Does Georgia Have State Income Tax On Pensions

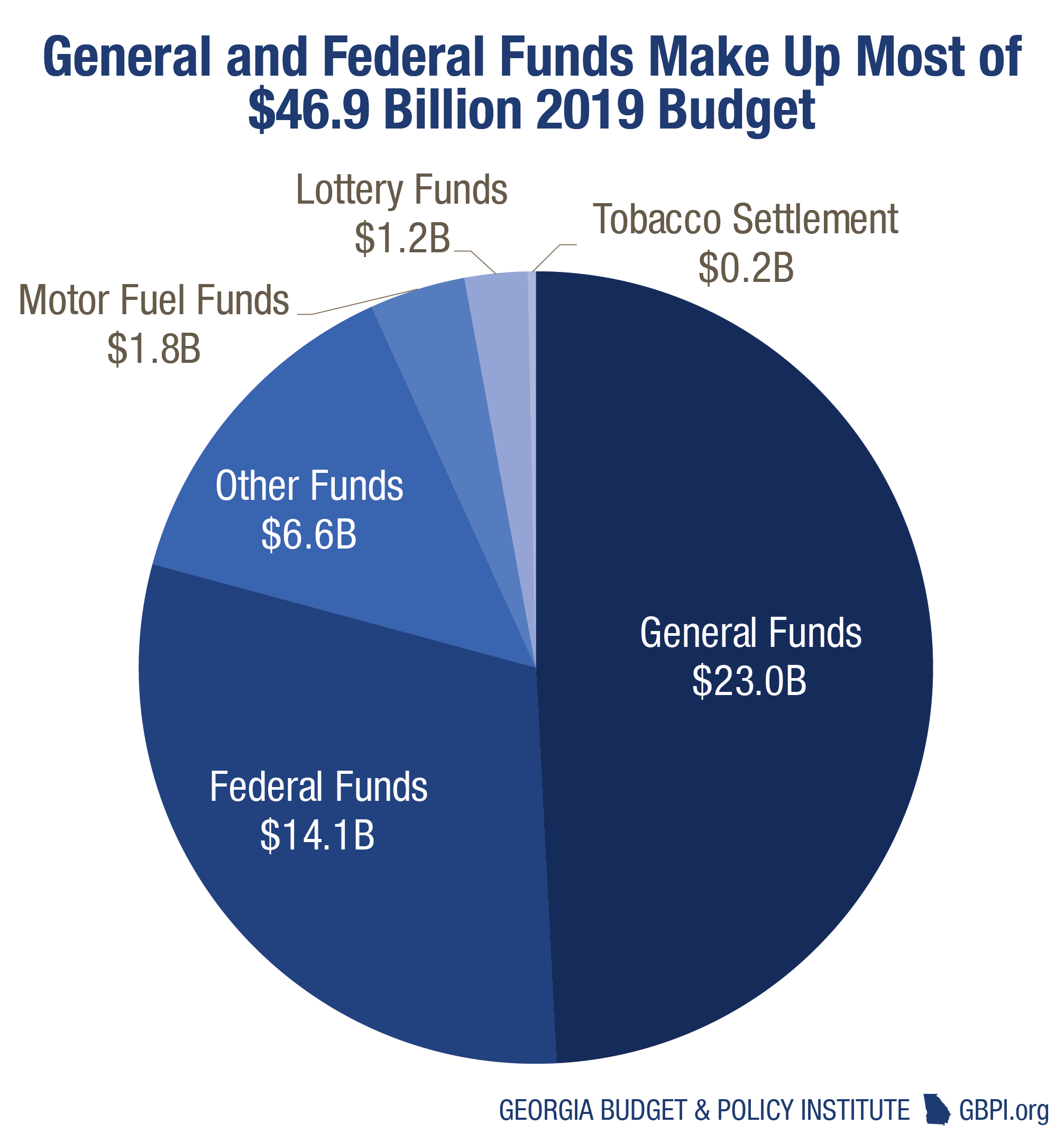

In addition to a moderate climate and year round warm weather the state of georgia offers tax breaks for seniors including generous exclusions on retirement income.

