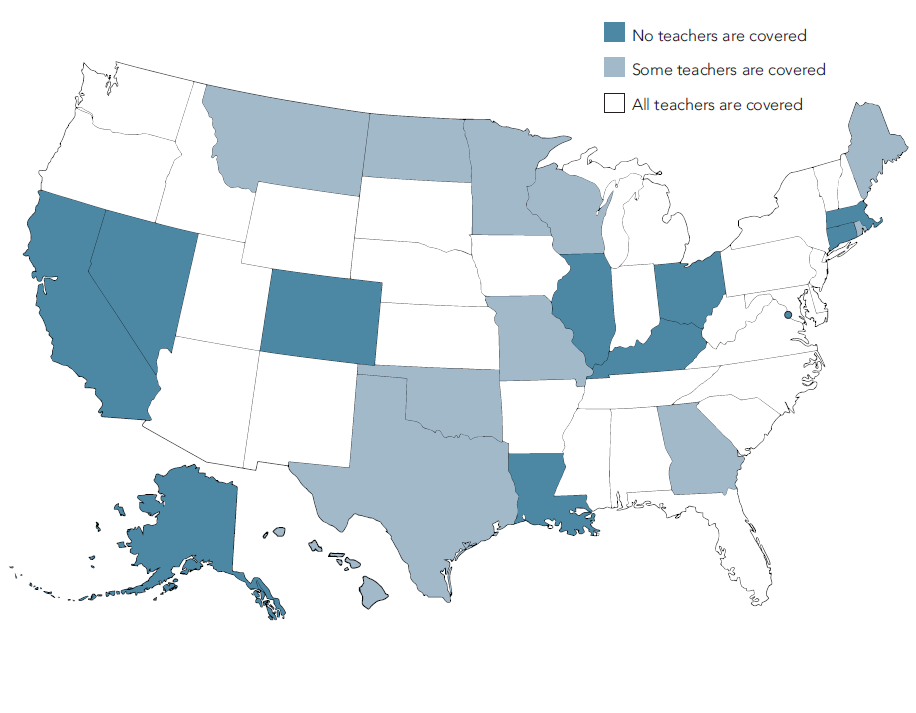

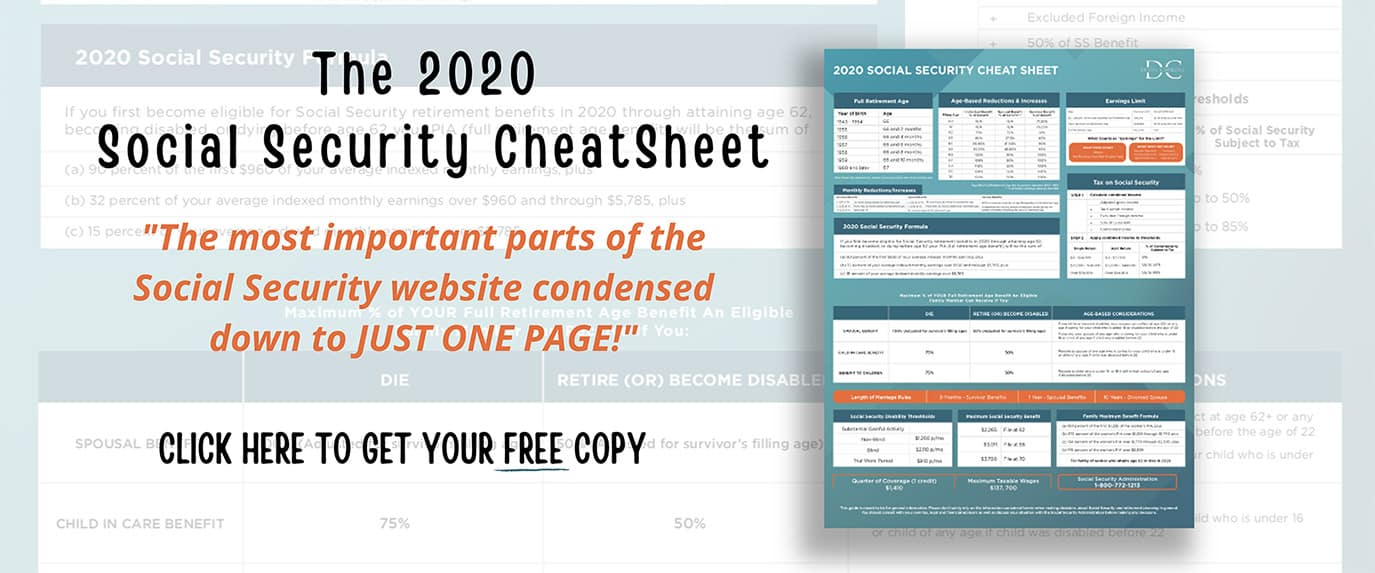

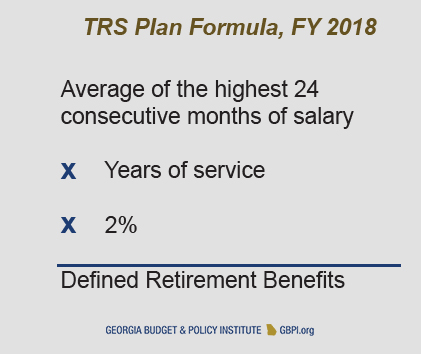

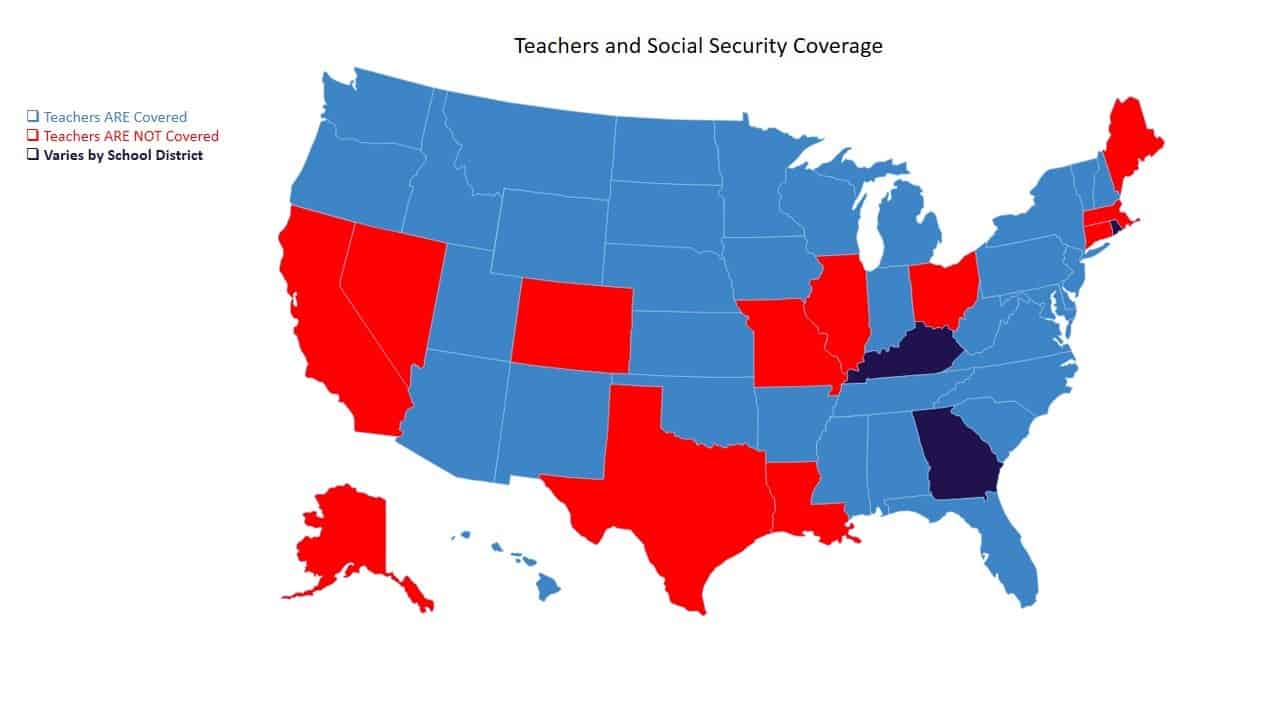

Social security income is exempt from state taxes as is up to 35000 of most types of. Taxable social security and railroad retirement on the federal return are exempt from georgia income tax. Yes as georgia does not tax social security and provides a deduction of 65000 per person on all types of retirement income for anyone age 65 and older.

In georgia social security retirement benefits are not taxed and the state provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older. The prairie state doesnt tax social security benefits either. When you spend your entire life building a retirement savings having this money taxed means you are losing your precious retirement income.

Pension and 401k income must be from a qualified employee benefit plan to be tax free though. Claiming a pension exemption individuals over the. For income that is taxed the lowest hawaii tax rate is 14 on taxable income up to 4800 for joint.

Georgia georgia has a provision for any retirement income including military retirement pay. Taxpayers who are 62 or older or permanently and totally disabled regardless of age may be eligible for a retirement income adjustment on their georgia tax return. Several state tax policies factored into that ranking including georgias exemptions from estate inheritance and social security taxes as well as its 4 percent statewide sales tax.

However georgia remains among the top 10 tax friendly states for retirees as ranked by kiplinger in 2017.

/GettyImages-144560286-577404875f9b5858752b6d6d-1a80d8ccaca4477c86b8b840a36f8868.jpg)

/Clipboard01-452705347a6e49ed8e82ca42d0a5cfa2.jpg)

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

/GettyImages-157422696-91d9faa2445f43fd95062873356b57bc.jpg)

/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/105880417-F-56a938613df78cf772a4e2eb.jpg)