Does Georgia Tax Pensions From Other States

Earned income is income from a trade or business wages salaries tips or other compensation.

Does georgia tax pensions from other states. If you are considering moving to another state you should be mindful of the fact that states often enact amend and repeal their tax laws. Please contact their revenue agency yourself to verify that the information is accurate. Are pensions taxable in georgia.

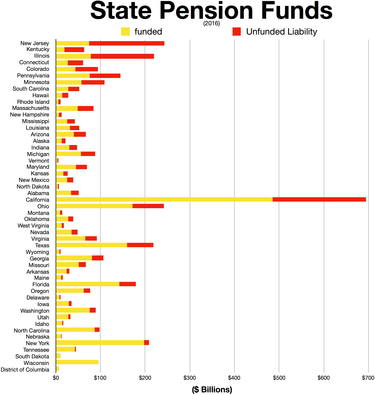

Ditto for 401. Up in alaska you dont have to pay income tax on your pensionor on any income for that matter. Taxpayers who are 62 or older or permanently and totally disabled regardless of age may be eligible for a retirement income adjustment on their georgia tax return.

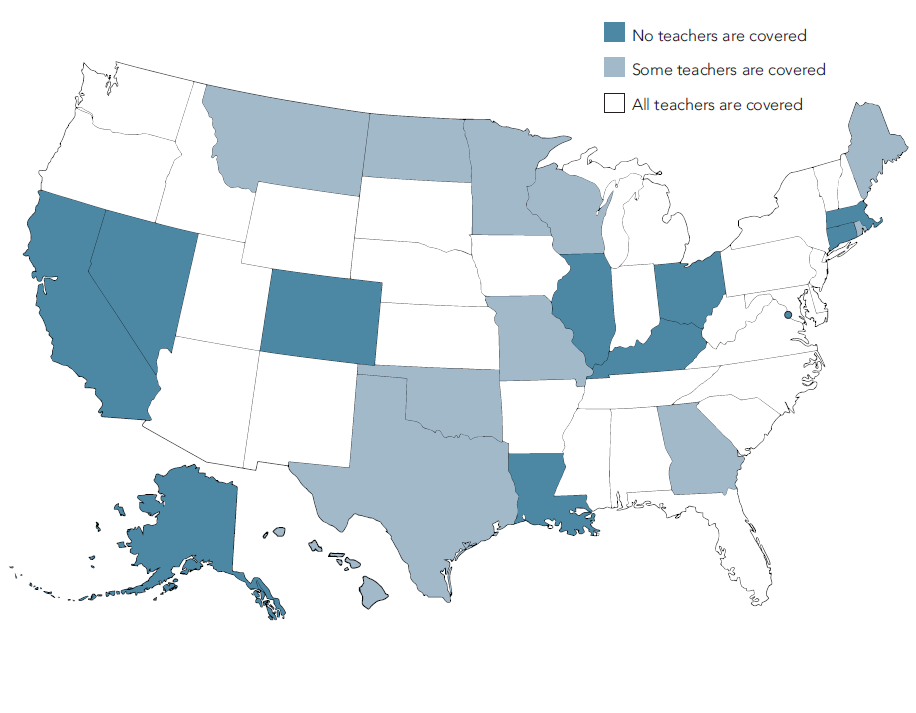

Residents of mississippi illinois and pennsylvania pay a state income tax but not on their pension income. See form it 511 for the retirement income exclusion worksheet to calculate the maximum allowable adjustment for this year. Its one of a handful of states without an income tax.