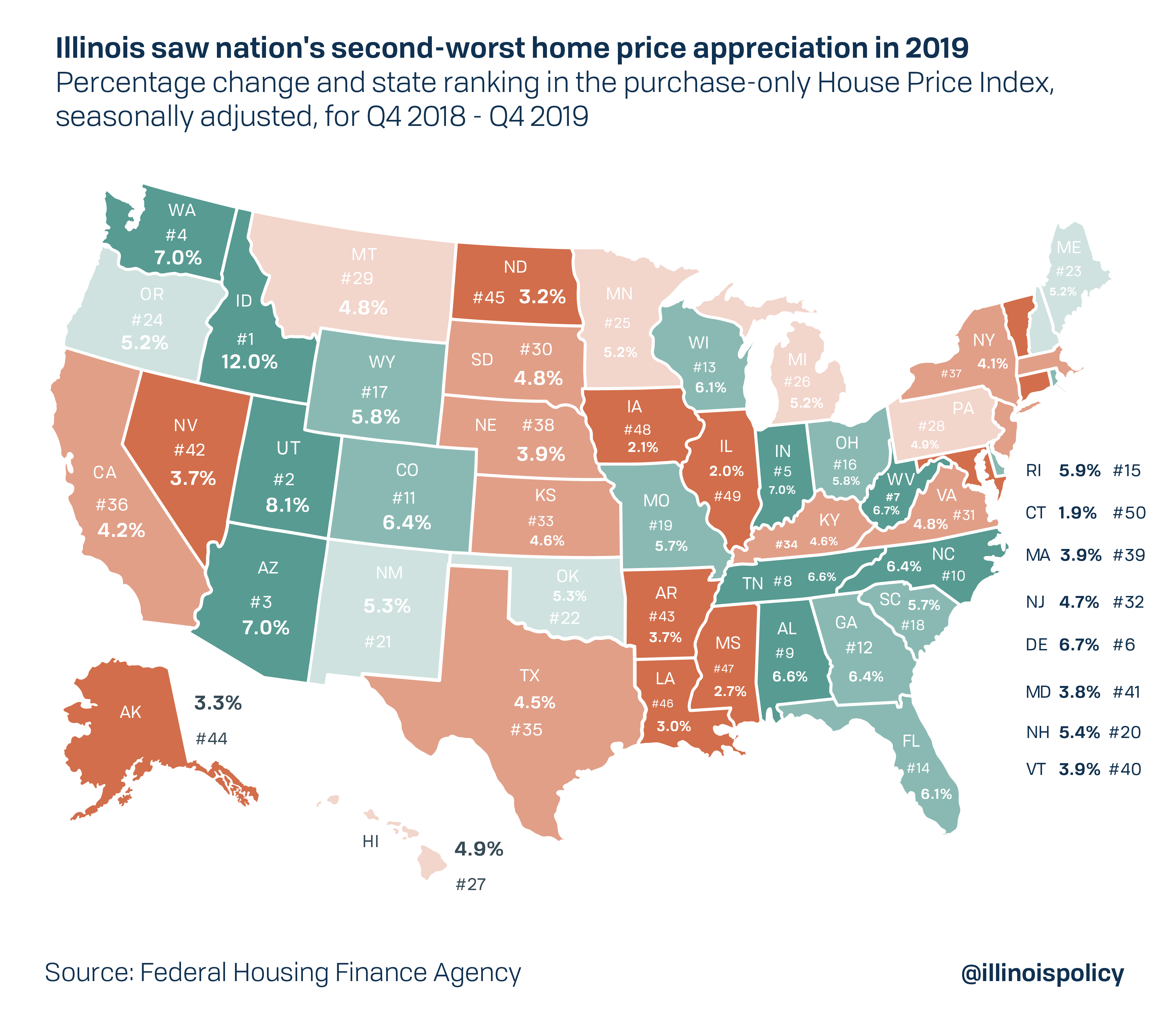

Does georgia have state income tax on pensions. On your georgia state income tax return form 500. 515 281 3114 or taxiowagov kansas yes. Thats one of the reasons why wyoming is the most tax friendly state in the nation.

Have you used turbotax or some other means to file your state tax return. At age 65 or older you are eligible to exclude up to. See form it 511 for the retirement income exclusion worksheet to calculate the maximum allowable adjustment for this year.

