Do Georgia Have State Taxes

You have income subject to georgia income tax but not subject to federal income tax.

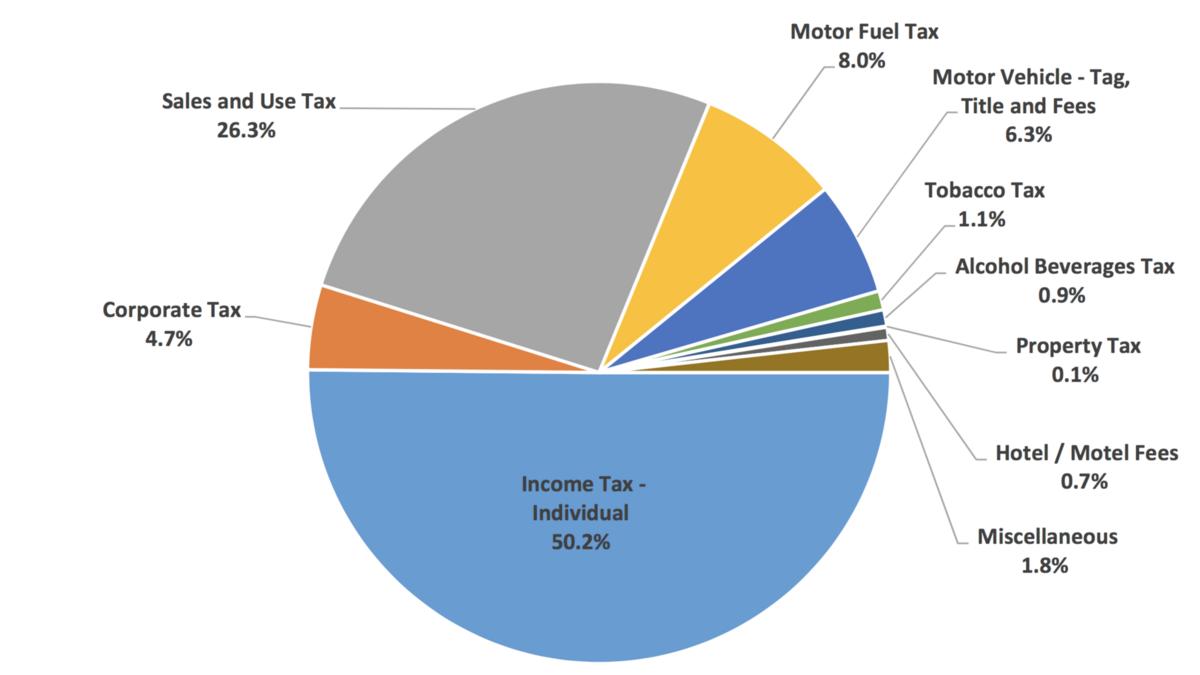

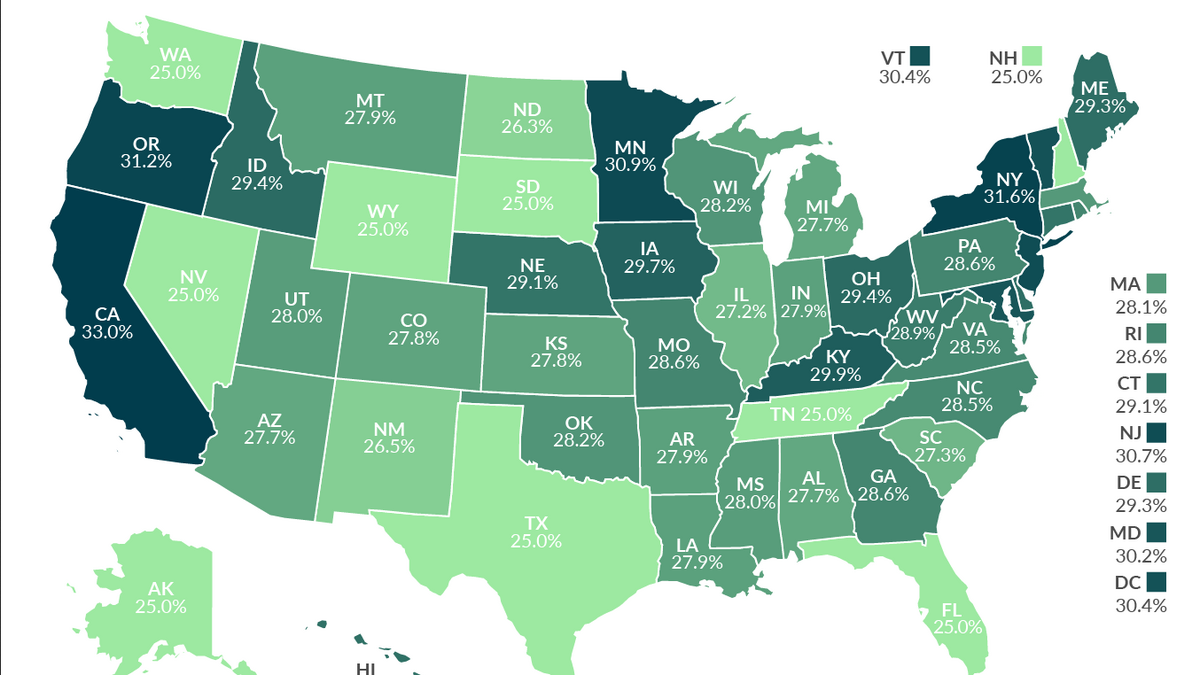

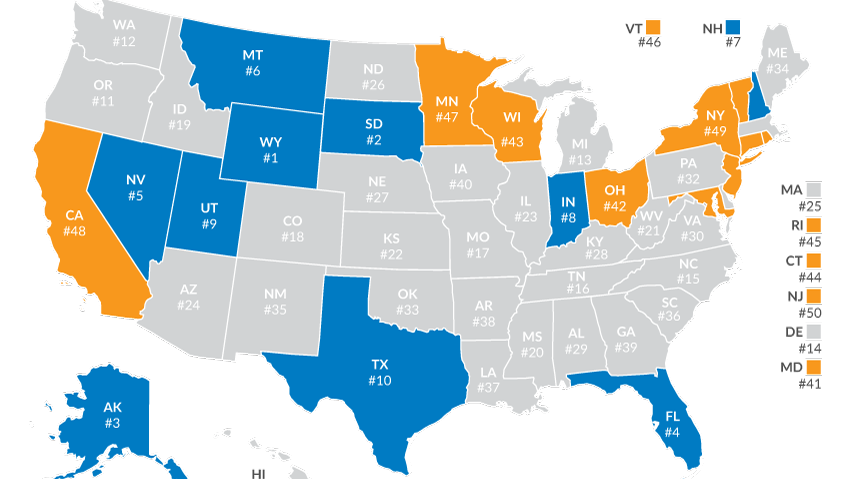

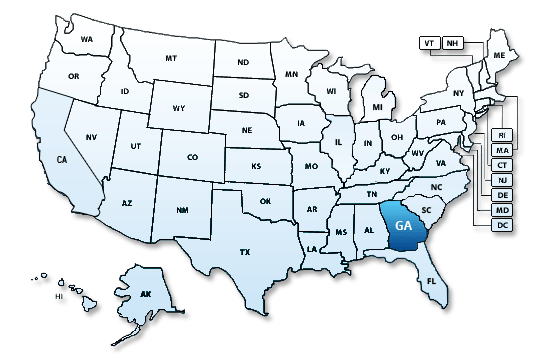

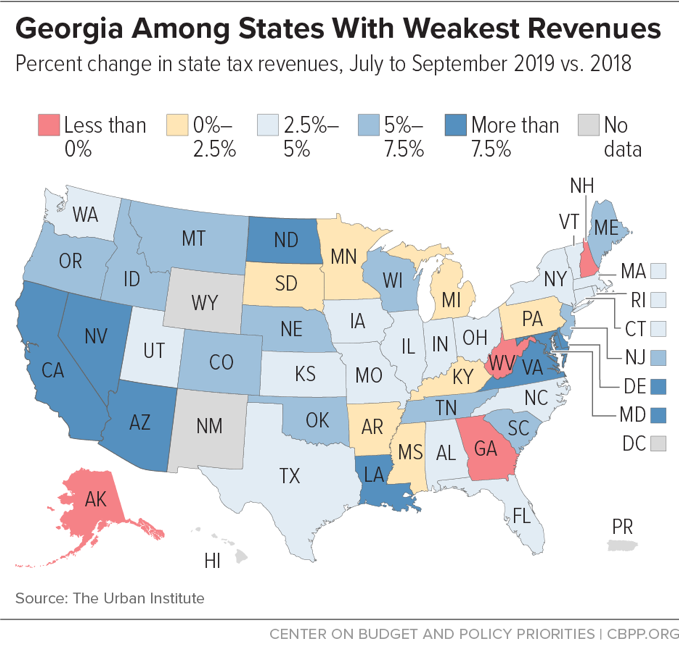

Do georgia have state taxes. Washington charges a significant tax on gasoline. The map below shows 17 orange states including the district of columbia where nonresident workers do not have to pay taxes. Georgia state income tax is applied to income at the following rates.

New hampshire is known for its exorbitant property taxes. Social security income is exempt from state taxes as is up to 35000 of most types of. For individuals the 1099 g will no longer be mailed.