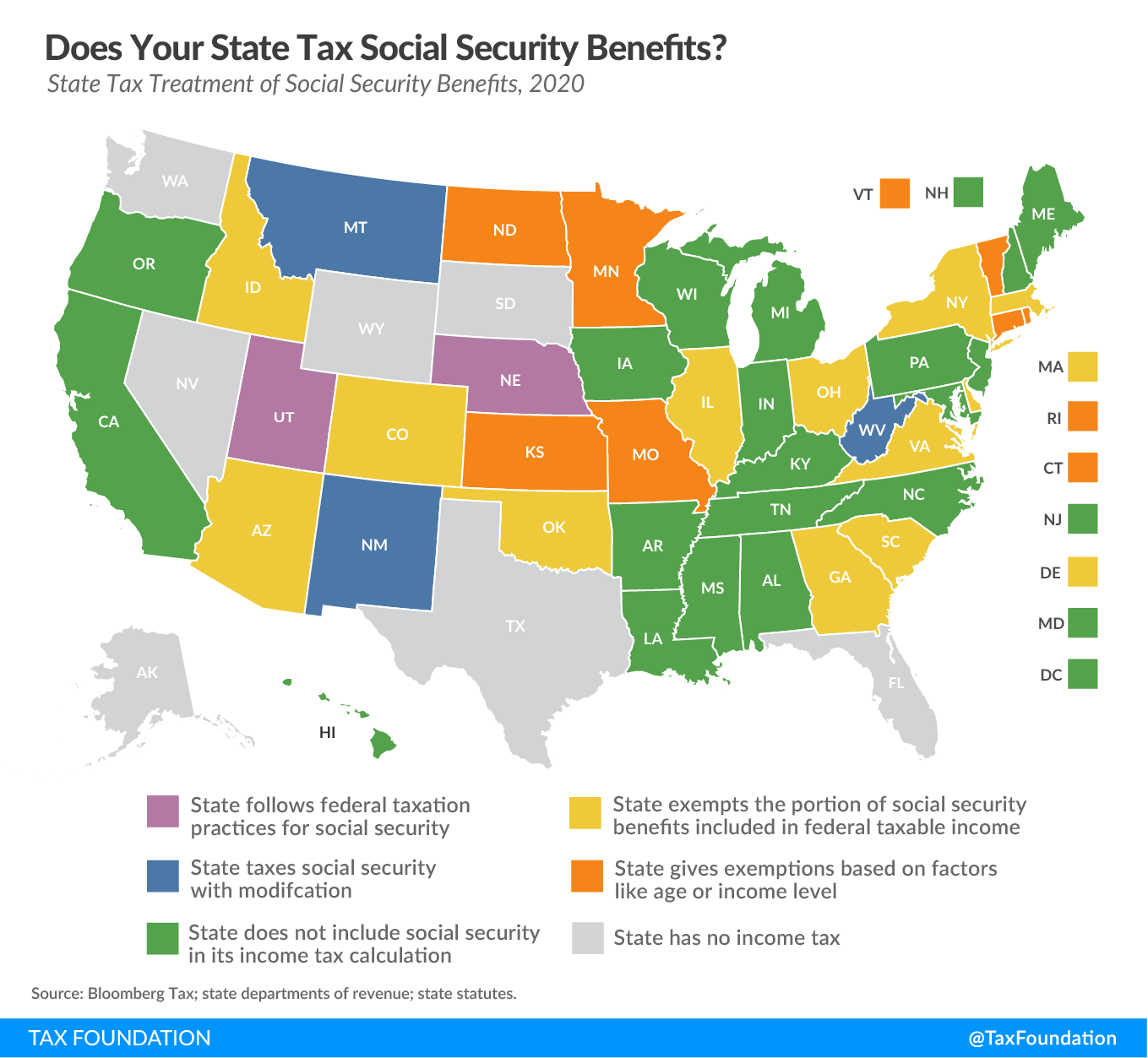

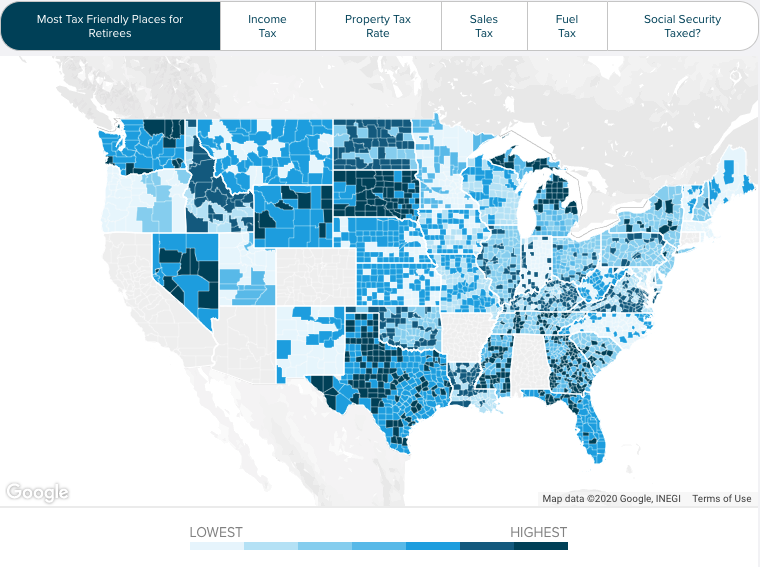

Social security income is exempt from state taxes as is up to 35000 of most types of. The other state has no income tax. Including both state and local rates the average total sales tax rate in georgia is 729 slightly above the national average.