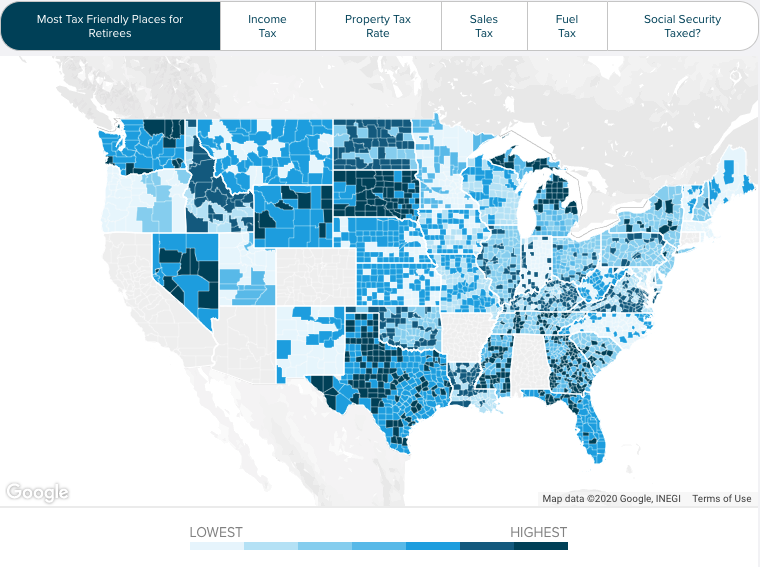

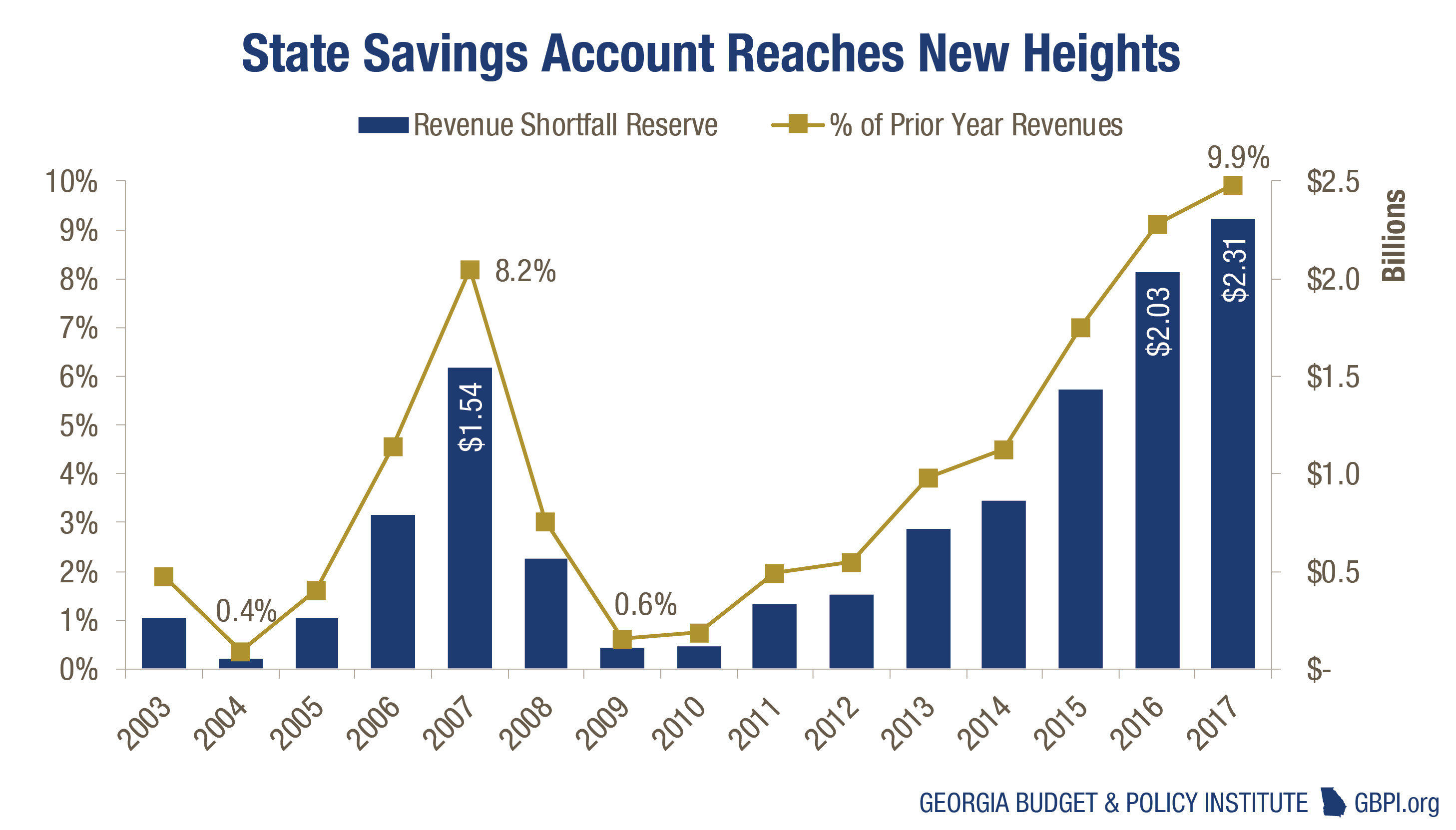

The income tax in georgia is a graduated income tax based on your federal taxable income. However georgia remains among the top 10 tax friendly states for retirees as ranked by kiplinger in 2017. If youre at least 59 years old the magnolia state wont tax your retirement income.