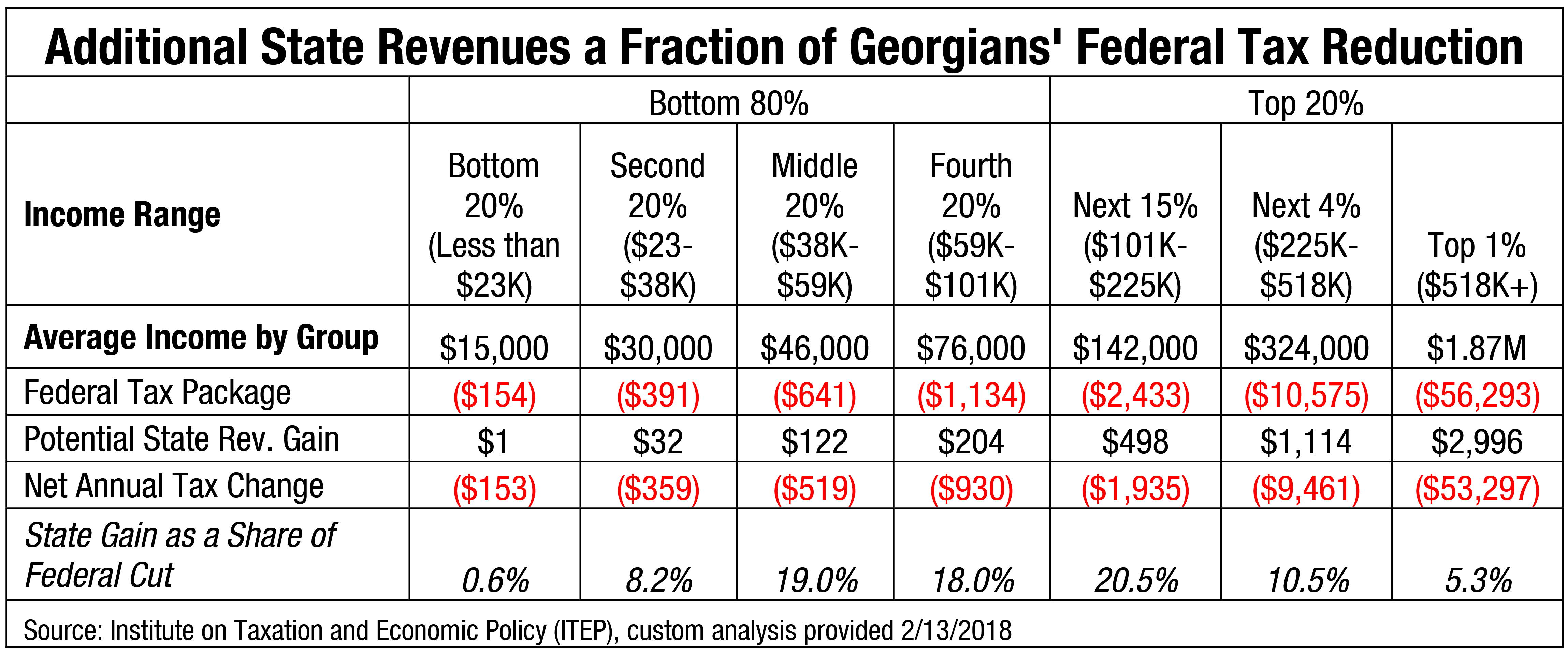

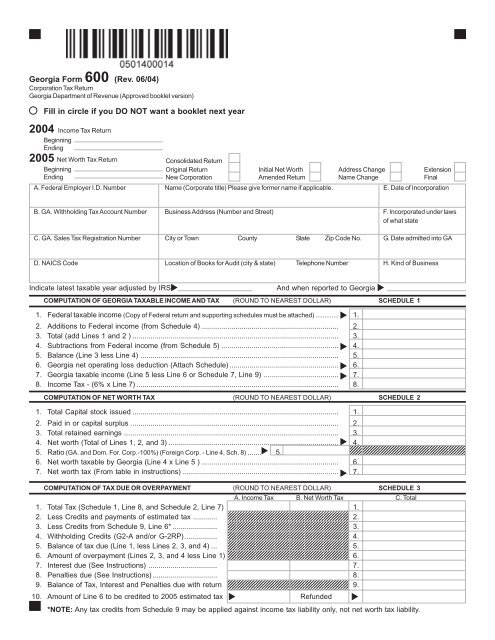

The table below shows state and county sales taxes in every county in georgia. How does that show up on my state returns. Tax return only a possession tax return only or both returns.

Your paycheck might be safe but youll be dinged at the cash register. Full year residents are taxed on all income except tax exempt income regardless of the source or where derived. Nevada and texas have high property taxes too.

You can owe georgia state income tax on florida wages florida. Retirement income exclusion httpsdorgeorgiagovretirement income exclusion. At the age of 63 you no longer have to pay state taxes.

This 1099 g form is for taxpayers who itemized deductions and received a refund credit or offset. This generally depends on whether you are considered a. Tennessee has one of the highest combined state and local sales tax rates in the country.

