Does Georgia Have State Tax Withholding

This includes tax withheld from.

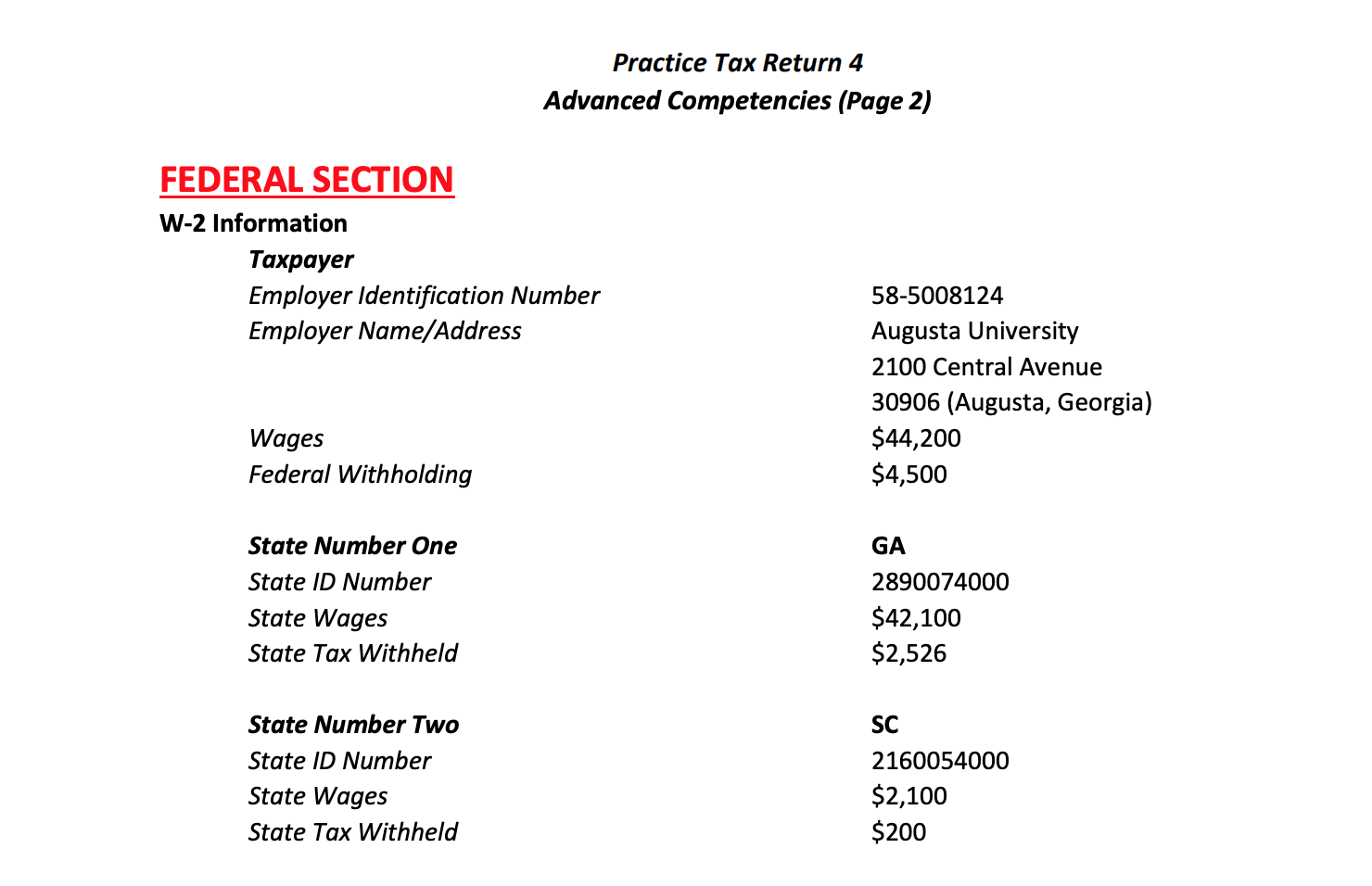

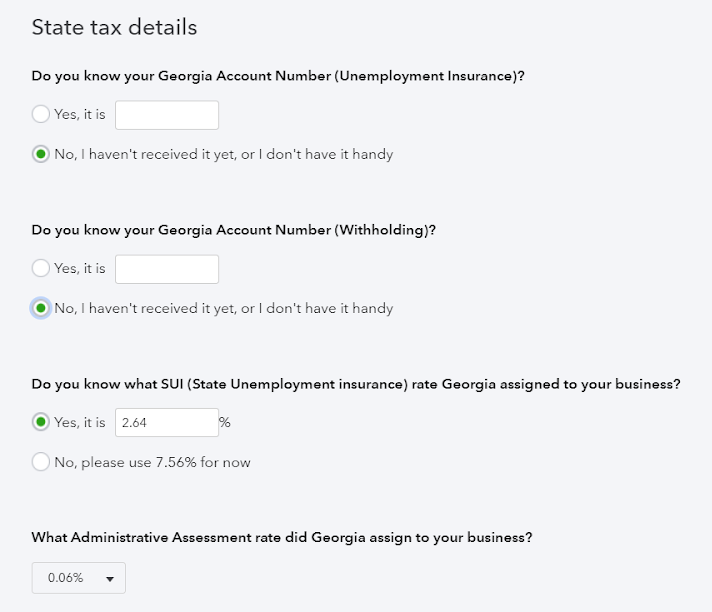

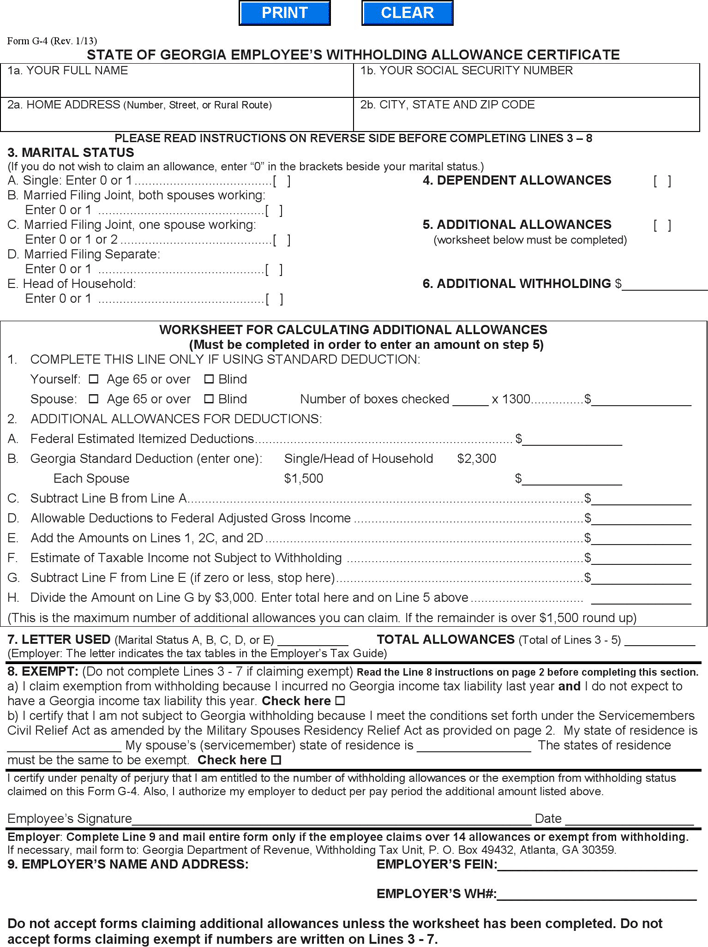

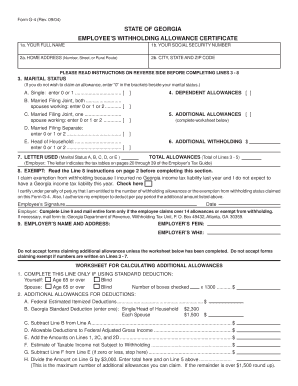

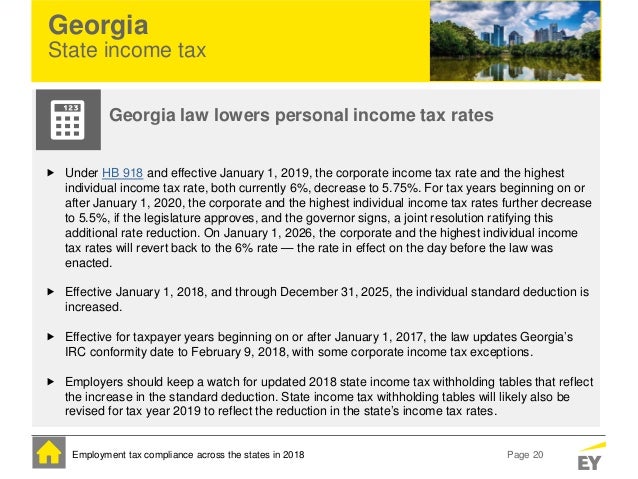

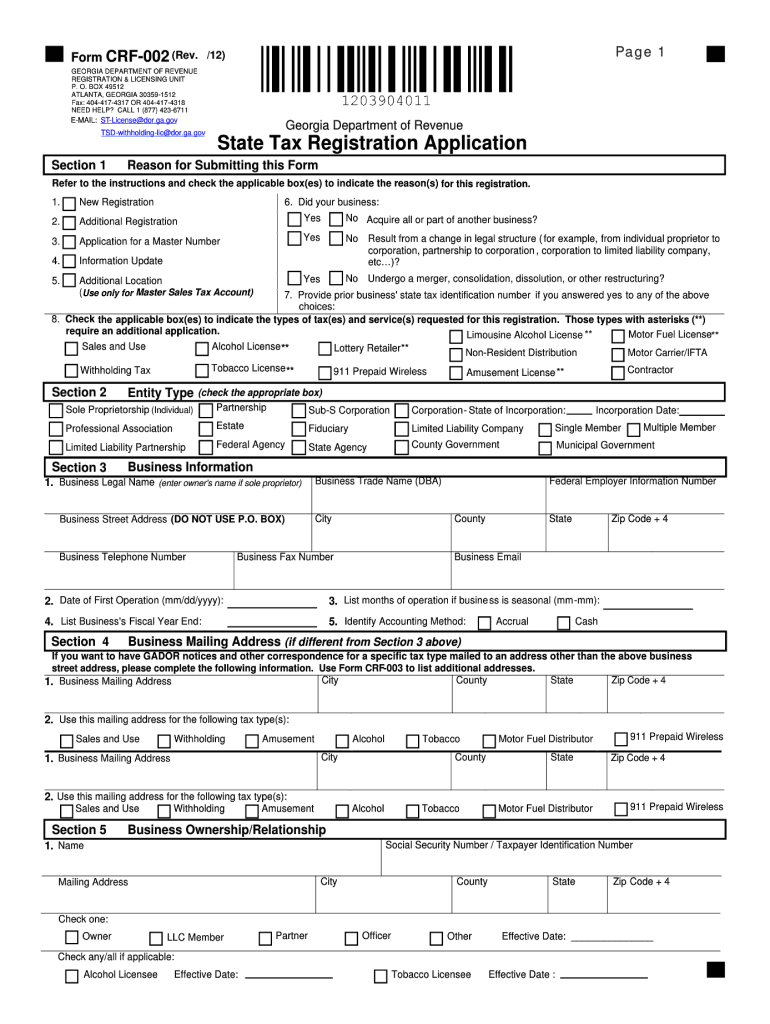