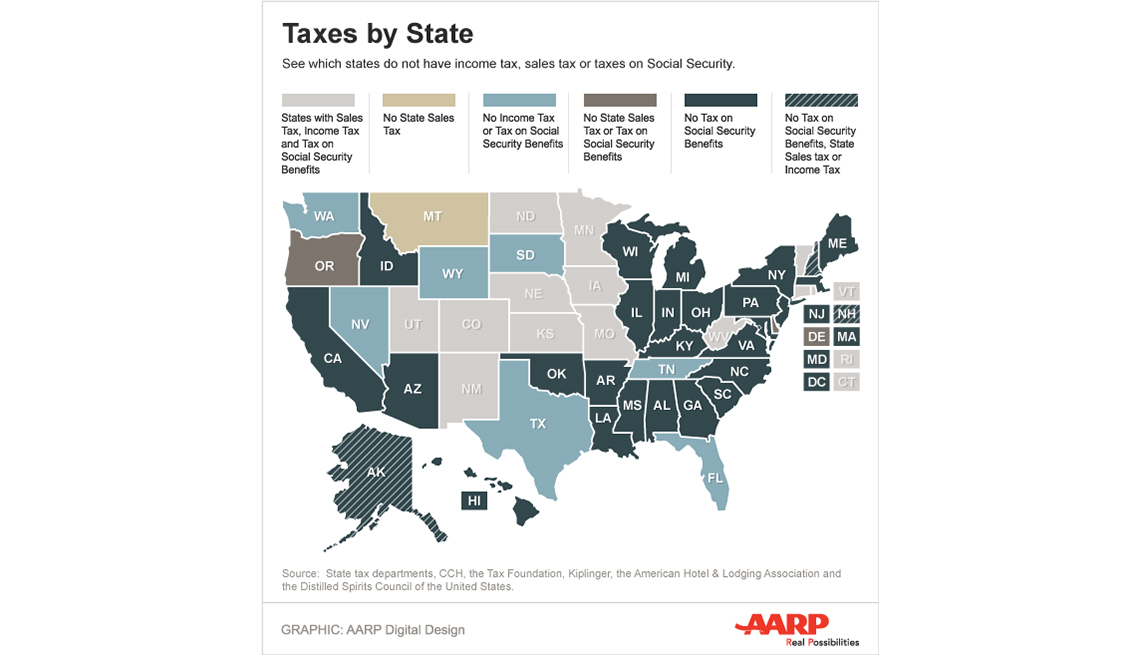

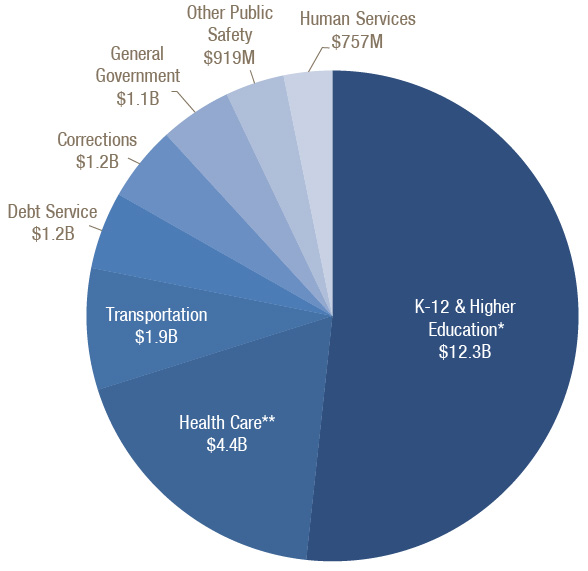

Are pensions taxable in georgia. Social security income is exempt from state taxes as is up to 35000 of most types of. However the state will take its share of 401k ira or pension income received by.