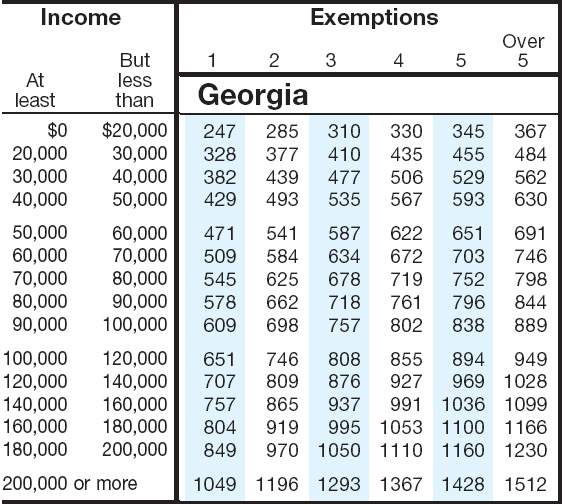

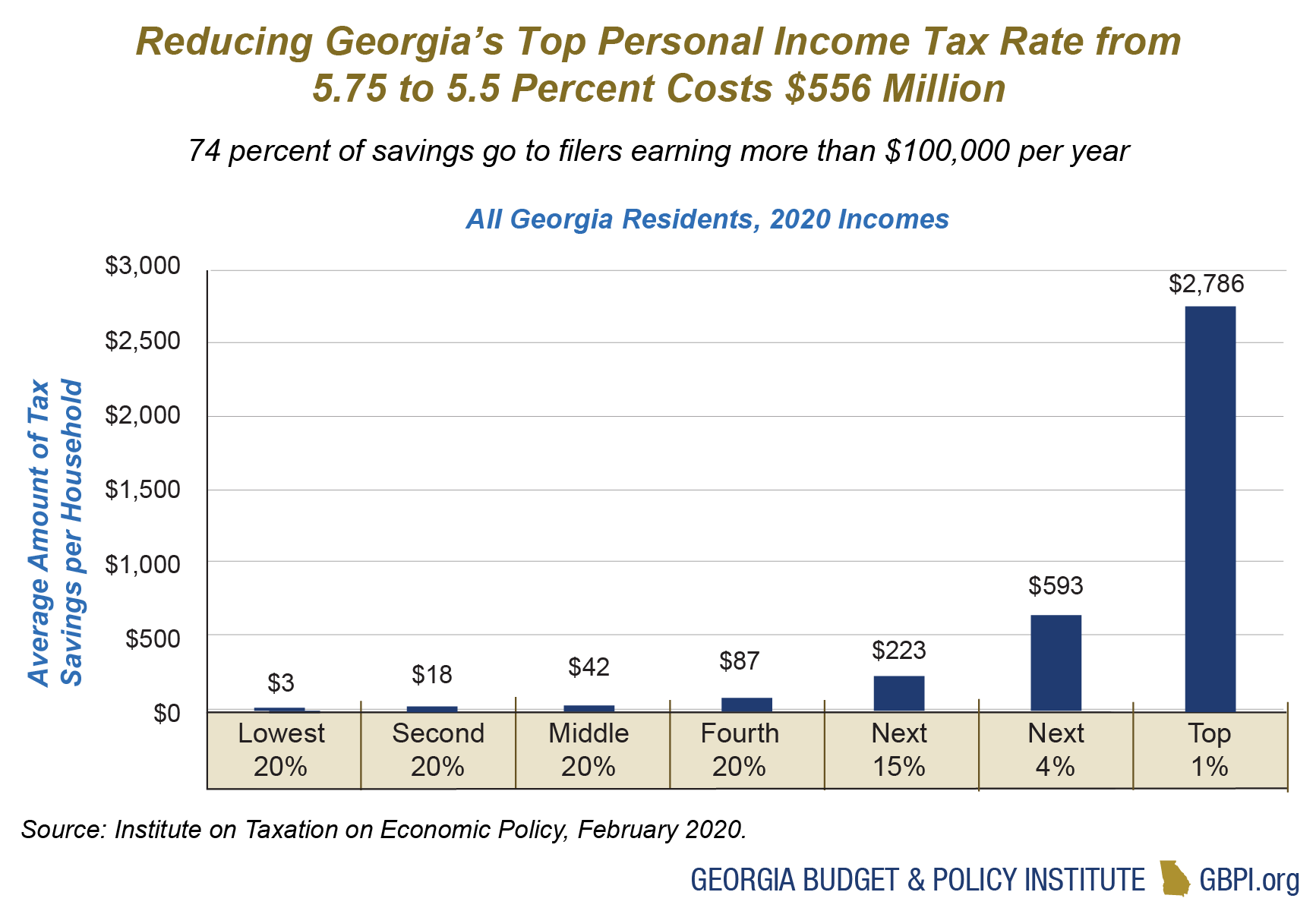

If you do live in georgia and work in florida and make enough money you will likely have to pay tax on your florida income to georgia. Single filer and married filing separately 1 on the first 750 of taxable income 2 on taxable income between 751 and 2250. Hover over each orange state to see existing reciprocity agreements with other states and which form nonresident workers have to file to get tax exemptions.

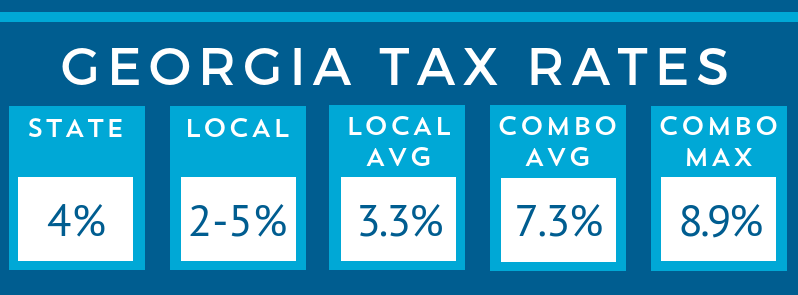

However georgia remains among the top 10 tax friendly states for retirees as ranked by kiplinger in 2017. While georgia has one of the lowest statewide sales taxes in the country among states that have a sales tax atlanta has its own city sales tax of 115 and counties can assess their own sales taxes of up to 5. Yes if under certain circumstances.

Your income exceeds georgias standard deduction and personal exemptions. If you have income from one of these possessions you may have to file a us.

%201.jpg)