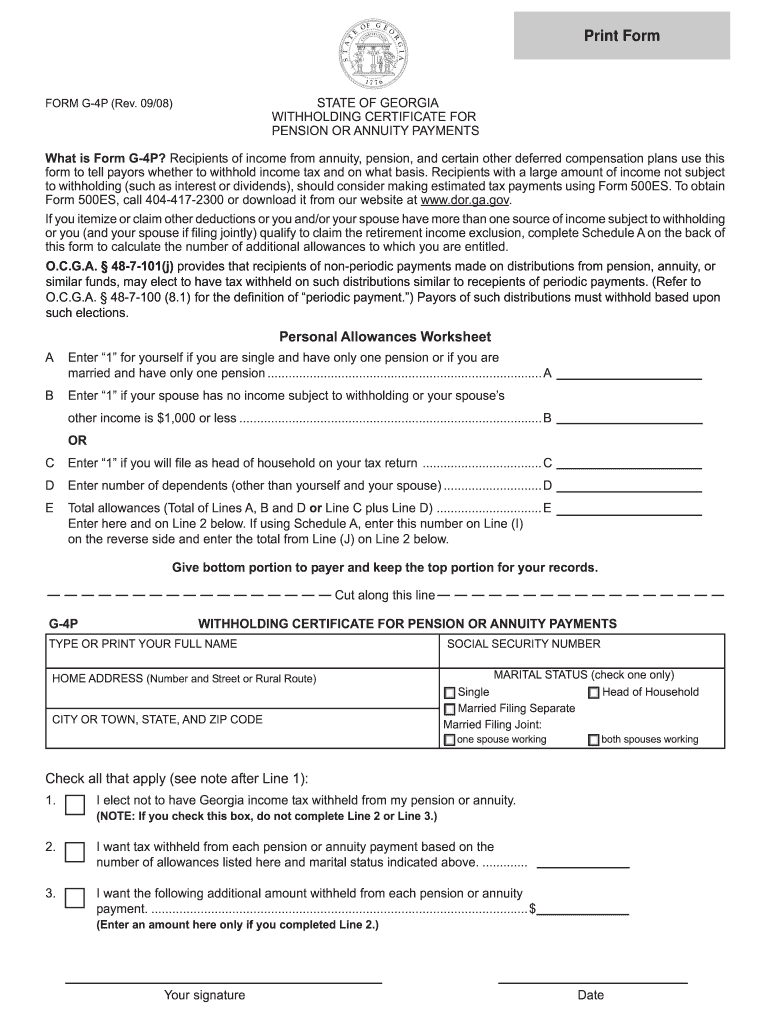

The retirement exclusion for taxpayers who are age 62 to 64 or less than 62 and permanently disabled remains at 35000. Retirement income includes items such as. Interest dividends net rentals capital gains royalties pensions annuities and the first 400000 of earned income.

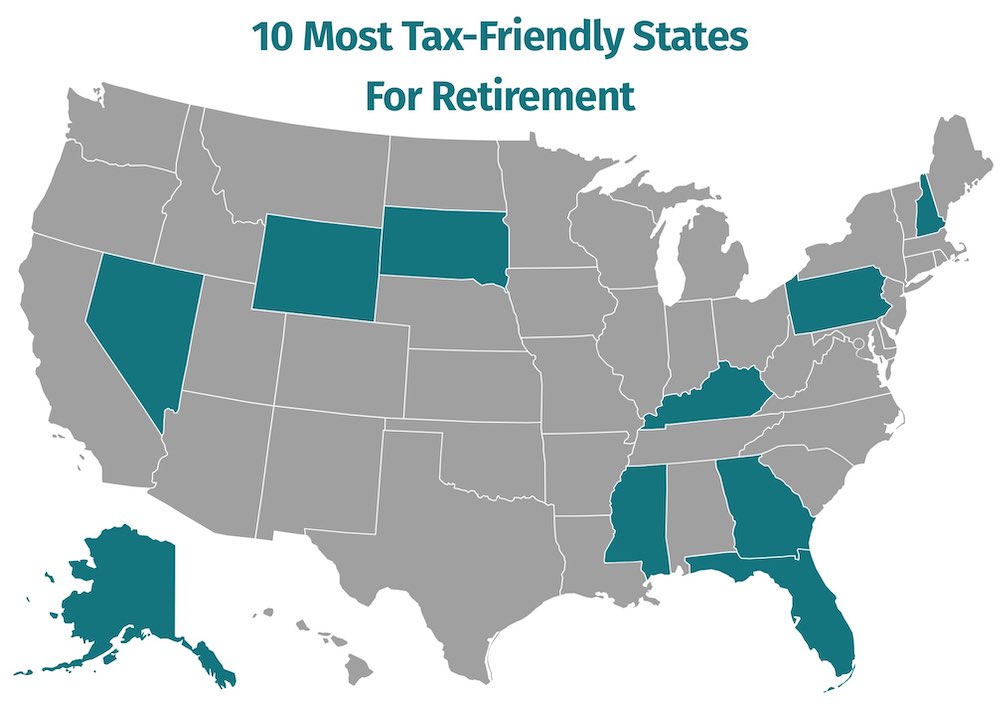

All out of state government pensions qualify for the pension exclusion. Though the state does levy a tax on stock dividends and interest income from. However georgia remains among the top 10 tax friendly states for retirees as ranked by kiplinger in 2017.

Additionally localities and counties in georgia collect their own sales taxes with rates up to 5. Income from public and private pensions and other types of qualified retirement income. Unlike many other states georgia does allow for the taxation of groceries but only the local rates apply.

Will your nys pension be taxed if you move to another state. Nys pension taxation requirements by state.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/105880417-F-56a938613df78cf772a4e2eb.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-537339072-59d54fb3aad52b0010b33ab4.jpg)