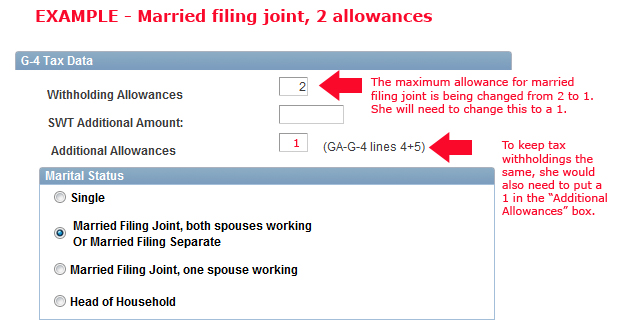

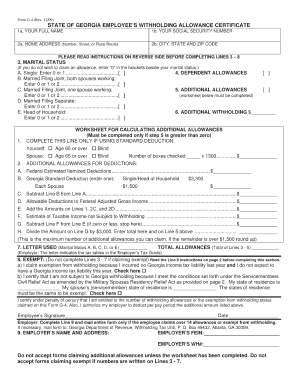

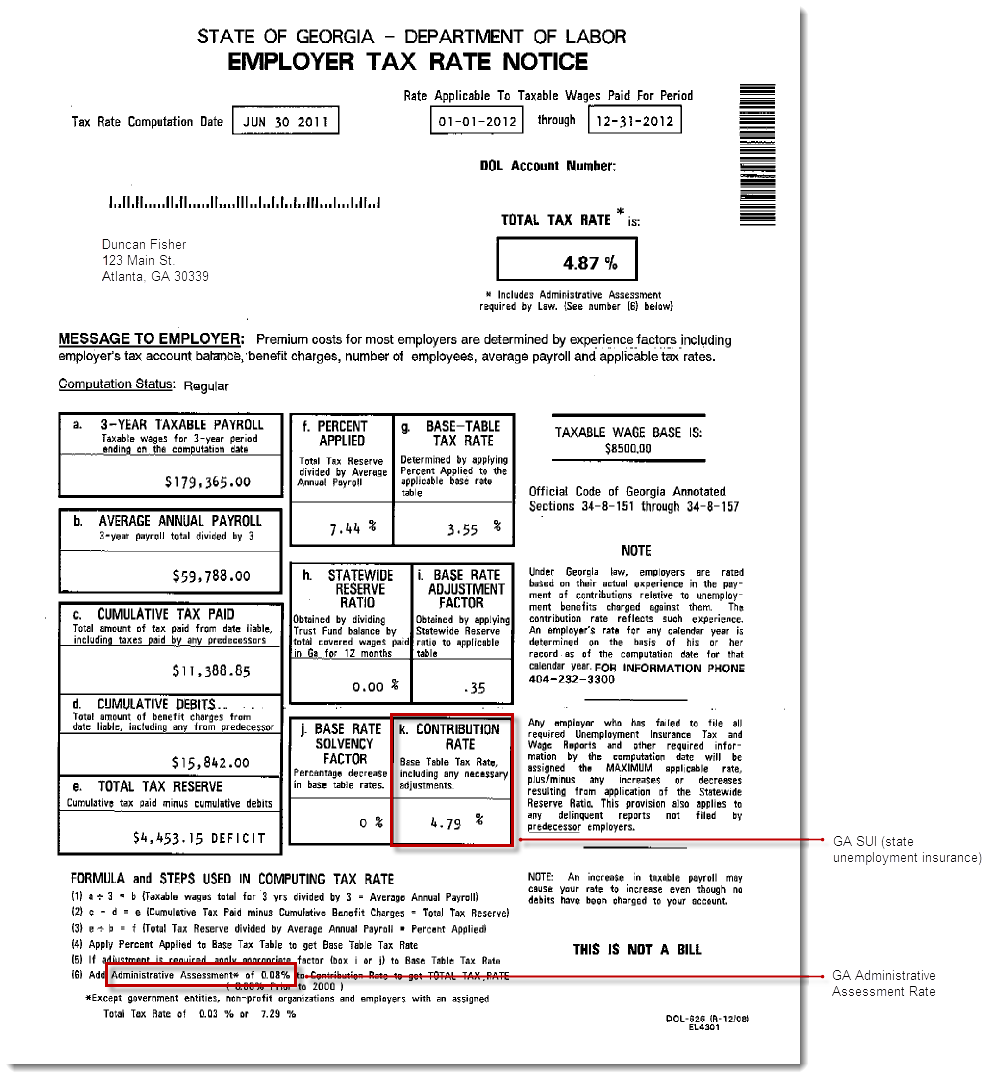

Does georgia have state tax withholding. Your paycheck might be safe but youll be dinged at the cash register. This registration does not require renewal and remains in effect as long as the business has employees whose wages are subject to georgia income tax withholding. Georgia requires employers to withhold state income taxes from employee paychecks in addition to employer paid unemployment taxesyou can find georgias tax rates hereemployees fill out g 4 georgia employees withholding allowance certificate to be used when calculating withholdings.

Register for a sales and use tax number. For withholding rates on bonuses and other compensation see the employers tax guide. If you work in iowa and are a resident of illinois your employer does not have to withhold iowa state income taxes from your wages.