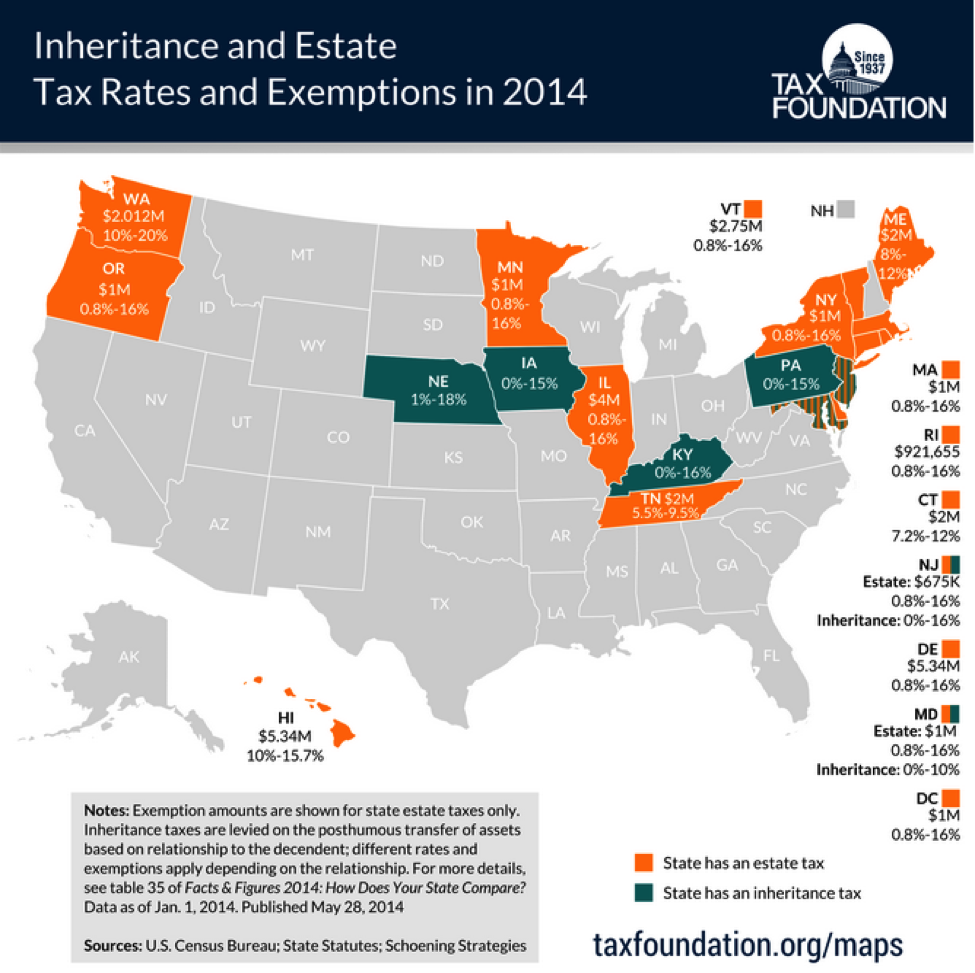

Ss not taxed but included in worksheets. However the state also provides tax relief in the form of an exemption on retirement income. Georgia has no inheritance or estate taxes.

Earned income is income from a trade or business wages salaries tips or other compensation. Wyoming doesnt have an income tax so you dont have to worry about a state tax hit on your pension. Georgia does not tax social security retirement benefits and provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older.

The georgia retirement income exclusion is available to any georgia resident age 62 or older when completing a state tax return. The states sales tax rates and property tax rates are both relatively moderate. Pensionretirement income exclusion 6000 or 12000 based on filing status and age.

Retirement income includes items such as. How have you been doing your taxes.

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/105880417-F-56a938613df78cf772a4e2eb.jpg)

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)