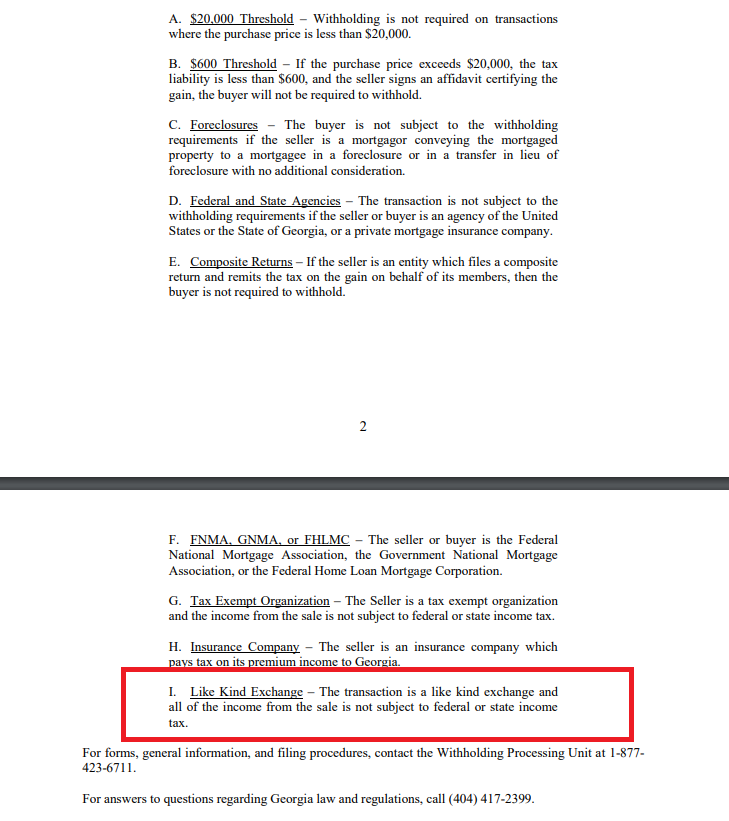

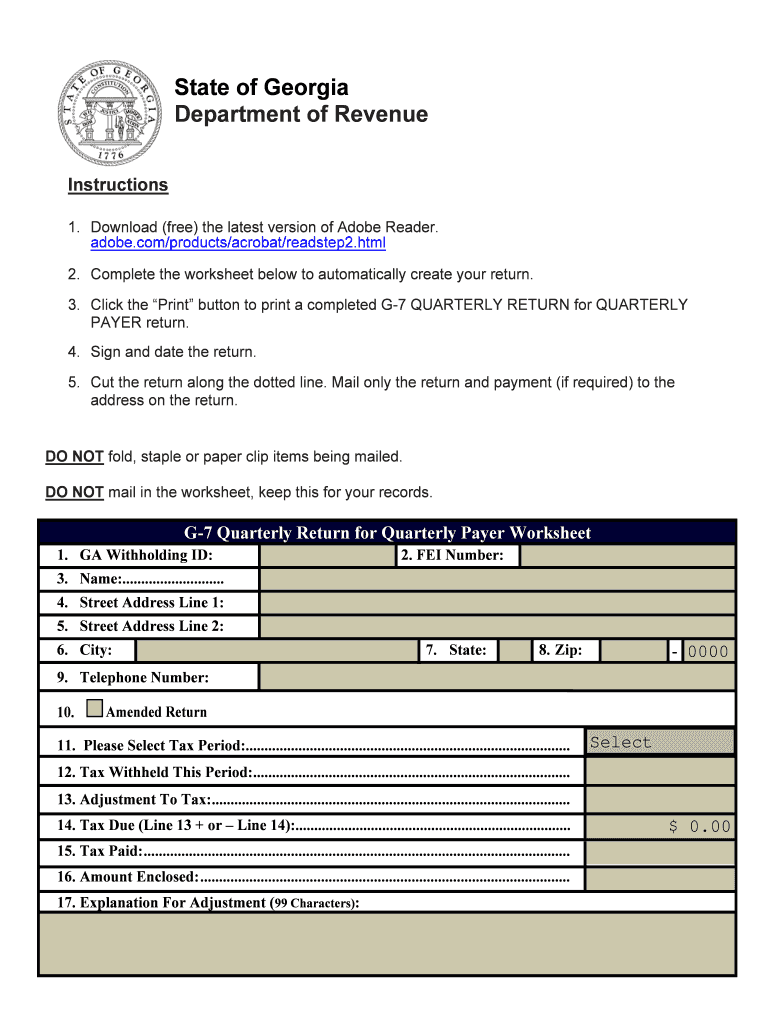

How to file a return and make a payment for a withholding film tax account. Any business that has employees as defined in ocga. Before sharing sensitive or personal information make sure youre on an official state website.

Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. The term state agency does not include any county municipality or local or regional governmental authority. These vendors must collect and remit tax on all retail sales of goods received in georgia by the purchaser and must file sales and use tax returns as required by the act.

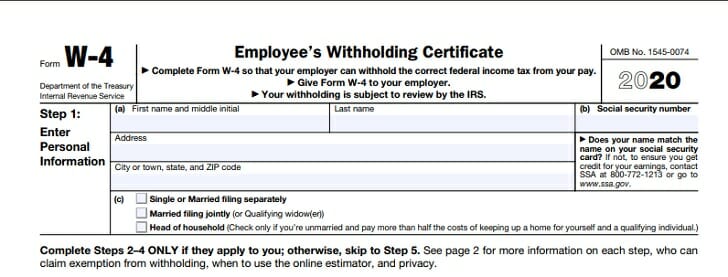

Submit exemption form 44 016 to your employer. States either use their own version of the state w 4 or the federal form w 4. New hampshire is known for its exorbitant property taxes.

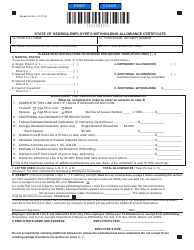

How third party bulk filers add access to a withholding film tax account. Form g4 is to be completed and submitted to your employer in order to have tax withheld from your wages. Tennessee has one of the highest combined state and local sales tax rates in the country.

Iowa has reciprocity with only one stateillinois. How to claim withholding reported on the g2 fp and the g2 fl. Film tax credit loan out withholding.

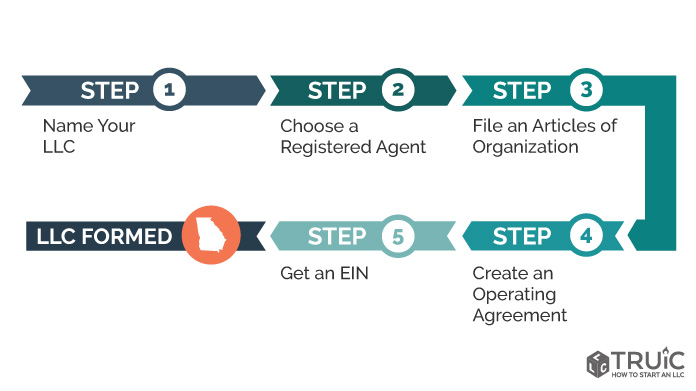

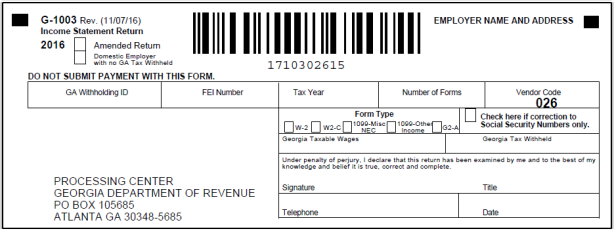

Local state and federal government websites often end in gov. Washington charges a significant tax on gasoline. 48 7 1004 must register for a withholding payroll number.

State of georgia government websites and email systems use georgiagov or gagov at the end of the address. What are my state payroll tax obligations. Instructions to submit fset.

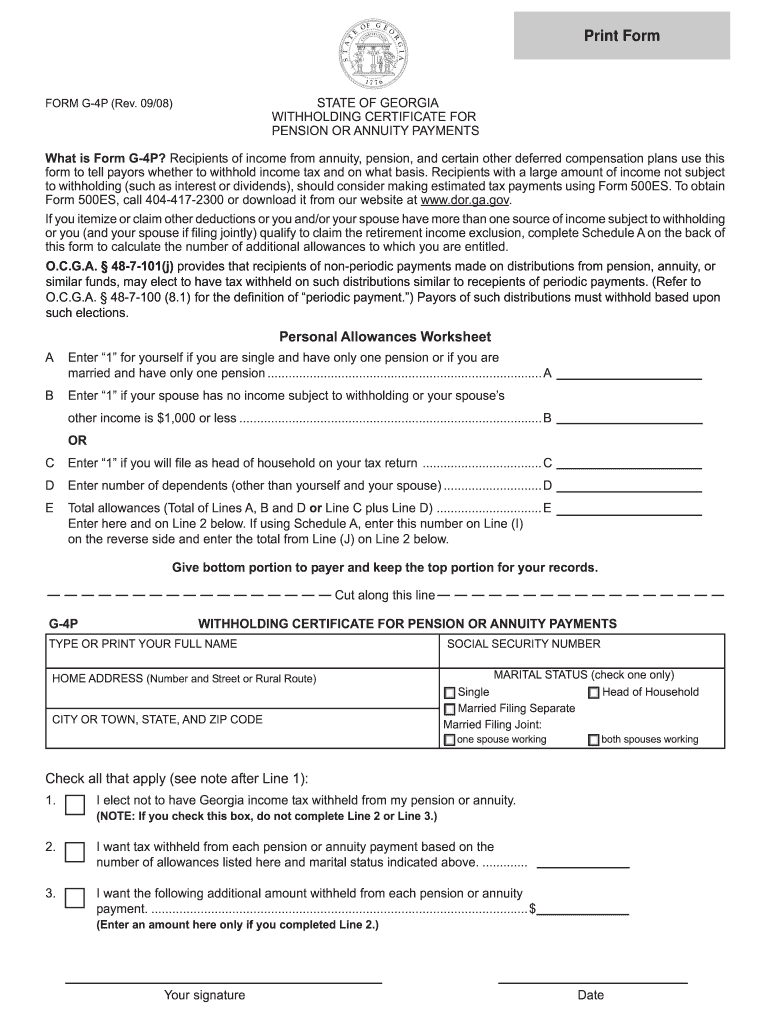

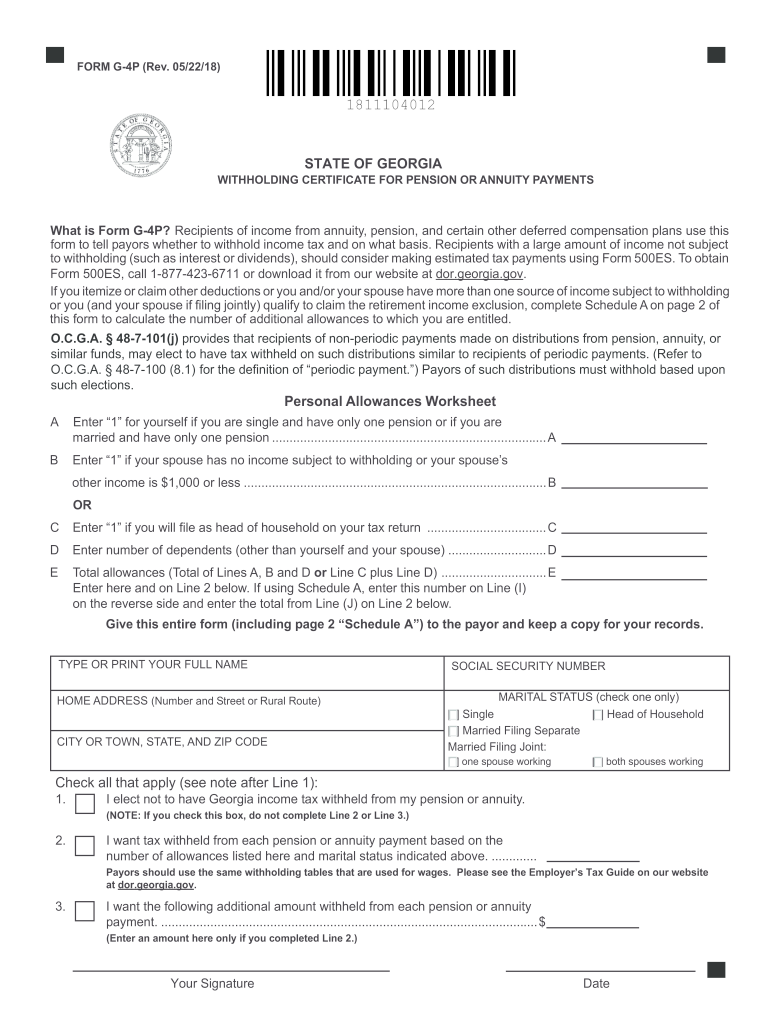

Florida is known for both high property taxes and a pretty. Nevada and texas have high property taxes too. Wages nonresident distributions lottery winnings pension and annuity payments other sources of income the withholding tax rate is a graduated scale.

Employers use state w 4s to determine state income tax withholding for employees. Tsdemployeeswithholdingallowancecertificateg 4pdf 19647 kb department of.

.jpg)

%201.jpg)